Overseas Prices Surge, China Witnesses Drastic Decline: Joint Venture Automakers Face Profit Challenges

![]() 01/14 2026

01/14 2026

![]() 630

630

Unable to Maintain Position, Struggling to Keep Pace

Author: Wang Lei

Editor: Qin Zhangyong

The 'Big Players' Feel the Heat in the Chinese Market.

Volkswagen Group has just unveiled its 2025 financial results, revealing an 8% plunge in sales for Europe's largest automaker in the Chinese market.

After being overtaken by BYD in 2024, Volkswagen has now slipped to third place in China's sales rankings, with domestic brands BYD and Geely taking the lead.

Volkswagen, once a dominant force in the Chinese market, now shows signs of fatigue. It's not just Volkswagen; traditional automotive giants that once reigned supreme are now gradually losing ground in the crucial Chinese market.

Take BMW as an example. Despite global sales growth, it faced a setback in China, with sales plummeting by 12.5%.

While some automakers celebrate historic milestones, achieving production and sales volumes of 4 million units, and others claim global electric vehicle sales crowns, China, the world's largest automotive market, is undergoing an unprecedented transformation.

01

Success in Traditional Fuels, Struggles in Transition

In 2025, Volkswagen Group delivered over 8.98 million vehicles globally, maintaining its position as the world's second-largest automaker after Toyota, based on currently available global sales data.

Compared to the previous year, sales only slightly decreased by 0.5%, a figure that may seem trivial at first glance, indicating overall strong performance.

Notably, pure electric vehicle deliveries reached 983,100 units, marking a 32% year-on-year increase and accounting for 10.9% of global sales. In 2025, nearly one in every nine new vehicles sold by Volkswagen Group was a pure electric model, signaling significant progress in its electric transformation.

However, a closer examination of Volkswagen's global sales breakdown reveals underlying issues.

Among major global markets, Europe stood out as a bright spot, with Volkswagen Group delivering 3.38 million vehicles, a 3.8% year-on-year increase, and electric vehicle sales surging by 66%.

Additionally, South America witnessed more pronounced growth, with an 11.6% increase and deliveries rising to 663,000 units. The overall decline is attributed to Volkswagen Group's two most crucial markets in the past, China and North America, which experienced significant downturns.

In North America, Volkswagen Group's annual sales declined by 10.4% to 946,800 units. In China, Volkswagen Group sold 2.69 million vehicles in 2025, an 8% year-on-year decrease.

While Volkswagen Group's overall decline in North America can be attributed to new U.S. government tariff policies and the elimination of electric vehicle subsidies, in China, the primary reason appears to be fierce market competition.

Furthermore, after being surpassed by BYD in total sales in China in 2024, Volkswagen was overtaken by Geely Auto this year. Once the market leader, Volkswagen now ranks third in China, behind BYD and Geely.

According to Geely Holding Group's recently released 2025 annual sales data, the group's total sales reached 4.116 million units, a 26% year-on-year increase. Geely Automobile Holdings Limited sold over 3.02 million units, a 39% year-on-year increase.

Additionally, BYD sold over 4.6 million new vehicles in 2025, becoming the global leader in pure electric vehicle sales with 2.25 million units sold, surpassing Tesla for the first time.

Crucially, in Volkswagen's annual sales report, the 983,100 pure electric vehicle sales, accounting for 10.9% of global sales, did not originate from China, the world's largest new energy market. Instead, fuel-powered vehicles dominated sales in China.

Volkswagen sold over 2.57 million fuel-powered vehicles in China, capturing more than 22% of the market. From another perspective, Volkswagen only sold 110,000 pure electric vehicles in China, a sharp decline of over two-fifths compared to 207,400 units sold in the same period last year. This sales composition reveals a significant gap with current Chinese consumer preferences.

