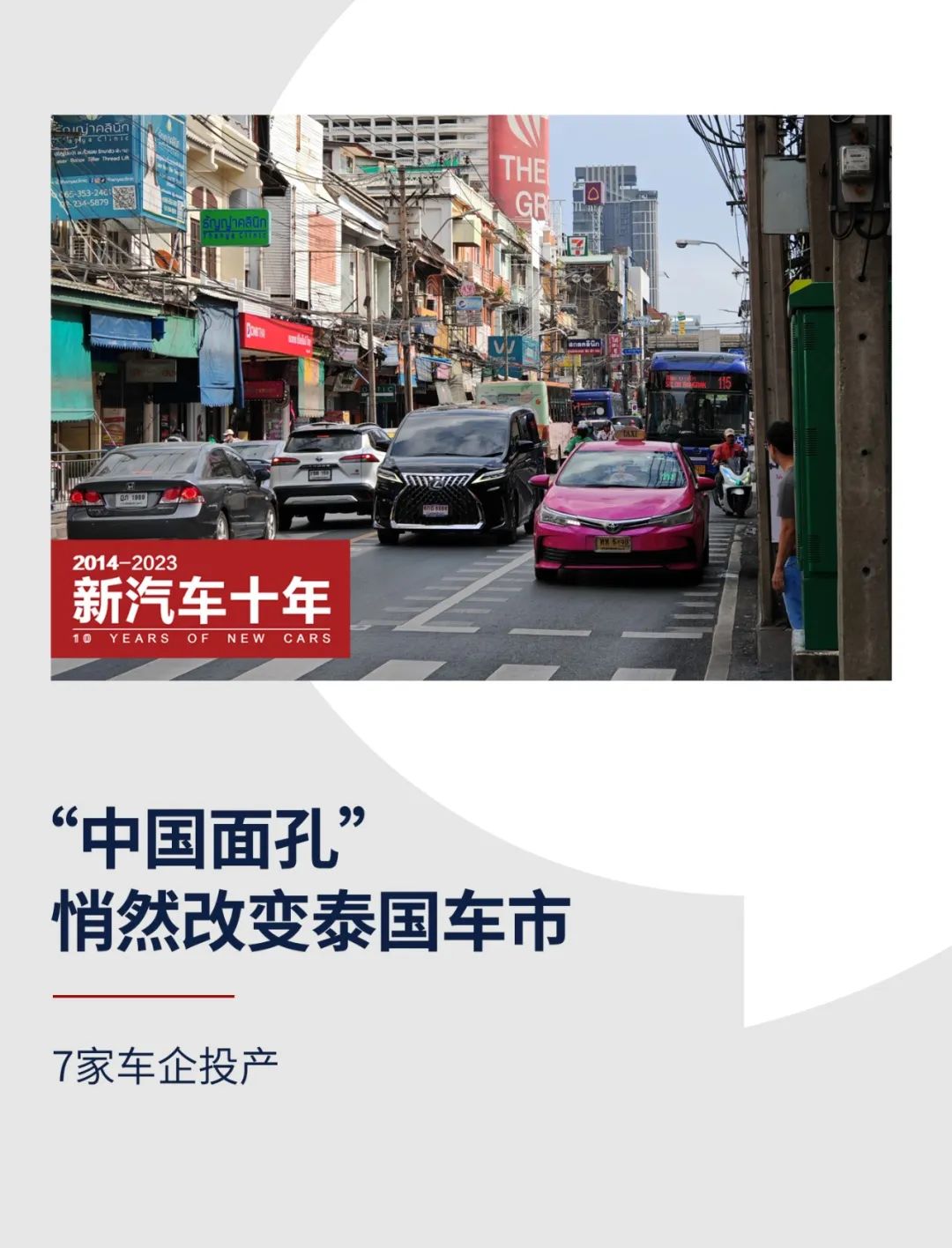

Chinese Faces" Quietly Transforming the Thai Automotive Market

![]() 07/10 2024

07/10 2024

![]() 491

491

Author | Zhen Yao

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

Rayong Province, located 185 kilometers southeast of Bangkok, Thailand, is approximately a 2.5-hour drive from the city, similar to the distance from Beijing to Baoding in China.

