From the rivalry between Huawei and Tesla, we look into the future of intelligent driving

![]() 07/05 2024

07/05 2024

![]() 577

577

"Once Tesla fully solves the problem of autonomous driving and mass-produces Optimus, any short sellers will be eliminated, even Bill Gates." On July 2nd, Musk once again drew such a "big pie" on social media X.

Meanwhile, Tesla's stock price also experienced a 24% increase in the recent three trading days. The unexpected delivery volume alleviated the pressure of inventory and price reductions, bringing hope to the capital market. Since Tesla released the latest version of FSD in 2023, end-to-end large models have become the hope in the field of intelligent driving.

In April 2024, Musk visited China again to promote the implementation of FSD, followed by rumors of cooperation with Baidu to launch road tests in Shanghai. China's new energy automakers have obviously felt the pressure from Tesla, this "catfish," accelerating their voice related to end-to-end large model intelligent driving.

First, "Nio, Xpeng, and Li Auto" made adjustments to their intelligent driving teams, followed by Huawei releasing its intelligent driving system "Qiankun" 3.0 in April. In mid-June, He Xiaopeng traveled to the United States to test drive Tesla's FSD. On June 30th, Huawei's Qiankun intelligent driving high-level function package was further reduced by 6,000 yuan, further intensifying the fierce market competition in the field of intelligent driving.

The intention of domestic automakers like Nio, Xpeng, Li Auto, and Huawei is clear: Chinese automakers hope to take the lead in occupying China's intelligent driving market before FSD is truly implemented. In this "encirclement," what role did Huawei play? Can the end-to-end large models that major manufacturers are competing for solve the fundamental problems of intelligent driving? Where will the future of intelligent driving in China steer towards?

Behind the price reduction, Huawei's target is not just Tesla

According to the announcement, the original price of the high-level function package for Huawei's intelligent driving system HUAWEI ADS (Qiankun intelligent driving) was 36,000 yuan, which will be adjusted to 30,000 yuan starting from the second half of this year. This is also the first price reduction action since Huawei released the Qiankun intelligent driving system in April 2024.

However, compared to before, Huawei's discount for intelligent driving system subscriptions is actually gradually narrowing: at the end of 2023, the price of Huawei's high-level intelligent driving package was 26,000 yuan; and before December 31, 2023, the limited-time promotional price of the high-level intelligent driving package was 18,000 yuan.

Behind the "apparent price reduction but hidden increase" operation, Huawei's confidence lies in the growth of product sales and the occupancy rate of its intelligent driving system. On July 1st, the production and sales report released by Seres showed that AITO's entire series delivered over 40,000 vehicles in June, reaching 42,000 vehicles, a record high. Among them, the cumulative delivery of the new M5 model exceeded 10,000 vehicles; the new M7 model delivered 18,493 vehicles in June, and its cumulative sales exceeded 110,000 in the first half of the year, ranking first among China's new force models.

Not long ago, Jin Yuzhi, CEO of Huawei's Intelligent Automotive Solution BU, also stated that in addition to Seres, Huawei's partners in intelligent driving include established automakers such as Changan and GAC. It is expected that by 2025, there will be more than 30 cooperative models equipped with Qiankun intelligent driving, and the expected installation volume will reach 2 million, which will be on the same level as Tesla in the Chinese market.

