Divergence Emerges in AI Investments: Alibaba 'Hits the Gas,' Tencent 'Taps the Brakes'

![]() 12/19 2025

12/19 2025

![]() 594

594

The divergence over AI is widening—we're talking about actions, not just opinions.

In the second half of this year, the 'AI bubble' theory became a focal point of discussion. Both Silicon Valley's internet giants and Wall Street's investment bank analysts participated in this debate.

For instance, Bill Gates publicly stated that while artificial intelligence is undoubtedly the most important thing right now, it doesn't mean all highly valued companies will succeed. Competition will be exceptionally fierce. 'A significant portion of these companies' valuations are unreasonable.'

Of course, there are also many who defend the current AI boom. Most argue that AI is expected to bring enormous value. Bret Taylor, chairman of OpenAI's board, offers a typical perspective: 'AI is a virtuous cycle bubble, similar to the internet bubble. While it may burst, it will create tremendous economic value.'

Shifting our focus back to China, we find that among the investments in AI, the tech giants have begun to diverge, with this divergence particularly evident between Alibaba and Tencent.

Tencent Lowers Capital Expenditure Guidance

The viral success of DeepSeek at the end of last year directly fueled domestic enthusiasm for AI investments, with the two giants fully committing to capital expenditure expectations.

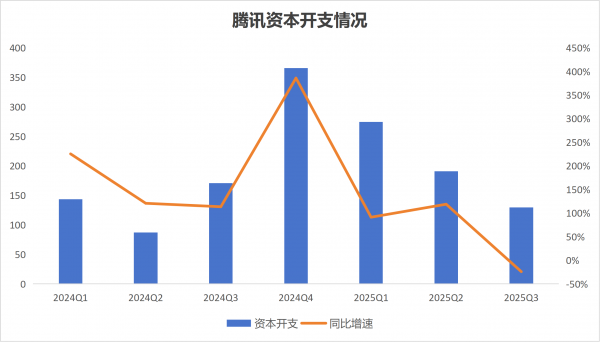

Let's first look at Tencent. In March, during the 2024 fourth-quarter and full-year earnings call, Tencent President Martin Lau stated plans to further increase capital expenditures in 2025, projecting that capital spending would account for a low double-digit percentage of revenue.

Based on this calculation, Tencent's capital expenditures this year will reach around 100 billion yuan. In fact, Tencent already achieved a 221% year-over-year increase in capital spending in 2024, clearly indicating its continued commitment to ramping up investments in the AI sector.

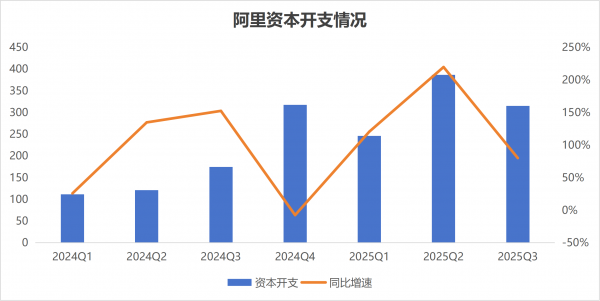

Alibaba has been even more aggressive. In February, Alibaba CEO Eddie Wu announced that over the next three years, Alibaba would invest more than 380 billion yuan in building cloud and AI hardware infrastructure, surpassing the total investment of the past decade.

The issue arose by the end of the year when the two giants showed differences in their AI investments. During the earnings call for the new quarter (Q2 of FY2026), Wu stated that the speed of server deployment still lagged far behind the growth in customer orders. 'From a broad perspective, the 380 billion yuan figure we previously proposed may have been too small. This judgment is based on the current customer demand we're seeing.'

In Q3, Alibaba's capital expenditures reached 31.501 billion yuan, an 80.1% year-over-year increase. For the first three quarters of this year, Alibaba's total capital expenditures were 94.789 billion yuan, a significant 132.7% year-over-year jump.

Meanwhile, Tencent recently stated that its capital expenditures for 2025 would fall below previous guidance ranges. Lau emphasized that Tencent currently has sufficient GPUs to meet internal needs.