Unlike Baoding, nestled in the heart of the North China Plain, Rayong Province is not only about 100 kilometers from Bangkok's Suvarnabhumi International Airport but also adjacent to Thailand's largest deep-water port, Laem Chabang Port, just 27 kilometers away, making its geographical location exceptionally advantageous.

It is here that BYD and several Chinese automakers embarked on their "Thai Dream."

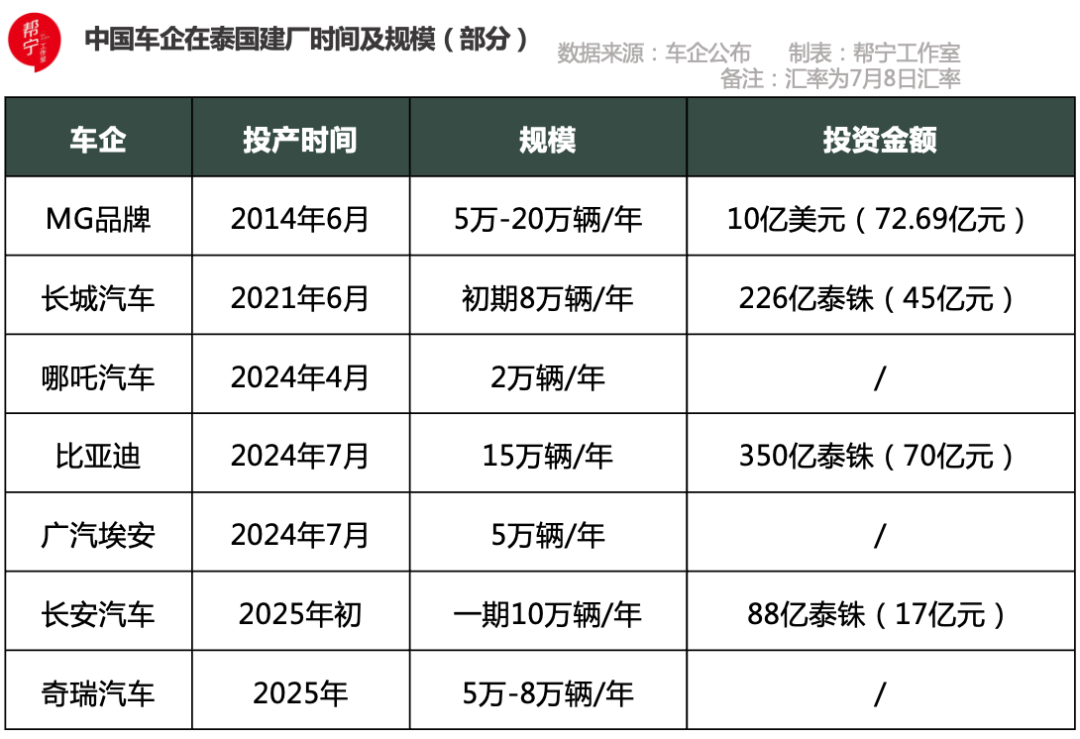

On July 4, 2024, with brand-new Dolphin vehicles rolling off the production line, BYD's Thai factory was officially completed and put into operation. This is BYD's first passenger vehicle factory in Southeast Asia to be completed and put into production, taking just 16 months from groundbreaking to operation, with an annual capacity of approximately 150,000 vehicles. It encompasses the four major processes of complete vehicle production and a parts factory, costing 35 billion Thai baht (approximately 7 billion yuan).

The completion and operation of this factory represent another significant move by BYD to further expand into the Thai market and accelerate its overseas expansion. The Chinese automaker also特意 held a ceremony here to mark the rollout of its 8 millionth new energy vehicle.

"BYD has only been in the Thai market for two years but has quickly won recognition, having been the sales champion of pure electric vehicles in Thailand for 18 consecutive months. Nowadays, out of every three pure electric vehicles sold in Thailand, one is a BYD," said Wang Chuanfu, Chairman and President of BYD Co., Ltd. at the event. He added that BYD will introduce more pure electric vehicle models and plug-in hybrid models in Thailand in the future.

