The 50 billion auto company "flash crash": Who is to blame?

![]() 07/22 2024

07/22 2024

![]() 733

733

The A-share market is unpredictable.

On July 19, the three major indices of the A-share market opened low and closed high. By the end of the trading day, the Shanghai Composite Index gained 0.17%, the Shenzhen Component Index gained 0.27%, the ChiNext Index gained 0.45%, and the Beijing Stock Exchange 50 Index fell 0.6%.

Strangely, despite the overall market rally, the auto sector did not benefit, with several auto stocks collectively diving, and some even hitting their daily limits.

Especially near the close at 15:00 in the afternoon, BAIC BluePark experienced a direct flash crash, closing at 9.21 yuan per share, with a decline of 9.97%.

Coincidentally, around 2:30 pm on the same day, the website of the State Administration for Market Regulation suddenly announced that BAIC BluePark Magna Automotive Co., Ltd. was recalling 3,418 units of Alpha T and Alpha S pure electric vehicles produced between November 2, 2021, and June 10, 2022.

The reason for the recall was that the raw material of the wave clamp used to fix the brake hose was defective, and the wave clamp might break, causing local loosening and wear of the brake hose. In extreme cases, this could lead to brake fluid leakage, longer braking distances, and potential safety hazards.

According to Tianyancha, BAIC BluePark holds approximately 46% equity in BAIC BluePark Magna Automotive Co., Ltd.

The problematic Alpha T and Fox Alpha S products were produced by BluePark Magna, a joint venture between BAIC BluePark and global luxury automaker Magna International in China.

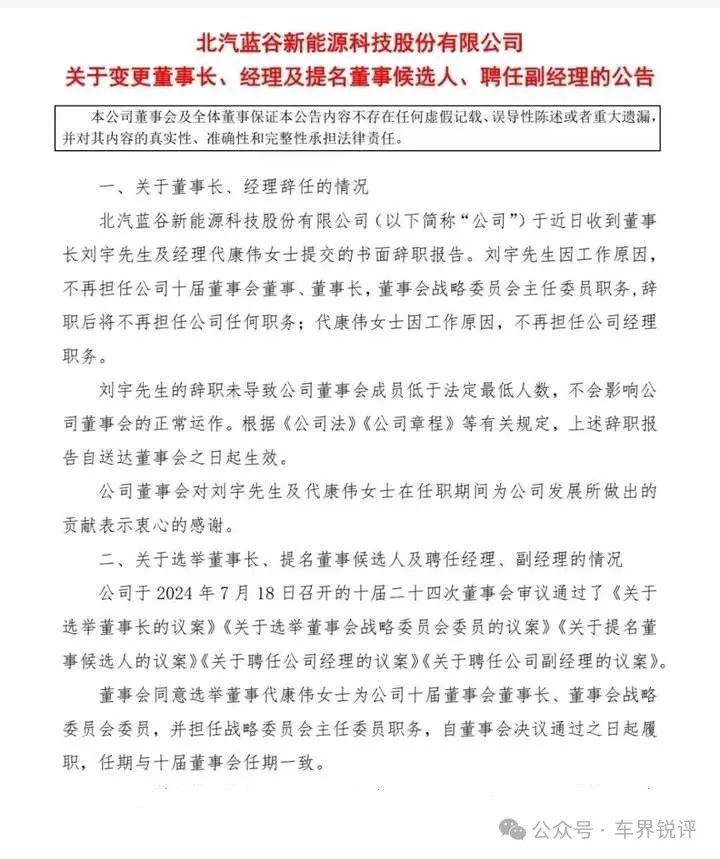

More importantly, on the evening of July 19, BAIC BluePark also underwent significant personnel changes, with Chairman Liu Yu resigning due to work reasons and no longer serving as a director or chairman of the company.

The board of directors re-elected Dai Kangwei as chairman of the company and appointed Zhang Guofu as the company's manager and Liu Guanqiao as the company's deputy manager.

Public records show that Dai Kangwei, a female born in June 1983, graduated from Beijing Institute of Technology with a master's degree in mechanical engineering and a Ph.D. in engineering.

