30% Layoffs Again, Why Is Polestar's Path Getting Narrower?

![]() 07/08 2024

07/08 2024

![]() 563

563

By the end of September, Polestar Technology (China) will lay off approximately 30% of its staff, with the supply-side employees being the most affected.

It is reported that the Polestar Chengdu factory has been shut down, and production has been transferred to the Polestar Chongqing factory and the Geely factory.

A large number of employees responsible for production and supply have been laid off. Many Polestar headquarters (Shanghai) employees are either leaving or choosing to stay with the company.

An employee revealed to the media: "Employees remaining at the Polestar headquarters will have their social security unified and transferred to Nanjing." This indicates that in the future, Polestar Technology is likely to relocate to Nanjing.

Currently, the Shanghai office of Polestar headquarters is gradually reducing its area.

This is Qin Peiji's attempt to save Polestar's operational status one month after being appointed as the Chief Operating Officer of Polestar Technology.

However, currently, Polestar Technology has not responded to the above situation.

Netizens lament that after the "airdrop" of Volvo executives, the seven-year-old Polestar did not usher in a big breakthrough but instead faced mass layoffs.

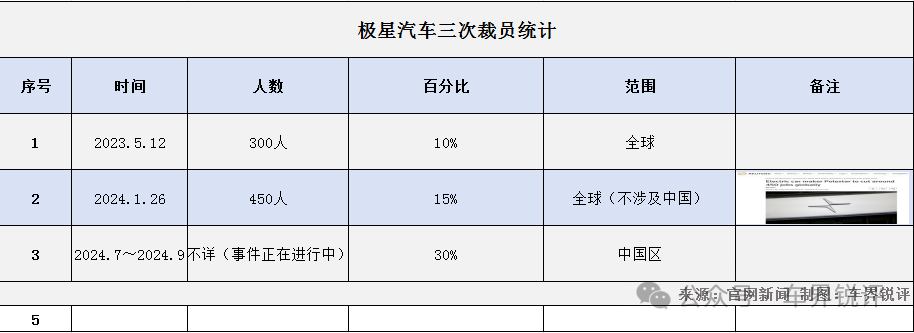

In fact, this is not the first time that Polestar has laid off employees.

In January this year, Polestar announced global layoffs of 15% (about 450 people), and this round of (global) layoffs did not involve the Chinese market.

It didn't expect it to affect the Chinese market so quickly.

In May last year, Polestar stated that it would strengthen cost management, laying off 10% of its global workforce (about 300 people) and freezing recruitment.

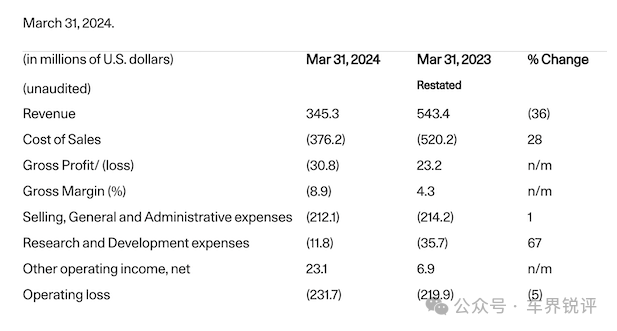

Compared to layoffs and plant closures, the deterioration of Polestar's financial situation is even more concerning.

On July 2 local time, Polestar announced its unaudited preliminary financial and operational performance report for the first quarter of 2024.

Specifically, in the first quarter of 2024, Polestar's deliveries decreased by 40% compared to the same period last year, reaching only 7,200 vehicles. Based on this data, Polestar is estimated to incur a loss of over 270,000 yuan for every vehicle sold in the first quarter of this year.

The reality is so cruel.

Perhaps besides financial deterioration, Polestar's poor sales in China are also a major factor in this round of layoffs in China. In April this year, Polestar sold 305 vehicles in China. Its cumulative sales in China from January to April were less than 1,000 vehicles.

To reverse the downturn, in June last year, Polestar announced the establishment of a joint venture with the Starry Group targeting the Chinese market, namely Polestar Technology, to take over Polestar's business in the Chinese market.

Even significant personnel adjustments were made in an attempt to achieve a breakthrough from within the management.

Not long ago, Polestar Technology announced the appointment of Frank van Meel as the Chairman of the Board.

