Botai Auto Connected Vehicle's valuation has increased nearly 8 times in 9 years, with some equity incentives priced as low as 10% of the original value!

![]() 07/05 2024

07/05 2024

![]() 696

696

Produced by: Entrepreneur Frontline

Editor: Qianqian

Reviewed by: Songwen

With the increasing development of technology, intelligent driving has gone from concept to reality, and the market size of intelligent driving is gradually expanding.

Against this backdrop, Botai Auto Connected Vehicle Technology (Shanghai) Co., Ltd. (hereinafter referred to as "Botai Auto Connected Vehicle"), a leading company in the intelligent cockpit industry, submitted a prospectus to the Stock Exchange of Hong Kong on June 28th, planning to list on the main board of the Hong Kong Stock Exchange.

Due to the promising prospects of the industry and the company's continuous revenue growth, Botai Auto Connected Vehicle has attracted the favor of institutional investors. Since 2015, it has attracted significant investments from top institutions such as Xiaomi (founded by Lei Jun), FAW Group, and Dongfeng Group.

In addition, to bind core employees, Botai Auto Connected Vehicle has conducted several equity incentives for its employees. Currently, the cumulative shareholding ratio of the employee shareholding platform exceeds 11%, involving hundreds of employees. If the company can successfully list, these employees will reap significant benefits.

1. Valuation increased nearly 8 times in 9 years

According to the prospectus, Botai Auto Connected Vehicle was established in 2009 with an initial registered capital of 135 million yuan. In the second year of its establishment, it launched China's first 3G auto-connected vehicle system, and in 2013, it launched China's first vehicle-grade operating system developed by a private enterprise.

Due to the high cost of product development, Botai Auto Connected Vehicle decided to seek financing in the primary market.

In November 2015, investment institutions represented by Chongqing High-tech invested 120 million yuan in Botai Auto Connected Vehicle at a cost of 16.32 yuan per share. After obtaining Series A financing, the company's post-investment valuation reached 1.072 billion yuan.

(Image / Botai Auto Connected Vehicle Prospectus)

In May 2018, Botai Auto Connected Vehicle obtained Series A+ equity financing of 142 million yuan, represented by Suning Rundong, a fund under Suning Zhang Jindong.

Interestingly, in 2021, Suning Rundong was investigated by the State Administration for Market Regulation due to suspected illegalities in acquiring company equity, and was finally fined 500,000 yuan by the authority.

However, this did not affect the development of Botai Auto Connected Vehicle. After the company's products were successively launched, Botai Auto Connected Vehicle was pursued by numerous capital investors in the primary market.

In Series B financing, the company introduced Tianjin Jinmi under Xiaomi Group and Dongfeng Group through equity transfer.

Since then, Botai Auto Connected Vehicle has successively completed Series B+, Series C, and Series D financings, raising funds of 837 million yuan, 1.37 billion yuan, and 1.072 billion yuan, respectively.

It is worth noting that the company's Series D financing was obtained on June 24, 2024 (four days before the prospectus submission). After completing the Series D financing of 1.072 billion yuan, the company's valuation has reached 8.572 billion yuan, representing an increase of approximately 8 times compared to the Series A post-investment valuation of 1.072 billion yuan.

It is reported that the investors in Botai Auto Connected Vehicle's Series D round are mainly local state-owned funds, such as Changchun Equity Investment Fund, whose actual controller is the Changchun Finance Bureau, and Sichuan Manufacturing Fund, which also has the presence of the Sichuan State-owned Assets Supervision and Administration Commission and Sichuan Finance Bureau.

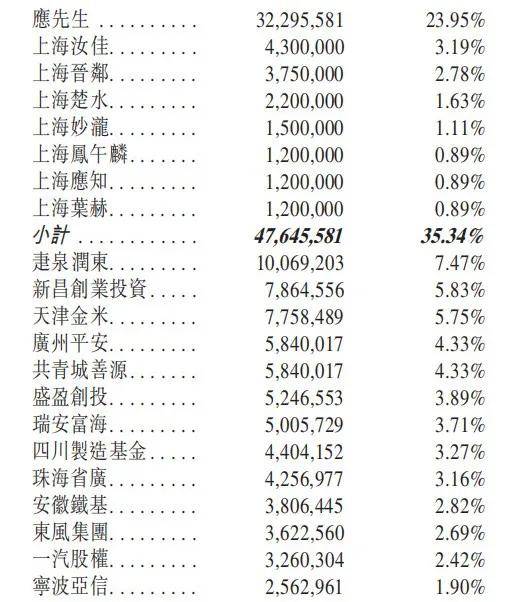

As of now, the company's founder and consistent action persons hold a combined stake of 35.34%, making them the actual controllers of Botai Auto Connected Vehicle. Tianjin Jinmi under Xiaomi Group holds 5.75% of the company's equity, Dongfeng Group holds 2.69%, and FAW Equity under FAW Group holds 2.42%.

