Chery's Overtime and Li Xiang's Layoffs: Are Carmakers' Internal Competitions Burdening the "Workers"?

![]() 07/08 2024

07/08 2024

![]() 663

663

Are Chery's employees working overtime to catch up with "Wang Chuanfu's back"?

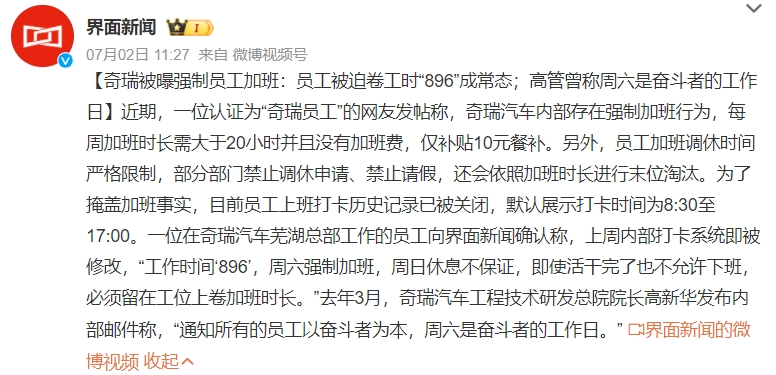

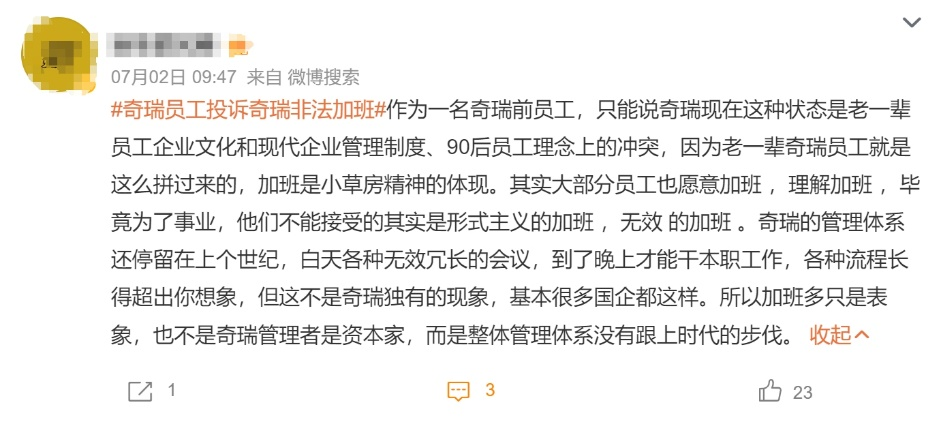

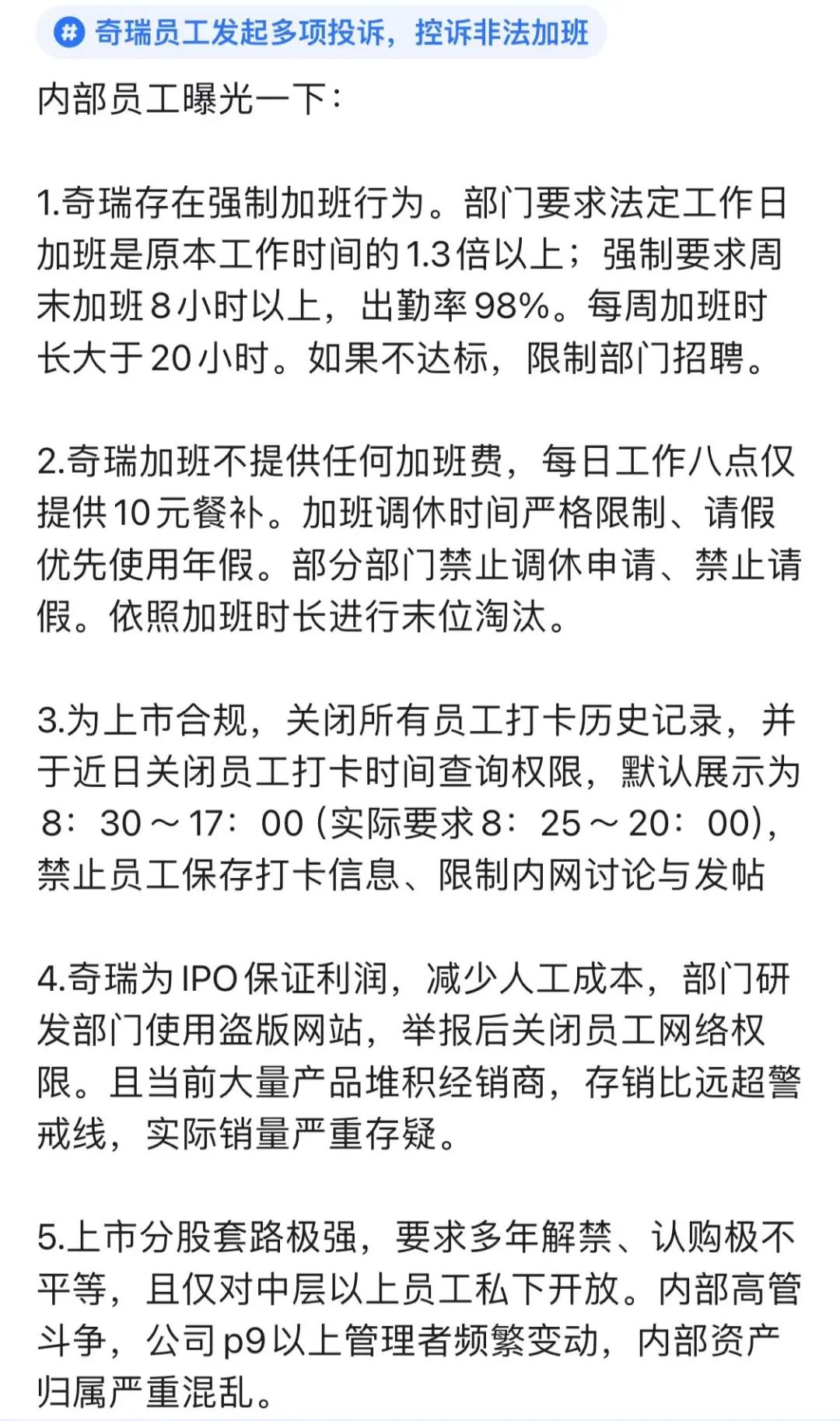

Recently, the topic "Chery employees complain about the company" surged to the top of the Maimai hot list. A Maimai user certified as a "Chery employee" posted that there is forced overtime behavior within Chery Automobile, with "896" being the standard, and sales frontline personnel even needing to work "007". However, despite such intensity, there is no overtime pay, and only employees who work overtime for more than 3 hours will receive a 10 yuan meal allowance.

The netizen also stated that to cover up the fact of overtime, the company will uniformly display the clock-out time of all employees as 5 pm.

According to reports from "Phoenix News," "Jie Mian News," and other media, multiple Chery employees said the description is true. These employees also revealed that in Chery, even if the work is finished, employees are not allowed to leave and must stay at their workstations to rack up overtime hours; some departments require 99% attendance on Saturdays, and departments compare overtime hours among themselves, and those who fail to meet the overtime coefficient (load rate) will be notified.

Source: Weibo screenshot

With Ningde Times in front and Chery behind, as employees' voices against overtime surge, it seems that the companies' days are not much better. Under the influence of price wars, the profits of many companies in the upstream and downstream of the automotive industry chain have declined, and employees work overtime only to receive tighter wages or even layoffs.

Will this be the norm for automakers for a long time to come?

01. Will Chery's overtime complaints affect its IPO?

Chery is not "alone" among automakers' "overtime army." In fact, overtime has long been the norm in domestic automakers and battery factories.

On the career social platform "Maimai," searching for well-known automakers such as BYD, Great Wall, NIO, Li Xiang, and XPeng can find information from employees certified by the automaker complaining about excessive overtime.

These netizens are spread across various positions. Some are current employees who directly admit to working "a lot" of overtime, while others are former employees who speak from experience, claiming that their "old employers" have severe overtime with no overtime pay.

