New Energy Sector 'Cuts Out the Rot' by Canceling Tax Refunds for Battery Exports

![]() 01/16 2026

01/16 2026

![]() 570

570

Lead-in

Introduction

For the battery and energy storage sectors, there's no need to panic; rather, accelerating the elimination process and weeding out weak players will help eliminate the dregs and preserve the high-quality elements.

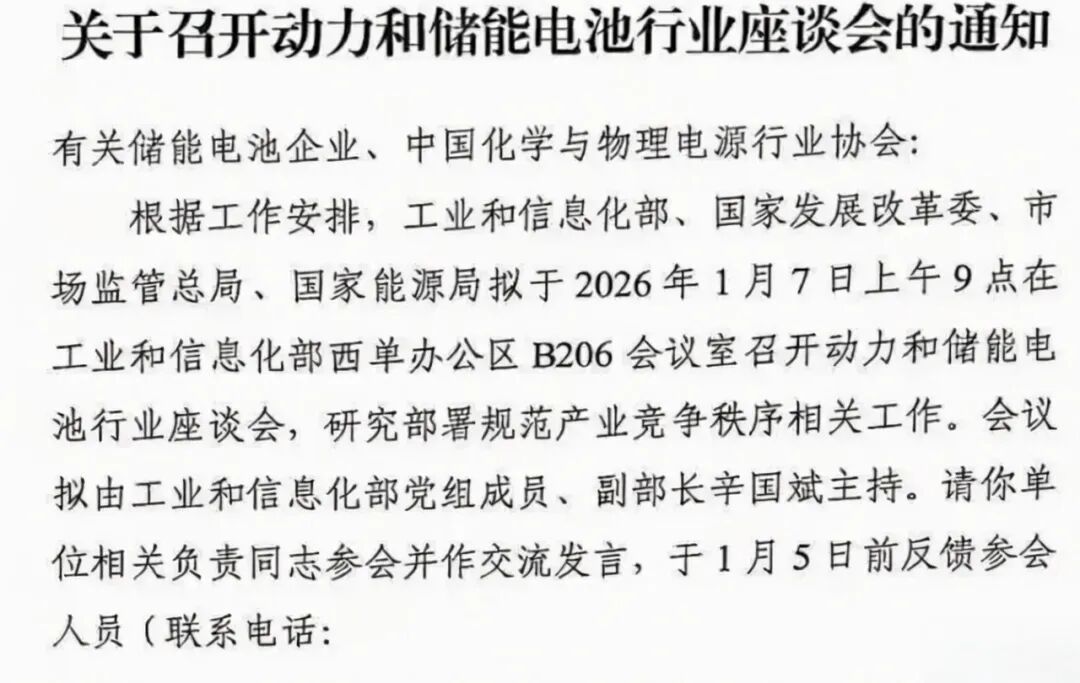

On January 7, 2026, in Beijing, an industry symposium that would otherwise have gone unnoticed took on immense significance.

The Ministry of Industry and Information Technology, the National Development and Reform Commission, the State Administration for Market Regulation, and the National Energy Administration jointly convened 16 leading power and energy storage battery companies, including CATL, BYD, Guoxuan High-Tech, and EVE Energy. The meeting's focus was squarely on optimizing capacity planning and regulating the market.

This was no ordinary "window guidance" session. After years of price wars and reckless expansion, the official message was unequivocal: The era of haphazard growth must come to an end; if companies won't take the initiative, regulators will step in.

01 Sudden Cancellation of Tax Refunds

The backdrop for this pivotal meeting was the growing issue of industry overcapacity. The Ministry of Industry and Information Technology bluntly instructed companies in the meeting minutes to "optimize capacity planning, mitigate overcapacity risks, and regulate market competition."

