July sees a flurry of new car applications, kickstarting the second half of the automotive market's "bloody" competition?

![]() 07/16 2024

07/16 2024

![]() 594

594

Multiple "first" products are on the horizon, and automakers have finally come to their senses.

Recently, the new cars unveiled by various automakers have indeed piqued the interest of many consumers. Xiaotong has already analyzed three highly discussed new cars: the Zeekr 7X, XPeng P7+, and Zhideji R7. However, many of these conclusions are based on speculations drawn from brand technology plans and cannot guarantee 100% accuracy.

Now, with the announcement of July's application information, in addition to these three new cars, all-new models such as the BYD Seal 05 and Geely Xingyuan have also appeared in the application list. Xiaotong notices that while these new models have different positioning, they are all new products from their respective brands entering mainstream segment markets, which may influence the purchase decisions of many consumers.

Seal 05: The first SUV on the Ocean Network equipped with the latest DM technology

Whether it's the Dynasty family or the Ocean Network, BYD has a sufficient range of products targeting the mainstream market. Moreover, thanks to the implementation of the fifth-generation DM technology, which "enables vehicles to run 2000km," BYD's sales have been further stimulated. The Seal 05, which appears in this month's application images, is the first SUV on BYD's Ocean Network equipped with the fifth-generation DM technology.

Seal 05

Furthermore, its sister model, the new Song Pro DM-i, also appears on the application list. The two models primarily differ in appearance, with the Seal 05 adopting a design style similar to the Destroyer 05, while the new Song Pro DM-i utilizes the classic chrome elements of the Dynasty family but with a more aggressive transformation of the lower grille mesh. The dimensions of the two models are shown in the figure below. The identical wheelbase confirms their status as sister models, while slight differences in body dimensions are mainly due to different exterior kits.

In terms of power, the Seal 05 and the new Song Pro DM-i share the same powertrain, featuring a plug-in hybrid system consisting of a 1.5L naturally aspirated engine and a drive motor. The maximum power of the engine is 74kW, while that of the motor is 120kW, matched with Fudi's lithium iron phosphate blade battery.

Compared to the current Song Pro DM-i, the engine power and drive motor power of the new Song Pro DM-i have decreased. However, with the introduction of the fifth-generation DM technology, the P1 motor also participates in power drive, resulting in an overall power performance that is stronger than that of the fourth-generation DM technology.

Although the Ocean Network already has popular models like the Seagull and Song PLUS, BYD's strategy undoubtedly hopes to create a blockbuster product similar to the Song Pro DM-i within the Ocean Network. In particular, to support the sales of the Ocean Network, the Song PLUS series has long played the role of an "external aid." Considering the long-term development of the Ocean Network, it must have a "pure-blooded" sales leader, and clearly, the Seal 05 is the product with high expectations.

Objectively speaking, the Dynasty family has a higher reputation in the domestic market, so the newly-launched Seal 05 may struggle to catch up with the Song Pro DM-i in sales, just as the Destroyer 05 has difficulty catching up with the Qin PLUS. However, if the Seal 05 and the new Song Pro DM-i can offer a surprising pricing, they are likely to capture potential customers from other competitors like the Yinhe L7 and Changan Qiyuan Q05, making them "small blockbusters" with little difficulty.

Zhideji R7: The first coupe SUV powered by HarmonyOS Intelligent Drive

Starting from the second quarter, HarmonyOS Intelligent Drive has accelerated its product update and iteration pace. In addition to upgrading existing models and the upcoming Xiangjie S9, Zhideji's second mass-produced vehicle, the Zhideji R7, also appears in this batch of application information, with an expected launch this year.

Regarding design, Xiaotong has previously analyzed the exterior of the Zhideji R7 and will not elaborate further here. In terms of dimensions, the Zhideji R7 measures 4956/1981/1634mm in length, width, and height, respectively, with a wheelbase of 2950mm. Compared to the Zhideji S7, it has a shorter length and height but a more prominent wheelbase. In other words, both the Zhideji S7 and R7 belong to the same class.

