Li Auto's 2026 Do-or-Die Battle: Sales Slip Out of Top Three, Profit Streak Ends! New Generation L9 Emerges as Key Leverage

![]() 01/26 2026

01/26 2026

![]() 433

433

Can Li Xiang's Vision Be Revived by the L9?

If we were to pick the most 'disappointed' auto company boss in 2025, Li Xiang would undoubtedly make the list.

Once the sales leader among new automotive forces, Li Auto faced its most severe 'setback' since its inception this year. Extended-range models came under pressure, with MEGA and i8 sales performing poorly. Although the December launch of the Li Auto i6 boosted the pure electric share to 44% and somewhat salvaged the situation, the 18.81% annual sales decline directly pushed Li Auto out of the top three in the 'New Forces Annual Sales Rankings.'

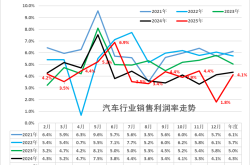

Graphic: Dianchetong

This downturn was even more striking amid the industry's growth wave. Brands like Leapmotor, Harmony Intelligent Mobility, XPeng, Xiaomi, and NIO all achieved significant year-on-year growth. Even second-tier brands such as ARCFOX, Avatr, IM Motors, and VOYAH showed steady improvement. The impressive performances of these peers undoubtedly exerted immense, unseen pressure on Li Auto.

Financially, the RMB 624 million net loss in the third quarter of 2025 marked the end of Li Auto's previous 11 consecutive quarters of profitability.

In terms of management structure, the departures of core executives like Zou Liangjun and Zhang Xiao, coupled with sustained performance declines, forced Li Xiang to dismantle the three-year 'professional manager' model and revert to a high-intensity 'startup' management approach, attempting to reverse the downturn with more efficient decision-making.

Additionally, in marketing, the Li Auto i8 launch sparked user dissatisfaction due to pricing and configuration controversies. Although an emergency adjustment the next day mitigated some impact, the subsequent 'Chenglong Truck Infringement' controversy pushed Li Auto into a prolonged public opinion storm, severely damaging its brand reputation.

Screenshot: Li Auto Live Stream

Facing an uncertain 2026, Li Auto has no room for retreat.

According to 36Kr Auto, Li Auto plans to launch a desperate counterattack this year, initially setting a growth target of around 40% for the year.

This means that based on last year's 406,000 units, Li Auto must sell 569,000 units this year, equivalent to an average monthly delivery of 47,400 units.

Whether Li Auto can regain its peak depends on this year's battle.

Reviving Li Auto with the New Generation L9? The Challenge is Exceptionally High

According to 36Kr Auto, Li Auto will focus its core resources on the new generation L9. The new car not only features comprehensive upgrades in size and chassis but also breaks through the 400km pure electric range barrier with a battery pack exceeding 70kWh. Notably, the car will also debut with the self-developed intelligent driving chip M100, aiming to take a crucial step in the intelligent driving field.

It is understood that the M100 chip excels in core scenarios such as VLA large model inference and visual task processing, with some performance surpassing NVIDIA's Thor-U and cost-effectiveness reaching over three times that of NVIDIA's Thor. Li Xiang even stated directly in the third-quarter earnings call that this would bring a 'fundamental transformation in product value and experience.'

Currently, Li Auto has implemented the VLA driver large model in the i8 model, paired with NVIDIA's Drive Thor-U chip offering 700TOPS computing power. Dianchetong's actual testing found that its assisted driving system can calmly handle complex urban road conditions and parking valet scenarios, also supporting natural language control, laying a solid algorithmic foundation for the M100 chip's implementation.

Source: Dianchetong Photography

Although the specific actual performance of the M100 chip remains unknown, it not only fills the market with anticipation but also has the potential to rapidly reduce chip costs, further optimizing the company's gross profit structure.