Thailand, as a bridgehead of the Southeast Asian automotive market, has long been dominated by Japanese brands. However, with the rise of new energy vehicles and the emergence of Chinese automotive brands, the existing landscape is quietly changing.

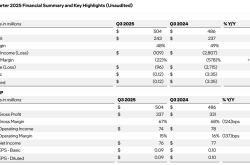

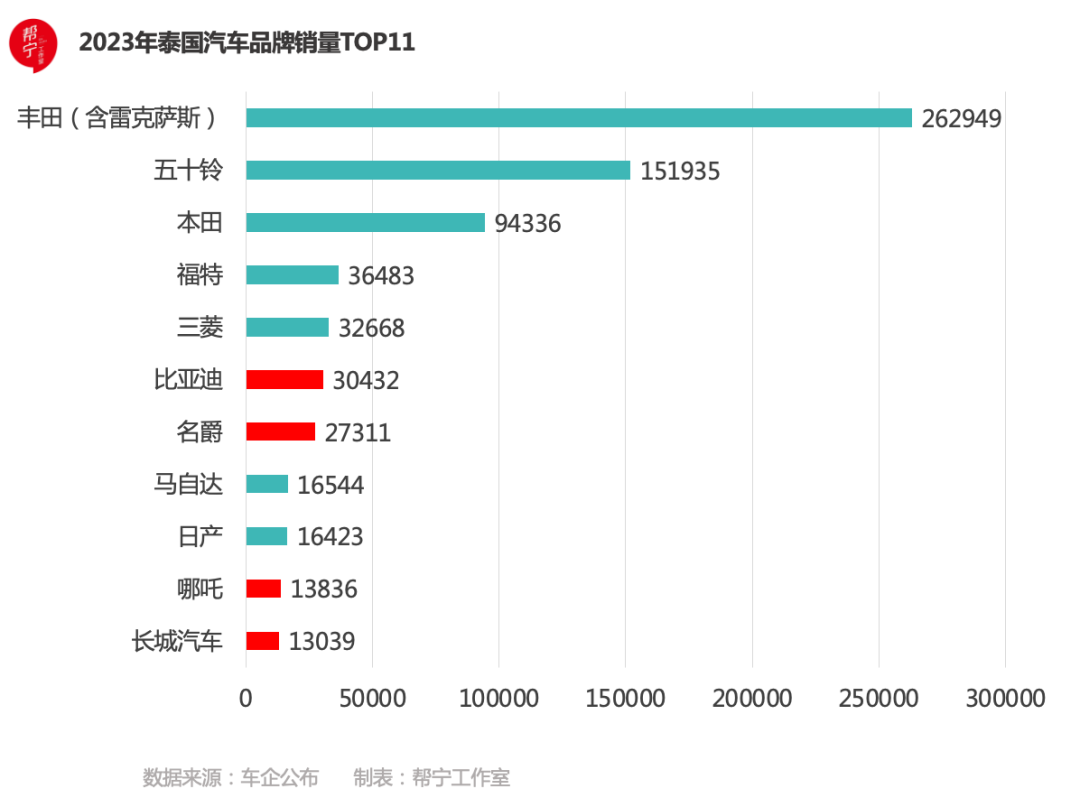

According to statistics from the Thai Automotive Institute, four Chinese brands made it to the top 11 list of Thai automotive brand sales in 2023. Notably, around 76,000 electric vehicles were registered in Thailand that year, accounting for 12% of total vehicle registrations. The top four were all Chinese brands, and Chinese brands held eight seats in the top ten.

Several Chinese automakers had already entered the Thai market before BYD.

The earliest can be traced back to December 4, 2012, when SAIC Motor and Thailand's Charoen Pokphand Group signed a cooperation agreement to jointly establish a vehicle manufacturing company and a vehicle sales company in Thailand, focusing on the production and sales of MG brand products.

In June 2014, the first phase of the project was successfully completed, and the first model, the MG6, rolled off the production line.

Subsequently, Great Wall Motor, GAC Aion, Changan Automobile, NIO Auto, Chery Automobile, Xpeng Motors, Wuling, and other Chinese automakers have all entered the Thai market through factory construction or exports.

