Are new energy vehicle companies increasing their reliance on dealer models because they want more scandals?

![]() 07/23 2024

07/23 2024

![]() 646

646

Original article by New Energy Outlook (ID: xinnengyuanqianzhan)

Recently, news spread online that AITO would abandon its direct sales model.

Subsequently, AITO officially refuted the rumor, stating that this was false information. A responsible person from AITO said, "AITO initiated channel adjustments in April and completed the transition in June. Currently, it operates under a direct sales + franchised dealer partnership model."

In fact, in addition to AITO, several new energy brands such as Denza, FANGCHENGBAO, XPENG, and WEY have already made changes to their channels, shifting from a single sales model to a dual-track model of direct sales and dealerships.

On one hand, new energy vehicle companies continue to embrace dealerships, while on the other hand, dealerships are plagued with scandals. According to data from the China Automobile Dealers Association, over 8,000 4S stores have completely disappeared in the past four years, and in 2023, the proportion of auto dealers incurring losses reached 43.5%.

Certainly, more striking than these figures was the news on July 21 that Guanghui Auto, China's largest auto dealer group by total sales volume and second-largest by revenue, was "locked in for delisting." If even the dealer giants are struggling, one can only imagine the situation for others.

As the price war and electrification trend in the automotive industry accelerate, new energy vehicle companies need dealerships to expand their reach and penetrate lower-tier markets, while dealerships also need to embrace new energy vehicles to emerge from their predicaments.

Is this internal friction or a way to band together for warmth? Both new energy vehicles and dealerships need this gamble.

1. The "charm" of direct sales is no longer affordable.

In recent years, with round after round of "price wars" breaking out in the automotive market, many automakers have had to "tighten their belts" and squeeze out room for price cuts by reducing costs. The direct sales model, first advocated by Tesla, seems to have become a major target for cost reduction and efficiency enhancement.

In 2013, Tesla's first experience center in China opened in Beijing's Qiaofu Fangcaodi, ushering in a new sales channel model for the Chinese automotive market – direct sales.

Photo/Tesla Fangcaodi Experience Center

Source/Internet, Screenshot from New Energy Outlook

To date, Tesla has over 520 direct sales stores in China, covering 83 cities; and a total of 297 direct sales and authorized body and paint centers, covering 180 cities.

Lixiang Auto, as one of the first wave of new energy vehicle companies in China to "eat the crab," also chose a nearly fully direct sales model. By the end of June 2024, Lixiang Auto had 497 direct sales retail centers in China, covering 148 cities; and a total of 421 direct sales after-sales service centers and authorized body and paint centers, covering 220 cities.

However, the direct sales model, once highly regarded by major new energy vehicle companies and brands, is no longer in vogue.

In 2023, AITO, which primarily operated under a direct sales model, comprehensively initiated channel reforms and embraced the dealership model. To date, 90% of AITO stores have transitioned from direct sales to dealerships, with only a small number of direct sales stores remaining in first-tier cities such as Beijing, Shanghai, and Guangdong.

In addition to AITO, many new energy brands have also realized the "expense" of direct sales and have gradually increased their reliance on dealership models.

By the end of 2023, NIO Auto had a total of 560 stores, with 85% being dealerships; XPENG had a total of 500 stores, with nearly 30% being dealerships.

On June 18, 2024, BYD's Denza and FANGCHENGBAO brands, which previously operated under a direct sales model, successively announced the full opening of dealership recruitment, signifying a shift to a "direct sales + dealer partner" model. Meanwhile, NIO's sub-brand Ledao will not follow the main brand's direct sales model but will introduce dealers to establish separate stores.

So, why is the automotive industry reversing course?