(Image / Botai Auto Connected Vehicle Prospectus)

From an objective perspective, obtaining large-scale capital increases from various state-owned funds before the IPO is undoubtedly a significant positive factor for Botai Auto Connected Vehicle, giving external investors more confidence in the company and greatly helping the company's listing and fundraising.

2. Some equity incentives priced as low as 10% of the original value

If the company can successfully list this time, it will not only be a luxurious capital feast for many investment institutions but also a feast for many employees of Botai Auto Connected Vehicle.

To retain core employees and motivate them, Botai Auto Connected Vehicle has conducted several equity incentives for its core employees.

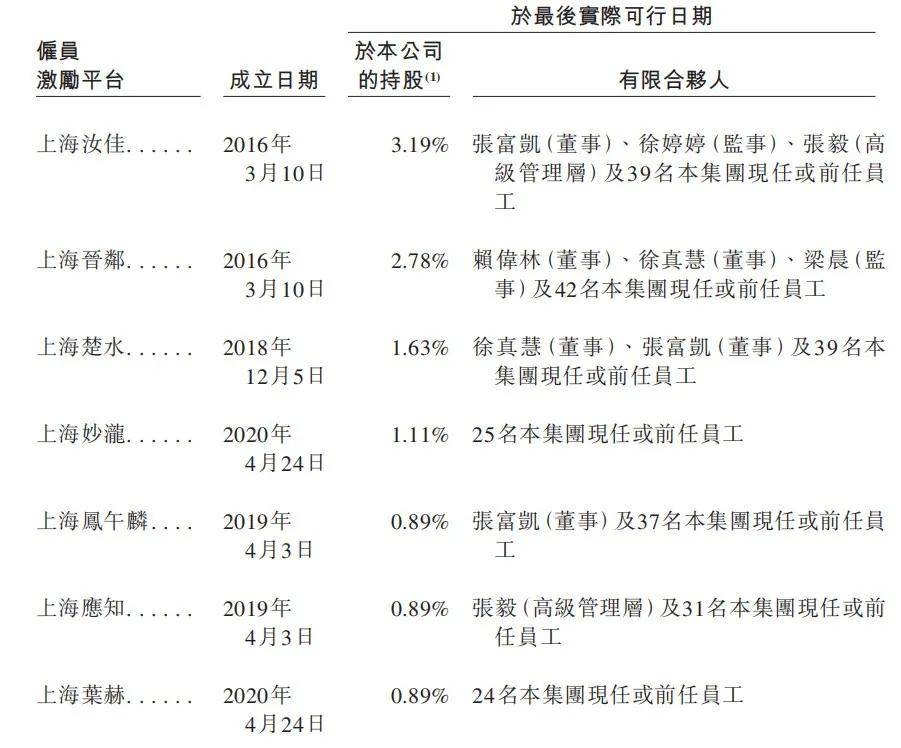

In 2016, Botai Auto Connected Vehicle established the equity incentive platforms Shanghai Rujia Enterprise Management Partnership (Limited Partnership) (hereinafter referred to as "Shanghai Rujia") and Shanghai Jinlin Enterprise Management Partnership (Limited Partnership) (hereinafter referred to as "Shanghai Jinlin") for the first time.

As of now, Shanghai Rujia and Shanghai Jinlin hold 3.19% and 2.78% equity in Botai Auto Connected Vehicle, respectively. Based on the company's latest valuation, the value of this equity is close to 500 million yuan.

According to Tianyancha, the person with the highest shareholding ratio in Shanghai Rujia is Zhang Fukai, the company's executive director, chief financial officer, and board secretary. In this shareholding platform, Zhang Fukai's personal shareholding ratio reaches 12.33%. Based on the company's Series D valuation, Zhang Fukai's shareholding amount in this platform alone exceeds 33 million yuan.

