Sales are too poor, Porsche China's CEO is replaced

![]() 07/22 2024

07/22 2024

![]() 584

584

Sales down 30% year-on-year

”

Author|Wang Lei, Liu Yajie Editor|Qin Zhangyong

Sales have been sluggish, and Porsche China's top leader is about to be replaced.

On July 20th, Porsche announced that Alexander Pollich will take up the position of President and CEO of Porsche China as early as September 1st this year, based in Shanghai.

The current President and CEO of Porsche China, Michael Kirsch, will be transferred to another important position within the group.

Just the day before the official announcement, on July 19th, Oliver Blume, Chairman of the Management Board of the Volkswagen Group and Chairman of the Porsche Global Executive Board, visited China again after three months and held an internal meeting at Porsche China headquarters in Shanghai.

At that time, news spread that Blume intended to replace Michael Kirsch, the President and CEO of Porsche China, and just one day later, this news was confirmed.

01 Bringing in Reinforcements

Pollich, the incoming CEO for China, is also a Porsche veteran.

According to official information, the 57-year-old Pollich has a background in business administration and economics and has worked for Porsche for 23 years.

He has served in Porsche's strategic department, engaging in the development of the global sales network. He has held several key management positions within the group, and since July 2018, he has been the Chairman of the Executive Board of Porsche AG Germany, and has also served as CEO of Porsche in Canada and the UK, successfully expanding the brand's local business.

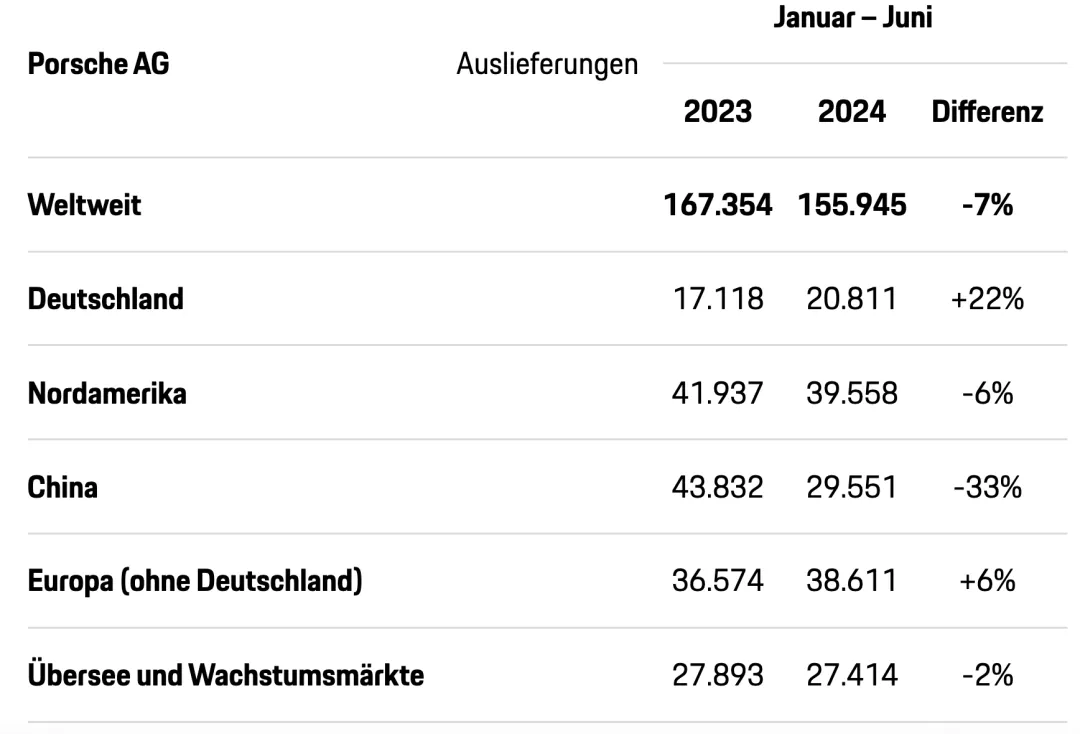

It is worth mentioning that in 2018, Porsche's sales in the German market declined by 11% year-on-year. However, in the year after Pollich took office in Germany, Porsche's sales in the German market increased by 10% year-on-year. In the first half of this year, Porsche's sales in the German market even increased by 22% year-on-year, ranking first in regional market growth.

Perhaps because of his experience in turning around Porsche's sales in the German market, Detlev von Platen, a member of the Porsche Global Executive Board, said, "We are delighted that Mr. Pollich will be taking the helm of the challenging Chinese market. He is an experienced sales expert and will further enhance Porsche's brand influence in China."

Speaking of which, his predecessor, Michael Kirsch, was also highly regarded by the group.

From 2012 to 2016, Kirsch served as Porsche China's Chief Operating Officer, responsible for sales, dealer development, and direct sales operations. In his fourth year in office, the Chinese market became Porsche's largest single market globally. Subsequently, Kirsch retired from his position and successively took charge of Porsche's operations in South Korea and Japan.

In 2021, Porsche sold 96,000 vehicles in China, accounting for nearly one-third of its global sales. However, in 2022, Porsche's sales in China declined for the first time since entering the market, with sales in the first half of the year down 16% year-on-year. In June 2022, Kirsch took over Porsche China's operations again as CEO.