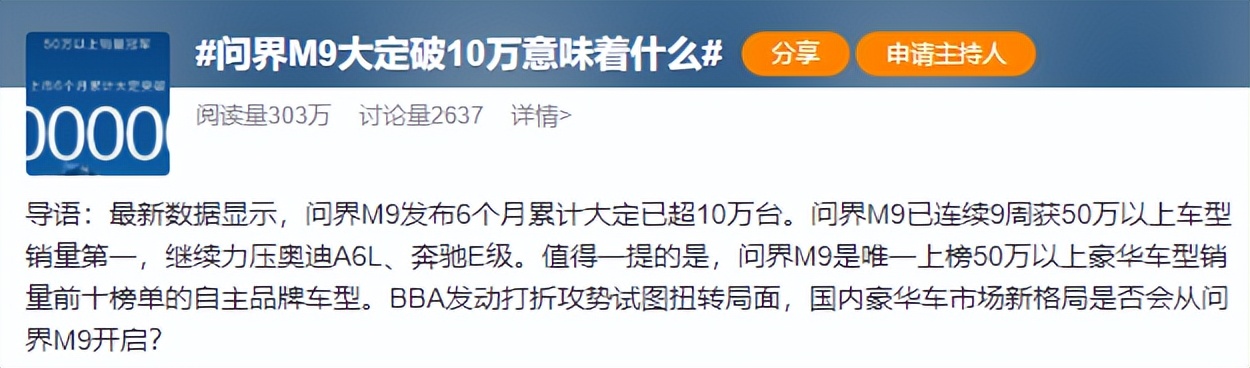

In addition to targeting Tesla in the field of intelligent driving, Huawei has also launched an assault on traditional luxury automakers such as BBA and Porsche. In May, the sales of the M9 model ranked first among vehicles priced above 500,000 yuan, surpassing traditional luxury cars such as BBA. Subsequently, the cumulative orders exceeded 100,000 in the next six months, causing widespread discussion and spread in the automotive circle.

In contrast, traditional luxury brands have seen a decline in sales. In the first quarter of this year, Porsche's sales in the Chinese market were 16,340 vehicles, a year-on-year plunge of 24%. Among the BBA camp, only Audi saw an 8.8% year-on-year increase, while BMW and Mercedes-Benz both saw declines in sales and prices to varying degrees, with models like the Mercedes-Benz C200L and EQB 260 experiencing price drops of over 40%.

Obviously, luxury brands can no longer hold onto their brand premium, prices, and sales. Huawei, with its technological advancements in intelligent driving and intelligent cabins, is replicating the development model of "facing giants, breaking giants, and becoming giants" that it used in the mobile phone market into the automotive field.

From this perspective, in the second half of the electric vehicle era, it seems to be a competition of brands, products, and traffic on the surface, but behind it is a brutal replacement of old and new forces. In the fierce market competition, it is necessary to provide both cost-effectiveness, intelligence, and value. Intelligent driving has become an important consideration for consumers when choosing new energy vehicles.

Can end-to-end large models solve the fundamental problems of intelligent driving?

However, although end-to-end large models provide a direction for the competition in the "second half" of new energy vehicles, they are still not enough to be called the ultimate solution for intelligent driving, mainly due to the following reasons:

Image source: 2024 Autonomous Driving Industry Research Report

1. Technological breakthroughs occur every year, but only models are far from enough

In the words of Ren Shaoqing, Vice President of NIO's Intelligent Driving R&D, the intelligent driving industry is changing too fast. Product functions need to be improved in quantity to keep up with the speed of industry changes and everyone's needs. Therefore, driven by strong demand, the intelligent driving industry almost has a new technological breakthrough every year:

In 2022, the buzzword was bird's-eye view, which simulates the effect of viewing the Earth's surface vertically from directly above, simplifying the vehicle's perception and understanding of its surroundings;

In 2023, it was OCC open city, providing more precise object shape information and reducing reliance on lidar;

In 2024, it is the end-to-end large model, which hands over raw data to the model for processing and directly outputs driving instructions from the model, solving the problem of information bandwidth.

However, too rapid technological progress and blind overpromotion may backfire. Ren Shaoqing believes that "you need to have some basic capabilities before end-to-end large models are useful, otherwise, it's a poison." That is to say, the prerequisite for building an end-to-end large model is that all functional modules of intelligent driving have been modeled and supported by an engineering system with sufficient performance and efficiency.

