BYD is closing in on SAIC

![]() 07/04 2024

07/04 2024

![]() 547

547

Unintentionally, BYD's monthly sales volume has come close to that of SAIC Motor, the largest domestic automaker.

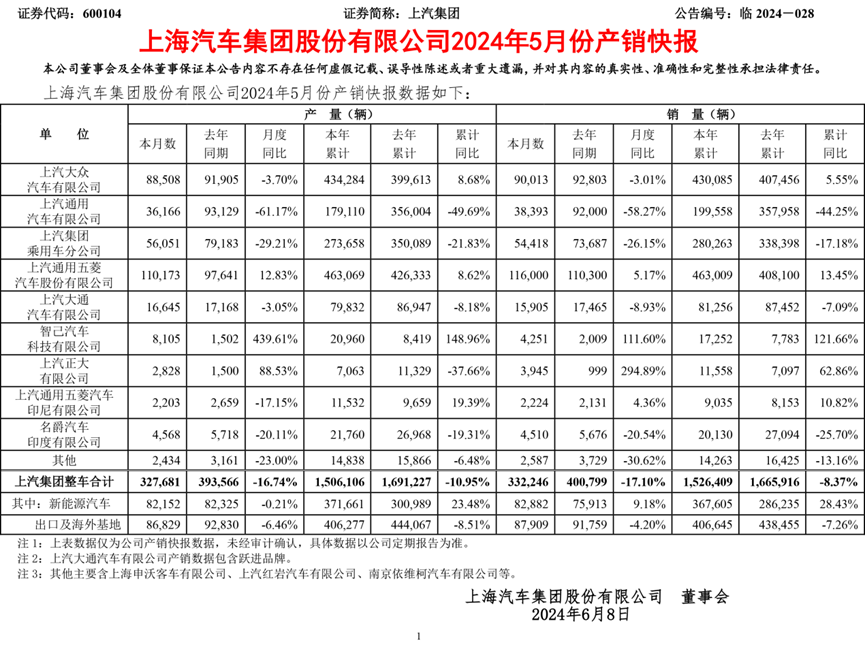

According to official data, SAIC Motor sold 332,246 vehicles in May, while BYD sold 331,817 vehicles. The sales gap between BYD and SAIC Motor is less than 500 vehicles. It's hard to imagine that SAIC Motor, which has been China's largest vehicle manufacturer for 18 consecutive years, with companies like SAIC-GM, SAIC Volkswagen, SAIC-GM-Wuling, and SAIC MAXUS under its umbrella, would one day be caught up by other automakers. Now, this result is increasingly becoming a reality.

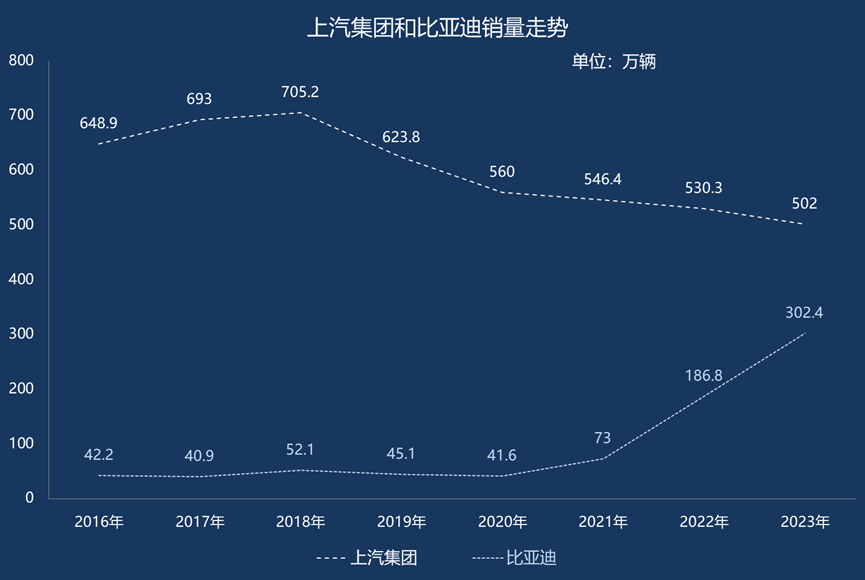

In recent years, SAIC Motor's sales have been declining slowly. In 2023, SAIC Motor's sales dropped to 5.02 million vehicles, over 2 million fewer than its peak. Behind the decline, the loss of momentum of SAIC Motor's joint venture automakers has been the direct reason. In the past few years, all three major joint ventures of SAIC-GM, SAIC Volkswagen, and SAIC-GM-Wuling have seen declines. Among them, SAIC-GM-Wuling sold 730,000 fewer vehicles than its peak, and SAIC-GM sold 1 million fewer vehicles than its peak.