From 2018 to 2020, Botai Auto Connected Vehicle successively established five employee shareholding platforms.

In the later-established employee shareholding platforms, Shanghai Chushui and Shanghai Fengwulin, Zhang Fukai again received equity incentives. In addition to Zhang Fukai, other senior executives of the company, such as Xu Zhenhui and Lai Weilin, also own equity in the equity incentive platforms.

As of now, Botai Auto Connected Vehicle has established seven shareholding platforms, holding a cumulative 11.39% equity in the company. These seven shareholding platforms benefit hundreds of employees. Currently, the value of this equity is close to 1 billion yuan. If the company can successfully list, these hundreds of employees will undoubtedly earn a significant amount.

(Image / Botai Auto Connected Vehicle Prospectus)

In this round of equity incentives, the company's founder, Ying Zhenkai, has benefited significantly.

According to Tianyancha, the actual controllers behind the above seven shareholding platforms are all Ying Zhenkai, and he holds a leading shareholding ratio in these platforms. He is also the person who has benefited the most from the company's successive equity incentives.

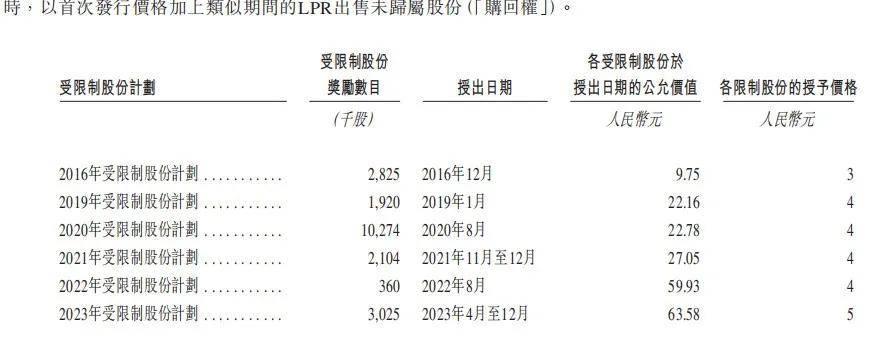

It is worth noting that in the employee equity incentives, the price at which the company grants shares to employees is extremely low. In 2016, during the initial equity incentive, Botai Auto Connected Vehicle granted shares to employees at a price of 3 yuan per share, when the fair value per share of the company was 9.75 yuan.

Since then, as the company's business developed, the fair value per share of the company has risen rapidly, but the price at which the company granted equity incentives to employees has not increased significantly compared to the fair value.

Taking the 2023 equity incentive as an example, the company granted 3.025 million shares to employees that year at a price of 5 yuan per share, when the company's fair value per share was as high as 63.58 yuan. The granting price was less than 10% of the fair value, almost equivalent to giving it away. Such low-priced equity incentives are uncommon among large enterprises.

(Image / Botai Auto Connected Vehicle Prospectus)