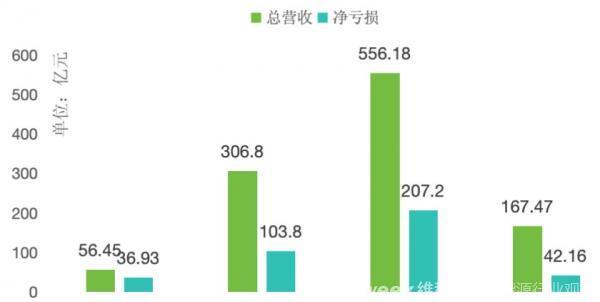

Perhaps it's due to "money." AITO's total revenue in 2023 was 5.645 billion yuan, with a net loss of 3.693 billion yuan; XPENG's total revenue was 30.68 billion yuan, with a net loss of 10.38 billion yuan; NIO's total revenue was 55.618 billion yuan, with a net loss of 20.72 billion yuan; and NIO Auto's total revenue was 16.747 billion yuan, with a net loss of 4.216 billion yuan.

Photo/Operating performance of the above companies in 2023

Source/Graphic by New Energy Outlook

According to a responsible person from an automaker, the average annual cost of operating a direct sales store in China is 4 million yuan. Based on this calculation, if three direct sales stores are opened in 250 key cities, the annual operating cost would be as high as 3 billion yuan.

Therefore, for brands that have been continuously losing money, the direct sales model has become a shackle, and reform is imminent.

Some industry insiders believe that in the early stages of new energy vehicle brand establishment, the direct sales model is more conducive to brand promotion and helps companies establish a standardized sales system. At the same time, new products usually have strong competitiveness, and rapid sales growth brings substantial channel profits to automakers, which is precisely the advantage that the direct sales system brought to brands like "NIO, XPENG, and Lixiang" in the past few years.

However, as market dividends gradually disappear, and the first batch of products from new brands enter the upgrade and replacement stage, risks will significantly increase.

2. Taking advantage of both models but unable to avoid their respective drawbacks.

As we all know, before the advent of the electrification era, the more flexible dealership model was favored by most automakers in China compared to direct sales.

First, each dealership has its own market network and resources, coupled with its understanding of the local market, enabling wider pre-sales market coverage for products. Second, the establishment of dealerships is fully responsible by the dealers, eliminating the need for automakers to invest funds, which to some extent reduces the cost pressure on automakers.

However, everything has its two sides, and there are advantages and disadvantages. The entry of the dealership model is bound to trigger a "butterfly effect" in the new energy vehicle market.

During the sales process, as dealers need to pay a deposit for the ordered vehicles, which are non-refundable, this transfers the original inventory pressure from automakers to dealers, indirectly leading dealers to discount sales later to dispose of inventory, lowering brand premium capabilities.

At the same time, their overall user experience and service are far inferior to the direct sales model.

Direct sales stores are generally located in high-traffic areas such as shopping malls, and their staff are directly managed by new energy manufacturers, making them more professional than dealership staff.

This model, which directly connects brands with users, not only allows users to enjoy brand services throughout the pre-sales to after-sales process but also accumulates a large number of fans for the brand. This is precisely why most mainstream new energy vehicle companies initially chose to join the "direct sales" trend.

In addition, as direct sales stores have an open and transparent pricing system, their sales staff only provide services, and consumers complete the order process on the official website, so there are generally no extra store tricks or business bundles during the entire purchase process.

Ms. Fang, a prospective Tesla Model 3 owner, told New Energy Outlook, "I used to buy gas cars at 4S stores, and I would always compare prices and calculate discounts at multiple stores of the same brand. The whole process was exhausting. This time, buying the Model 3 was hassle-free. The sales staff were very professional in their explanations, and the prices and discounts were open and transparent. I think I'll prioritize brands with direct sales stores in the future."

"When I bought my car, I knew that XPENG stores had both direct sales and authorized stores. I heard that authorized stores offer more gifts, so I chose to buy from such a store, but the service attitude was really not commendable," said Mr. Luo, an XPENG G6 owner.

Some new energy vehicle owners believe that it's not necessary to get caught up in whether to buy from a direct sales store or a dealership. Those who care about pre-sales service should choose direct sales, while those who care about cost-effectiveness should choose dealership 4S stores. However, after-sales service is actually the same, as long as there are direct sales stores, after-sales service can be directly selected from them, even if they are farther away.

It's worth noting that the current instability in the new energy price system can also adversely affect the orderly operation of the dealership model.