After reaching peak capital expenditure amounts and growth rates in Q4 of last year, Tencent has become more 'cautious' this year, with capital spending decreasing quarter by quarter. In Q3, capital expenditures were 12.983 billion yuan, a 24.1% year-over-year decline.

Differing Emphases in AI Strategies

The contrasting increases and decreases in AI investments by the two giants reflect their differing strategic emphases in AI.

For Alibaba, AI is not just a grand narrative for the future but also a driver of immediate business growth.

Alibaba's long-reliance on e-commerce faces two major challenges: first, the stagnation of industry-scale growth, as the e-commerce sector's GMV has long bid farewell to high growth; second, increasingly fierce industry competition. Besides direct competition with traditional e-commerce players like JD.com and Pinduoduo, Alibaba also faces pressure from 'new e-commerce companies' like Douyin and Meituan. Public information shows that Alibaba's market share in China's e-commerce sector peaked at over 80% but has since declined to around 40% in recent years.

After facing regulatory antitrust measures in 2015 due to its 'either-or' strategy, Alibaba's cloud computing and internet infrastructure business became its fastest-growing segment, with Alibaba Cloud becoming the market leader in China's cloud services market.

In FY2024, Alibaba Cloud's revenue accounted for over 10% of total revenue for the first time; in the first half of FY2026 (April-September 2025), cloud revenue's share of total revenue reached 14.78%, a new all-time high.

The explosion in AI application demand has further fueled Alibaba Cloud's growth. During the earnings call announcing the three-year, 380 billion yuan AI investment plan in February, Alibaba outlined three key investment priorities for the future: AI and cloud computing infrastructure construction; AI foundational model platforms and AI-native application R&D; and AI-driven transformation and upgrading of existing businesses.

At this year's Cloud Town Conference, Wu proposed that large models are the next-generation operating systems and that Tongyi Qianwen aims to become the 'Android of the AI era.'

If AI represents the 'water, electricity, and coal' of the future, then Alibaba's AI strategy aims to position itself as the indispensable infrastructure company providing these essentials across all industries. For Alibaba, AI is infrastructure, and it must place heavy bets.

Tencent's AI strategy, on the other hand, is much 'lighter.' On one hand, with WeChat as its super traffic gateway, Tencent's gaming and advertising businesses face little pressure, and AI serves more as a tool to drive business growth and enhance operational efficiency. On the other hand, applications are Tencent's forte, and even in the AI era, Tencent remains confident in its ability to succeed through applications.

In fact, after 'buzzing' for much of the year, Tencent's AI strategy seems to have undergone some subtle adjustments. At the March 2025 Tencent Global Digital Ecosystem Summit in Shanghai, Tencent's AI strategy was described as a multi-model approach featuring 'firm commitment to self-developed models + open embrace of advanced open-source models,' with comprehensive layouts at the foundational capability, model, and application layers to provide users with a rich array of AI application products and drive industrial innovation and growth.

By September, Tang Daosheng, Tencent's Senior Executive Vice President and CEO of the Cloud and Smart Industries Group, stated at the 2025 Tencent Global Digital Ecosystem Summit that Tencent's strategic choices ultimately return to prioritizing users. Tencent considers user pain points in specific scenarios and determines which solutions best and most effectively address user needs.

Tang emphasized that while there are many AI application scenarios, Tencent remains focused on how to make AI serve people well, driving technological capability development with human needs at the center. Based on this direction, Tencent naturally proposes 'creating useful AI.'

Clearly, Tencent's AI strategy is tilting toward the application side, hoping to empower businesses by opening up AI capabilities and leveraging its strong positions in consumer (C) and business (B) scenarios.

The Battleground Shifts to the Application Side

In November, during an interview at the University of Hong Kong, Alibaba Chairman Joseph Tsai contrasted Chinese and U.S. AI competition by stating that the winner won't be whoever has the best model but whoever can best apply it to their industry and daily life. This reflects an 'application mindset.'

