Sales Plummet by 25%: Are Chinese Cars Facing Peril in Russia?

![]() 01/26 2026

01/26 2026

![]() 555

555

Introduction

Introduction

Sales decline and market share dwindles, yet selling under an alternate brand can still yield profits.

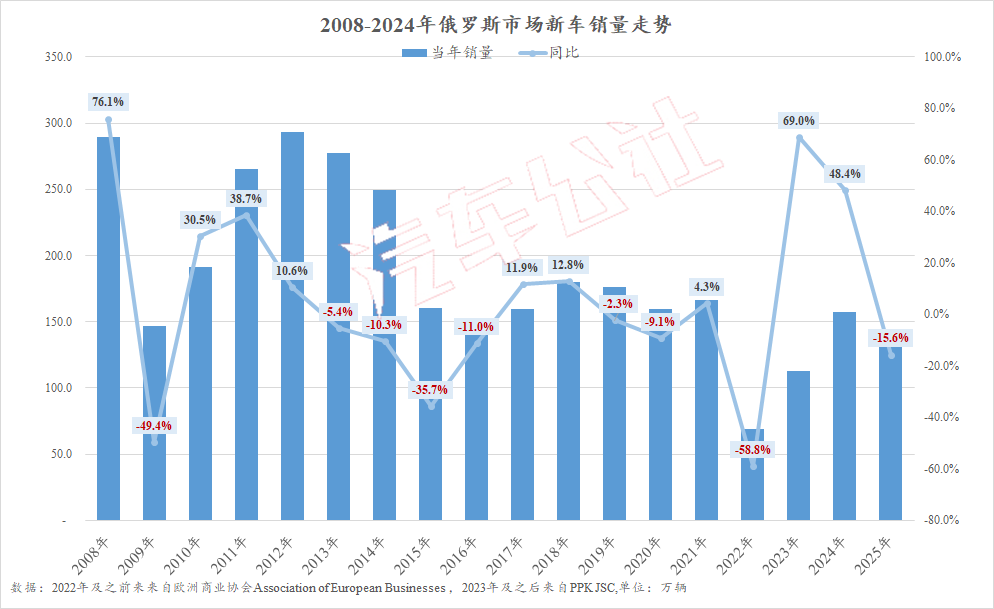

Following significant growth in 2023 and 2024, the Russian new car market experiences another downturn in 2025.

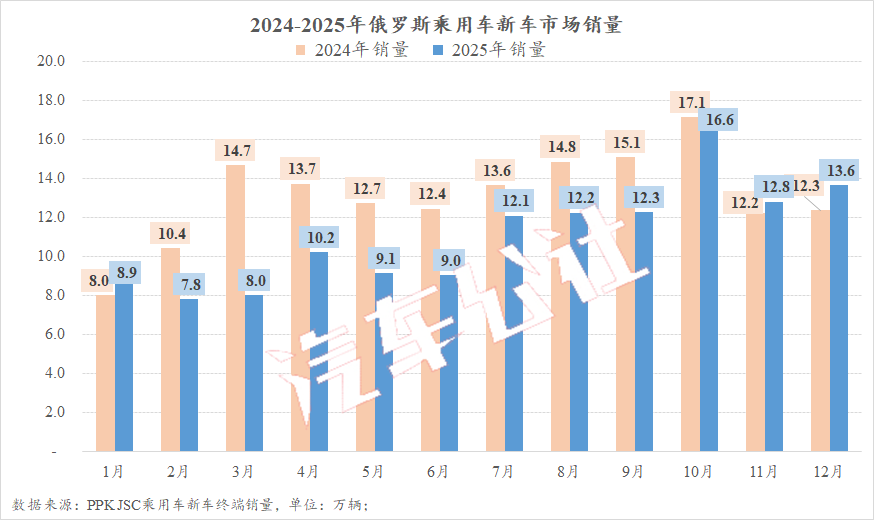

Taking passenger cars, which dominate the new car market, as an example, data from the Russian statistical agency PPK JSC (based on the number of new passenger cars sold to consumers) reveals that a total of 1.326 million new passenger cars were sold in Russia in 2025, marking a 15.6% year-on-year decrease.