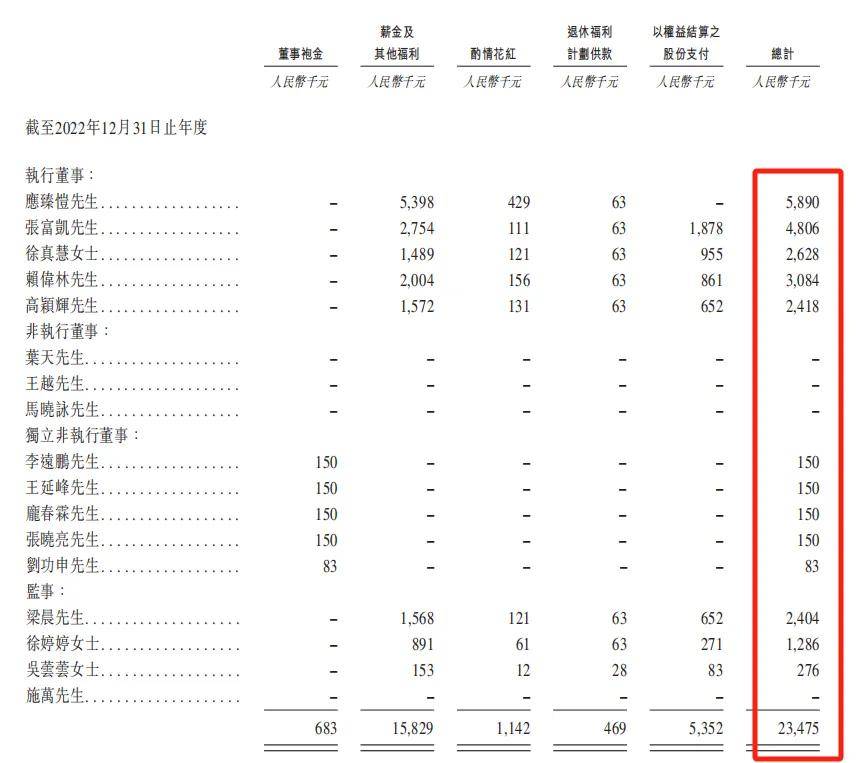

In addition to equity incentives, Botai Auto Connected Vehicle has not been stingy with compensation for its management team.

According to the prospectus, the salary and other benefits of the company's founder, Ying Zhenkai, reached 5.89 million yuan in 2023, while Zhang Fukai's comprehensive income in 2023 was 4.806 million yuan. The annual salaries of several other executive directors were all above 2.4 million yuan.

(Image / Botai Auto Connected Vehicle Prospectus)

In this regard, Botai Auto Connected Vehicle stated that to retain professionals in technology entrepreneurship and development, the company must provide competitive benefits and incentives.

3. Declining profitability, when will it turn a profit?

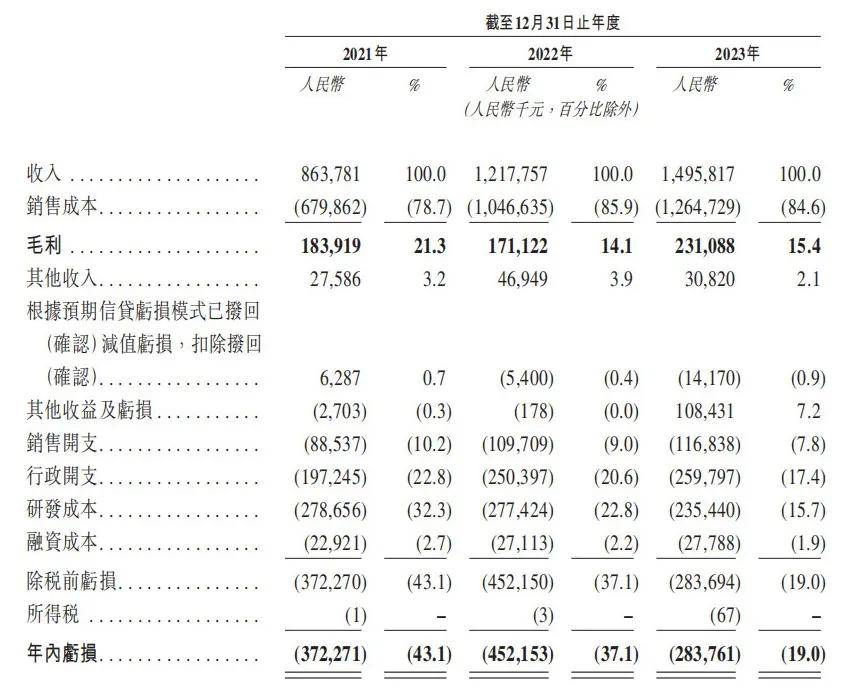

Although Botai Auto Connected Vehicle's valuation continues to increase, the company has still failed to shake off the embarrassing situation of continuous losses.

Data shows that the company's revenue from 2021 to 2023 (hereinafter referred to as the "reporting period") was 864 million yuan, 1.218 billion yuan, and 1.496 billion yuan, respectively.

Although revenue has increased year after year, it has still failed to shake off losses. During the reporting period, the company's annual loss was 372 million yuan, 452 million yuan, and 284 million yuan, respectively; the adjusted net loss (measured under non-IFRS) was 324 million yuan, 391 million yuan, and 218 million yuan, respectively, totaling 933 million yuan in net losses over three years.

(Image / Botai Auto Connected Vehicle Prospectus)

Regarding the company's losses, Botai Auto Connected Vehicle explained that the large expenditure costs such as sales and research and development expenses led to the company's losses.

