Storming the Smart Cockpit: New Energy Vehicles Have Reached Their Limits!

![]() 06/18 2024

06/18 2024

![]() 698

698

Early automobiles were simply transportation tools that took passengers from point A to point B. Limited by technological capabilities, neither passengers nor automakers had the concept of a "cockpit." It was only when Bosch introduced car audio speakers, car radios, and other accessories that the vehicle control functions within the cockpit were improved.

It was not until the 1960s that the design of automobiles basically stabilized, and the concept of the car cockpit gradually took shape. In the 1990s, small-sized central control screens with built-in car navigation, Bluetooth, and other functions were added. Users could also bring their own CD discs to listen to music, providing a basic entertainment experience. But frankly speaking, even top-of-the-line luxury models were far from reaching the level of a "smart cockpit."

In my opinion, the true association between the car cockpit and intelligence can be traced back to the Tesla Model S introduced in 2014. Its built-in large screen was eye-catching, and it integrated most of the vehicle control functions into the screen. However, it was the 2016 launch of the Roewe RX5 that truly popularized the smart cockpit concept. For less than 130,000 yuan, it achieved voice control functionality, marking the beginning of intelligent connected vehicles.

While such changes sparked widespread debate among netizens about whether physical buttons were still necessary, starting with the Model S, luxury brands like Mercedes-Benz and BMW indeed gradually eliminated many physical buttons. No matter how intense the online comments are, at least from the perspective of automakers, large screens and fewer physical buttons have become a design trend for smart cockpits.

"The first half of the automobile era is electrification, and the second half is intelligence." Smart cockpits are just one aspect of intelligence, but competition among automakers in this field is particularly fierce. Both new forces and traditional brands have reached a relatively close level. Therefore, suppliers at the upstream of the industry, what technical advantages they bring to the table, may influence the development speed of automotive smart cockpits.

Chip Section: The Era of Pursuing High Computing Power Has Arrived

Qualcomm: Still the Preferred Choice for Smart Car Chips

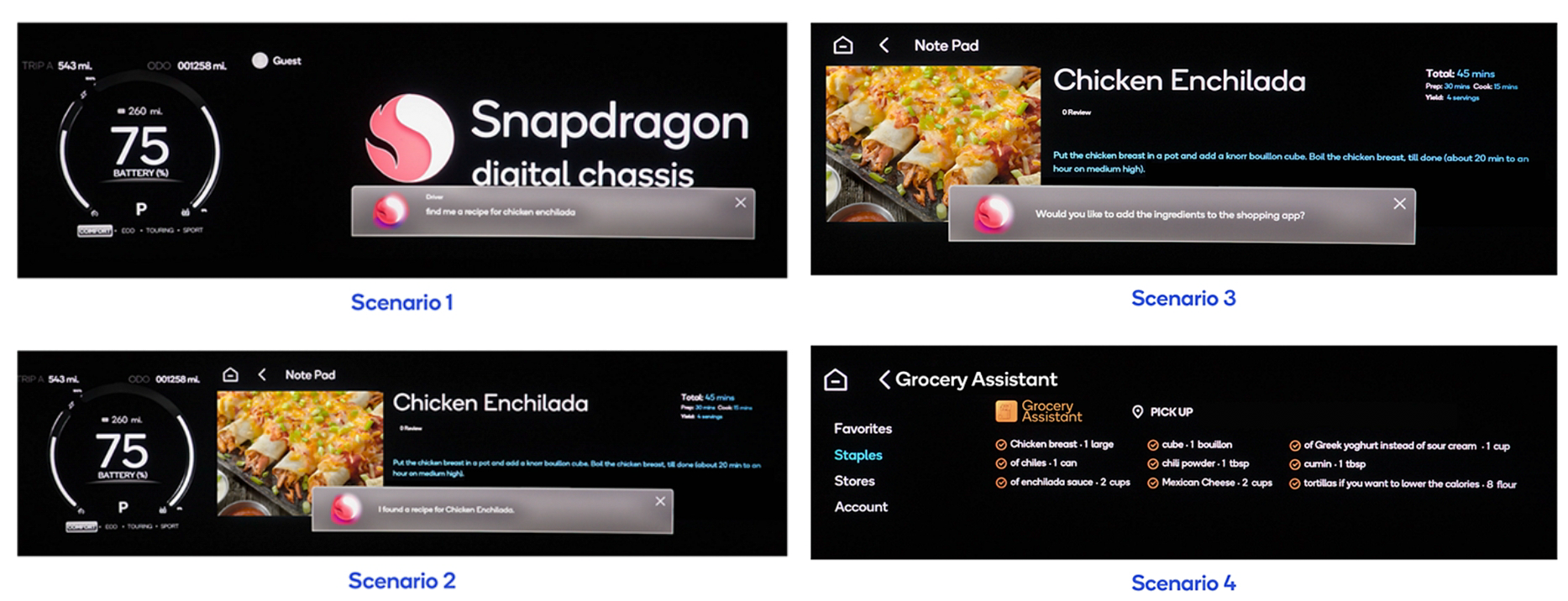

Qualcomm's achievements in the technology field are well-known, and it has also been deeply involved in the automotive field for nearly 20 years. Between 2014 and 2021, it released four generations of smart cockpit platforms, with smart cockpit chips evolving from the initial 602A, 820A to the well-known 8155 and 8295 chips.