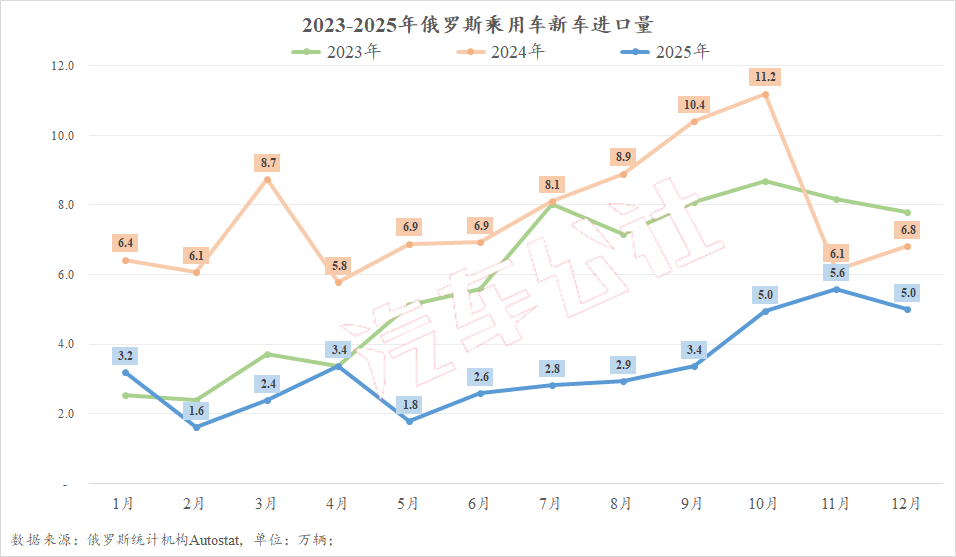

This downturn is primarily attributed to the automotive market gradually normalizing. Starting from the end of 2023, the Russian government began to continuously tighten policies related to the automotive industry, especially those concerning imported cars, in order to support local automakers and encourage foreign automakers to achieve localized production. For instance, there have been multiple significant hikes in vehicle recycling and scrappage fees and import car tax rates.

In June 2023, all imported and locally produced vehicles were required to gradually restore compliance with the current requirements of the Technical Regulations on the Safety Level of Domestic Vehicles.

In August 2023, vehicle recycling and scrappage fees saw a substantial increase.

In October 2023, automotive brands with official dealers in Russia were no longer permitted to import through parallel channels.

In February 2024, electric and hybrid vehicles imported into Russia were no longer eligible for the simplified certification system.

In April 2024, vehicles imported from countries within the Eurasian Economic Union were subject to duties, value-added tax, and consumption tax in accordance with Russian requirements (any benefits enjoyed in other countries due to tariff differences must be compensated).

In October 2024, recycling and scrappage fees were increased again, with import vehicle recycling and scrappage taxes rising by 70%-85%, and continuing to increase by 10%-20% annually until 2030.

In January 2025, Russia began to increase import car tariff rates, with reports indicating that corresponding tariffs would increase by 20%-38% depending on the specific price of the imported vehicles.

In December 2025, value-added tax and vehicle recycling and scrappage fees were increased once more.

A series of policy changes have led to a sharp decline in imported car sales and a significant increase in new car prices. Particularly after the 70%-85% increase in import vehicle recycling and scrappage taxes in October 2024, followed by another tariff hike for imported cars in January 2025, Russian light vehicle sales began a continuous monthly decline in February.

Due to the implementation of new value-added tax and recycling and scrappage taxes on December 1st, a large number of consumers made purchases before the new policies took effect. The automotive market only returned to growth in November 2025. The new increment created by this brief growth was very limited, so the year ultimately ended with negative growth.