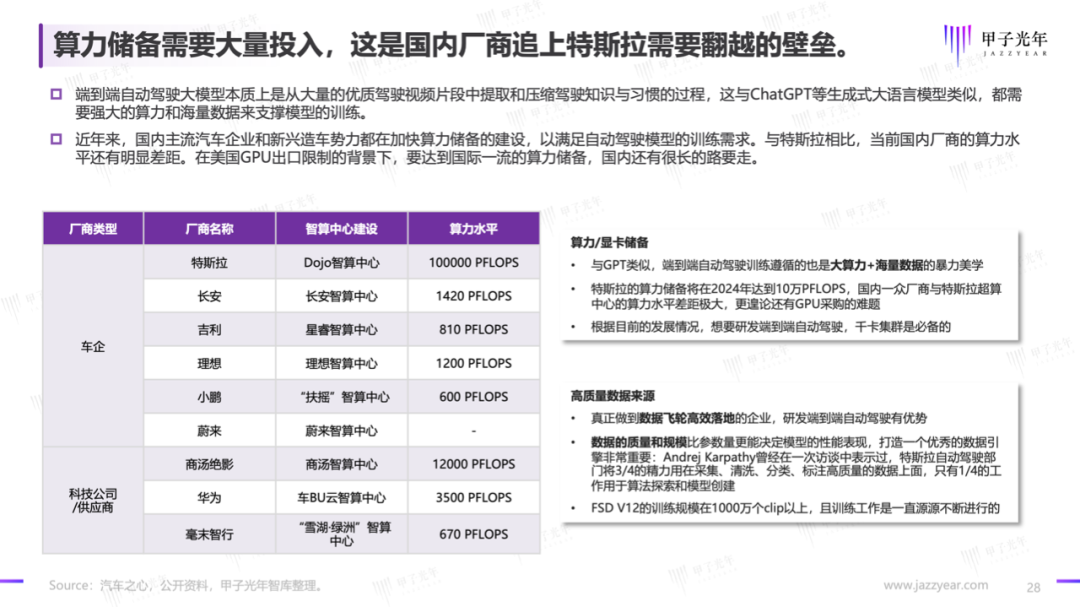

2. Still requires significant investment in computing power and data reserves

Similar to GPT, end-to-end autonomous driving training follows the brute force aesthetics of large computing power + massive data, requiring a large amount of computing power reserves and high-quality training data accumulation.

Currently, Tesla's computing power reserve is expected to reach 100,000 PFLOPS in 2024, with FSD driving mileage exceeding 1 billion miles, and it is continuing to increase rapidly. At the same time, Andrej Karpathy, the former head of Tesla's Autonomous Driving Department, said in an interview that 3/4 of the department's efforts are spent on collecting, cleaning, categorizing, and annotating high-quality data, providing continuous material for the iteration and optimization of FSD.

In this regard, domestic manufacturers lag far behind Tesla, with relatively low computing power levels and facing difficulties in GPU procurement.

3. Slow commercialization progress, and the flywheel effect has not yet been prominent

In addition to gaps in infrastructure and technology, the most important issue facing intelligent driving is: how to better commercialize?