As a product under HarmonyOS Intelligent Drive, the Zhideji R7 naturally utilizes Huawei's ADS intelligent driving system. Considering that the upcoming Xiangjie S9 will be the first to equip the ADS 3.0, it can be inferred that the subsequently launched Zhideji R7 will also use the latest ADS 3.0 intelligent driving system, including the latest generation of HarmonyOS cockpit. Since the Zhideji R7 and Zhideji S7 are in the same class, the Zhideji R7 is expected to be on par with the Zhideji S7 in terms of technological and comfort configurations.

In terms of the crucial power aspect, the Zhideji R7 continues to be equipped with Huawei's motor system, offering both single-motor and dual-motor powertrains. The maximum power of the single-motor version is 215kW, while that of the dual-motor version is 365kW, which is identical to the Zhideji S7. The battery pack capacity of the Zhideji R7 has not been disclosed yet, but Xiaotong speculates that it will not differ significantly from that of the Zhideji S7. Considering the vehicle's handling, the Zhideji R7's acceleration capability and pure electric driving range will be inferior to that of the Zhideji S7.

In recent years, several pure electric coupe SUVs such as the XPeng G6, Model Y, and Leadway L60 have been launched, and the Zhideji R7 represents HarmonyOS Intelligent Drive's first attempt in this segment. Its purpose is not difficult to understand. The Zhideji brand hopes to expand into more categories to open up market gaps. According to plans, Zhideji will also introduce pure SUV products, eventually forming a relatively complete product matrix.

On the other hand, the sales of the Zhideji S7 are not ideal, making it necessary to launch a second model to boost sales growth.

Since the Zhideji R7 is in the same class as the Zhideji S7, it can be inferred that the price of the Zhideji R7 will not differ significantly, with a starting price possibly around RMB 260,000. However, it must be said that this price does not offer obvious competitiveness against the Model Y. If the starting price can be reduced to around RMB 220,000, the Zhideji R7 will be more attractive.

