SAIC Motor's Empty Promises: From Swap Stations to Solid-State Batteries

![]() 07/10 2024

07/10 2024

![]() 667

667

It has been 231 days since the last Weibo post from @Feifan Auto with the words "battery swap" (09898.HK, NASDAQ: WB).

Image source: Weibo @Feifan Auto

In 2022, Feifan Auto's RISING AUTO official account announced a "three-step" plan: to build nearly 40 swap stations by 2022, nearly 300 by 2023, and nearly 3,000 by 2025.

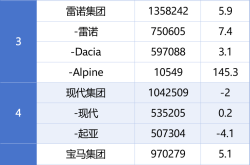

If these numbers are unfamiliar, consider NIO's (09866.HK; NYSE: NIO) approach—since building its first swap station in 2018, it has established 2,439 swap stations as of June 30 this year.

In other words, Feifan Auto aimed to become another NIO in the battery swap space within four years.

However, Feifan Auto overestimated itself.

Swap Stations Missed, Owners Complain of Deception

At Feifan Energy Day in August 2023, Xu Jun, General Manager of Feifan User Operations Center, revised the second-phase target of 300 swap stations to "over 50 swap stations in over 10 cities by the end of 2023."

Image source: Weibo @Feifan Auto

Almost a year after Feifan Energy Day, an angry Feifan owner finally voiced their discontent, sending an open letter demanding justice:

"How many swap stations have you built and put into operation? A total of 26, with 17 in Shanghai";

"Your most recent new station launch was on January 30 this year, and there haven't been any new stations since then for half a year";

"We, the majority of battery rental car owners, feel deeply deceived and fooled!!!".

The letter is filled with disappointment, but the owners remain restrained, demanding, for example, that Feifan reduce battery rental fees to industry standards and stop using "in planning" as an excuse, instead clearly informing owners of future swap station plans.

However, owners may be disappointed as Feifan is shifting from "All in swap stations" to "All in solid-state batteries".

"Battery swap is probably not sustainable, but it will still exist. The focus has shifted to solid-state batteries." On July 8, a source close to Feifan shared with Yuan Media Hui that due to a lack of sales support, both partners like China Petroleum (601857.SH, 00857.HK) and Sinopec (600028.SH, 00386.HK) and Feifan internally have lost confidence in the battery swap model.

"Building and operating a swap station costs money, and there need to be enough cars using it to cover these costs. But Feifan's sales have been in the hundreds for months." The source said.

According to insiders from a well-known battery swap company, compared to NIO, which has built over 2,400 swap stations with fourth-generation technology, Feifan's swap station construction costs are significantly higher, potentially reaching tens of millions including swap station construction, site rental, and expansion costs.

Even at a 50% discount from the estimated ten million per station, Feifan would need to prepare 15 billion yuan to achieve its 2025 target of building nearly 3,000 swap stations. This figure exceeds SAIC Motor's (600104.SH) entire 2023 annual profit.

Regarding Feifan's shift to solid-state batteries, Yuan Media Hui contacted SAIC Motor's public relations department for confirmation but did not receive a reply by the time of publication. However, recent actions by SAIC Motor and Feifan Auto suggest this shift is not unfounded.

Owners Hope for "Lossless" Exit from Battery Rental Plan

At SAIC Motor's New Energy Technology Conference in May this year, Zu Sijie, Vice President, Chief Engineer, and Dean of the Innovation Research and Development Institute, dedicated the last third of the conference to solid-state batteries, officially announcing that "fully developing solid-state batteries is the most important strategic deployment for SAIC Motor's electrification." In contrast, little time was given to swap stations.

One might argue that solid-state batteries can also be swapped. Technically, battery swap and solid-state batteries are not mutually exclusive, but they are contradictory in terms of usage scenarios.

Compared to current mainstream liquid lithium-ion batteries, solid-state batteries offer advantages of longer range and faster charging based on higher energy density and safety. When electric vehicles offer nearly 1,000 kilometers of range and can replenish hundreds of kilometers in just 10 minutes, owners' range anxiety and charging anxiety will be greatly reduced, making battery swap less convenient than charging and reducing demand.

According to Li Zheng, General Manager of SAIC Qingtao, by 2025, multiple SAIC independent brand models, including IM Motors, will achieve large-scale deployment of solid-state batteries. Perhaps the upcoming Feifan RC7 will showcase solid-state battery plans.

According to Tianyancha information, SAIC Qingtao is an energy technology joint venture established by Qingtao (Kunshan) Energy Development Group and SAIC Motor, with the former as the majority shareholder, founded in 2023.

Image source: Ministry of Industry and Information Technology official website

Regarding battery swap, Feifan RC7 has four models submitted to the Ministry of Industry and Information Technology, with one supporting battery swap and three not. In comparison, four out of five available Feifan F7 models support battery swap.

For owners who bought into Feifan's battery swap "pie," the underwhelming swap station construction not only affects their daily use but also causes tens of thousands of yuan in economic losses.

"I accept paying 1,260 yuan per month for battery rental, which is 500 yuan more expensive than NIO, and the 80 yuan per month service fee. But the worst part is that the car's value has plummeted, and it's difficult to sell for even 100,000 yuan. Returning or buying out the battery requires a three-month penalty and a 1,500 yuan battery removal fee." On July 8, a Feifan F7 owner in Guangzhou showed Yuan Media Hui several second-hand car quotes for their vehicle, with the highest not exceeding 100,000 yuan and the lowest at 80,000 yuan.

The owner paid the original price of 229,900 yuan a year ago, with a discount of 84,000 yuan for battery leasing, resulting in a net payment of approximately 135,000 yuan. With monthly battery rental and service fees of 1,340 yuan, they have paid about 16,000 yuan so far.

In a year, the owner's Feifan F7 has depreciated by over 30%. Meanwhile, many second-hand car dealers, upon learning the car was purchased with battery leasing, have required them to buy out the battery before selling. The penalties and service fees for buying out or returning the battery add up to over 5,000 yuan in losses.

"Initially, I thought Feifan, being part of SAIC, should be no worse than NIO. Plus, they partnered with PetroChina and Sinopec for swap station construction, which seemed convincing, so I chose the battery rental model. Little did I know I was stepping into a deep hole." The owner said they now hope the manufacturer can waive penalties and battery removal fees to reduce their losses when selling the car.

Some images are sourced from the internet. Please notify us for removal if there is any infringement.