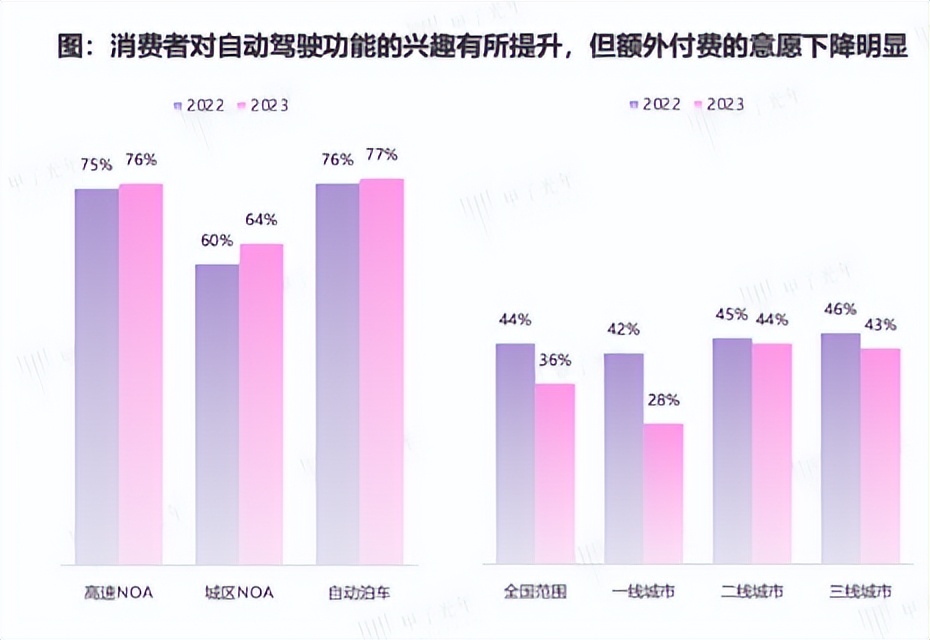

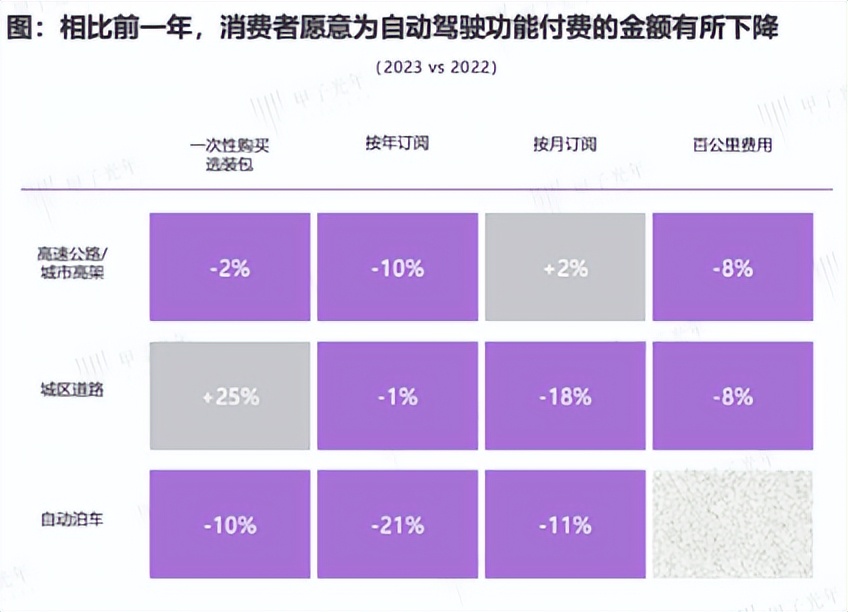

The fact is that in the increasingly fierce "internal competition" in the automotive industry, consumers face an inherent contradiction when purchasing a car: although their interest and expectations for the "intelligence" and autonomous driving functions of cars are increasing, their willingness and amount to pay are generally declining.

To a certain extent, AI has indeed redefined the automobile, but it seems to have not brought the expected new market to the business model of the passenger car industry: the subscription service model has not yet achieved large-scale popularization, and autonomous driving functions have instead become a "hard cost" that automakers have to bear in order to improve the driving experience and enhance product quality.

Where will the future of intelligent driving steer towards?

Since there are still many problems with end-to-end models, is there a better option for intelligent driving?

"Vehicle-road-cloud" may be a possible solution, using the combination of road-side and hardware-side to solve the deficiencies in the vehicle's own environmental perception and data processing capabilities.