In the new automotive decade, China's automotive industry is heading towards the global market. Due to various natural advantages, Thailand has become an important base for China's automotive overseas strategy. From product exports to ecosystem exports, using Thailand as a springboard to gradually radiate throughout the ASEAN market has become a consistent blueprint for Chinese automotive brands.

Why Thailand?

Upon landing at Suvarnabhumi Airport, one can immediately see a BYD ATTO 3 (Yuan Plus) on a prominent billboard at the immigration area.

Driving from the airport to downtown Bangkok, one can see that advertising billboard resources along the highway are almost completely occupied by Chinese automakers, including BYD, MG, Great Wall, GAC Aion, NIO, Xpeng, Changan, etc., making it a dizzying sight.

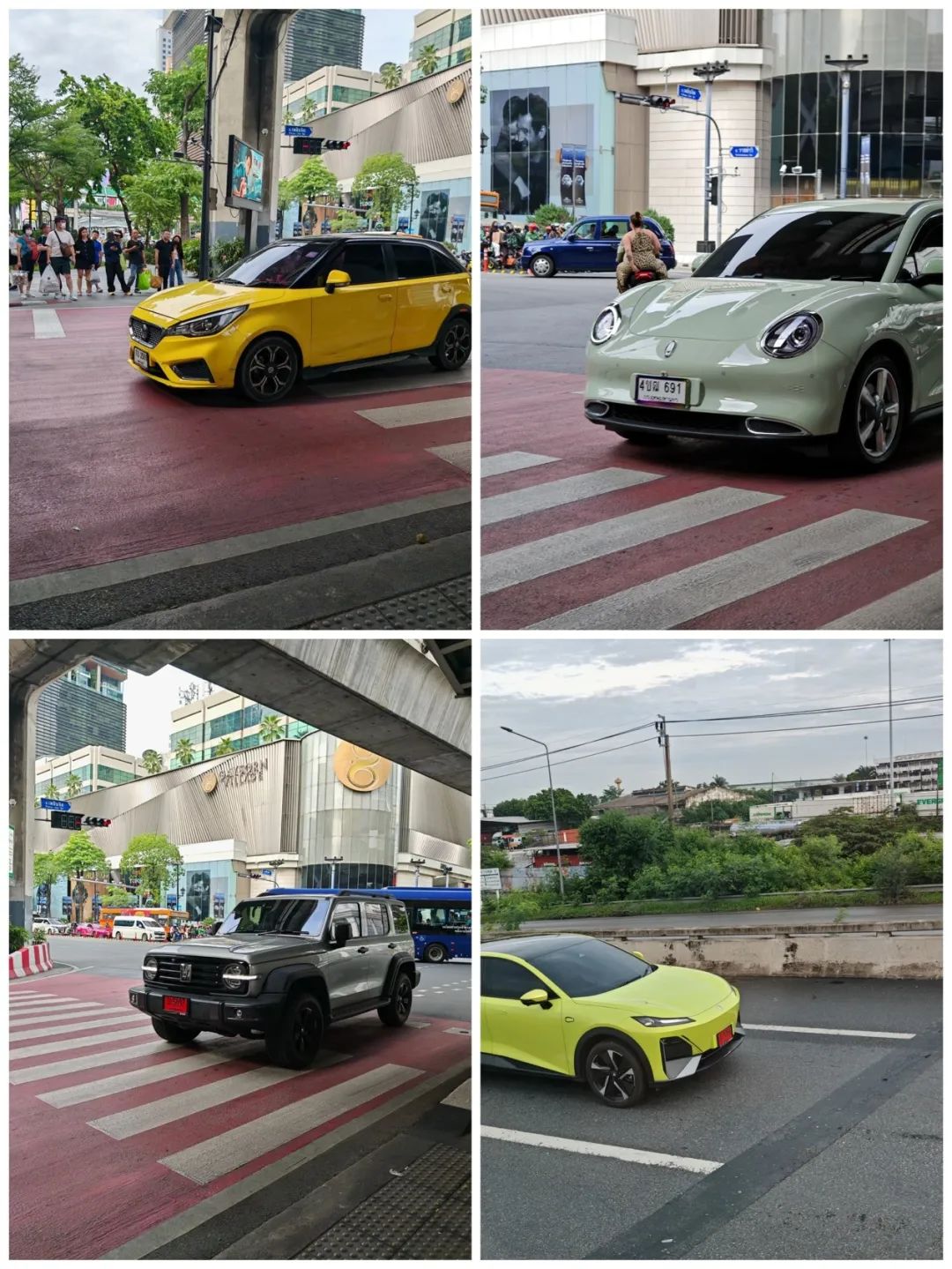

On the streets of Bangkok or in parking lots, Chinese brands such as Deep Blue, MG, BYD, Ora, and NIO have a high visibility, becoming a scenic spot on the streets of Bangkok.

Why have Chinese automakers chosen Thailand? This is closely related to Thailand's solid industrial foundation, proactive policy support, and unique geographical layout.

First, the industrial foundation.

Rayong Province, known as the "Detroit of the East," is an important industrial base in Thailand with over 1,300 industrial enterprises. Its main industries include automobiles, chemicals, steel, oil refining, natural gas, and electricity. Thailand's national industrial development zone, Map Ta Phut Industrial Estate, is located within Rayong Province.

Among industrial projects, the automobile industry has developed the fastest in Rayong Province in recent years. World-renowned automakers such as General Motors, Ford, Toyota, Honda, Mitsubishi, Isuzu, Nissan, and BMW have set up factories there to produce vehicles for the Thai and Southeast Asian markets. Rayong Province serves as the production base for these renowned automakers in Asia.

Next, geographical location.

As the saying goes, "To win Thailand is to win ASEAN." Thailand is the largest automobile manufacturing country in Southeast Asia, with over 60 years of experience in vehicle assembly and manufacturing. Its annual vehicle production capacity is close to 2 million units, accounting for about half of the Southeast Asian automotive market.

Furthermore, Thailand has nearly 700 first-tier automotive suppliers that can directly supply parts to automobile assembly plants, with a local parts procurement rate of 98%, providing a robust local supply chain support for automobile manufacturing.