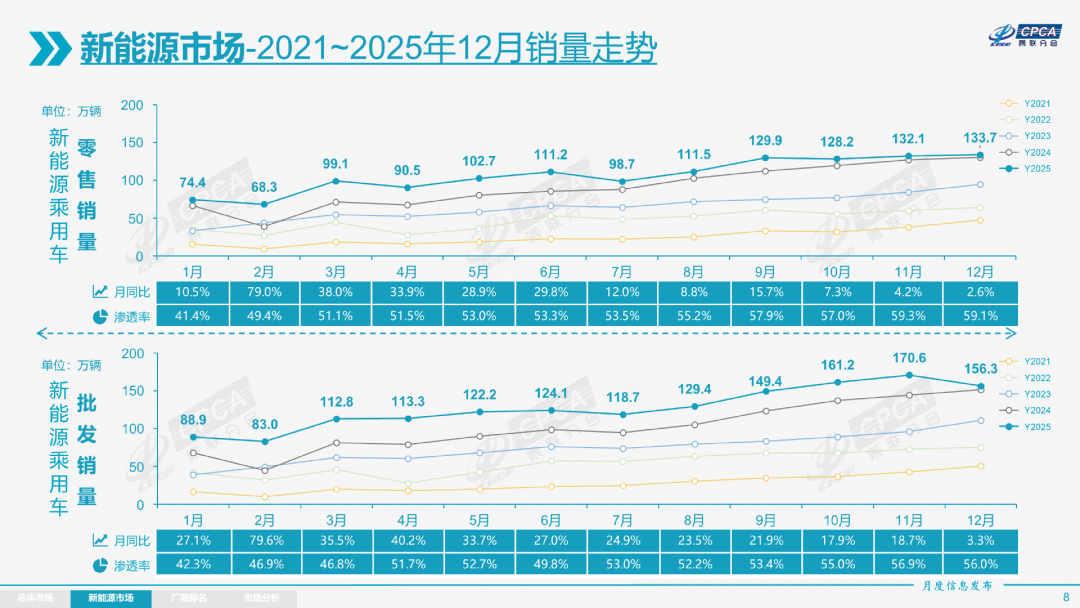

Recently, the China Passenger Car Association released December's domestic passenger car market new energy retail penetration rate, reaching a record high of 59.1%. Since March 2025, new energy penetration in the domestic retail market has surpassed the 50% mark.

Throughout 2025, the cumulative retail penetration rate of new energy passenger vehicles reached 53.9%, indicating that new energy vehicles have become the dominant force in the domestic passenger car market.

Volkswagen's current sales composition in China partially explains its inability to reverse declining sales.

Of course, Volkswagen has taken action. "In China, For China" has become its new mantra, taking root in Hefei with a €3.5 billion investment, assembling over 3,000 Chinese software and hardware engineers to create Volkswagen's "Wolfsburg in China" and establish its largest comprehensive R&D center outside Germany.

It also collaborated with XPENG Motors to build vehicles and partnered with Horizon Robotics and other companies for intelligent driving solutions. According to plans, over 20 pure electric, plug-in hybrid, and extended-range models will be launched in the Chinese market by 2026. By 2027, various brands under the group will introduce over 30 electrified models in China.

However, the results of these efforts will only become apparent after 2026.

02

Strategic Shifts

It's not just Volkswagen; other traditional automotive powerhouses have also seen their market shares squeezed in China, a trend that is not new.

Nearly all traditional luxury brands have been affected, with varying degrees of severity.

In 2025, BMW delivered 2.464 million new vehicles globally, a slight 0.5% year-on-year increase, halting the sales decline trend seen in 2024.

BMW brand sales reached 2,169,761 units, a 1.4% year-on-year decrease; MINI sales were 288,290 units, a 17.7% increase; Rolls-Royce sales were 5,664 units, a 0.8% decrease.

Throughout 2025, BMW delivered 642,000 new energy vehicles, an 8.3% year-on-year increase, accounting for approximately 26% of total sales; pure electric vehicle sales were 442,000 units, a 3.6% year-on-year increase, representing 18% of total sales. This is positive news for the traditional automaker in transition.

However, like Volkswagen Group, BMW's situation in the Chinese market has been the biggest factor dragging down its global performance.

From a market segmentation perspective, BMW divides its sales into three regions: Europe, Asia, and the Americas. Europe and the Americas saw significant annual sales growth, with increases of 7.3% and 5.7%, respectively. Only Asia experienced a decline.

The sales decline in Asia was primarily driven by the Chinese market. In 2025, BMW Group's sales in China were 625,500 units, a sharp 12.5% year-on-year decrease, with a 15.9% decline in the fourth quarter.

This marks BMW's second consecutive year of decline in China, dropping from a high of 820,000 units in 2023 to 715,000 units in 2024 and 626,000 units in 2025, a two-year decrease of 200,000 units.

Breaking it down by quarter, BMW consistently experienced declines in China throughout 2025.

Despite this, China remains BMW's largest single market, contributing 25.4% to its annual sales. BMW clearly understands that the more it struggles in China, the more it needs to "reprove" itself.

Therefore, we see BMW making a series of adjustments: the new pure electric platform designed for electrification, the Neue Klasse platform, was officially launched on a large scale this year. In 2026, BMW plans to introduce around 20 new products in China.

Not just Volkswagen and BMW Group have "woken up." Following BMW, Mercedes-Benz also disclosed its 2025 sales performance, selling 2.16 million passenger and commercial vehicles globally in 2025, a 10% year-on-year decrease. Passenger vehicle sales were 1.8 million units, a 9% year-on-year decrease.

In China, Mercedes-Benz's sales declined by 19% to 575,000 units in 2025.

Since 2015, China has been Mercedes-Benz's largest single market globally, with sales once exceeding 30% at their peak. This year's performance ranks only above 2016's 481,000 units in the past decade of sales in China.

To accelerate its rebound, Mercedes-Benz continuously injects "Chinese soul," exchanging capital for technology, time, and market. For instance, it uses a Chinese team to lead auxiliary driving R&D, deepens collaboration with autonomous driving company Momenta, and officially announces its stake in Geely's Qianli Technology. Over the next three years, Mercedes-Benz plans to launch multiple China-exclusive models, including pure electric SUVs and long-wheelbase CLAs.

It's evident that behind these frequent moves by traditional giants is a race to lead the second half of the intelligent driving era.

In contrast, domestic autonomous brands that have already emerged as strong contenders now hold nearly 70% of the passenger car market share for the year. The status of joint ventures and domestic brands seems to be reversing. Especially amid the intelligent driving wave, Chinese automotive brands are launching a comprehensive counterattack.

From affordable A-segment cars to high-end new energy vehicles costing tens or even hundreds of thousands, Chinese brands have established their presence. Three years from now, how much market share will remain for joint ventures or overseas automakers?