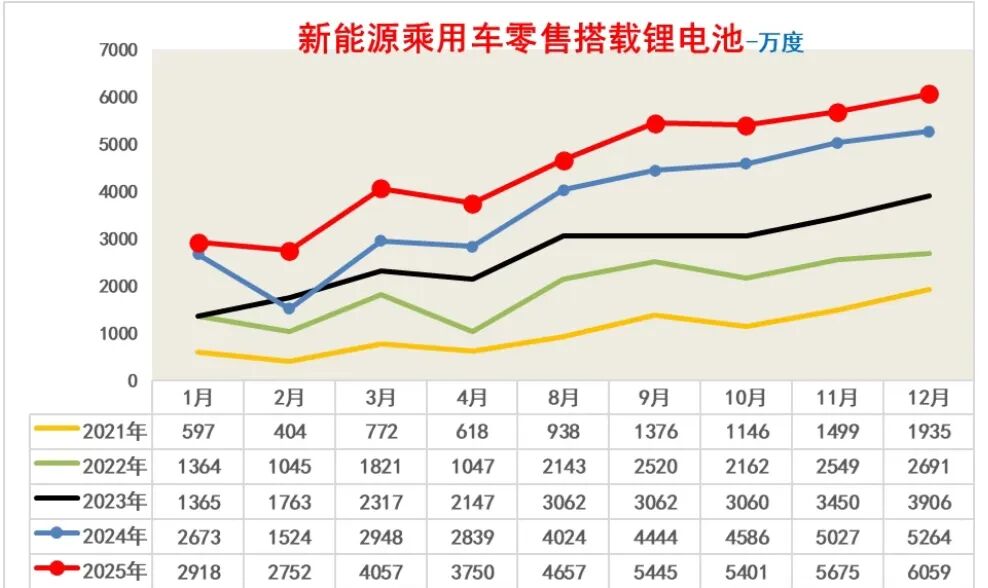

The timing was strategic. In the fourth quarter of 2025, demand for new energy lithium batteries had weakened, with a noticeable decline in passenger vehicle battery installations.

In December, new energy vehicle production even experienced a 5% month-on-month decline, with lithium battery demand falling short of expectations. The industry stood at a critical juncture.

Simultaneously with the meeting, significant news emerged regarding adjustments to export tax refund policies. On January 8, 2026, the Ministry of Finance and the State Taxation Administration jointly announced the cancellation of value-added tax export refunds for photovoltaic products.

The policy outlined a clear timeline: Starting from April 1, 2026, export tax refunds for photovoltaic products will be entirely phased out. For battery products, the refund rate will be reduced from 9% to 6% between April 1 and December 31, 2026, before being completely eliminated from January 1, 2027.

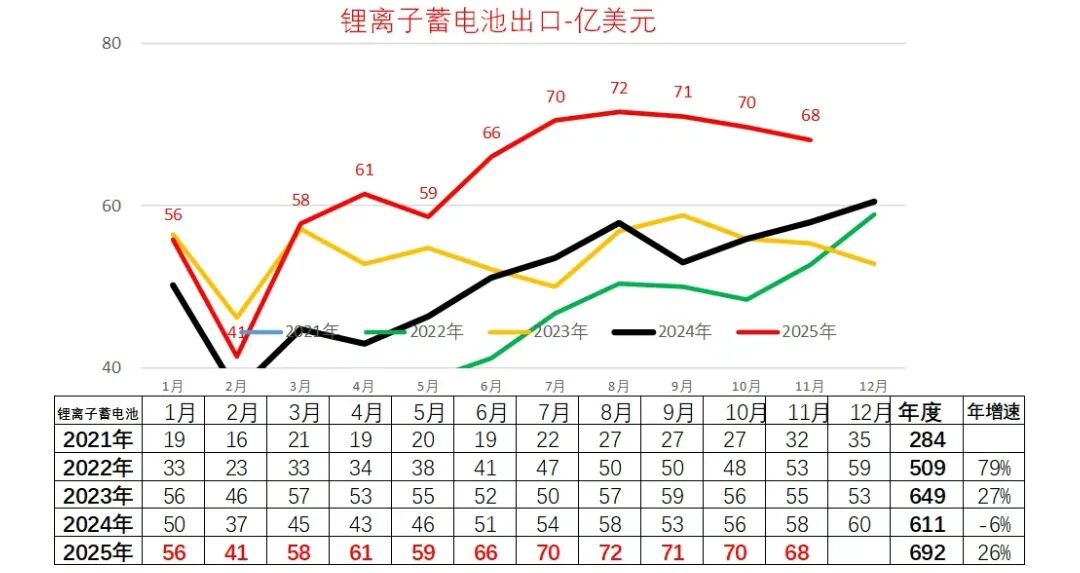

For an extended period, export tax refunds ranging from 9% to 13% have been instrumental in enabling Chinese new energy products to maintain "extreme cost-effectiveness" in the international market. The cancellation of these refunds will directly increase companies' export costs.

The rationale behind this policy shift is straightforward: to compel price increases, prevent domestic manufacturers from engaging in "suicidal" price-cutting battles in overseas markets; to alleviate trade tensions and reduce accusations from European and American nations regarding Chinese new energy product "subsidies"; and to retain profits domestically, as products now command global dominance and no longer require fiscal incentives to secure market share.