From a geographical perspective, Thailand not only has advantages in its domestic market but can also radiate throughout Southeast Asia, serving as the core and bridgehead of the Southeast Asian automotive market.

Southeast Asia is a rapidly growing market with a population of over 600 million, and demand for new energy vehicles is continuously increasing.

Lastly, national policies.

Currently, Southeast Asian governments are actively promoting the transformation of the traditional fuel vehicle industry. Thailand is one of the most proactive countries in promoting electric vehicles at the policy level, providing opportunities for Chinese new energy automakers to switch lanes.

The Thai government has implemented a series of preferential policies such as tax reductions and subsidies, and tariff exemptions to encourage the development and popularization of electric vehicles.

In 2021, Thailand introduced the "30·30" policy, explicitly stating that 30% (about 725,000 units) of domestically produced vehicles will be zero-emission vehicles (ZEVs) by 2030, with plans to increase the number of ZEVs to 1.35 million by 2035.

In February 2022, to further promote the development of electric vehicles, Thailand launched an EV revitalization policy centered on subsidies: starting from June 2022, each pure electric vehicle can enjoy a maximum purchase subsidy of 150,000 Thai baht (approximately 30,000 yuan).

Driven by these policies, Thailand's pure electric vehicle sales reached 76,300 units in 2023, a year-on-year increase of 6.8 times. The top-selling model was BYD's Atto 3 (Yuan PLUS), with 19,000 units sold throughout the year.

However, to qualify for these preferential policies and subsidies, automakers must have factories in Thailand. This condition is one of the key reasons why many Chinese automakers choose to build factories in Thailand.

Breaking Through Challenges

The Thai market is full of opportunities but also poses challenges.

Walking through the streets and alleys of Thailand, Japanese brand vehicles are ubiquitous, often giving people the illusion of being in Japan, as if this were the second hometown of Japanese automakers.

Before Chinese automotive faces emerged, Japanese automakers had been deeply rooted in Southeast Asia for 50 years. In the two major automotive markets of Thailand and Indonesia, Japanese automakers hold 80-90% market share, driving away many American and European automakers.