According to LatePost, Tongyi Laboratory has three key objectives this year: first, to maintain a leading position in model rankings, with superior model performance, download volumes, and number of derivative models; second, to penetrate more commercial application scenarios; and third, to achieve a Dozens of times (dozens of times) increase in daily average calls for the entire Tongyi model ecosystem by 2025.

Penetration of commercial application scenarios is seen as a crucial KPI, though advancements in the Tongyi Qianwen model have overshadowed this goal. However, Alibaba has recently made significant strides on the application front, marked by the launch of the 'Qianwen' project. The original Tongyi app was renamed Qianwen and underwent major functional iterations.

Alibaba has brand-differentiated the Tongyi Qianwen model and the Qianwen app, with Tongyi Laboratory continuing to focus on foundational R&D while the Qianwen app targets the consumer (C) market. To this end, Alibaba established the Qianwen C-End Business Group, aiming to make Qianwen a 'super app' and the primary gateway for users in the AI era.

Tongyi Qianwen was actually launched as early as September 2023, around the same time as ByteDance's Doubao and Moonshot AI's Kimi. However, despite continuous breakthroughs at the model level, the development of the Tongyi Qianwen app has been lackluster.

QuestMobile data shows that by the end of Q3 this year, the Chinese AI-native application with the most users was Doubao, with 172 million monthly active users (MAUs); DeepSeek followed closely with 145 million MAUs. These two applications have formed a crushing competitive advantage over others, and Tongyi Qianwen naturally doesn't rank among the 'top tier.'

After the launch of the Qianwen project, things finally began to change. According to public data, within 23 days of its public beta, the Qianwen app surpassed 30 million MAUs, becoming the fastest-growing AI application globally in recent times.

Following the Qianwen app's launch, Alibaba's Ant Group subsequently rolled out Lingguang, a full-modal general AI assistant, and upgraded its AI health application 'Ant Aifu,' demonstrating Alibaba's continued efforts in the C-end application market.

In response to Alibaba's surprise offensive in AI applications, particularly C-end apps, in the second half of the year, other giants have yet to respond.

Tencent's latest move is to adjust its large model R&D structure, establishing new AI Infra, AI Data, and Data Computing Platform departments. Meanwhile, Yao Shunyu, a 27-year-old former OpenAI researcher, was appointed as Tencent's Chief AI Scientist, reporting to Martin Lau. Yao also serves as head of the AI Infra and Large Language Model departments, reporting to Lu Shan, President of the Technology Engineering Group.

The newly established AI Infra department will focus on building technical capabilities for large model training and inference platforms, concentrating on core technologies like large model distributed training and high-performance inference services to construct a competitive edge in large model AI infrastructure and provide stable, efficient technical support and services for large model algorithm R&D and business scenario implementation.

The upgraded AI Data and Data Computing Platform departments will respectively handle the construction of large model data and evaluation systems and the development of data intelligence fusion platforms for big data and machine learning.

Yao Shunyu's recruitment is a significant signal. Yao proposed the ReAct framework, enabling large language models to both think and act, becoming a cornerstone of global Agent R&D. His view that the AI industry is shifting from model training to applications aligns with Tencent's strategy of 'creating useful AI.'

This year, Yao also introduced the concept of 'AI's second half,' arguing that while the first half was about 'training' and competing on who could feed larger parameters, the second half will focus on 'evaluation and definition'—how to evolve AI from mere question-answering machines into intelligent agents capable of solving complex real-world problems. This perspective resonates with Tencent's strategic thinking on 'creating useful AI.'

With Alibaba making continuous moves in the C-end market and Tencent bringing in the foundational researcher of Agent studies, the AI competition has officially shifted to the application side.

Earlier this year, Goldman Sachs proposed a well-known viewpoint in its report 'China Internet Outlook: Tracking Top AI and Applications'—'For China's AI infrastructure, look to Alibaba; for AI applications, look to Tencent.' However, judging by the nearly year-long layouts of these two giants, neither seems satisfied with this perspective.

The content and views in this article are for reference only and do not constitute investment advice. Investing carries risks, and decisions should be made cautiously.