Source: Maimai screenshot

An industry insider said that whether to work overtime and the frequency of overtime are related to the position, department, leadership style, work rhythm within the group, and industry cycle.

Overtime may occur during the initial stages of a project and during the final delivery phase. If there are unexpected events that disrupt the research and development plan, such as a rival suddenly releasing a new car, the workload will also increase significantly. Non-technical positions such as product operations and HR often work overtime, but during critical project periods, technical personnel may also work overtime until late at night. Even individual project teams, due to poor management capabilities, may require employees to work overtime for a long time.

Zhang Xiang, a visiting professor at the Huanghe Science and Technology University, said that overtime in automakers is a normal phenomenon now, and not working overtime may delay product development progress, increase vehicle manufacturing costs, and thus put the company at a disadvantage in competition. As a relatively vulnerable group, most employees still choose to silently endure.

Feng Shiming, the director of Shanghai Minghua Youdao Consulting Company, said that the automotive industry also had overtime before, but not as exaggerated as it is now. Overtime itself is not可怕, but unlimited, ineffective, and unpaid overtime has become a public hazard and one of the main hallmarks of "convolution."

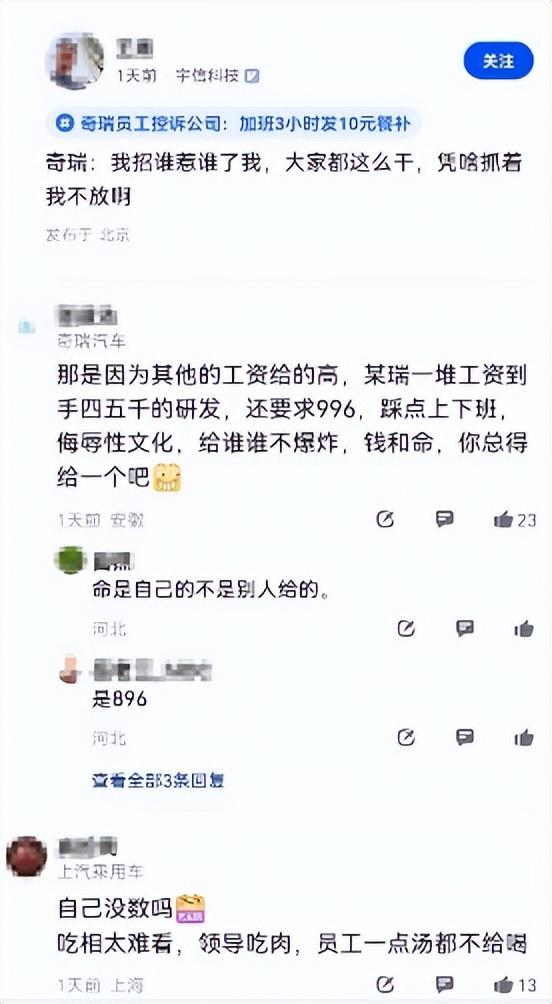

If so, why is Chery singled out? Some Maimai users certified as Chery employees believe it is because other automakers pay higher salaries. "A certain Rui has a bunch of R&D staff earning four or five thousand yuan, and they are required to work 996 with strict clock-in and clock-out. This insulting culture would make anyone explode."

Source: Maimai screenshot

The issue of salary was also mentioned by the netizen who exposed Chery's forced overtime, claiming that Chery's salary level is so low that even if the salaries of companies like NIO, XPeng, and Geely were halved, they still couldn't match it.