The Snapdragon 602A chip was Qualcomm's "debut" in the automotive chip market, and not many models used this chip, including only older models like the Audi Q7 and BYD Tang. The intelligent experience was not particularly good. Two years later, the Snapdragon 820A chip was released, which was adopted by models like the Xiaopeng P7, Audi A4L, and Zeekr 001. Its biggest highlight was the enrichment of intelligent interaction methods, no longer limited to voice control.

In 2019, the Snapdragon 8155 chip was released, which was the first chip to support 5G networks. Starting from the announcement that the Weiying Moka would use this chip, domestic brands have followed suit, and I even felt that models using the 8155 chip would advertise the chip extensively. The latest 8295 chip boasts an AI computing power of 30TOPS, and its GPU 3D rendering performance and GPU computing power are 3 times and 2 times higher than the 8155 chip, respectively. A single 8295 chip can drive up to 11 screens.

Such powerful computing power has quickly attracted car brands that emphasize intelligence and have strong financial backing, such as Mercedes-Benz, NIO, Zeekr, and Jiyue, among others. It's worth noting that while many domestic brands are starting to adopt the 8295 chip, joint venture brands are just beginning to adopt the 8155 chip, such as the Toyota Camry's ninth generation and the all-new Volkswagen Magotan.

The advantages of Qualcomm's cockpit chips are not only their popularity from being first to market but also their understanding of graphic rendering capabilities and communication network connectivity in the mobile terminal field. Of course, the advantage of being first is also very important, which means Qualcomm's cockpit chips possess what may be the most mature and comprehensive solutions in the industry, with the lowest development costs. This is also a difficulty for subsequent cockpit chip companies to challenge Qualcomm.

MediaTek and NVIDIA: Breaking Qualcomm's Monopoly with AI?

In the field of smart cockpit chips, Qualcomm has always occupied a dominant position, with MediaTek being one of its few competitors. Before 2020, MediaTek launched the MT2712 and MT8666 chips to compete with Qualcomm's 820A and 8155 chips, but their manufacturing processes and computing power could not match Qualcomm's Snapdragon chips. However, they are cost-effective and have been applied in some overseas brand models, but it's difficult for them to break into the mainstream market.

To this end, MediaTek has chosen to collaborate with NVIDIA in addition to introducing more high-end cockpit chips.

NVIDIA has a dominant position in the field of autonomous driving chips, and there has always been a clear dividing line between autonomous driving chips and smart cockpit chips. However, to control costs, gradually, automakers hope to use a single chip to jointly control the cockpit and intelligent driving. The integration of cockpit and driving has gradually become a trend, and NVIDIA has also released fusion chips that integrate cockpit and driving.

One of the reasons MediaTek chose to collaborate with NVIDIA is to顺应 the demands of the era of AI big models. The AI capabilities of autonomous driving chips far exceed those of cockpit chips. MediaTek's advantages lie in low power consumption and communication connectivity, while NVIDIA has advantages in graphics computing and AI technology. In March of this year, MediaTek launched the Dimensity cockpit chip with NVIDIA technology, and the flagship Dimensity automotive cockpit platform released at the end of April features a generative AI engine. The 4nm process cockpit chip can run AI big models with 7 billion parameters on the side.

Perhaps many believe that AI big models do not have a direct impact on improving our car experience, but I have experienced car systems with built-in AI big models and found that in addition to having generative AI capabilities, they can also accurately identify vague instructions, greatly enhancing the voice assistant experience. In addition, I believe a more practical application scenario is the intelligent car user manual. Encountering car usage difficulties, you can directly communicate with the voice assistant, even solving issues like "What is the fault light of the person with a big sword shining on their back?"

However, so far, I have not found any models that use MediaTek's Dimensity automotive cockpit platform. Most models still use the 8155 and 8295 chips, which already possess AI computing power.

In the long run, MediaTek's investment in AI big models will undoubtedly push smart cockpits towards more intelligent development, but the current effects are not obvious.