At the time of the official announcement, von Platen said, "Michael Kirsch has contributed significantly to Porsche's successful expansion in the Asian market during his previous tenures in various markets, coupled with his previous management experience at Porsche China, we believe he is fully qualified to lead Porsche China in this important strategic market."

However, his previous rich experience in operating the Chinese and Asian markets did not allow Kirsch to continue to thrive in the Chinese market. Data shows that while Porsche's global sales increased by 3% in 2022, sales in China declined by 2.5% year-on-year. In 2023, Porsche's sales in China declined by 15% year-on-year, making it the only declining market segment for Porsche globally, with North America overtaking China as Porsche's largest single market.

At that time, Porsche CEO Oliver Blume optimistically stated that increased sales in other markets could compensate for the decline in the Chinese market, and Porsche adjusted its product supply to China in 2023.

However, from January to June this year, the decline in Porsche's sales in China has further intensified, with a year-on-year decline of 33%, the only market with a double-digit decline. Sales in the North American market declined by 6% year-on-year, and global sales decreased by 7%.

The consecutive two-year decline in sales in China has also affected downstream dealers.

In May this year, due to a significant drop in sales, Porsche China still chose to pressure dealers to maintain inventory, even though dealers were already selling cars at a loss. This led to a confrontation between dealers and Porsche headquarters: some Porsche dealers stopped taking delivery of cars and demanded subsidies from Porsche headquarters while also requesting the replacement of relevant executives.

Until now, Porsche's sales are still not good. At the beginning of July, a salesperson at a Porsche Center in Shanghai introduced, "All Porsche models except the 911 currently offer zero-interest financing for a limited time, with no interest or handling fees for five years. Porsche Cayenne models are discounted by 10-20%, 911 models by 10%, and Taycan electric models by over 40%."

Externally, Porsche cannot compete with Chinese domestic brands; internally, it faces dealer backstabbing. The high discounts offered through "trading price for volume" are not as attractive to consumers as expected. "It's not that Porsche is unaffordable, but Xiaomi SU7 offers better value for money" is still a popular joke. The rise of China's domestic new energy vehicle brands is promoting technological equality, and Porsche can only grit its teeth and endure the trials.

Faced with this situation, Blume could no longer be optimistic and directly chose to bring in reinforcements.

02 Poor Sales and Ineffective Electrification

Porsche has always been a golden brand, and many car dealers have scrambled to secure high-quality resources. However, now dealers are choosing to "force the issue" and make their grievances public, and the root cause of all this lies in the inability to sell products.

Due to the cliff-like decline in Porsche's sales in China, Michael Kirsch's transfer now appears more like a dismissal.

From Porsche's overall personnel appointments and dismissals in China, since 2004, the tenure of Porsche's top leader in China has generally been around 4 years.

It should be noted that Kirsch took over from Jens Puttfarcken as President and CEO of Porsche China on June 1, 2022, and has only just completed two years in the position before being replaced. This speed of position changes is indeed somewhat fast.

This also indirectly indicates that this adjustment is indeed closely related to the decline in Porsche's sales in the Chinese market.

Moreover, as early as May 24th, members of the Expert Committee of the China Automobile Dealers Association stated on social platforms that "Porsche headquarters has sent an investigation team to investigate the problems in the Chinese market, indicating that the German headquarters has lost trust in the Chinese CEO."

In addition, during the joint boycott incident by dealers in June, several core dealers had already raised the demand for "replacing Chinese executives."

Now, Kirsch's transfer is not unexpected.

Alexander Pollich, who succeeds Michael Kirsch, is described by Porsche in the press release as "an internationally experienced sales expert."

With experience in multiple countries and expertise in sales, Pollich perfectly matches Porsche's current predicament in China.

It should be noted that this year marks a significant product replacement cycle for Porsche, with the third-generation Panamera, the new all-electric Taycan, the second-generation Porsche Macan, and the mid-cycle refresh of the 911 all set to be launched. This year can be described as Porsche's largest-scale product replacement cycle in its history, so Porsche cannot afford to be careless at this crucial juncture.

In Porsche's announcement, Pollich's main tasks after taking office have been clearly outlined, with the core being to reverse Porsche's sales decline in the Chinese market.

In addition to implementing the brand growth strategy in the Chinese market, working more closely with dealer partners, and further optimizing internal processes and structures, Pollich will also drive Porsche's electrification transformation in China.

In summary, his focus will be on four main areas: pricing, sales, dealers, and electrification.

According to Porsche's planning goals, by 2025, new energy vehicle sales will account for half of total sales, and by 2030, the proportion of pure electric vehicles will exceed 80%.

At present, the global new energy vehicle market growth rate has slowed down, and compared to this, Porsche's electrification process will be more dependent on the Chinese market. The new leader faces no shortage of challenges.

Moreover, the joke about buying a Porsche and getting a Xiaomi car as a gift is likely to become a thing of the past. As BBA (BMW, Benz, Audi) have successively exited the price war, Porsche must stabilize its price system in China and maintain its ultra-luxury brand value and height.

Whether it is sales or electrification transformation, the challenges are significant, and it remains to be seen how Pollich will respond.