For Botai Auto Connected Vehicle, as the scale of operations expands, it is reasonable for the company's sales and administrative expenses to increase. Later, as the company's revenue continues to expand, the impact of sales and administrative expenses on the company will weaken.

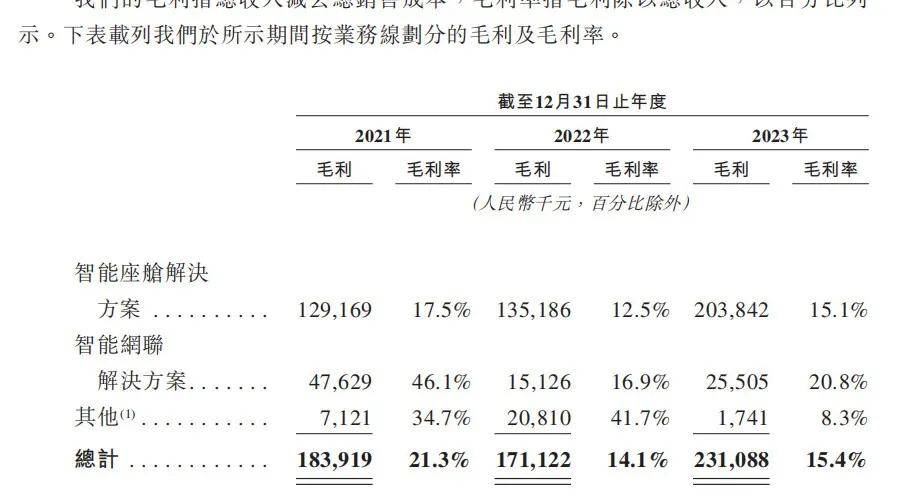

However, it is worth noting that the profitability of Botai Auto Connected Vehicle's two main businesses is declining. In terms of revenue, Botai Auto Connected Vehicle's business is mainly composed of intelligent cockpit solutions and intelligent connectivity solutions.

During the reporting period, the profitability of both business segments declined. In 2021, the gross profit margins of Botai Auto Connected Vehicle's intelligent cockpit solutions and intelligent connectivity solutions were 17.5% and 46.1%, respectively. By 2023, the gross profit margins of these two businesses had dropped to 15.1% and 20.8%, respectively.

Under the influence of the declining profitability of the company's two core businesses, Botai Auto Connected Vehicle's overall gross profit margin dropped from 21.3% in 2021 to 15.4%.

(Image / Botai Auto Connected Vehicle Prospectus)

In this regard, Botai Auto Connected Vehicle stated that the reason for the decline in the gross profit margin of intelligent cockpit solutions is the increase in material costs. While the decline in the gross profit margin of intelligent connectivity solutions is mainly due to the expiration of a contract with a major customer in 2021.

The decline in Botai Auto Connected Vehicle's gross profit margin is related to the rise in raw material prices, but the company's inability to pass on the increase in raw material prices to downstream customers is also a manifestation of the company's lack of strong core competitiveness.

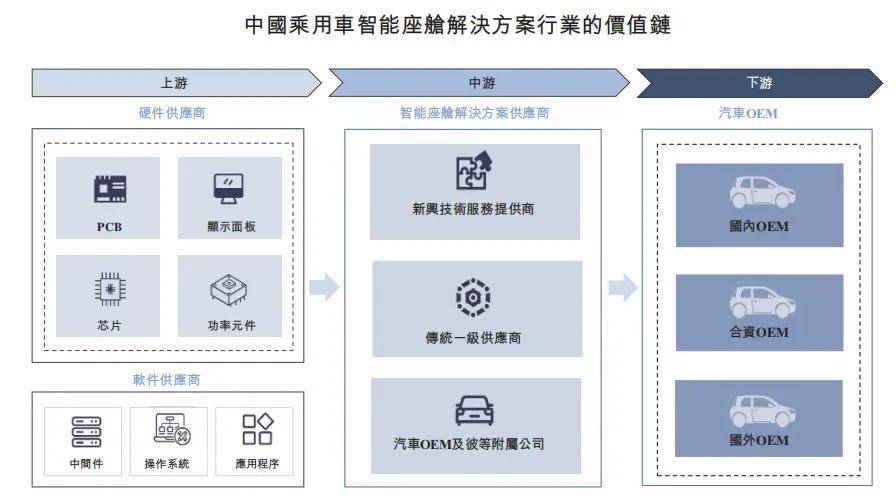

Taking the intelligent cockpit solutions, which account for nearly 90% of the company's revenue, as an example, the company is located in the midstream of the industry chain, with upstream suppliers of raw materials such as chips and downstream automobile manufacturers.

