"No Selling Cars at a Loss!": Price Manipulation Can No Longer Be Concealed

![]() 12/19 2025

12/19 2025

![]() 521

521

Industry Reshuffle on the Horizon

Author: Wang Lei

Editor: Qin Zhangyong

Is the Price War Finally Coming to an End?

The 'Compliance Guidelines for Pricing Behavior in the Automotive Industry (Draft for Comments)' issued by the State Administration for Market Regulation has caused a stir in the automotive circle, acting as a 'bombshell.'

The guidelines outline numerous regulations, clarifying price compliance requirements for various aspects, ranging from complete vehicles to spare parts production, and from pricing strategies to sales behavior.

However, the most attention-grabbing aspect is the 'explicit prohibition on automakers selling vehicles below cost,' along with the mandatory requirement for transparent pricing and clear contract delivery dates.

These requirements may seem self-evident, but they serve as a guiding light for the automotive industry. No wonder some netizens have joked that now, no automaker executive will complain at product launches about losing tens of thousands of yuan on each vehicle sold.

01

The Price War Is Finally Subsiding

Since the release of the pricing behavior compliance guidelines, several automakers, including BYD, Leapmotor, XPENG, Changan, Chery, BAIC, Great Wall Motor, and JAC, have issued statements in response, expressing their support.

Although the content of each automaker's statement varies, their core viewpoints are largely similar. All have expressed opposition to any form of price fraud and unfair competition, vowing to eliminate (put an end to) behaviors such as dumping below cost and false advertising.

It's evident that the automotive industry has long been suffering from the price war.

This sentiment has inevitably reached the end-consumer market, with some users expressing concerns that as the exemption for purchase tax on new energy vehicles is reduced in 2026, terminal discounts for car purchases will inevitably decline next year. Coupled with the prohibition on price wars, will buying a car become more expensive?

Let's first examine what the compliance guidelines say.

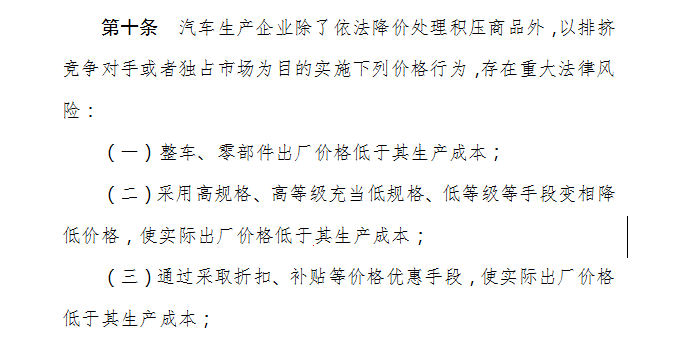

The regulations concerning automakers are primarily distributed in Article 10 of the guidelines, which explicitly stipulates that, except for clearing inventory, automakers shall not reduce the factory price of complete vehicles or spare parts below production costs for the purpose of excluding competitors.

Article 10 also details nine prohibited behaviors, such as disguisedly lowering prices by using high-specification or high-grade components as low-specification or low-grade ones, resulting in actual factory prices below production costs, known as 'disguised upgrades.' Other prohibited behaviors include offering price discounts, subsidies, or engaging in material exchanges, debt offsets, or invoice-related actions, all of which are identified as significant legal risks.

Overall, except for inventory clearance, selling cars at a loss is no longer feasible.

However, this raises a question about how automakers define the production costs of their models. Given the complex cost structure of automakers, including the allocation of R&D investment and fluctuations in battery costs, it is challenging to standardize evidence collection.

In response to this, the draft for comments specifically clarifies that the production costs of automakers include manufacturing costs and period costs comprising management, financial, and selling expenses. However, the specific implementation will depend on subsequent detailed rules.

This also implies that the production cost of a vehicle is not constant but will fluctuate with sales performance.

In addition to prohibiting sales at a loss, price hikes are also included in the scope. Article 11 stipulates that when there is a severe imbalance in supply and demand in the automotive supply chain, but the costs of automotive spare parts manufacturers have not significantly changed, substantial price increases without justifiable reasons are prohibited.

However, market prices are not solely determined by automakers but also by downstream dealers. Article 18 of the compliance guidelines targets dealers, prohibiting them from selling vehicles below purchase costs. The nine prohibitions almost mirror those applied to automakers.

However, an additional method of 'bulk discounts' is mentioned, which aims to prevent large dealers from obtaining wholesale prices and subsequently dumping vehicles at lower prices.

Furthermore, dealers or online platforms are required to prominently display all information regarding vehicle configurations, sales prices, and promotional rules. They must also strictly distinguish between the prices of automotive products and sales service prices.

This means that the past practice of some dealers using 'list prices' as a diversion while negotiating actual transaction prices will no longer be viable. Price adjustments must be made promptly, and even clearance sales of inventory vehicles must adhere to regulations.

Additionally, the guidelines strictly prohibit any form of price surcharges, including paid unlockable features. Free trial periods and fee structures must be clearly communicated, eliminating hidden charges and deceptive price increases during the consumption process and significantly enhancing price transparency.

Sellers must explicitly inform consumers of the exact delivery time before the transaction and include it in the contract, assuming liability for breaches. Vague terms such as 'estimated' or 'approximately' are no longer permitted, putting an end to the prolonged and undocumented waiting periods for consumers after purchasing a vehicle.

Moreover, even price reductions through 'official price cuts' are further restricted. Article 23 of the draft for comments requires automakers to establish a price compliance management mechanism. Major price adjustments, new product pricing, and other matters must be decided through collective decision-making processes.

This means that future price reductions will not be arbitrarily decided on a whim. Incidents like a certain brand officially cutting prices three times in a year are unlikely to occur again.