From April 2008 to May 2021, she held various positions at Foton Motor's Research Institute, including software development engineer in the New Energy Technology Center and deputy director of the New Energy System Development Institute. She also served as engineer, section chief of System Integration and Calibration, assistant director of the Technology Center, head of the Strategy Development Department, assistant to the dean, and deputy dean at Beijing Electric Vehicle Co., Ltd.

From March 2021 to September 2021, she concurrently served as general manager of Beijing Electric Vehicle Co., Ltd.'s BluePark Power System Branch.

From April 2021 to present, she has served as director and general manager of Beijing Electric Vehicle Co., Ltd.

From June 2021 to present, she has served as manager and director of BAIC BluePark New Energy Technology Co., Ltd.

In July 2024, she was appointed deputy chief engineer and chairman of Beijing Electric Vehicle Co., Ltd.

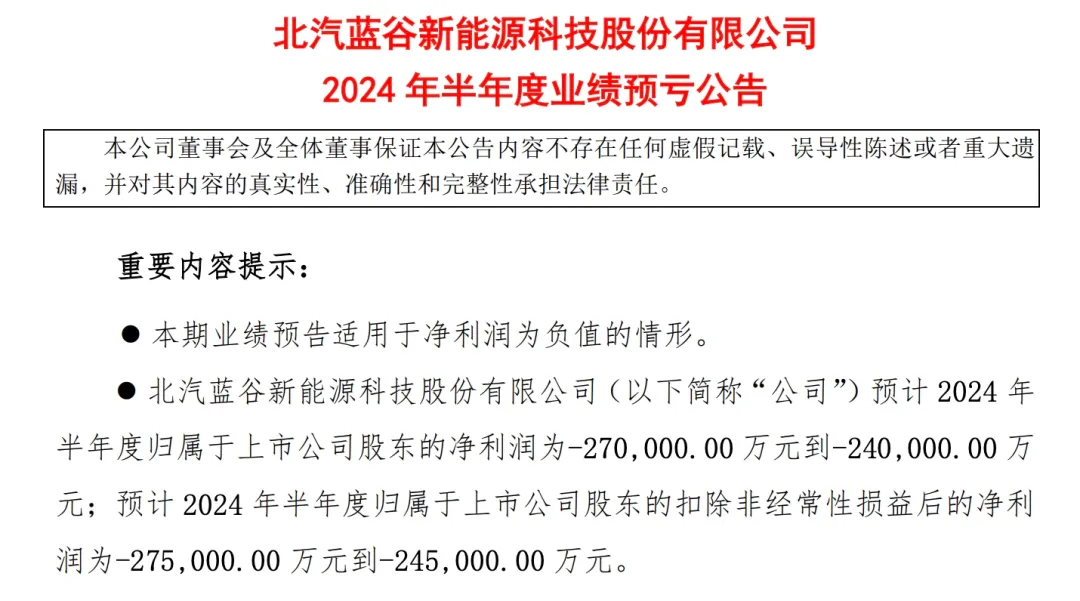

In fact, shortly before the announcement of the personnel changes, BAIC BluePark's earnings forecast for January to June was also bleak.

According to the forecast, BAIC BluePark's net loss for the first half of 2024 was 2.4 billion to 2.7 billion yuan, compared to a loss of 1.98 billion yuan in the same period last year.

In fact, BAIC BluePark has been mired in huge losses in recent years.

Financial data shows that from 2020 to 2022, BAIC BluePark's revenue was 5.272 billion yuan, 8.697 billion yuan, and 9.514 billion yuan, respectively, with year-on-year growth rates of -77.65%, 64.95%, and 9.40%; net profits were -6.482 billion yuan, -5.244 billion yuan, and -5.465 billion yuan, respectively, with year-on-year growth rates of -7145.36%, 19.11%, and -4.22%; and deducted net profits were -6.646 billion yuan, -5.544 billion yuan, and -5.838 billion yuan, respectively, with year-on-year growth rates of -660.79%, 16.59%, and -5.31%.

This means that in the past four and a half years, BAIC BluePark's net loss has been approximately 24.9 to 25.2 billion yuan.

It is worth mentioning that the subsidies received by BAIC BluePark have also been decreasing year by year. From 2020 to 2023, the government subsidies included in the company's current profit and loss were 113 million yuan, 131 million yuan, 81.6259 million yuan, and 69.7786 million yuan, respectively.