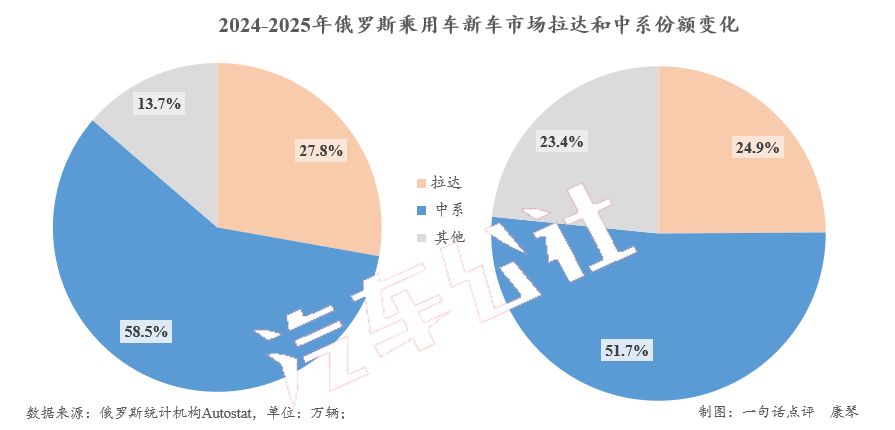

01 Chinese Car Market Share Drops to 51.7%

As we all know, after the outbreak of the Russia-Ukraine conflict, foreign automakers such as Korean, Japanese, and French brands, which once held significant market shares, withdrew one after another. In 2022, Russian passenger car sales plummeted by nearly 60%. Meanwhile, a large number of Chinese automotive brands quickly entered the market, filling the void.

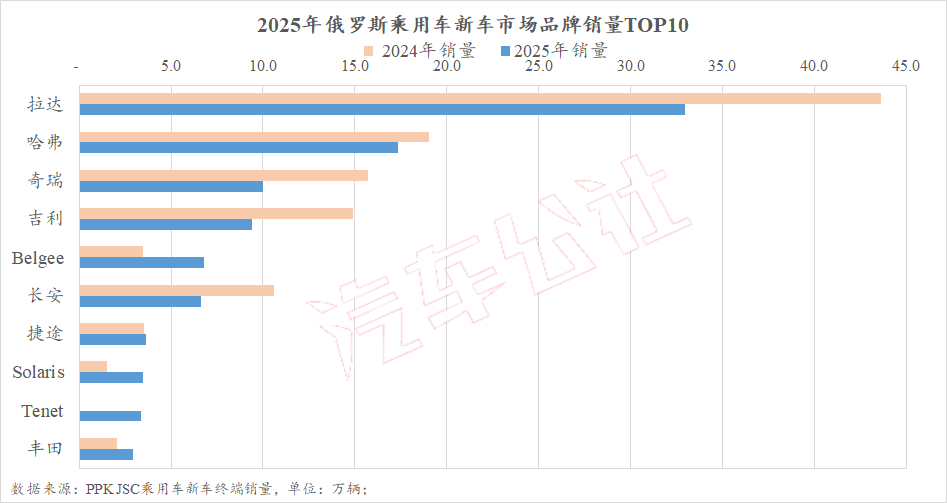

In 2024, Chinese automotive brands (excluding joint venture brands of Chinese automakers abroad) surpassed the 50% market share threshold in the Russian passenger car new car market for the first time. Therefore, the Chinese brands were naturally the most affected by the downturn in the Russian automotive market in 2025. Sales of independent brands such as Haval, Chery, Geely, and Changan all decreased to varying degrees.

Specifically, according to PPK JSC data, among the top ten brands in new passenger car sales in Russia in 2025, only four saw positive year-on-year growth, one had no year-on-year data as it entered the market less than a year ago, and among the five Chinese brands, only Jetour achieved positive growth.

Lada, as a giant in the Russian domestic automotive industry, remained at the top with 330,000 units sold in 2025, but its year-on-year decline reached 24.4%, far exceeding the overall market decline of 15.6%. Its market share narrowed to 24.9%, hitting the lowest point since 2022.

Haval continued to rank second with 173,000 units sold, although its sales fell by 9.1% year-on-year, its market share increased to 13.1%.

Chery continued to hold the third place, but its sales fell by 36.4%, with only 100,000 units sold. Its market share of 7.5% was the first time it fell below 10% in nearly three years.

Geely's sales fell by 36.9%, with 94,000 units sold.

Belgee, a joint venture between Geely and Belarus, nearly doubled its sales to 68,000 units in 2025 as its product lineup expanded, and its market share increased to 5.1%.

Changan experienced the most severe decline among the top ten brands, with sales falling by 37.6% to 66,000 units.

Jetour had the smallest increase among the four brands with positive year-on-year growth, at only 3.9%.

Solaris, a brand that rebadges Hyundai and Kia models, saw its sales reach 35,000 units in 2025, a 132% year-on-year increase, thanks to an increase in its dealer network and terminal price discounts.