Longying No. 1 and Other Domestic Chips Enter the Market

In addition to the above two technology companies, many domestic brands have also introduced chips, with the Longying No. 1 chip from Xinqing Technology being a representative example. It is understood that the Longying No. 1 chip is the first domestic 7nm automotive-grade chip, officially announced for mass production on March 30 of last year and gradually applied to products under the Geely Holding Group, such as the Lynk & Co 06 EM-P, Yinhe L6, and Raylan 7.

In terms of performance, the Longying No. 1 chip has a GPU computing power of 900GFLops and a CPU computing power of 90kDMIPS, supporting up to six screens. Its competitor, Qualcomm's 8155 chip, has a GPU computing power of 1100GFLops, a CPU computing power of 105kDMIPS, and supports connecting four 2K screens or three 4K screens.

From a computing power perspective alone, the Longying No. 1 chip is slightly inferior, but according to AnTuTu's car chip benchmark data in May, the Longying No. 1 chip scores higher than the Snapdragon 8155 chip.

I believe this may be attributed to the synergies between hardware and software. Xinqing Technology was jointly funded by Ecarx Technology and Arm China, and Ecarx Technology was co-founded by Li Shufu and Shen Ziyu. It can be said that Geely is the "financial backer" of Xinqing Technology, which explains why the Longying No. 1 chip was first applied to Geely Group models.

Even though the Longying No. 1 chip lags behind the Snapdragon 8155 chip in computing power, Geely can achieve a smoother and practical experience through continuous optimization of algorithms. As a third-party supplier, Qualcomm finds it difficult to obtain automakers' underlying data, so it is reasonable that even with higher computing power, its benchmark scores may not match those of the Longying No. 1 chip.

In addition, with the entry of technology companies, the automotive industry has more options in terms of chips. For example, the Wenjie M9 uses Huawei's Kirin 9610A chip, and the JAC Refine RF8 also uses this chip. The chip boasts a CPU computing power of up to 200kDMIPS, far exceeding the 100kDMIPS of the Snapdragon 8155 chip and approaching the 220kDMIPS of the Snapdragon 8295 chip.

I have experienced the Wenjie M9 and found that the infotainment system can simultaneously run multiple functions such as navigation and entertainment, supporting multiple screens running simultaneously. The performance of features like phone streaming and other car-to-phone connectivity functions is also smooth, providing an experience similar to mobile terminal devices.

In my opinion, powerful computing power is just one aspect of Huawei's Kirin 9610A chip. The most important point is the perfect balance of the HarmonyOS ecosystem. Within the same ecosystem, the Kirin 9610A chip can optimize algorithms to form a powerful automotive solution. This also means that chips are starting to be tied to ecosystems, and OEM automakers will need to consider more factors.

Summary: High Computing Power Is Only the "Basic Skill," Hardware-Software Synergy Is the Key

Currently, Qualcomm remains the "leader" in the field of smart cockpit chips. Its 8155 and 8295 chips have left many competitors in awe, but it is not without competitive pressure.

One of the most important points is hardware-software synergy.

From the perspective of automakers, using the most powerful smart cockpit chip will directly contribute to the product's popularity and make it easier to be recognized by the market. However, for most consumers, the smart cockpit experience is always the top priority. Even if the infotainment system uses a weaker chip, as long as the desired functions can be smoothly implemented, consumers will be willing to pay for it.

According to AnTuTu Auto's car infotainment system performance rankings, the top four models all use the Snapdragon 8295 chip. It's worth noting that while the Longying No. 1 chip scores higher than the 8155 chip, there are different presentations when it comes to specific models.

In some tests conducted by Dianchetong, it was found that a model equipped with Qualcomm's Snapdragon 8295 chip still experienced unexpected lags when displaying lane-level navigation interfaces. This shows that software optimization is crucial for improving the performance of the infotainment system.

Therefore, we can conclude that outstanding parameters do not represent the performance of a chip or the performance of a specific model. Moreover, high-computing-power chips are only the basis for obtaining a smooth experience. To create a good smart cockpit, it is necessary to achieve hardware-software synergy.

Screen Section: Large Size, Multiple Quantities, Diverse Patterns

Chips are suppliers at the upstream, and in the midstream, we have in-vehicle screens. As the "intelligent entry point," displays have always been an important core component in smart car cockpits. In addition to gradually enriching displayed information, different types of in-vehicle screens have emerged for different purposes, such as central control screens, dashboards, HUD heads-up displays, rear screens, and electronic exterior rearview mirror displays.

Because of this, in-vehicle screen suppliers seem to have found a new spring.

Where is the Breakthrough for "Traditional Screens"?