It is worth mentioning that assisted driving is just one of the application scenarios for the M100 chip. According to Li Xiang's plan, the chip will become a core pillar for Li Auto to bet on embodied intelligence and create 'automotive-shaped robots.' In other words, Li Auto will expand into 'new species' areas like humanoid robots based on the technological accumulation of the M100, with cars serving as the core carrier to verify and refine the chip's extreme capabilities beforehand.

Returning to the new generation L9 itself, its significant evolution in intelligent driving chips, body size, chassis tuning, and pure electric range indeed gives it stronger hard power in the high-end new energy SUV market. However, relying on a single model to revive the entire brand is clearly far from enough.

Firstly, the high-end SUV market landscape has evolved from a 'duopoly' to a 'wolf pack.'

The dominance of the Li Auto L9 is being eroded. The AITO M8 and M9 continue to sell well, while new entrants like the NIO ES8, Zeekr 9X, Tengshi N8L, IM LS9, and VOYAH Taishan have broken the original landscape.

These competitors not only closely follow in intelligence but also surpass in chassis quality, luxury feel, and brand positioning. Li Auto's core 'home use' label is being rapidly diluted. Even the new generation L9's long pure electric range and advanced intelligent driving struggle to form a dominant advantage in the homogeneous competition.

Source: Li Auto Official

It is also evident from Li Auto's sales composition that whether it is the L series or the pure electric series, the volume models are the Li Auto L6, Li Auto i6, Li Auto L7, and other lower-priced products. According to data published by Chezhijia, high-end models like the Li Auto L9, Li Auto MEGA, Li Auto i8, and Li Auto L8 accounted for less than 7% of sales in December last year, with flagship models having a limited pulling effect on overall sales.

Dianchetong understands Li Auto's strategic consideration of focusing its core resources on the L9. After all, the L9 is the brand's flagship SUV, carrying the most cutting-edge technological strength. However, given the current market intensity and changing consumer demands, attempting to revive the entire market with just one model undoubtedly poses immense challenges for Li Auto.

Secondly, consumers are gradually developing fatigue towards Li Auto's 'family car attributes.'

The once 'refrigerator, TV, large sofa' that was Li Auto's survival tool for attracting fans has now become a 'standard feature' of various high-end SUVs. When AITO brings a stronger HarmonyOS ecosystem, NIO builds an irreplaceable battery swap barrier, and Zeekr showcases a hardcore driving gene, Li Auto finds it difficult to evoke a 'must-have' purchase impulse from users.

This also means that for the new generation L9 to support the 40% growth target, it must offer differentiated advantages that competitors do not possess.

Source: Dianchetong Photography

The Truth Behind Li Auto's Sales Decline: Dual-Line Warfare Undermined the Extended-Range Foundation

If we were to pinpoint the root cause of Li Auto's 2025 predicament, it lies in the severe imbalance of its product layout.

Last year, Li Auto completed its product system of '4 extended-range + 2 pure electric SUVs + 1 pure electric MPV.' To expand its pure electric product matrix, Li Auto shifted its core resources towards the pure electric field.

Li Auto indeed aimed to rapidly expand its pure electric matrix, but reality dealt a heavy blow.

The challenges in the pure electric field were far more daunting than Li Auto anticipated. The flagship pure electric MPV model MEGA faced controversy over its design and lagged in the charging infrastructure, with annual sales of only 18,500 units, far below expectations. Although the pure electric SUV i8 quickly eliminated the negative impact after a price adjustment post-launch, its annual sales were only 23,100 units, significantly lagging behind competitors in the same price range.

The only model that performed reasonably well was the Li Auto i6, which gained recognition from some users due to its high cost-effectiveness. However, this was not enough to change the low overall sales proportion of Li Auto's pure electric models or fill the market gap left by the slowing growth of extended-range models.

Source: Li Auto Official

While the pure electric field struggled to gain momentum, the extended-range foundation encountered problems.