(Image / Botai Auto Connected Vehicle Prospectus)

The company's downstream customers are large automobile manufacturers such as FAW Group, Dongfeng Motor, and Geely Automobile. Facing such large-scale customers, Botai Auto Connected Vehicle does not have the ability to transfer the increase in raw material prices to downstream customers.

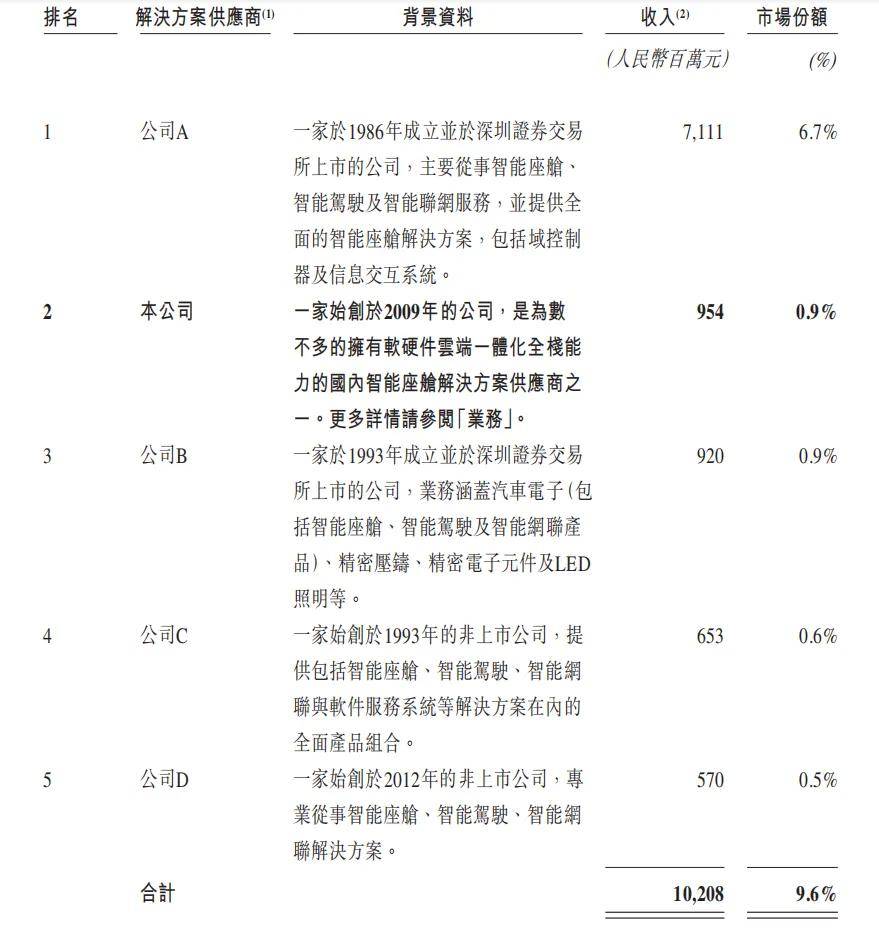

In addition, although Botai Auto Connected Vehicle is the second-largest provider of intelligent cockpit solutions in China, its market share is only 0.9%, and the combined market share of the top five suppliers is only 9.6%. The market share of the top-ranked supplier alone is as high as 6.7%, which shows how fierce the competition in intelligent cockpit solutions is.

It is reported that new-energy vehicle manufacturers represented by NIO and Xpeng Motors have their own intelligent cockpit solutions.

(Image / Botai Auto Connected Vehicle Prospectus)

For Botai Auto Connected Vehicle, as the industry is still in its early stages of explosion, the company's revenue and valuation are still growing. However, under the influence of rising raw material prices and fierce industry competition, even with revenue of nearly 1.5 billion yuan in 2023, the company has failed to turn a profit. Entrepreneur Frontline will continue to keep a close eye on when the company can achieve profitability.

*Note: The images in the article are from Shutterstock based on the VRF agreement.