Aiming for 2 million vehicles, how likely is Geely Automobile to succeed?

![]() 07/05 2024

07/05 2024

![]() 672

672

Geely Automobile recently delivered a highly "gold-laden" answer sheet.

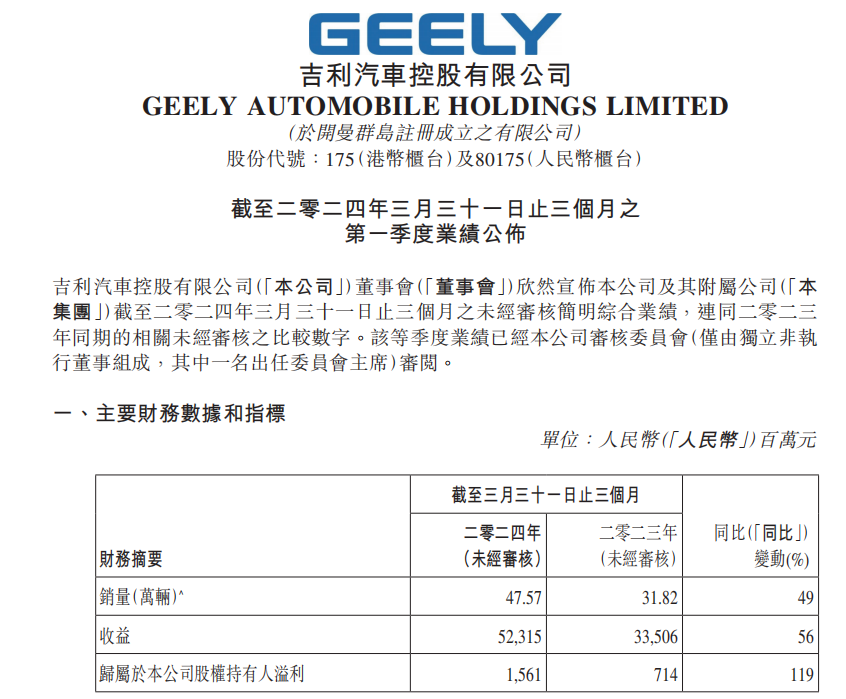

According to the financial report, in the first quarter of 2024, Geely Automobile achieved revenue of 52.3 billion yuan, representing a year-on-year increase of 56%; net profit attributable to shareholders of the listed company reached 1.561 billion yuan, an increase of 119% year-on-year; overall sales reached 475,700 vehicles, representing a year-on-year increase of 49%, outpacing the overall market growth rate.

It is worth mentioning that the competition in the automotive market did not show any signs of easing in this quarter, with price wars still ongoing. Under this background, many automakers are still facing considerable operational pressure. According to incomplete statistics, among the 15 vehicle manufacturers listed on A-shares and Hong Kong stocks with passenger cars as their main business, as many as 9 saw revenue increase without a corresponding increase in profits.

Judging from its performance, Geely Automobile seems to have sufficient strength to navigate the cycle and achieve growth. Based on its current product sales performance, it has also set a higher target: to achieve sales of 2 million vehicles in 2024 and an overall penetration rate of new energy products of over 40%.

However, Geely Automobile is still in a transitional period, and there are still many variables in its future development, especially in the context of the intensifying price war in the automotive market.

At the 2024 first-quarter earnings conference held on July 2nd, Geely Automobile CEO Gui Shengyue stated that the company's main strategy for dealing with price wars is to enhance its competitiveness. What does "enhancing competitiveness" entail?

Brand advancement and technological innovation, is Geely Automobile embarking on a new cycle?

From the financial report, it can be seen that in the first quarter of 2024, new energy automotive products have become an important growth engine for Geely Automobile, with sales reaching 144,000 units, representing a year-on-year increase of 141%, accounting for over 30% of total sales.

Among them, the three brands of Geely, Lynk & Co., and Zeekr played an important role in driving sales: from January to May 2024, total sales reached 254,226 vehicles, representing a year-on-year increase of approximately 126%.

It can be seen that Geely Automobile's mid-to-high-end new energy brand layout has had a greater synergistic and promoting effect on the company's development.

Specifically, with the strengthening of consumer demand, advanced technology, and the gradual exit of luxury brands in the era of fuel vehicles, China's mid-to-high-end new energy vehicle market is in an expansion phase.