As SAIC Motor's sales have declined in recent years, the automotive market has become saturated, and market competition has become increasingly fierce. At the same time, the electrification of automobiles has become increasingly popular, and consumer demand for automobiles is also changing. Nowadays, more and more consumers are starting to pursue plug-in hybrid models and extended-range electric vehicles. Meanwhile, with continuously improving range and charging facilities, pure electric vehicles are also becoming increasingly popular. As a result, traditional gasoline-powered vehicles are gradually losing consumer favor. Many joint venture automakers have seen declines in sales, and even luxury brands have not been spared. In sharp contrast to SAIC Motor's decline, BYD's sales have skyrocketed, from 416,000 vehicles in 2020 to 3.024 million vehicles in 2023.

Data shows that in May, SAIC Motor's sales fell 17.1% year-on-year, while BYD saw a significant increase of 38.1% year-on-year. In the first five months of this year, SAIC Motor's cumulative sales were 1,526,409 vehicles, down 8.37% year-on-year; BYD's cumulative sales reached 1,271,325 vehicles, up 26.8% year-on-year. Today, the sales gap between BYD and SAIC Motor is less than BYD's monthly sales. Last year, the gap between BYD and SAIC Motor reached 663,000 vehicles. BYD's chairman Wang Chuanfu said at the 2023 financial report investor communication meeting that the new energy vehicle industry has entered a knockout round, and 2024-2026 will be a decisive battle of scale, cost, and technology. Chinese automakers are accelerating the launch of new energy products, which will erode the market share of joint venture brands. According to the sales and production report released by SAIC Motor, both SAIC Volkswagen and SAIC-GM-Wuling achieved growth in the first five months of this year. Among them, SAIC Volkswagen sold 430,085 vehicles in the first five months, up 5.55% year-on-year; SAIC-GM-Wuling sold 463,009 vehicles in the first five months, up 13.45% year-on-year.

While both SAIC Volkswagen and SAIC-GM-Wuling are growing, SAIC-GM is still experiencing significant declines. In May this year, SAIC-GM sold only 38,393 vehicles, a significant drop of 28.27% year-on-year. In the first five months of this year, SAIC-GM sold 199,558 vehicles, with a year-on-year decline of 44.25%. Currently, SAIC-GM has become the largest "gap" in SAIC Motor's sales. In the first five months of this year, SAIC Motor sold 139,507 fewer vehicles than the same period last year, while SAIC-GM sold 158,400 fewer vehicles than the same period last year. An indisputable fact is that under the hot sales, almost all of BYD's models have become benchmarks in their respective market segments, and brands like Wenjie, Tesla, Lixiang, and NIO have also become stars in their respective market segments. With strong brand appeal, these new energy brands and products have gained market dominance.

In May, SAIC Motor sold 97,000 new energy vehicles, an increase of 27.4% year-on-year; in the first five months, SAIC Motor sold 367,600 new energy vehicles, an increase of 28.43% year-on-year. In terms of overall sales trends, SAIC Motor's performance in the new energy vehicle market is relatively impressive. However, from another perspective, SAIC Motor's sales of new energy vehicles in the first five months are equivalent to BYD's sales in just one month. Among SAIC Motor's new energy vehicles, only the Wuling Hongguang MINI EV, Wuling Bingo, Wuling Xingguang, and Volkswagen ID.3 have performed relatively well. SAIC-GM's best-selling new energy vehicle is still the Buick Velite 6, while the market performance of the new pure electric models on the Ultium platform, including the Buick E5, Buick E4, Cadillac Lyriq, and Arcadia, is relatively sluggish.

For SAIC Motor, increasing the sales proportion of new energy vehicles and gaining market dominance in the new energy vehicle market have become even greater challenges than抑制sales declines. Currently, SAIC Motor's market performance in new energy vehicles is gradually strengthening, but it has not yet been able to make up for the decline in gasoline-powered vehicle sales. Therefore, some opinion leaders have pointed out that in June, SAIC Motor's sales may be surpassed by BYD. Of course, it will take some time for BYD's annual sales to exceed SAIC Motor's. In 2024, BYD's sales target is to increase by 20% from 3.02 million vehicles in 2023, to about 3.624 million vehicles. Even if SAIC Motor continues to decline at its current rate, its sales in 2024 will still exceed 4.5 million vehicles, leading BYD by over 1 million vehicles. However, BYD is getting closer and closer to SAIC Motor. For the development of China's automotive industry, BYD's rise is a good thing.

(Images sourced from the internet, please remove if infringing.)