Due to excessive resource dispersion towards the pure electric field, the main models in the L series did not receive substantial upgrades throughout 2025, gradually being surpassed by competitors like AITO in terms of product strength. Once sales pillars like the L9 saw significant sales declines due to competitor pressure, while pure electric models failed to timely fill the void, ultimately leading to a nearly 20% plunge in Li Auto's overall sales in 2025. The dismal performance forced Li Auto to make strategic adjustments.

Against this backdrop, Li Auto's 2026 strategy shifted towards the extended-range track, clearly a more pragmatic choice, but it does not mean abandoning pure electrics. Currently, Li Auto has made it clear that it will continue to iterate the Li Auto i8; based on exposed spy photos, the pure electric SUV Li Auto i9, positioned larger than the i8, has also entered the testing phase and is expected to be launched later this year.

However, whether this strategic adjustment can propel Li Auto back into the leading camp depends on the implementation effectiveness of two key issues.

First, the stability of the extended-range foundation. Li Auto's sales foundation has never been the L9 but volume models like the L6 and L7. To stabilize the extended-range market, relying solely on upgrading the flagship L9 is far from enough. The key is to activate the market advantages of the L6 and L7. Whether it can rapidly boost the sales of these two main models directly determines its ability to stop the decline and stabilize in the short term, which is Li Auto's lifeline.

Second, the precision of breaking through in pure electric products. The Li Auto i6's monthly sales exceeding 15,000 units have proven that Li Auto's pure electric route is not unviable, but the core is to avoid making the mistake of aggressive expansion again. Instead of spreading resources thinly across the pure electric field, it is better to focus on niche markets to create 'small but beautiful' hit products. Whether the upcoming i9 can become a hit product on par with the 'all-new NIO ES8' will directly determine whether Li Auto can truly break through in the pure electric field.

Source: Li Auto Official

In the short term, if Li Auto can rapidly activate the market advantages of the L6 and L7, stabilizing the extended-range foundation will likely not pose significant problems. However, in the long term, establishing a synergistic development model between extended-range and pure electrics is the core confidence for Li Auto to stand firm in the ultimate new energy competition. If the pure electric layout always relies on the dividends of the extended-range market and fails to achieve independent profitability, Li Auto will inevitably fall into a passive position in market competition and struggle to recover.

Stabilizing the present with extended-range and planning for the future with pure electrics. Ultimately, whether Li Auto can regain its leading position depends on whether its new products can precisely hit user pain points and break through the market with a ruthless market positioning.

Epilogue

Li Auto's strategic intent for this year is already clear: using the new generation Li Auto L9 as the vanguard to drive the stability of the extended-range models' foundation while precisely targeting the pure electric field to create hit products.

One extended-range and one pure electric, advancing on dual fronts, aiming straight for the core battlefield of regaining the top spot in new force sales.

Currently, Li Auto holds several key trump cards: a solid foundation of over 1.54 million users, a clear positioning of 'high-end home-use SUVs,' and continuous investment in self-developed technological reserves. Especially in the extended-range technological track, its deep user cognition and product understanding remain its difficult-to-surpass advantages.

Source: Li Auto Official

However, it is evident that Li Auto still faces severe challenges. Leapmotor is accelerating its volume growth with extreme cost-effectiveness, AITO is aggressively advancing with Huawei's ecosystem, and Xiaomi is making a high-profile entry with ecological momentum. These competitors have established a clear competitive barrier in technology, products, and ecosystems, and consumer demands for high-end SUVs have long surpassed the single 'family' label.

Moreover, in the pure electric field, Li Auto has not yet established a sufficiently distinct brand cognition, and shaping its pure electric image remains a crucial ongoing task.

Achieving the annual target of nearly 570,000 units is indeed no easy feat, but for Li Auto, 2026 is not just a sales sprint. It needs to prove whether a brand, after experiencing strategic adjustments and market fluctuations, possesses strong error-correction capabilities and the resilience to re-lead the market.

(Cover image source: Li Auto Official)

Interpretation of Li Auto's New Force Auto Market New Energy

Source: Leitech

All images in this article are from the 123RF Authentic Library (royalty-free image library) Source: Leitech