Thailand has no mandatory vehicle scrappage policy. This means that fuel vehicles can continue to be used as long as they pass safety and emission inspections regularly.

This policy may lead to the Thai automotive market approaching saturation. For electric vehicles, if the replacement market cannot be effectively activated, it will be difficult to maintain high growth rates in the future.

Additionally, Thailand's pure electric vehicle market is still in its infancy, with inadequate charging facilities, congested roads, and low consumer acceptance, posing obstacles for Chinese automakers to explore this market.

Facing these challenges, SAIC Motor, which is actively advancing internationalization, took the lead in introducing the MG brand into the Thai market.

Since the first MG6 rolled off the production line in Thailand in 2014, despite the overall decline in the Thai automotive market, SAIC-CP MG's products and services have continued to grow against the trend. Over three years, its compound growth rate reached 200%, steadily expanding the Thai market and successfully shaking up the long-dominated Thai automotive market landscape by Japanese vehicles.

As of April 2024, SAIC-CP MG held a 15.7% market share in Thailand, ranking sixth in sales for three consecutive months, becoming the Chinese automotive brand with the highest monthly sales ranking. From January to April this year, MG's market share in Thailand increased to 3.3%, a growth of 6.5%, ranking sixth, up one position from last year.

2024 marks the 100th anniversary of the MG brand, which has been in Thailand for over a decade. This Chinese automaker is committed to ranking among the top three in the Thai automotive industry and becoming the preferred brand of local young people in the new decade.

The rise of the MG brand in the Thai market has attracted global attention from the automotive industry, boosting the confidence of Chinese automakers in establishing a foothold in Thailand, radiating throughout ASEAN, and facing global development.

Great Wall Motor is one of them.

In February 2020, Great Wall Motor announced the acquisition of General Motors' manufacturing plant in Rayong Province, Thailand. The plant covers a vast area of 818,100 square meters and has the potential for a maximum annual capacity of 135,000 vehicles. In addition to paying for the acquisition of the plant, Great Wall Motor invested an additional 5 billion yuan in factory renovation and upgrades.

Today, in the Thai automotive sales directory, one can find several new energy products under Great Wall Motor, including the Haval H6 HEV, Tank 500 HEV, Tank 300 HEV, and Ora Good Cat.

Changan Automobile is also actively deploying here. On October 17, 2023, at the Belt and Road Initiative Entrepreneurs Conference, Changan Automobile and the Thailand Board of Investment signed an agreement on the spot, planning to invest 8.8 billion Thai baht (approximately 1.77 billion yuan) in Thailand to build a new energy vehicle production factory with an initial design capacity of up to 100,000 vehicles.

GAC Aion also views this as an essential step in its internationalization strategy. Recently, GAC Aion announced that its smart eco-factory in Thailand will be completed in mid-July. At that time, the second-generation AION V will roll off the production line globally, marking GAC Aion's further deepening and expansion in the Thai market.

In 2022, NIO Auto chose Thailand as its first destination for overseas expansion, becoming the first Chinese new energy vehicle brand to export right-hand-drive models. "Using Thailand as a fulcrum, NIO is accelerating its expansion into the Southeast Asian market and launching new vehicles in countries such as Malaysia," said a NIO Auto representative.

Pingpala Wichaikun, Thailand's Minister of Industry, highly praised the contribution of Chinese new energy vehicles: "Chinese automakers investing in Thailand and bringing vehicles with advanced production technology will promote the development of the new energy vehicle industry in Thailand and even ASEAN." The continuous development of Thailand's electric vehicle ecosystem has boosted local consumers' confidence and demand for pure electric vehicles. Kasikorn Research Center forecasts that in 2024, sales of electric vehicles (EVs) in Thailand will reach between 85,000 to 100,000 units, marking a year-on-year growth of 25% to 47%. This is promising news for Chinese automakers.

Over the past decade, from brands like MG, Great Wall, BYD, Changan, and Nezha, to Aion, XPeng, and Wuling, the "Chinese faces" have been quietly transforming the Thai automotive market. The Thai market has not only witnessed the leap in Chinese new energy vehicle technology but also the era of Chinese automakers’ grand maritime endeavors.