In the past six months, none of "NIO, XPeng, and Li Auto" expected it

![]() 07/05 2024

07/05 2024

![]() 563

563

Introduction

Introduction

Surprise, disappointment, and joy have intertwined.

Responsible Editor: Cui Liwen

Editor: He Zengrong

"I'm already in the ICU, almost gone."

"We're not much better, sitting outside the ICU, ready to go in."

At the end of 2019, in Hong Kong's Victoria Harbor, the above conversation took place between He Xiaopeng and Li Bin. And months later, He Xiaopeng shared another photo on his personal WeChat Moments, showing himself sitting on a sofa with Li Bin and Li Xiang, their arms around each other.

With the caption, "Three miserable guys, reminiscing about hardships and cherishing sweet moments."

Undeniably, as the most outstanding representatives of China's emerging automotive forces, they have gone through the most difficult and dark period together, and the relationship between the three founders seems to have developed a mutual respect.

However, since last year, "differentiation" has become the main theme hovering over "NIO, XPeng, and Li Auto." On one side, Li Auto has surged and flourished after seizing the opportunity, while on the other side, NIO and XPeng have struggled and self-rescued after falling into a quagmire.

The stark contrast in their situations has also led to subtle changes in the relationship between the three founders, more precisely, between Li Xiang and He Xiaopeng, Li Bin.

With the passage of time, on January 1, 2024, standing at that special moment, each holding the "2023 terminal report card" of their respective emerging automotive brands, there is already a relatively clear prediction of their next moves.

Li Auto has established a leading position in the extended-range segment and will embark on exploring the pure electric segment. The journey ahead seems to have no major obstacles.

XPeng, with its monthly delivery volume continuously exceeding 20,000 units, has also gradually found its own rhythm. It will be good if the journey ahead can maintain stability and progress.

NIO has been struggling, becoming the most concerning entity. The journey ahead feels like it will be fraught with difficulties, and there are no overly optimistic signs.

At this moment, the first half of the competition has apparently ended, and once again holding the just-received "NIO, XPeng, and Li Auto" terminal report cards, the results are greatly unexpected.

The brand that was expected to soar high has suffered a significant blow; the brand that was expected to maintain its foundation has suddenly fallen into a quagmire; the brand that was expected to face immense pressure is not doing as badly as anticipated.

As for who it refers to, feel free to identify yourself.

First, let's focus on Li Auto.

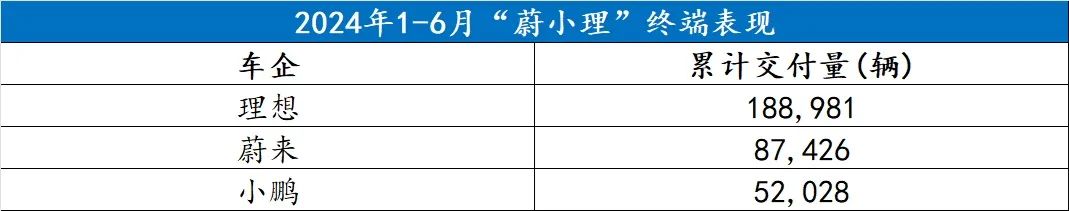

From January to June, a cumulative delivery of 188,981 new vehicles seems quite impressive at first glance. But considering that its founder, Li Xiang, once boasted of aiming for an annual target of 800,000 vehicles, it becomes clear that this emerging automotive brand has fallen short of expectations.

The main reason for its deviation from the track is undoubtedly the "failed listing" of Li Auto MEGA. In comparison, the overly blind confidence during the generational transition of the 2024 models of Li Auto L7, L8, and L9, as well as the tremendous pressure brought by formidable rivals like Wenjie, have also become "catalysts."

Fortunately, after continuous correction, such as temporarily suspending the promotion of other models in the pure electric M series and refocusing attention on the extended-range track; reevaluating the positioning and pricing of the 2024 models of Li Auto L7, L8, and L9; and ensuring that the "trump card" of L6 is foolproof.

Combined with last month's output, Li Auto has finally slowly returned to the right track. In the second half of the year, the biggest task ahead seems to be only "selling cars with all its might."

However, considering the bloody competition in the current Chinese automotive market and the fierce competition from those chasing from behind, trying to secure more "pie" is by no means easy. After a hard fall, the so-called "myth" surrounding Li Auto has apparently been dispelled.

Turning to XPeng, which was expected to maintain stability and progress.

From January to June, a cumulative delivery of 52,028 new vehicles was achieved. Although this is an improvement compared to the same period last year, it is undoubtedly far from the expected development trend.

So, some readers may ask, what happened to this emerging automotive brand? On the surface, in the first half of the year, apart from the XPeng X9, a pure electric high-end MPV, there were no other viable additions to the product matrix, and the fierce competition in the price range of several main sales products has pushed it into a quagmire.

But looking deeper, the real "crux" of XPeng lies in the lack of "harmony" between the various departments of the company. From research and development to product development, marketing, and delivery, there are always various issues arising at some point.

In the second half of the year, with the arrival of XPeng MONA M03 and the B-class pure electric sedan with the internal code "F57" on the horizon, this emerging automotive brand seems to be "thirsty for rain after a long drought."

With the support of these two new models, whether they can help increase the monthly delivery volume back above the "boom-bust line" of 20,000 units will be a "must-answer" question that cannot be missed. In addition, whether they can truly enhance their organizational combat effectiveness will also determine its future direction.

As for NIO, which made its final appearance, it has proven with actions that "the lower the expectations, the greater the surprise."

A cumulative delivery of 87,426 new vehicles from January to June has been quite impressive, considering the shrinking demand in the high-end pure electric market and the limited product upgrades of the entire NT2 platform's 2024 models.

Especially in the second quarter, the monthly delivery volume stabilized above 20,000 units, reaching a record high of 21,209 units in June. Regarding the reasons for this positive state, Li Bin gave his judgment in a post-earnings call after the first-quarter financial report was released.

"First, it is undoubtedly due to the completion of product transitions, with increased competitiveness for the 2024 models; second, the adjustment of the long-life battery and BaaS strategy in March has attracted many users, with a subscription ratio exceeding 80%, including the promotion of buy four get one free; third, the enhancement of sales capabilities and sales networks; fourth, the increase in battery swap stations, and the recognition of the battery swap model; and finally, the improvement in the second-hand car value retention rate and brand reputation."

In summary, this emerging automotive brand has slowly found its own rhythm.

However, objectively speaking, NIO's output in the first half of the year mainly relied on the ET5 family, ES6 family, and ES8, while the contribution of the remaining "7-series brothers" was almost negligible.

Moreover, it is worth noting that even as delivery figures gradually rise, NIO still faces a dilemma: the increasing number of users purchasing through the BaaS model has further lowered its average vehicle price, making it difficult to substantially improve gross margins. In other words, it is difficult to balance quantity and profit.

Of course, the above pain points are just the tip of the iceberg of the many persistent issues facing this emerging automotive brand. In the second half of the year, how to consolidate the foundation while exploring new avenues will be NIO's main challenge.

NIO, Ledo, Firefly... They seem to be working together in harmony, but in reality, there are hidden currents beneath the surface...