In this major policy overhaul targeting the "new three export champions," inverter manufacturers emerged as the unexpected beneficiaries. According to current policy trends, the tax refund cancellation primarily affects battery cells and photovoltaic modules, leaving inverters unscathed.

The news sparked a stir in the industry, with leading inverter companies "breathing a sigh of relief." The reason is evident: As the "brain" of photovoltaic and energy storage systems, inverters are subject to rapid technological advancements and have not yet succumbed to the near-insane overcapacity and price collapse witnessed in batteries and modules.

Officials' decision to temporarily retain tax refunds for inverters is, in fact, a strategic blend of "precision strikes" and "targeted protection," aimed at safeguarding the high-value-added power electronics sector. This differentiated policy approach reflects policymakers' nuanced understanding of various industry segments.

02 Accelerating Industry Reshuffling

What's intriguing is why industry giants did not oppose but instead supported the policy. Because this policy is a long-term boon for the giants and a setback for small and medium-sized manufacturers.

For those small and medium-sized manufacturers relying on low-end capacity and surviving on meager profits from state tax refund subsidies, the cancellation of refunds will instantly turn their already slim profit margins negative.

However, companies like CATL and BYD, with their strong scale effects and technological advantages, can offset the impact by raising overseas prices or leveraging their overseas factory networks.

When the "lifeline" of tax refunds is withdrawn, small factories unable to sustain themselves will face bankruptcy or be acquired en masse. The giants' agreement to optimize capacity is essentially a pact to "eliminate non-core capacity," thereby regaining pricing power.

Cui Dongshu, Secretary-General of the China Passenger Car Association, noted that the timing of this adjustment is relatively opportune. Domestic lithium battery demand for vehicle installations in the first quarter of 2026 accounts for only about 18% of the annual total, leaving approximately 7 percentage points of idle capacity based on the timeline, roughly half of the fourth-quarter shipments.

Therefore, the first-quarter export rush will not significantly disrupt the industry's battery supply and demand dynamics. It will also favor a relative supply-demand balance for domestic battery demand in the second half of the year and reduce opportunities for lithium carbonate speculation.

This policy effectively provides the industry with a buffer period, allowing companies time to adjust their production and export strategies. The refund rate reduction does not take effect until April 1, 2026, with full cancellation not occurring until January 1, 2027, giving companies ample time to adapt to the new market landscape.

Structural shifts are underway in the main export markets for Chinese lithium batteries. EU market demand has reached around 40%, growing by 4 percentage points in 2025 compared to 2024.

Meanwhile, China's lithium battery exports to the United States have sharply declined, falling by 9.5 percentage points in 2025 compared to 2024. The decline to the U.S. is equivalent to the total export volume to Southeast Asia, which ranks third.

China's export structure primarily targets the EU, Southeast Asia, Oceania, the Middle East, and other regions. In 2026, EU tolerance for Chinese battery exports is expected to diminish, making China's proactive reduction of lithium battery export tax refunds a prudent move.

03 'Surgical Precision' Is Imperative

From the symposium to tax refund adjustments, Chinese authorities are employing near-"surgical precision" to excise redundant and subpar elements from the new energy industry.

For giants possessing core technologies and capable of telling compelling "value stories," this is a golden turning point. For small and medium-sized manufacturers trapped in low-end market competition and reliant on policy subsidies, winter has arrived.

Reducing lithium battery export tax refunds can, on one hand, prompt Chinese export product prices to return to reasonable levels, reducing the so-called "subsidizing overseas consumers" phenomenon and allowing export prices to more accurately reflect market supply and demand. On the other hand, it helps address international concerns and alleviate trade frictions.

China's new energy industry is entering an era of "high-quality contraction." This is not a simple scale reduction but a structural adjustment from quantitative to qualitative growth. Policy guidance has shifted from the past approach of "helping to get on the horse and sending them off" to "weaning and promoting self-reliance."

In 2026, China's lithium battery demand for new energy vehicles is expected to decline significantly year-on-year, with battery manufacturers potentially needing to reduce production and implement furloughs to cope with demand fluctuations. When the dividends of price wars are exhausted, the moment to truly test a company's internal strength has arrived.

Companies capable of enhancing product value through technological innovation, diversifying market risks through globalization, and reducing costs through refined operations will emerge victorious in the new round of industry reshuffling. Those reliant on policy subsidies and low-price competition will gradually be eliminated by the market.

China's new energy industry is bidding farewell to wild growth and entering a new phase of mature competition. This policy-led industry reconstruction will shape the global battery industry landscape for the next decade.

Editor-in-Chief: Shi Jie Editor: He Zengrong

THE END