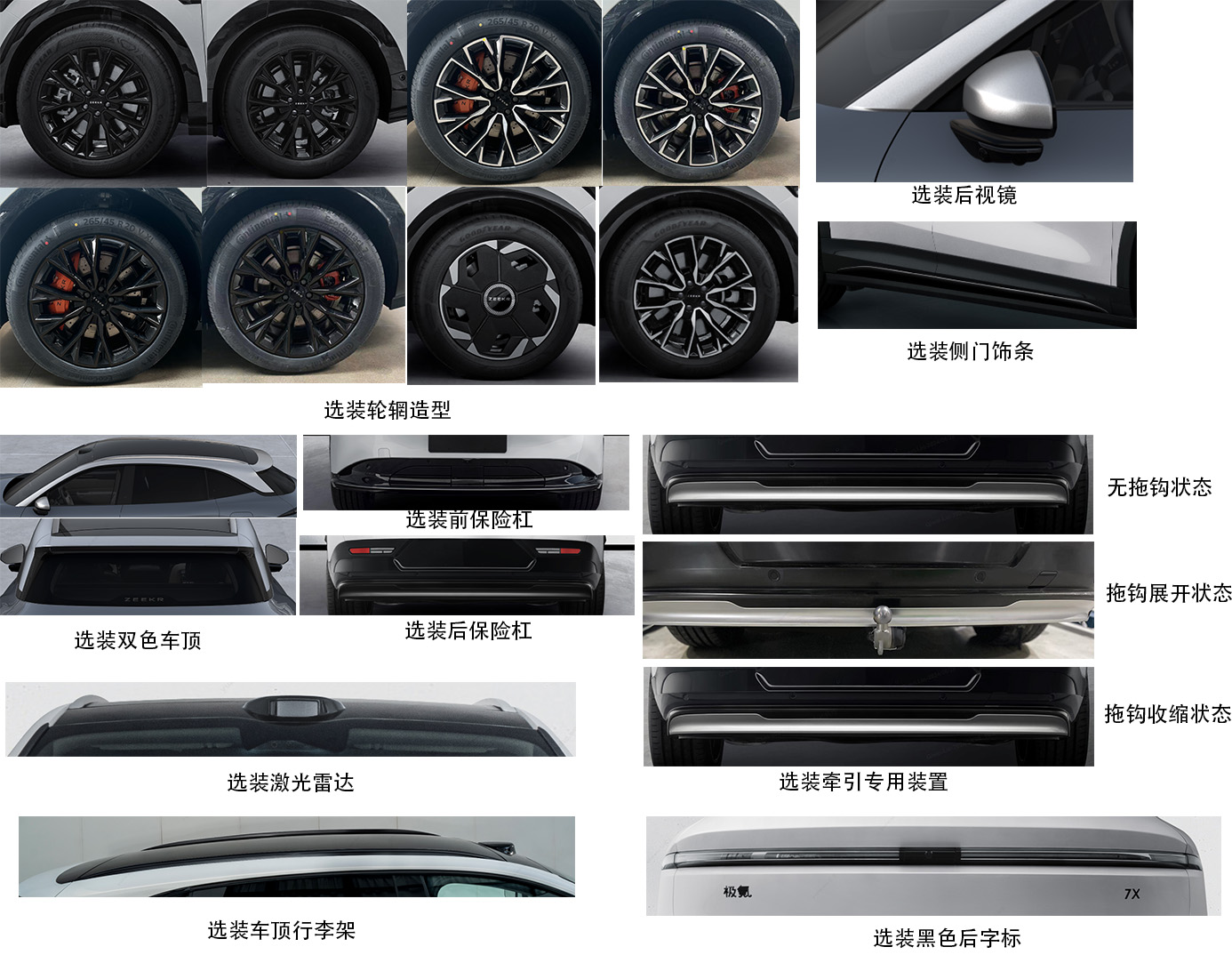

Zeekr 7X: The first pure electric SUV designed for volume sales

Zeekr is a high-end pure electric brand under the Geely Group. So far, Zeekr has had a certain voice in the pure electric sedan segment, but it has struggled to generate significant sales in the SUV and MPV segments. In particular, its SUV model, the Zeekr X, has a price point that many consumers can afford, but its product positioning is too niche, with few people willing to spend RMB 200,000 on a small pure electric SUV. The Zeekr 7X in the application information was born to attract more mainstream SUV users.

From recent information released by Zeekr, we know the overall dimensions and exterior elements of the Zeekr 7X, roughly understanding that its design style bears a high resemblance to the Zeekr 007. Its through-body smart light bar still leaves a deep impression on Xiaotong.

However, according to the application information, the Zeekr 7X only offers options without LiDAR and other intelligent driving hardware, unlike the Zeekr 007, which provides an option to remove the through-body smart light bar. In other words, the Zeekr 7X will not initially lower the purchase threshold by removing the light bar, but this cannot be ruled out in the future.

Regarding power, the Zeekr 7X has applied for both single-motor and dual-motor versions. The maximum power of the single-motor version is 310kW, while the dual-motor version adds a drive motor with a maximum power of 165kW, identical to the Zeekr 007. It's worth noting that the two single-motor versions declared have different curb weights, suggesting that they will carry battery packs of different capacities based on different configurations, resulting in different pure electric driving ranges.

Combining the published power and driving range data, we can simply and crudely regard the Zeekr 7X as the SUV version of the Zeekr 007, with a starting price likely to be just over RMB 200,000. In the mid-size pure electric SUV market, the Model Y remains the leader in this segment, with many models claiming to capture its market share. These models primarily focus on cost-effectiveness, offering stronger performance, driving range, or comparable intelligent driving capabilities at lower prices, but ultimately, they have not gained much traction.

While retaining its cost-effectiveness advantage, the Leadway L60 also boasts a battery swap feature that the Model Y lacks, technologically distinguishing itself and potentially becoming a "key player" in capturing the Model Y's market share. The question now facing the Zeekr 7X is that if it merely offers an attractive price without other differentiating advantages, it may face a similar awkward situation after its launch as other competitors—without unique features, what reason can it give to convince consumers not to choose Tesla?

