Why Is Li Auto Emulating Tesla's Strategy Even as Its Legend Fades?

![]() 01/29 2026

01/29 2026

![]() 473

473

For the first time, Li Auto and Tesla are encountering similar growth challenges simultaneously: declining sales, and a slowdown—or even a drop—in profit and revenue growth.

Leaders of both companies have made analogous strategic choices and adjustments, intensifying their focus on AI beyond their core automotive operations. How resolute are they in this endeavor?

Even the Model S/X are now taking a backseat to humanoid robots.

During the earnings call, Musk painted a visionary picture of an "epic future": AI5, Optimus, Robotaxi... Significant resources will be funneled into hardware like batteries and chips.

A few days prior, Li Xiang proposed at an internal meeting that the company should go all out for the "last window" of opportunity in AI. Both firms are fully committed to AI, with Musk claiming the backing of shareholders and investors, while Li Auto faces criticism for "diverting from its core business."

As Tesla's profit-making legend unravels, is there still a viable path for newcomers following in its footsteps?

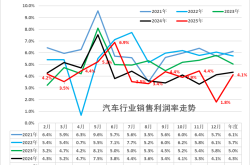

Profit Legend Unraveled? Still the Cash King Among Automakers

In 2025, Tesla's annual revenue reached $94.8 billion, marking a 3% year-on-year decline. This represents Tesla's first revenue drop after years of rapid expansion. Profits also decreased alongside revenue, with net profit standing at $3.794 billion, a 46% year-on-year decrease.

The primary reason for the collapse of the profit legend lies in the weakening of its core automotive business: declining new car sales, fewer regulatory credits, and reduced subsidies.

In 2025, Tesla sold 1.636 million new cars globally, a nearly 10% year-on-year decrease. Sales also fell in key regional markets. In the U.S., 581,000 vehicles were sold, an over 8% decline. In China, 614,000 vehicles were sold, a slight year-on-year decrease. Europe experienced the worst sales decline among major markets, with 238,000 vehicles sold in 2025, a 27% year-on-year decrease.

According to German official statistics, in December of the previous year, BYD's new car registrations in Germany more than doubled those of Tesla. For the entire year, BYD's sales in Germany, Europe's largest electric vehicle market, surged sevenfold to 23,000 units. Additionally, BYD outperformed Tesla in the UK, Europe's second-largest PHEV market.

2025 marks a challenging year for Tesla's transition from a "vehicle hardware company" to a "physical AI" company. Nevertheless, operating/free cash flow remained positive in 2025, with cash and investment balances significantly increasing to around $44.1 billion, providing substantial financial support for AI training clusters, inference computing power, and physical intelligence projects like FSD and Optimus.

During the earnings call, Musk stated that Tesla would substantially increase capital investment this year to prepare for an "epic future," encompassing the entire battery supply chain, solar cells, and AI chips.

Why Is Li Auto Pursuing Tesla's "Non-Core" AI Focus?

The essence of transitioning to physical AI is integrating fleets, robots, and energy networks into a closed-loop operation of data-computing power-software.

Shortly before Tesla's earnings release, Li Auto proposed at an internal meeting that 2026 would be the "last window" for its full-throttle AI push. Li Xiang, the leader, assessed that globally, no more than three companies would successfully deploy comprehensive layouts in the four core AI fields: foundational models, AI chips, embodied intelligence, and operating systems. Li Auto aims to... He also explicitly stated the goal of developing and swiftly launching humanoid robots.

Media reports indicate that the new L9 model slated for release this year will feature significant configuration updates, including the debut of its self-developed intelligent driving chip, M100. According to RoadCars, besides the intelligent driving chip, the vehicle's communication and operating system will also switch to the self-developed XingHuan OS.

Shortly before the earnings release, Musk posted on social media that AI5's performance on a single SoC is comparable to NVIDIA's Hopper, while a dual-SoC configuration rivals NVIDIA's Blackwell, all at a lower cost and price.

Tesla has explicitly stated that mass-produced Optimus robots will incorporate the latest AI5 chips, which Musk refers to as Tesla's "most powerful heart" ever built for robots.

"The robot's brain is the same autonomous driving computer as Tesla's cars," Optimus utilizes the same AI inference chips and computing platform as FSD. During the call, Musk mentioned that the next-generation self-developed AI chip would uniformly serve "physical intelligence" inference scenarios like vehicle FSD and Optimus, and that AI5 and subsequent AI6 would also be utilized for data center training/inference, thereby constructing a unified chip and software platform.

Regarding the latest progress on self-developed chips, Musk pointed out that he dedicates a significant amount of time each week to the A15 chip, as it currently represents Tesla's most critical bottleneck. The AI5 chip is anticipated to complete design in 2026 and enter mass production in 2027.

"Without chips, the humanoid robot Optimus is merely a lifeless mannequin," Musk assessed that in the coming years, the biggest challenge limiting Tesla's growth will be AI chip and memory capacity. Therefore, Tesla must establish its own TerraFab wafer plant to mitigate geopolitical risks.

Recently, Musk announced that starting February 14, FSD would eliminate its one-time purchase option and fully transition to a subscription model. In the fourth-quarter earnings report, Tesla disclosed for the first time that the number of FSD paid users (including one-time purchases and monthly subscriptions) was around 1.1 million, accounting for approximately 12% of the company's cumulative vehicle sales.

In essence, from Tesla's successful trajectory, expanding the business from automobiles to AI does not constitute a deviation from the core. From cars to robots to Starlink and AI Grok, these endeavors have genuinely supported Tesla in achieving an "ecological reaction."

Deeply Learning from Tesla Is Not the Mainstream Choice for Domestic Automakers

Apart from Li Auto, few domestic automakers have declared an all-in commitment to AI. From the perspective of intelligent driving deployment, an increasing number of mainstream automakers are leaning towards an engineering approach of "supplier ecosystem + system integration." The rationale is pragmatic: balancing mass production rhythm, functional safety, and cost structure. Behind leading automakers like Chery, Great Wall, Geely, and BYD, several top suppliers can be identified.

Among the newcomers, besides Li Auto, NIO and XPeng have also opted to self-develop chips and operating systems, resembling an "experience-oriented" systems engineering approach: optimizing key experiences through data closed loops. However, they have not pursued true full-stack self-development.

By self-developing key hardware and software, such as XPeng's Xpilot intelligent driving system and NIO's Banyan and Adam computing platforms, these companies aim to achieve differentiated user experiences by controlling core functions, ensuring high synergy between software and hardware, thus providing smoother and more personalized intelligent driving and cabin functions, and continuously delivering new value to users through OTA upgrades.

However, even these leading newcomers do not independently develop all core components. They also integrate mature solutions like external sensors and high-performance computing chips (e.g., NVIDIA Orin), focusing self-development efforts on strategic core areas.

A discernible trend is emerging: an increasing number of automakers are reverting to an "engineering mindset." The core lies in achieving a delicate balance of cost, experience, and business model closure. It reflects a profound consideration of market demand, cost control, and profitability paths.

Undeniably, despite earning $3 billion less annually, shareholders and investors remain willing to support Musk's AI gamble. The underlying rationale is that products developed under this model possess a higher ceiling. FSD's long-standing dominance in the intelligent driving field is also predicated on this. This is precisely Li Auto's rationale for going all-in on AI: it's a gamble worth undertaking.

Because of this, even without replicating Tesla's model, domestic automakers fully concur with the broad direction Musk has identified. Self-developed chips + self-developed large models + robots are areas where every mainstream automaker is making strategic moves.