Can Polestar Automotive Turn the Tide Under the Threat of Delisting?

![]() 06/20 2024

06/20 2024

![]() 411

411

Can it be learned in just three years?

Edited by: Zhang Ge

Style: Chen Chen

Source: Rhodium Finance - Rhodium Finance Research Institute

A healthy market has both advances and retreats.

Both the delisting of A-shares based on face value and the "one dollar" delisting of US stocks serve as a "market bottom line," strengthening the effects of survival of the fittest and the premium currency.

Back in June 2022, Polestar Automotive officially listed on the Nasdaq in the US. As a high-end electric vehicle brand backed by two powerful financial backers, Volvo and Geely, it attracted much attention from investors at the time.

However, surprisingly, it fell into a "delisting" crisis in just two short years, and its share price also plummeted to an all-time low.

The decline stemmed from a notice of non-compliance received from Nasdaq on May 17 for failing to submit its 2023 annual report on time. The company's stock price fell sharply for several consecutive days starting May 20 and fell below $1 on May 21. As of June 18, 2024 (EDT), Polestar Automotive closed at $0.69, having traded below $1 for 20 consecutive trading days.

According to Nasdaq regulations, a warning will be issued if the stock price remains below $1 for 30 consecutive trading days. If the company fails to take corresponding measures to self-rescue and raise its share price within 90 days of the warning, it will be announced that trading in its stock will be suspended, facing the risk of delisting.

Regarding the reasons for the "difficult birth" of the annual report, Polestar Automotive announced on April 30 that the company needs more time to settle its books and records, complete the preparation of financial statements, and complete the audit procedures for the year ended December 31, 2023, while correcting certain errors in the 2021 and 2022 annual and interim financial statements. Polestar Automotive expects that this correction will have a positive impact of less than 5% on the net loss for 2021 and a negative impact of less than 5% on the net loss for 2022.

In fact, since its listing in June 2022, the overall trend of Polestar Automotive's share price has been unfavorable, with continuous fluctuations and declines. The latest closing price has fallen by about 93% from the high of $13.36 on the first day of listing.

Of course, the company hasn't been idle. On June 5, according to Jiemian News, Geely executive Qin Peiji is set to replace Chen Siying as Chief Operating Officer of Polestar Technologies. On June 17, Polestar Automotive announced that it is working with existing and new partners to expand its retail market footprint, with plans to enter seven new markets in France, the Czech Republic, and other countries by 2025. On June 18, Polestar Automotive announced that Board Chairman Samuelsson will step down, and former Volkswagen China CEO Andreas Renschler will take over.

It begs the question, how did the prestigious Polestar Automotive come to this? Can the above-mentioned "grand plans" and executive changes boost business confidence?

01

Consecutive losses, annual sales targets not met

Lack of presence in the Chinese market

Can "blood transfusion" + layoffs solve the problem?

LAOCAI

The fundamentals speak volumes.

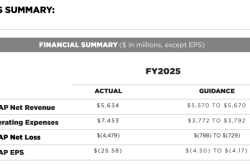

In 2021 and 2022, Polestar Automotive had revenues of $1.337 billion and $2.462 billion, respectively, with losses of $1.007 billion and $466 million. As of the first three quarters of 2023, the company's revenue was $1.844 billion, with a loss of $468 million. Over two years, it has accumulated losses of $1.941 billion.

Behind the consecutive losses, sluggish sales are an important consideration. According to the Economic Observer, from 2020 to 2023, Polestar Automotive's global sales were 10,200, 29,000, 51,500, and 54,600 vehicles, respectively, showing sustained growth, but the overall volume is still significantly behind that of BYD, NIO, and XPeng. Especially in 2023, the year-on-year growth rate encountered a bottleneck, and even started to decline in the first quarter of 2024, with global sales of about 7,200 vehicles, a year-on-year decrease of 40%.

It should be noted that, according to the National Business Daily, Polestar Automotive had set a sales target of 80,000 vehicles for 2023. With sales falling short of expectations in the first half of the year, Polestar lowered its expectations to 60,000-70,000 vehicles mid-year. Even so, the result of 54,600 vehicles still failed to meet the target, which is quite embarrassing.

Looking at the regional composition of sales, most are concentrated in Europe and North America. According to Autohome, of the 51,500 vehicles sold by Polestar in 2022, more than 30,000 were sold to the EU market.