XPeng P7+: The first flagship sedan equipped with the latest top-tier intelligent driving technology

XPeng Motors CEO He Xiaopeng revealed some information about the XPeng P7+, which also appears in the application information, allowing Xiaotong to grasp the basic capabilities of the XPeng P7+.

He Xiaopeng stated that the XPeng P7+ is over 5 meters long, and we can find the exact length from the application information. The data shows that the XPeng P7+ measures 5056/1937/1512mm in length, width, and height, respectively, with a wheelbase of 3000mm. Positioned as a large sedan, it is directly one class higher than the XPeng P7, with a wheelbase identical to the Xiaomi SU7 but more prominent length and height.

Regarding the powertrain, the XPeng P7+ has applied for two single-motor versions with maximum power ratings of 180kW and 230kW, equipped with lithium iron phosphate batteries. These power parameters fall between the current XPeng P7i and XPeng P7, indicating that not many XPeng P7+ models have completed the application process, but two options focusing on performance or driving range are still provided.

Theoretically, the XPeng P7+ has a higher positioning than the XPeng P7i and should command a higher price. However, the new car will utilize the latest "pure vision" high-level intelligent driving solution without LiDAR, thus offering more pricing possibilities. Xiaotong boldly speculates that the starting price of the XPeng P7+ may also be just over RMB 200,000.

Based on this price, competitors for the XPeng P7+ include products like the BYD Han EV, Xiaomi SU7, and Zhideji L6, and it can even compete with mid-size pure electric sedans like the Zeekr 007 and Model 3 in higher price segments. From a technological and pricing perspective, the XPeng P7+ is indeed quite competitive. However, focusing on XPeng Motors' product matrix, the market share of the current XPeng P7i is likely to be eroded by the XPeng P7+.

Nevertheless, if the new XPeng P7i also adopts the latest intelligent driving technology without LiDAR, its price is expected to drop below RMB 200,000, so the impact of "sibling cannibalization" will not be significant. The main issue remains whether it can capture market share from other pure electric sedans.

Automakers actively seek change, and introducing "first" new cars is just the beginning

In addition to the aforementioned models, new vehicles such as the MG S5, Ye S7, and Geely Xingyuan also appear in this batch of application information. The other new applications are mostly derivative models. Looking back at the application information from the first half of the year, personalization was the main theme. A relatively high proportion of the new models were niche products like station wagons, off-road vehicles, and high-end small cars. However, from the application information released in July, Xiaotong observes that car manufacturers are starting to step out of their comfort zones and are aiming to penetrate more mainstream market segments.

In an effort to seek differentiated competition, many car manufacturers are attempting to move towards more personalized development. However, even so, the era of competing on technology and configurations in the automotive market is far from over. Low energy consumption and high intelligence remain the mainstream demands in the current domestic new energy vehicle market. Niche products have a relatively small market size, and securing a foothold in the mainstream market is the greatest guarantee for car manufacturers' profitability.

It's important to note that the mainstream market has many competitors, and the aforementioned models may face certain challenges. The brand influence of the Haishi 05 is not an issue, but how to increase its sales while ensuring the sales of the new Song Pro DM-i remains strong could be a problem. The Zhijie R7 leverages Huawei's brand influence, but if the starting price reaches over 250,000 yuan, its market competitiveness might not be very strong. The ZEEKR 7X is in the mid-size pure electric SUV market, which has many products targeting family users, so ZEEKR 7X urgently needs to find its unique advantages. The XPeng P7+ might strengthen its price advantage, but it faces many well-known competitors, and the competitive pressure is not much less than that faced by the XPeng P7i.

The competition in the mainstream market is fierce, and no car manufacturer can guarantee that its product will inevitably become a "dark horse" upon release. However, since it is the mainstream market, as long as thorough product research is conducted in the early stages and product technology is ensured, there is a chance to be recognized by the market. Moreover, this chance is certainly much higher than in the niche market.