Tenet, a Sino-Russian joint venture that rebadges and produces Chery models, can be considered the biggest dark horse in the Russian new car market in 2025, with total sales reaching 33,000 units just four months after its launch.

Toyota once again made it to the top ten brand list after a year, with sales of 29,000 units, a 40.3% year-on-year increase. Toyota has not officially returned to the Russian market, but dealers have introduced vehicles into the country through parallel imports.

Because sales of major head automakers such as Haval, Chery, Geely, and Changan have all decreased, and unlisted brands like Omoda, Exeed, Li Auto, and Zeekr have also suffered significant losses, the market share of independent brands in the Russian market has significantly narrowed in 2025.

After organizing PPK JSC's data, the Russian statistical agency Autostat found that Chinese automotive brands sold 685,000 new cars in Russia in 2025, a 25% year-on-year decrease. Therefore, China's market share in the Russian passenger car new car market decreased from 58.5% in 2024 to 51.7% in 2025, marking the first decline in market share for Chinese brands in the country in recent years.

02 Continue to Make Profits Under a Different Brand

It is worth noting that 2025 may only be the beginning, and the market share of Chinese cars in Russia may continue to decrease in 2026.

Although Belgee and Tenet rebadge and produce independent models of Geely and Chery, the Russian automotive industry generally considers the former a Belarusian brand and the latter a Russian domestic brand, so neither is included in the Chinese brand category.

It is reported that Tenet emerged partly because, as a local brand assembled in Russia, Tenet's prices should be slightly lower than imported cars, and consumers purchasing Tenet models need to pay less recycling and scrappage fees than foreign brands. Another reason is that Chery sells in many overseas markets, and selling in Russia under the name of Tenet allows Chery to avoid sanctions from the United States and European countries in other markets, minimizing risks.

Therefore, there is news that, considering the above factors and to make room for Tenet in the market, Chery will gradually withdraw from the Russian market in the future.

Perhaps not only Chery, but the sharp decline in Geely's sales may also be a decision made after weighing these factors. After all, as a member of the Eurasian Economic Union, Belarus enjoys certain preferential conditions for import and export trade with Russia.

Therefore, although the surface market share of Chinese cars in Russia will significantly decrease in the future, they will continue to make profits in Russia in a less risky manner. Subsequently, more Chinese brands may choose to sell in Russia under a "rebadged" approach.

For the Russian government, the local assembly of brands like Tenet can fully utilize idle factories and promote the development of the Russian domestic automotive industry. Solaris, which also sells rebadged models, is also regarded as a Russian domestic brand.

As local brands, in addition to reduced recycling and scrappage fees, Tenet and Solaris can both enjoy Russian national automotive loan subsidies. Due to meeting localized production requirements, Tenet will also become a candidate model for Russian taxis alongside brands like Haval.

Of course, all these favorable policies are only for automotive brands that have achieved localized production. For brands like Toyota that rely more on imports, the step-by-step escalation (continuous addition of policies) has increased costs, and the Russian automotive market still faces numerous difficulties and challenges.

In fact, brands like Toyota, Hyundai, Kia, and Renault, which once ranked high in the Russian market, may also want to return.

In February 2025, the CEO of Renault Group, based on the temporarily suspended situation at the time, wanted to exercise the repurchase right for the original factory. However, the takeover of the factory, AvtoVAZ Group, demanded a huge "compensation" of 112.5 billion rubles (approximately 9.7 billion yuan at the time). The result was predictable; Renault naturally gave up.

Indeed, after these foreign automakers left under pressure from the political situation, their original factories have found new managers, operators, and even third-party participants. For example, half a year after Renault announced its withdrawal from Russia, one of its factories resumed mass production in November 2022, producing the Moskvich 3e, a rebadged version of JAC Motors' E40X.

Recently, there have been reports that the St. Petersburg factory, which previously produced Toyota and General Motors vehicles, will be fully operational this year.

Regarding the trend of the Russian new car market in 2026, due to the further increase in value-added tax and recycling and scrappage fees, which will cause terminal prices to rise, and increasingly stringent automotive loan conditions, such as the need for formal employment certificates, coupled with the time required for brands shifting to localized production to adjust their production lines, the first half of this year may mainly see negative growth. Whether the full year can turn positive depends on the performance in the second half of the year.

Editor-in-Chief: Du Yuxin Editor: Wang Yue

THE END