In China, two mid-to-high-level executives from Volvo also joined Polestar. In early June, Qin Peiji, Deputy General Manager of the Sales Company of Geely Automobile Group, was transferred to Polestar Technology as the Chief Operating Officer, responsible for the company's sales, channel development, marketing, and other business segments. Jia Xiaohui, Senior Director of Public Relations at Volvo Car Group China Sales Company, also joined Polestar Technology as the CMO.

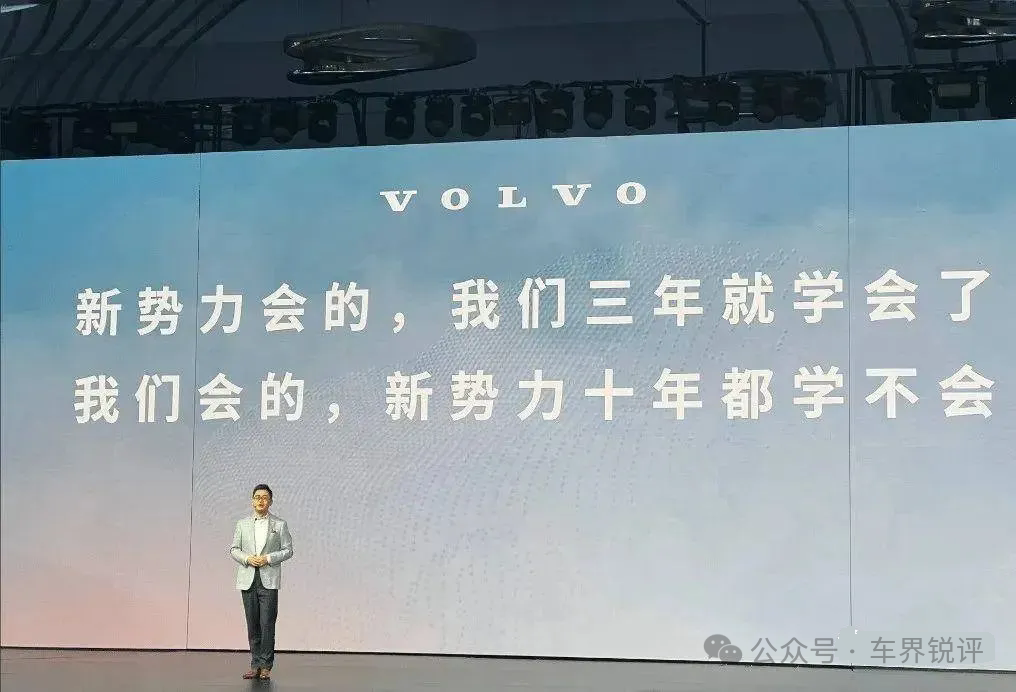

It feels like Volvo's slow-paced management culture cannot save the "troubled" Polestar. Polestar needs a quick fix.

In fact, Polestar has a close relationship with Volvo, but Volvo's culture and management cannot support Polestar's development.

Why is that?

The Polestar brand was originally founded in 1996 as the Swedish automotive brand Polestar.

In 2005, it became a performance model supplier for Volvo.

In 2009, Volvo incorporated Polestar into its racing and performance car research and development department. In 2015, Volvo fully acquired Polestar, which became Volvo's electrical and high-performance research and development department.

In October 2017, Volvo and Geely jointly announced the formation of a high-end electric vehicle joint venture brand, which is now Polestar.

In June 2022, Polestar announced the completion of its business merger with the special purpose acquisition company (SPAC) Gores Guggenheim and its listing on the Nasdaq, with a market capitalization of $27.6 billion on its first day of trading, surpassing traditional automakers such as Nissan and Renault.

From a timeline perspective, compared to NIO and XPeng, Polestar is indeed three years late. However, Polestar, which understands cars better, did seize the opportunity in Europe in its early years and flourished abroad.