In contrast, the Chinese market is relatively weak. According to the Economic Observer, in 2021, Polestar Automotive sold 2,048 new vehicles in China, accounting for only 6.90% of its global sales. In 2022 and 2023, Polestar Automotive did not choose to disclose Chinese market data. According to the National Business Daily, sales in China in 2023 were about 1,100 vehicles. Since the delivery of its first model in 2020, Polestar has sold a cumulative total of about 5,000 vehicles in the Chinese market. In the first four months of 2024, Polestar Automotive's cumulative sales in China were less than 1,000 vehicles. This is even less than the weekly sales of the newly listed Xiaomi Automotive in April (a total of 7,058 vehicles delivered in April).

In 2023, China's production and sales of new energy vehicles both exceeded 9 million, ranking first globally for nine consecutive years. Backed by Volvo and Geely, two powerful financial backers, but barely having a presence in the largest consumer country for new energy vehicles, it is indeed disappointing that Polestar Automotive has struggled to increase its sales.

As we all know, the automotive industry is a typical scale industry. Especially for new energy automakers, rapidly increasing production is the only way to raise gross profit margins, escape the quagmire of losses, repay research and development to form a virtuous ecosystem, and create a unique moat.

With its own sales not satisfactory, external "blood transfusion" has become a top priority. In November 2023, Polestar Automotive announced that it had received a total of $200 million in convertible loans from shareholder Volvo Cars; Geely Sweden Automotive Investment Co., Ltd. is providing it with a term loan of $250 million, for a total of $450 million.

On February 28, 2024, Polestar Automotive announced that it had obtained external financing of $950 million (equivalent to approximately RMB 6.748 billion), a three-year loan provided jointly by a syndicate of 12 domestic and foreign banks.

"For us, the most important thing is to be able to focus on launching new vehicles. This financing provides the funds needed to complete projects for the Polestar 2, 3, and 4 models this year and the 5 model to be added in 2025," said Chief Executive Officer Thomas Ingenlath.

In addition, to ease financial pressure, Polestar has tightened its belt and cut staff. According to the Yangtze River Business Daily, in May 2023, Polestar announced global layoffs of 10% and a freeze on hiring. In January 2024, it announced that due to the current challenging market, it plans to lay off about 450 employees globally, accounting for about 15% of its total workforce.

02

Getting up early but arriving late

Just because it doesn't adapt to China's "competition"?

Solid quality control is crucial

LAOCAI

However, both "blood transfusion" and layoffs are stopgap measures, and the real solution lies in improving the company's profitability.

Public information shows that Polestar Automotive was born in Sweden, Europe, and became Volvo's supplier of performance models in 2005. In 2009, Volvo incorporated Polestar into its racing and performance vehicle development department.

Backed by Volvo, performance and design are Polestar's two major advantages, and it has a certain reputation in the European and American markets. Whether in terms of product technology or brand depth, it is not inferior to existing new energy forces. Taking the company's first-generation product, the Polestar 1, as an example, with a maximum output of up to 600 horsepower and a maximum torque of 1,000 Nm, it gained popularity in Europe right after its debut thanks to its powerful performance and minimalist design.

However, this has changed in the domestic market.

In April 2024, Shen Ziyu, Chairman and CEO of Polestar Technologies, lamented: "Our brand awareness in the Chinese market is not good. We got up early but arrived late. This is because after 2017 to 2018, Polestar's investment in the Chinese market was relatively limited, including in corporate, product planning, as well as intelligence and localization."

Indeed, Polestar entered the Chinese market at just the right time, when the market was booming and there were ample opportunities for territorial expansion. It should be noted that Li Auto's first model, the Li ONE, was officially launched on April 10, 2019, and NIO's first model, the ES8, was only launched at the end of 2017.

Unfortunately, Polestar did not seize the opportunity, and its limited investment and strategic misjudgment allowed it to cede the market to others.

Take Lynk & Co, another brand under Geely, as an example. Founded in 2017, it is also positioned as a global high-performance electric vehicle brand, but its domestic popularity far exceeds that of Polestar Automotive. According to Guancha.cn, in the first quarter of 2024, Lynk & Co sold 61,100 vehicles, an increase of 64% year-on-year, exceeding Polestar's annual sales in 2023.