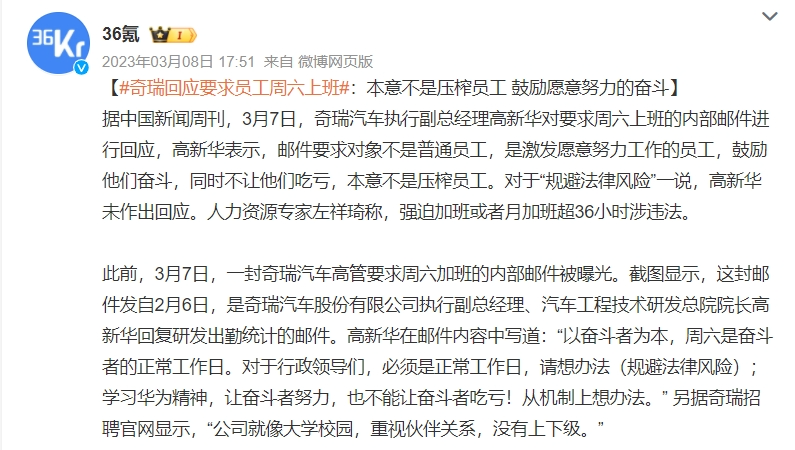

It is worth mentioning that in March 2023, Gao Xinhua, Dean of Chery Automobile Engineering Technology Research Institute, mentioned in an internal email: "Strivers are the foundation, and Saturdays are the normal working days for strivers. For administrative leaders, they must be normal working days. Please find a way (to avoid legal risks). Learn from the Huawei spirit, let strivers work hard, and don't let them suffer!" Later, Gao Xinhua responded that the email was not intended for ordinary employees but to inspire those willing to work hard, and the intention was not to exploit them.

Source: Weibo screenshot

Learning the Huawei spirit is relatively easy, but matching equivalent salaries is not something all companies can achieve.

However, the leadership's call is not entirely ineffective. In 2023, Chery Automobile's revenue exceeded 300 billion yuan for the first time, with sales reaching a record high of 1.88 million vehicles, a year-on-year increase of 52.6%. Car exports also reached approximately 937,100 vehicles, a year-on-year increase of 101.1%, ranking first among Chinese brand passenger car exports for 21 consecutive years. In the first six months of 2024, Chery maintained high growth, with cumulative sales of 1.1006 million new cars, a year-on-year increase of 48.4%. Among them, new energy vehicle sales reached 180,900, a year-on-year increase of 181.5%.

In the fourth quarter of 2023, Yin Tongyue, Chairman of Chery Holding Group, publicly stated that Chery Automobile was "up early but arrived late" in the new energy field. However, he remains confident in Chery entering the top tier in 2024 and setting a new goal: "By the middle of 2024, we aim to return to the top three in new energy, and by the end of this year, we want to see Wang Chuanfu's back."

Source: Douyin video screenshot

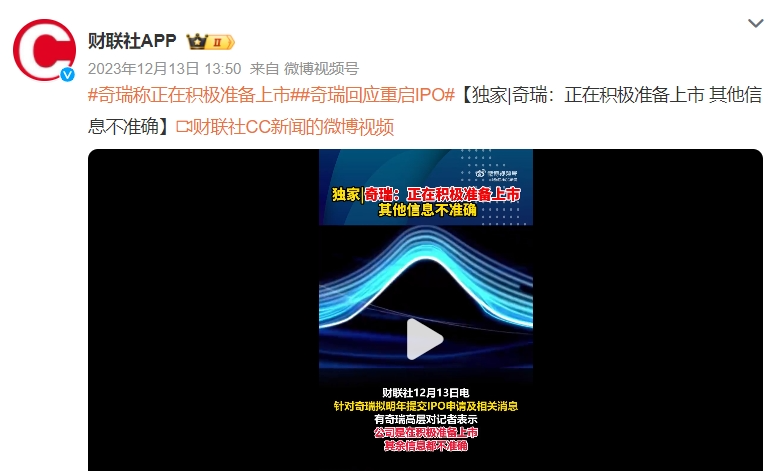

It is worth mentioning that at the end of 2023, there were rumors that Chery had restarted its IPO plan, with the expectation of completing its A-share listing by 2025. In response, a senior Chery executive told the media that the company is actively preparing for the listing, but other information is inaccurate.

Source: Weibo screenshot

On Weibo, a self-proclaimed former Chery employee said that older generations of Chery employees have worked hard in this way. Most people are willing to understand and accept overtime for the sake of their careers, but what they cannot accept is formalistic and ineffective overtime.