02

From a Vicious Cycle to a Positive Cycle

When competitors resort to price reductions, fellow automakers have few better strategies than to follow suit.

According to data released by the China Passenger Car Association, from January to July 2020-2022, the number of price-reduced models by automakers was only around 50. During the same period in 2023, this number surged to 113. From January to July 2024, the number of price-reduced models further increased to 147. This year, from January to July, the number of new cars with price reductions was 106.

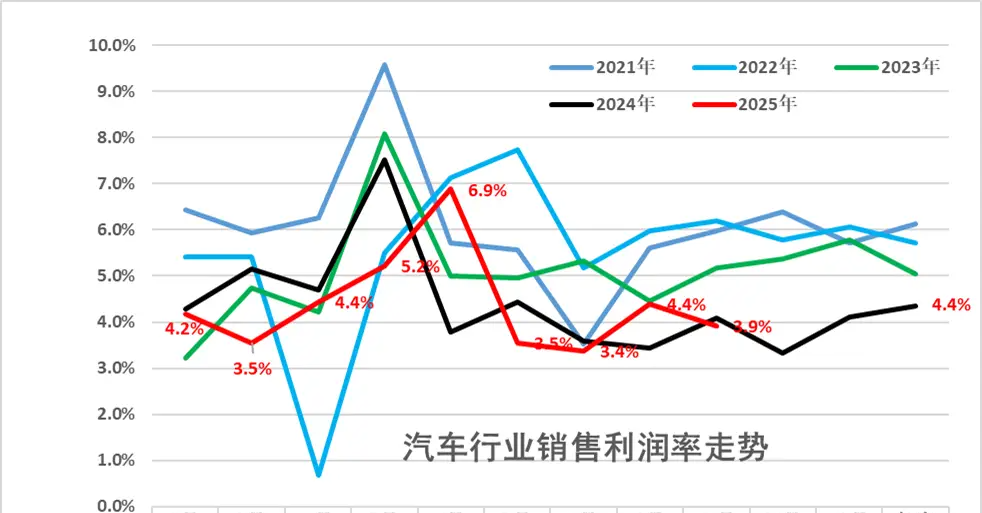

Behind this seemingly prosperous scenario lies a harsh reality for industry profit margins. After more than two years of price wars, the overall profit margin of China's automotive industry fell to its second-lowest level in history in 2025.

According to data from Cui Dongshu, Secretary-General of the China Passenger Car Association, the sales profit margin of the automotive industry from January to October was only 4.4%. Although slightly warmer than the same period in 2024, it still hovered at a five-year low, below the average profit margin of 6% for downstream industrial enterprises. The sales profit margin for October alone plummeted to 3.9%.

From January to October, the gross profit per vehicle in the automotive supply chain was only 14,000 yuan. In the first half of 2025, the proportion of unprofitable automotive dealers rose to 52.6%, with 74.4% experiencing varying degrees of price inversions.

The prolonged low-price competition has not only severely squeezed the profit margins of automakers but also, like a domino effect, passed cost pressures down to component manufacturers and dealers in the supply chain.

A very real example is that the sharp decline in profits has made automakers more cautious about R&D investment, and some models have even experienced 'specification reductions,' with safety issues being the primary concern.

Additionally, the survival dilemma of automotive dealers is intensifying. The closure of 4S stores has left consumers without comprehensive after-sales service, and some consumers have even encountered situations where they did not receive their vehicles before the 4S store went out of business, resulting in significant losses.

Moreover, the price war has backfired.

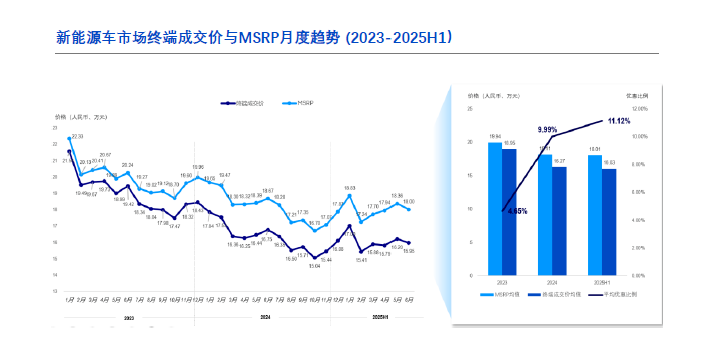

According to the 'Research Report on China's Passenger Vehicle Volume, Price Trends, and Pricing Strategies' jointly released by consulting firm Roland Berger and Autohome for three consecutive years, the proportion of 'wait-and-see' consumers who chose to delay purchases due to price promotion policies surged from 28% in 2023 to 45% in the first half of 2025.

Furthermore, an increasing number of consumers are gradually associating new car prices with vehicle quality and configurations when making purchases. The proportion of consumers who believe in 'you get what you pay for' has significantly risen from just 13% in 2023 to 34% in the first half of 2025.

The report suggests that the sustained 'price war' has raised consumer expectations for automaker price reductions. Especially as the proportion of non-essential users (repeat/additional purchases) continues to rise, the escalating price war has failed to stimulate consumption but has instead prolonged the car purchase (car purchase) decision-making cycle.

From a consumer's perspective, this is easily understandable: as price wars intensify in various forms and subsidies are expected to increase, maximizing benefits can only be achieved by purchasing later.

The result is that the more prices drop, the more hesitant people become to buy.

As we become accustomed to electric vehicles becoming increasingly affordable, we must not forget that behind the low prices often lie various hidden dangers related to safety, product quality, and service. This timely brake on the price war will not only make competition in the automotive market more rational but also result in safer products. This two-year-long disorderly competition is finally returning to normalcy.