In 2024, affected by the "price for volume" war among automakers, many domestic auto dealers frequently encountered scandals. Among them, Guangdong Yongao Group decided to officially close down from March 1 due to poor management and heavy debt; in early July, Senfeng Group encountered financial issues that prevented car owners from registering their vehicles; and in mid-to-late July, Guanghui Auto Group, which had previously been exposed by multiple media outlets for wage arrears and difficulties in vehicle delivery, saw its share price plummet and faced delisting.

Photo/Yongao Group announced closure on March 1, 2024

Source/Internet, Screenshot from New Energy Outlook

3. Looking beyond channels to channels.

Looking at the overall automotive market, the dealership model can indeed rescue new energy manufacturers under heavy financial pressure, as supporting a large number of stores and sales staff is a considerable expense.

However, the drawbacks of the dealership model are indeed a headache for both consumers and manufacturers.

Therefore, for new energy manufacturers to balance the dual-track model of "direct sales + dealerships" and maximize its benefits, they must impose some "constraints" on dealers' service and pricing systems.

Photo/XPENG's new retail model

Source/XPENG Official Account, Screenshot from New Energy Outlook

In terms of management, direct sales stores and dealerships should supervise each other to ensure that management is error-free and compliant, with a focus on service quality and brand image display. In terms of pricing, a complete and transparent pricing standard system should be established, with direct sales stores and dealerships not "fighting internally" to reduce situations such as "price hikes" and "additional installations," maintaining a relatively balanced sales state.

Of course, whether it's "competing on price" or "competing on channels," as means of cost reduction and efficiency enhancement, they are by no means a "silver bullet" for a brand to maintain a long-term presence in the market.

Zhang Xiaorong, Dean of the DeepTech Research Institute, told New Energy Outlook, "Facing the intense competition in the current market, what new energy vehicle companies should do most is strengthen their core competitiveness, which includes improving product quality, strengthening technological research and development, optimizing user experience, providing better after-sales services, etc. Additionally, they should keep an eye on competitors' moves and adjust their strategies in a timely manner to respond to market changes."

Mr. Gu, a prospective buyer of the ZEEKR 001 and an experienced driver with over ten years of driving, has extensive experience in car purchases. In his view, when buying a car, one must first understand the policies and benefits clearly and then compare prices across stores, distinguishing between dealerships and direct sales stores. "Of course, what ultimately convinced me to make a decision was the vehicle itself. Good quality and performance can save a lot of trouble in the future. Although the rear space of the ZEEKR 001 is not large, the driving experience and intelligent driving features are the reasons I ultimately chose it," he said.

"The appearance and space of the L Series have always been my favorite points, suitable for families. But what satisfies me most is the after-sales service. When I went to the store for after-sales film application shortly after picking up my car in May, they kindly reminded me about formaldehyde issues and patiently demonstrated the formaldehyde removal steps for me," said Ms. Niu, an owner of the Lixiang L8.

Quantitative change is a necessary preparation for qualitative change, and quantitative change and qualitative change are mutually permeating. Therefore, in the future, new energy brands should continue to focus on brand positioning, layout, and technology, carefully honing good products as the best strategy.

Companies like XPENG and NIO Auto already have clear plans.

In terms of products, XPENG plans to introduce approximately 30 new or facelifted models within the next three years. According to NIO Auto's official plan, the B series, targeting the 10-150,000 yuan segment, will launch three models in 2025, and the A series, targeting the 100,000 yuan segment, will also be launched in 2025. The D series, targeting the 200,000 yuan segment, will be introduced in 2026.

In terms of technological research and development, in 2024, XPENG plans to invest 3.5 billion yuan in AI technology with intelligent driving at its core. NIO Auto expects to apply at least 10 black technologies to its new products.

Photo/NIO Auto's 2025 plan

Source/Internet, Screenshot from New Energy Outlook

In summary, regardless of whether new energy brands continue to adopt the direct sales model or embrace dealerships in the future, they should establish a complete and fair transparent pricing system as soon as possible and instill service experience into every store to achieve a balance, as no channel model is perfect.

In the future, whether new energy brands can find the optimal model through channel reforms based on their actual situation and continue to create good new products will be the key to whether they are eliminated by the market.