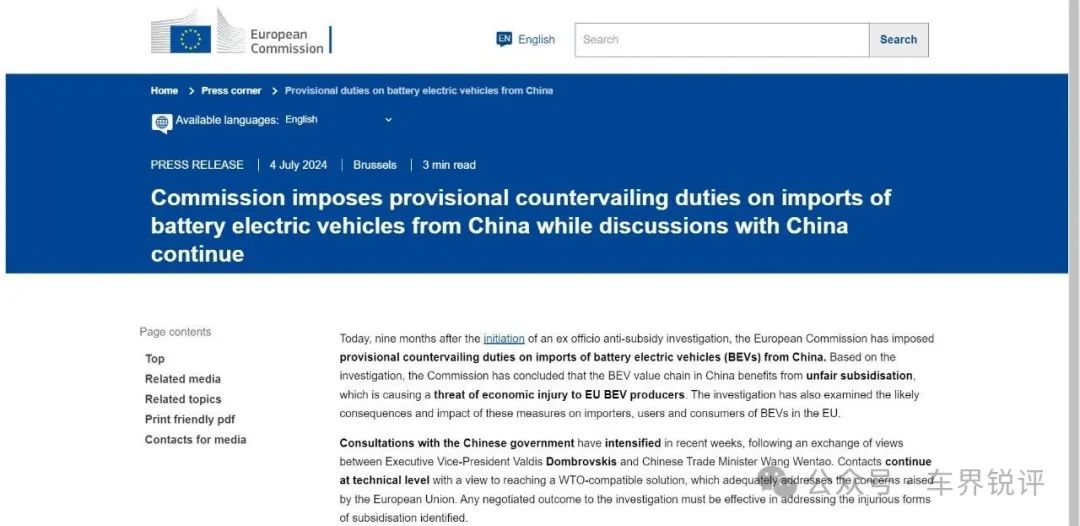

However, in the new round of EU trade wars, Polestar's sales abroad have declined due to political factors, showing no sign of stopping.

(On July 4, the European Commission issued a countervailing investigation announcement)

If sales decline in a foreign environment, we can always return home.

Strangely, despite the popularity of domestic new energy vehicles, Polestar has always struggled to find its direction. It shouldn't be like this, considering its backing by Geely's vast platform.

As a result, Polestar has not only failed to rank among the top domestic electric vehicles but has even struggled to compete with its own brand, with a low brand awareness that is barely known.

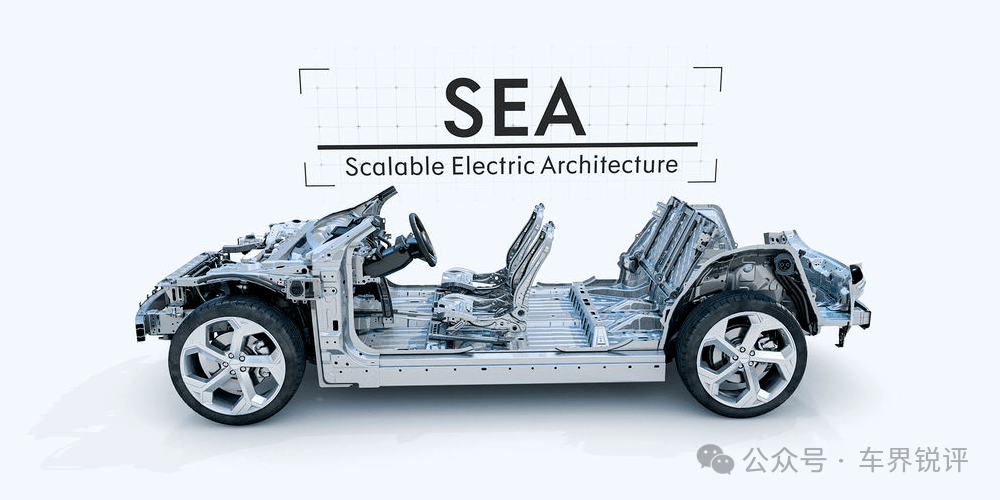

(SEA Vast Architecture)

Li Shufu, the chairman of Geely Automobile, angrily scolded at an internal meeting last year: "Not only is there no positive news, but there is no negative news either. How low is the existence of the Polestar brand!"

Even funnier is that due to the urgency to increase sales, Polestar offered significant discounts in China, earning it the nickname "fracture car" among netizens. In 2022, the official guidance price for the Polestar 2 dual-motor high-performance version was 460,000 yuan, while the price on automotive trade channels was 263,000 yuan, representing a decrease of approximately 42.8%.

Even so, it is almost impossible to see Polestar cars on the road in China.

From the current situation, Polestar has missed the best opportunity for China's rapid development. Whether Polestar can truly leverage Geely's electric technology and China's large-scale advantages in R&D and procurement to achieve a low-cost, high-performance brand positioning will be crucial going forward.

With an established technology platform and a mature market audience, it remains to be seen whether Shen Ziyu, the new CEO of Polestar Technology, and the transferred Volvo executives can successfully navigate and broaden Polestar's path.

In conclusion, Polestar doesn't have much time left.