Source: Weibo screenshot

There are also self-proclaimed Chery internal employees who said that to comply with the IPO, Chery has closed all employees' clock-in history and query permissions, prohibiting employees from saving clock-in information. To ensure profits for the IPO, it has reduced labor costs, used pirated websites in the R&D department, and accumulated a large number of products with dealers.

Source: Maimai screenshot

However, Liu Haixu, an expert committee member of the Trust and Fund Committee of the China Arbitration Law Society, told the media that if companies involve large overtime pay or compensation, they must accrue related expenses in accordance with the law, which may also affect the company's profit performance. If public opinion disputes arise due to legal and compliant issues in employment, it may also affect the listing review.

02. Large-scale cost reduction and efficiency enhancement, automakers' "elimination race" intensifies

In addition to overtime, layoffs in various automakers this year have also attracted widespread attention, involving both traditional joint venture automakers and new carmaking forces, even Tesla.

Just looking at the scale of layoffs, Tesla CEO Elon Musk announced in April this year that the company would lay off 10% of its global workforce, meaning the departure of at least 14,000 employees, the largest known layoff in the automotive industry. Among other automakers, Guangqi Honda's layoffs are also over a thousand, and Li Xiang Auto is over 5,600 people.

Source: Canned image library

According to previous reports by "China Business Times," over 13 car brands have been exposed to layoff plans. If we consider the entire parts supply chain, the list of companies laying off employees will be even longer.

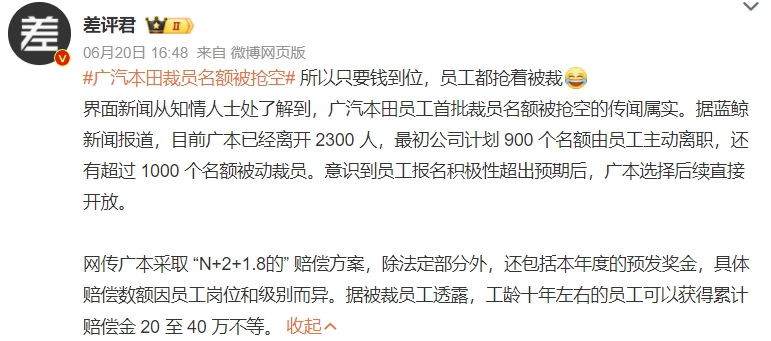

Interestingly, Guangqi Honda adopted a compensation plan of "N+2+1.8," where "N+2" is the standard compensation, with an additional 1.8 months' bonus on top. Depending on the employee's position and level, there may be additional compensation. Such layoff conditions are even more generous than Tesla's "N+3," attracting many employees to volunteer, resulting in a shortage of layoff positions.