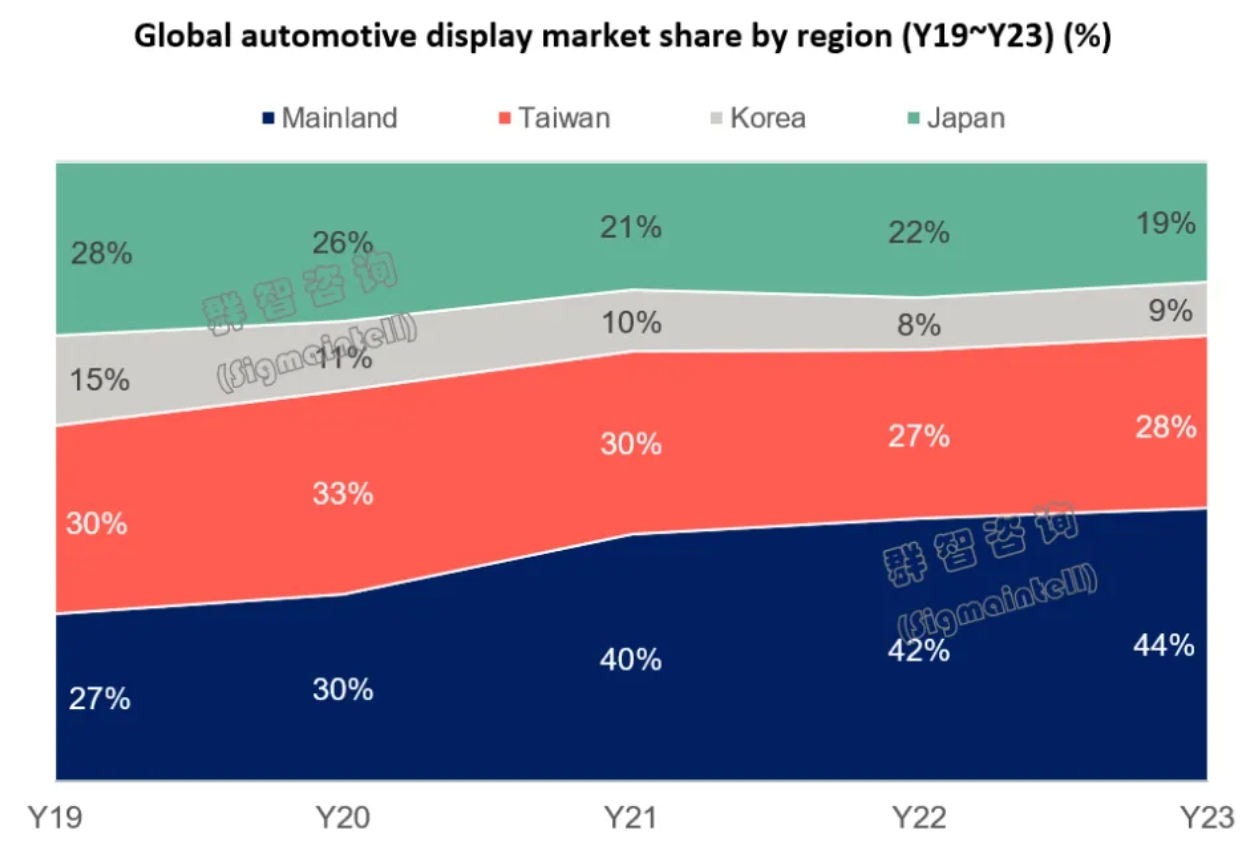

According to statistics from Sigmaintell, the shipments of the global automotive display panel market in 2023 reached approximately 210 million units, representing a year-on-year increase of 7%. Panel manufacturers in mainland China account for 44% of the global automotive display market shipments, leading the world. Obviously, this is directly related to the development of the domestic new energy vehicle market.

In 2023, BOE, Tianma, Japan Display, AUO, and LG Display were the top five global automotive display panel companies, with a combined market share of 61%. However, I noticed that the concentration of in-vehicle display screens is not high, and the market shares of the top five companies are not significantly different. This indicates that there is no obvious gap in the core technologies possessed by screen suppliers, and each supplier has an opportunity to increase its market share.

Of course, it is not easy for suppliers to become unique in the field of in-vehicle screens. Compared to mobile terminal devices, the primary task of in-vehicle screens is to ensure reliability and service life, followed by the specifications and quality of the screen itself. Looking at the domestic market, some automakers have achieved differentiated advantages, one of which is ultra-large screens.

The 45-inch 8K seamless smart screen in the Yinhe E8 is from BOE in China. The 35.6-inch 6K high-definition central control screen in the Jiyue 01 is a joint creation by Jidu and TCL CSOT. LG Display has also released a 57-inch P2P integrated LCD display with a natural curved effect with a radius of curvature of 3500R.

Of course, large screens are just one of the differentiated advantages. After research, it was found that various suppliers and automakers have already come up with many tricks, such as Corning's collaboration with Tianma Microelectronics and GAC to launch flexible OLED cockpit displays, and Continental's 3D crystal shell automotive displays.