The continuous loss of profits and decreasing subsidies are mainly due to BAIC BluePark's sales performance falling short of expectations.

According to statistics from the official WeChat account of the automaker, BAIC BluePark's sales have declined in both June and the first half of the year. While the performance of the ARCFOX brand has been good, with 8,000 vehicles sold in June, an increase of more than three times year-on-year, and nearly 18,000 vehicles sold in the first half of the year, a doubling year-on-year, the overall sales base of ARCFOX is still small compared to its peers.

However, on the whole, ARCFOX's sales base is small, and there is still a significant gap compared to its peers. Compared to Seres, which saw a 155% year-on-year increase in the first half, and on a high base, ARCFOX seems to be paling in comparison and is not favored by investors.

If it weren't for the support of BAIC Group and the local GZW, BAIC BluePark's TS would have been inevitable sooner or later.

Therefore, the flash crash in BAIC BluePark's share price at this time was not without warning, with continuous net losses, unstable personnel structure, continued difficulty in improving sales, and frequent issues with vehicles.

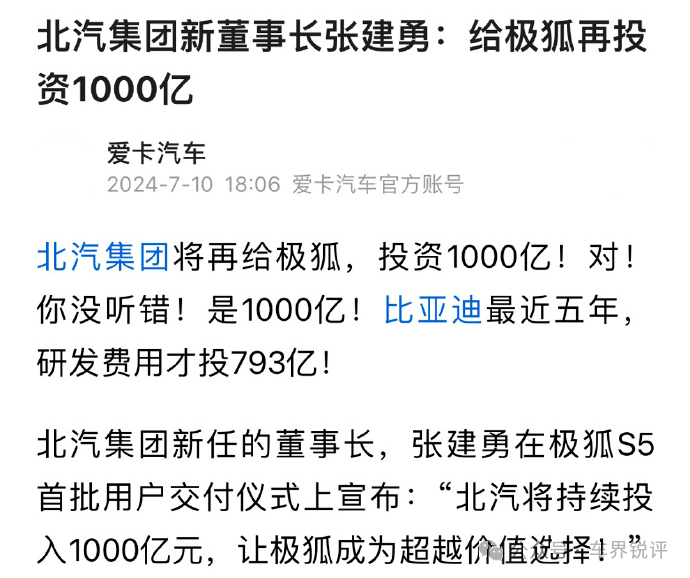

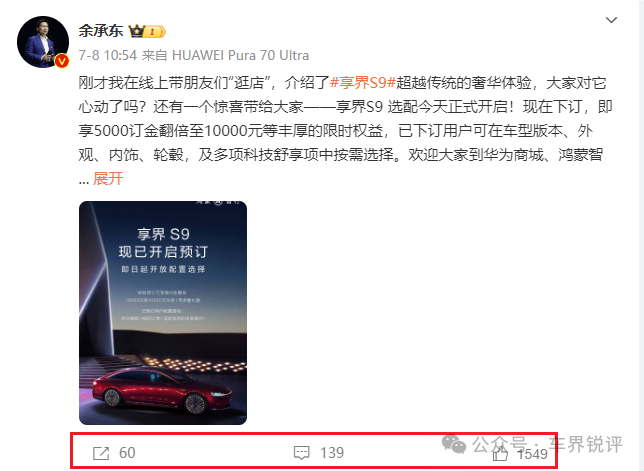

It remains to be seen whether BAIC BluePark's share price can return to its glory days of a 50.24% increase in the first half of the year after the launch of the Enjoy S9, a collaboration between BAIC BluePark and Huawei.

Have you noticed that as the launch of the Enjoy S9 approaches, netizens are less enthusiastic about its sales expectations, with fewer discussions, which may also be one of the reasons for BAIC BluePark's flash crash.

Looking back, BAIC BluePark's cooperation with Huawei began in 2017, even earlier than Seres' AITO brand, which follows the Smart Selection model.

As a result, Seres achieved positive cash flow last year and significant profits this year. In comparison, BAIC BluePark seems to have missed the best opportunity to catch Huawei's fast train. Currently, relying on an executive-level S9 to turn BAIC BluePark around seems like an uphill battle. Do you agree?