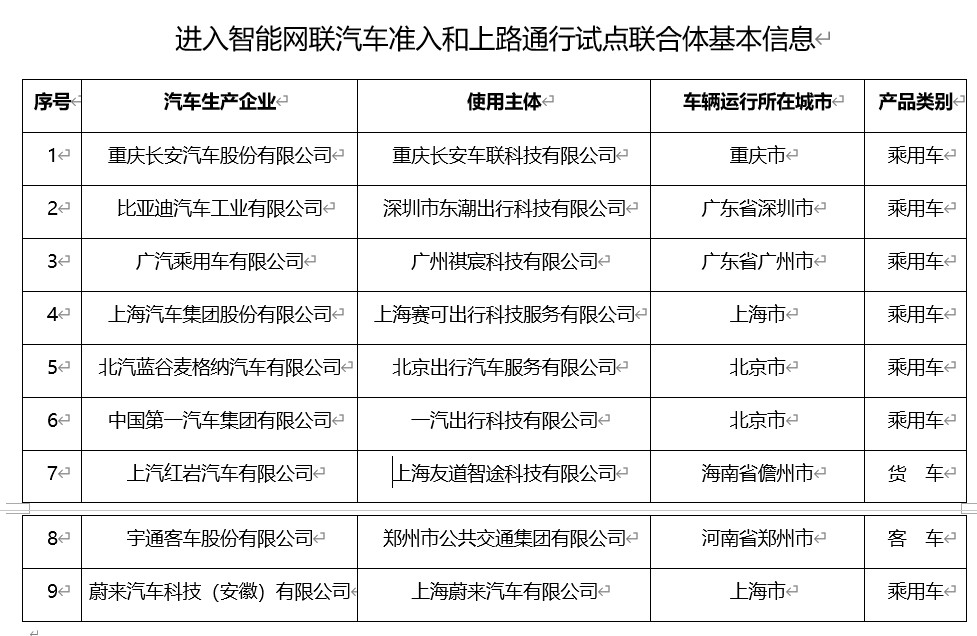

On June 4th, the Ministry of Industry and Information Technology launched a whitelist of pilot intelligent driving enterprises, with automakers such as BYD, NIO, Changan, GAC, and SAIC obtaining L3-level intelligent driving access and road testing pilot. These "consortia" consist of automobile manufacturers and transportation companies. One is responsible for production, and the other is responsible for road testing. The list also mentioned the need to strengthen infrastructure construction such as intelligent driving and the Internet of Things, namely "vehicle-road-cloud integration".

On July 3rd, after nearly half a year of full brewing, the list of the first batch of "vehicle-road-cloud integration" pilot cities was finally released. From a market perspective, it is predicted that the industry's output value will exceed 700 billion yuan in 2025 and reach a scale of 2.6 trillion yuan in 2030.

According to data from the China Society of Automotive Engineers, as of the end of May 2024, a total of 17 demonstration zones, 7 Internet of Vehicles pilot zones, and 16 dual-intelligence pilot cities have been established nationwide, with over 32,000 kilometers of open test roads, more than 7,700 test licenses, and over 120 million kilometers of test mileage.

From this perspective, high-level autonomous driving and "vehicle-road-cloud integration" have moved from small-scale testing and validation to a critical period of rapid technological evolution and even moving towards large-scale application. The accelerated development of the "vehicle-road-cloud" track means that the "first year" of high-level intelligent driving in China is imminent.

Professor Zhu Xichan from the School of Automotive Engineering at Tongji University stated that vehicle-road-cloud integration will be mainly used to solve problems such as road data collection, dangerous road conditions, obstructed road surfaces, extreme weather, and other special driving situations in current intelligent driving. Industry insiders also stated that the current accuracy of single-vehicle intelligent recognition may only be 90%, and the remaining 10% of scenarios can be addressed through "vehicle-road-cloud integration".

From this perspective, vehicle-road-cloud integration is a supplement to single-vehicle intelligence, and the two will move forward in parallel, bringing new changes and business opportunities to the transportation industry. The currently advocated "new quality productivity" calls for us to dig deep into our potential and nurture new growth points driven by technological innovation, and the strategy of "vehicle-road-cloud integration" is precisely a vivid example of this call.

The future of intelligent driving in China will no longer be high and mighty, but will penetrate into every inch of the roadside and ground, resonating with the daily lives of millions of people.

Source: Hong Kong Stock Research Community