Of course, the degree of competition in the domestic market in recent years is evident to all. During the "China Automotive Chongqing Forum" on June 6, 2024, Li Shufu, Chairman of Geely, frankly stated that "the price war in the Chinese automotive industry is unparalleled in the world," while Wang Jun, President of Changan Automobile, said that "excessive competition will lead to the驱逐良币 (expulsion of good money by bad)," and Wang Chuanfu, President of BYD, believes that "competition will create world-class brands belonging to China."

Shen Ziyu lamented that "the Chinese market is too competitive, and we don't have much of an advantage in competing with others on price and parameters. We can't compete and we can't afford to compete."

The consideration lies in the fact that the basic quality control does not seem to be very solid either. In April 2023, the Polestar 4 made its global debut at the Shanghai Auto Show. However, less than a year later, it was recalled due to quality issues. On March 29, 2024, the State Administration for Market Regulation announced that recently, Polestar Auto Sales Co., Ltd. has decided to recall certain 2023-2024 model year domestic Polestar 4 pure electric vehicles produced between November 29, 2023, and February 1, 2024, totaling 1,867 vehicles.

According to Polestar Automotive, some of the vehicles within the recall range may trigger brake control degradation due to a problem with the brake controller software, causing functions such as brake electronic assistance to fail, reducing brake effectiveness, and posing a safety hazard.

Browsing the Car Quality Network, related complaints are also concentrated on quality defects, price instability, and other aspects.

After all, the driving experience is the lifeblood of a company's development and the cornerstone of all "competition." In terms of price and parameters, Polestar can be a bit laid-back, but it must be sufficiently aggressive on the quality front. As we all know, Volvo, the "big brother," has won the trust of consumers with its reputation for "safety" and embarked on a long-term path.

Looking at the above recall questions, how much homework does Polestar still have to do?

03

From management to product positioning

Why are there so many changes?

LAOCAI

Looking deeper, the stagnation of the company's development and the uncertainty of its product positioning are also considerations.

Public information shows that Polestar has launched four models globally: Polestar 1, Polestar 2, Polestar 3, and Polestar 4. However, there is a sense of disconnection among the four models, and they have not formed a coordinated approach.

Back in August 2018, the Polestar 1 was released, targeting the Tesla Model S, with a pricing of up to 1.45 million yuan and a limited production of 500 vehicles per year, creating a hunger marketing strategy. In contrast, brands like Li Auto's "Li ONE" and XPeng's "G3" quickly opened the market with their first models by relying on cost-effectiveness.

In November 2020, Polestar's second model, the Polestar 2, arrived late, targeting the Tesla Model 3, with a starting price of 299,800 yuan, which was relatively affordable. However, at that time, new force representatives such as NIO, XPeng, and Li Auto had already entered the mass delivery phase, and Polestar Automotive had a low brand awareness in China. Moreover, unlike traditional gasoline-powered cars, the performance technology of electric-driven new energy vehicles cannot be fully demonstrated, while features like televisions, refrigerators, and large sofas are more tangible and easily favored by domestic consumers. Subsequently, coupled with quality issues such as "incorrect speedometer settings in the dashboard software" and "faults in the connection components between the vehicle and the inverter," it once again failed to make much of a market splash.

The Polestar 3, launched in 2022, has returned to a high-end positioning, with prices starting at 698,000 yuan for the dual-motor long-range version and 798,000 yuan for the high-performance version. However, the fluctuating pricing of its models inevitably left the market somewhat confused and waiting.

Currently, Polestar Automotive mainly relies on the sales of the Polestar 4 in China. According to Jinrongjie, the cumulative sales of this model in the first four months of this year were 746 vehicles.

Industry analyst Wang Yanbo said that for automakers, especially in emerging markets like new energy vehicles, brand market positioning is crucial. This relates to the consumer segment and who the competitors are. Targeting which market, such as Li Auto's positioning as a mobile family, NIO's positioning in battery swapping, etc.; reviewing Polestar's product line, the fluctuating pricing indicates that the automaker lacks a clear understanding of brand positioning and market development, which not only makes it difficult to harvest popular models but also easily disrupts brand positioning and market perception.

Not only that, according to Jiemian News, Polestar has undergone several changes in leadership since entering the Chinese market in 2017.

On January 2, 2024, Chen Siy