Source: Weibo screenshot

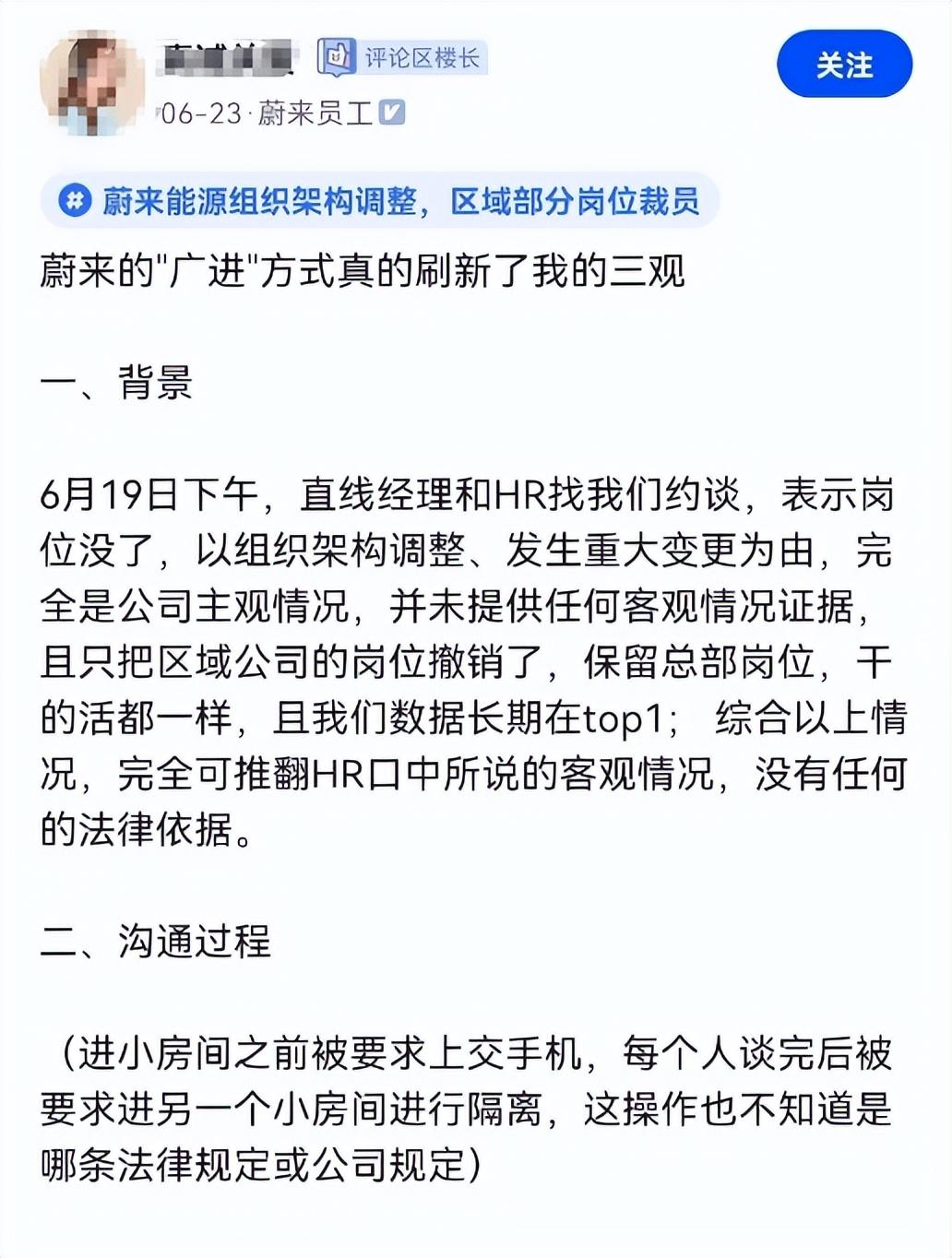

In contrast, the "new forces" in the automotive industry are still struggling to survive, and their layoff conditions lag behind those of well-established multinational automakers. Recently, there have been complaints on social media about NIO's layoffs, claiming that NIO suddenly unilaterally terminated labor contracts, closed all permissions, and cleared office equipment without signing agreements or notifying employees. The employee believes that this behavior constitutes "illegal termination" and should be compensated at the "2N" standard rather than the "N+1" standard for negotiated contract termination.

Source: Maimai screenshot

Both密集裁员 and 大范围加班 reflect the trend of collective cost reduction and efficiency enhancement in the automotive industry.

After years of rapid growth, the domestic automotive industry is entering a transition period. According to statistics from the "China Association of Automobile Manufacturers," in May this year, China's auto sales totaled 2.417 million vehicles, a year-on-year increase of 1.5%. Among them, passenger car sales were 2.075 million, with a year-on-year increase of 1.2%. Both figures hit the lowest monthly growth rate since the negative growth in November 2022, excluding the impact of the Spring Festival.

At the same time, the entry of new carmaking forces is intensifying the sense of urgency within the industry in various aspects. On the research and development side, the development cycle of some products has been compressed to just over a year, more than twice as fast as the previous development process of foreign automakers. On the sales side, customer retention and adding WeChat have become KPI indicators, and everything is done to obtain leads and transactions.

With slow domestic demand growth and further intensified industry competition, automakers are engaging in price wars to gain competitive advantages. Both new energy vehicles and fuel vehicles, luxury brands and cost-effective brands, are directly participating in the price reduction trend, leaving dealers in distress.