Data from the China Passenger Car Association shows that the proportion of new energy vehicle sales priced above 400,000 yuan in China has increased from 1.2% in 2017 to 3.4% in 2023. In this regard, Cui Dongshu, Secretary-General of the China Passenger Car Association, also pointed out that the sales structure of the national passenger car market has continued to rise, with a significant increase in the sales share of high-end models.

Against this backdrop, automakers that seize the mid-to-high-end market and focus on locking in user groups with high consumption power are expected to capture a larger market share and丰厚丰厚的 profit returns.

Based on this, Geely Automobile intends to use its three major brands of Geely, Lynk & Co., and Zeekr as a starting point to move up the ladder. Among them, Geely Galaxy is positioned in the mid-to-high-end new energy field, Lynk & Co. leads the global new energy high-end market, and Zeekr is positioned in the luxury intelligent pure electric segment.

However, the creation of high-end products often requires strong technological empowerment to match the relatively high price positioning, which undoubtedly requires automakers to invest more in research and development. Especially in the current stage of accelerated industry reshuffling, core technological innovation is the most crucial competitiveness for automakers.

From the financial report, Geely Automobile has maintained a high intensity in research and development. It is reported that its cumulative R&D investment in the past 10 years has exceeded 200 billion yuan, and R&D investment in 2023 reached 7.81 billion yuan, an increase of 15.5% year-on-year.

Based on this, Geely Automobile has also achieved significant research and development results. For example, in the field of power batteries, on June 27th, Geely Automobile released its independently developed Shendun Short Blade Battery, which uses a lithium iron phosphate system and has a cell energy density of 192 Wh/kg, ranking in the first tier of the industry.

In addition, it is worth mentioning that with brand advancement and technological innovation, Geely Automobile has also gained stronger momentum to expand overseas in 2024, leveraging this to open up a larger business scale.

At the earnings conference, Geely Automobile Group CEO Gan Jiayue said, "Geely is the most internationalized independent automaker, with partners such as Volvo, Renault Korea, and Proton." Data shows that in June 2024, Geely Automobile exported 35,300 vehicles, representing a year-on-year increase of 61%; in the first half of the year, the company exported 197,400 vehicles, representing a year-on-year increase of 67%.

From the perspective of automakers, with the increasingly fierce competition in the domestic market, intensifying overseas market expansion is expected to achieve more long-term business benefits.

Specifically, in the domestic market, the industrial competition landscape has entered a period of deep reshaping, with "the strong getting stronger and the differentiation intensifying." Public data shows that the top 10 companies in terms of new energy vehicle sales in 2023 sold a total of 8.241 million vehicles, representing a year-on-year increase of 47.7% and accounting for 86.8% of the total. Among them, the top three companies sold a total of 5.065 million vehicles, accounting for a market share of 53.3%.

Under intense competition, the penetration rate of new energy vehicles in the domestic market has also reached a relatively high level. According to data from ACEA and the China Passenger Car Association, in the first half of April 2024, China's new energy vehicle retail penetration rate reached 50.39%, becoming the first large automotive market in the world where the new energy vehicle penetration rate exceeded 50%. In March 2024, the new energy vehicle penetration rates in the United States and the European Union were 9.3% and 20.1%, respectively.

It can be seen that the development potential of the overseas new energy vehicle market is greater, and domestic automakers have also reached a critical period of shifting battlefields.

However, currently, China's exports are still dominated by fuel vehicles. According to data from the General Administration of Customs, in the first quarter of 2024, passenger car exports reached 1.13 million vehicles, representing a year-on-year increase of 27%. Among them, gasoline passenger car exports accounted for approximately 57%, while new energy (pure electric and plug-in hybrid) passenger car exports accounted for approximately 40%. From this perspective, domestic new energy automakers such as Geely still need to increase their overseas expansion efforts.

Overall, by focusing on the main line of new energy, intensifying technological research and development, and expanding overseas, Geely Automobile is emerging from the transitional pain period of traditional fuel vehicle manufacturers.

However, from an industry perspective, competition in the new energy vehicle sector is a norm both domestically and internationally, and what enables automakers to maintain stability and gain greater growth under competition is always technological innovation and implementation.

Intelligence and low-altitude economy, Geely Automobile's present and future intertwined

The general consensus that "in the first half of the competition in the new energy vehicle industry, it depends on battery, motor, and electronic control technologies, while in the second half, it depends on intelligence" has pointed out the direction for automakers' future development.

From a product perspective, as the integration of cutting-edge technologies such as autonomous driving and intelligent connectivity increases, the mechanical attributes of new energy vehicles are constantly weakening, while their digital attributes are constantly strengthening. Future cars will not only be a means of transportation that transfers people and objects from point A to point B but also high-frequency, deeply integrated electronic consumer goods in everyone's lives.

As Lei Jun pointed out in the book "Xiaomi Entrepreneurial Thinking," smart cars are essentially "consumer electronics" products that, along with personal mobile devices and home environments, will form a complete intelligent living scenario.

Moreover, in the process of promoting intelligent transformation, automakers are also expected to achieve greater growth. Previously, the Southern Industry Think Tank released the "New Energy Vehicle Product Value Index (2023)" and pointed out that "the higher the degree of intelligence in cars, the higher their market value and potential, especially for independent brands."

Therefore, intelligence is undoubtedly an important path for Geely Automobile to deepen its transformation. Currently, Geely Automobile's intelligence is concentrated in its "integration of land and sky" large-scale travel ecosystem blueprint.

On the "ground," emphasis is placed on intelligent driving. Currently, with the rapid development of intelligent vehicles, the integration of vehicles, roads, and clouds has entered the pilot demonstration and full-scale connectivity stage, and "new forces" are adjusting their intelligent driving teams to move towards end-to-end large models.

For example, NIO abandoned its long-used "perception-decision-control" technical route and explored using end-to-end large models to achieve high-level intelligent driving; XPeng Motors released China's first mass-produced end-to-end large model in May this year; Geely Automobile has also explored intelligent driving forms by launching the Xingrui Intelligence Computing Center and releasing its self-developed Xingrui AI large model.

In the "sky," with the蓬勃development of the low-altitude economy, flying cars may be a new direction worthy of Geely's attention. According to data from the China Business Research Institute, the global eVTOL market size reached 12.53 billion US dollars in 2023, representing a year-on-year increase of 12.38%, and it is expected that this market size will increase to 14.08 billion US dollars in 2024.

According to relevant data, as of the end of 2023, more than 800 companies or institutions worldwide are developing eVTOL products, among which new energy automakers are becoming important participants.

For example, XPeng Huitian, a subsidiary of XPeng Motors, has announced multiple flying cars, among which the Traveler X2 recently completed its maiden flight in the Beijing Daxing International Airport Economic Zone; GAC Group has launched the split-type flying car GOVE; and Geely Technology's first flying car from Volocopter also recently completed its first public flight. It can be foreseen that the progress of flying car pilot demonstrations will become one of the focal points of Geely Automobile's future financial reports.

Although there are many participants in the above-mentioned market, and the industry as a whole is in a technological exploration phase, there are still many uncertainties about who will lead the way. However, focusing on Geely Automobile, it also has relatively significant advantages in breaking through.

Looking deeply into the "integration of land and sky" travel ecosystem, future transportation systems and satellite frequency orbit resources are the fundamental guarantees. As China's first technological enterprise that "builds cars and stars with one hand," Geely Automobile is in a leading position in this regard. It is reported that currently, the construction progress of Geely's future travel constellation has reached 27.8%, more than twice that of SpaceX's Starlink plan, with more diverse functionality.

The company has also announced that it will launch 11 satellites, including the "Geely Galaxy" satellite, in early 2024, helping to upgrade the "integration of land and sky" ecosystem. By 2025, Geely will complete the deployment of 72 satellites in the first phase of the constellation, providing two-way satellite application services to users worldwide.

Looking back, at the beginning of the new energy vehicle era, traditional fuel vehicle manufacturers such as Geely Automobile faced a dilemma where new energy products had not yet gained momentum, while fuel vehicles had "disappeared." However, with its profound technological research and development accumulation and management operation experience, it has now returned to the center stage. Looking ahead from this foundation, from computing power to imagination, the story of automotive form evolution is far from over.

Source: Hong Kong Stock Research Society