Source: Canned image library

Xing Haitao, the secretary-general of the China Federation of Industry and Commerce Automobile Dealers Chamber of Commerce, said that in the most extreme cases, cars worth millions of yuan were sold by dealers for prices of four to five hundred thousand yuan. Many dealers lamented: "Making less of a loss is already equivalent to making money."

However, the price war's cost is declining profits. In 2023, nearly half of the 19 vehicle manufacturers listed on A-shares and Hong Kong stocks saw revenue growth without profit growth. Among the "new forces," all except Li Xiang (2015.HK) suffered losses. Among joint venture automakers, the net profits of the three major brands under SAIC Motor (600104.SH) - Volkswagen, General Motors, and Wuling - declined by 58% year-on-year.

Amid changes, automakers have to tighten their belts, and "cost reduction and efficiency enhancement" is a theory that internet giants have already practiced. In this elimination race that seems to have no end in sight, the most important thing is to survive first.

03. The incessant "internal competition," automakers urgently need to find a balance

However, there are already automakers voicing opposition to internal competition.

In June this year, Zeng Qinghong, Chairman of GAC Group, said at the China Automobile Chongqing Forum that excessive internal competition would have a negative impact on the company's profitability and social contribution. The automotive industry should have a broad perspective and focus on long-term strategies rather than engaging in internal competition.

Source: Weibo screenshot

There are also views that the consumption and exploitation of employees in new technology industries such as the automotive industry will have a reverse demonstration effect, affecting other industries.

However, historically, the automotive industry has indeed undergone a cycle from "flourishing" to "oligopoly rule." Therefore, a consensus within the industry is to see both sides of "internal competition."

Lin Shi, the secretary-general of the China-Europe Association for Intelligent Connected Vehicles, said that if overtime employees have sufficient motivation to produce high-quality, innovative products and technologies, it is naturally beneficial to the industry. Being too laid-back is not good for industrial progress or consumers. However, overtime may also erode employees' creativity, inhibit social consumption, and when automakers become sweatshops, it will affect future talent attraction. The industry should compete under the bottom line of quality and legality and not be too cost-insensitive, as this may affect the company's lifespan.

Feng Shiming, director at Shanghai Minghua Youdao Consulting Co., stated that appropriate "involution" can promote competitive vitality, advance industry progress, and benefit consumers. However, excessive "involution" can disrupt the normal competitive environment, potentially leading to tragic personal injuries, reducing product quality, and possibly providing foreign regulatory bodies with reasons to sanction us, thereby harming China's automotive industry and consumers' interests. He calls for car companies to establish "anti-involution" alliances and unions, to accept employee reports of severe labor law violations by car companies, and to periodically publicize them. This would ensure mutual supervision and allow public opinion to monitor the situation as well.

In practical implementation, Feng Shiming believes that car companies first need to enhance regulation at the technical level: technologies that do not meet national standards, have been reported with real names and have verifiable evidence, and have repeatedly caused public safety incidents must be subject to thorough investigation, scientific evaluation, and necessary corrective actions, such as recalls or sales suspensions.

Secondly, companies should strengthen profit audits. For instance, if the profit margin per vehicle is within 5%, any price reduction should require approval to avoid predatory pricing and vicious competition.

Finally, a circuit breaker mechanism should be established for user complaints. If a specific model has recurring complaints of the same issue verified to be true and reaching a certain level, a mandatory recall and correction should be implemented. If the rules of the game are open, fair, and consistent, theoretically, it will achieve a natural balance of "involution."

Another consensus is that the current endless "involution" is unlikely to see a turnaround in the short term.

Lin Shi believes it is difficult to predict how long the involution will last. Without technological breakthroughs or innovative, high-quality products, car companies are unlikely to balance profitability because homogeneous products cannot command high prices, and overly complex materials incur high costs.

Feng Shiming, on the other hand, stated that the duration of involution varies by company. Car companies with consistently high sales may maintain high levels of involution for a long time, while those with poor sales, engaging in involution for its own sake, might soon face bankruptcy and restructuring, naturally ending the involution.

This is destined to be a long process, but which car company can resist the allure of being "infinitely glorious" after withstanding the trials and crossing the cycles?