"Monthly sales below 20,000 units? I'm embarrassed to greet people outside"

![]() 07/23 2024

07/23 2024

![]() 638

638

Introduction

Reaching monthly sales of 20,000 units has become an important benchmark for differentiating the performance of emerging automotive companies.

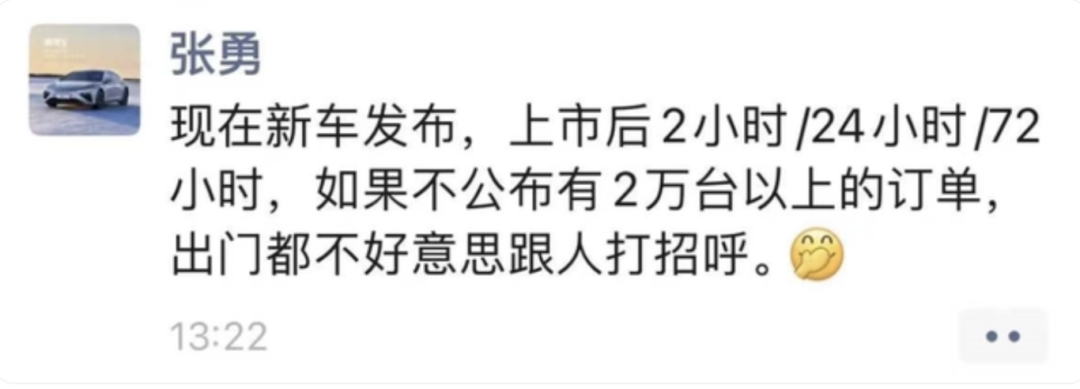

"Nowadays, when a new car is launched, if it doesn't announce orders exceeding 20,000 units within the first 2 hours/24 hours/72 hours after going on sale, I'm embarrassed to greet people outside."

Two years ago, Zhang Yong, CEO of Nezha Auto, made such a sarcastic remark on his social media. At that time, these remarks were seen as both a mockery of the exaggerated order trends for new car launches and as promotion for Nezha Auto's own new model, the Nezha S. Back then, the monthly sales of leading emerging automakers mostly hovered around 10,000 units.

Fast forward two years, with the efforts of various new energy automakers, China's new energy market has further developed, and its market share has continued to hit record highs, even showing momentum to surpass a 50% market share.

Against this backdrop, the monthly sales of emerging automakers have also risen, and the joke of "if a new car doesn't receive over 20,000 orders within 72 hours of launch, I'm embarrassed to greet people outside" has been replaced by "if monthly sales don't reach 20,000 units, I'm embarrassed to greet people outside," which now seems reasonable.

According to statistics from Auto Society on the half-year sales of major emerging brands, three automakers have successfully surpassed 20,000 units in monthly sales, or even approached 30,000 units. They are Lixiang, AITO, and Aion. In the first half of the year, their sales were 189,000 units, 181,200 units, and 126,300 units, respectively.

Of course, if we focus on June's single-month performance, six automakers exceeded 20,000 units in monthly sales. Among them, NIO, ZEEKR, and Leapmotor surpassed 20,000 units; Aion exceeded 30,000 units; and the top two, Lixiang and AITO, even surpassed 40,000 units.

Therefore, from the perspective of monthly sales data, the executives of the aforementioned automakers have nothing to be embarrassed about when greeting people outside.

They, Battling for 20,000 Units

First, the competition between AITO and Lixiang.

As emerging automakers with similar product positioning and both pursuing the extended-range route, coupled with the personal influence of Li Xiang and Yu Chengdong... these similarities and overlaps destine them for inevitable head-to-head battles.

In 2022, AITO launched the M7, directly entering the market segment of the Lixiang ONE. This "battle" between 300,000-yuan extended-range 6-seater mid-to-large SUVs sounded the clarion call for their mutual offensive.

At that time, the AITO M7 set the fastest record for a domestic new energy brand to deliver over 10,000 units in a single month; on the other hand, the monthly sales of the Lixiang ONE halved to around 5,000 units. And with the launch of the new AITO M7, its large-scale orders exceeded 60,000 units just over a month later, highlighting the unfavorable situation of Lixiang.

In fact, it's not just the AITO M7. From the AITO M5 to the AITO M9, the models under AITO and Lixiang have highly overlapping markets, with the former's products almost simultaneously blocking the latter's path. Fortunately, Lixiang quickly adjusted with its relatively stable user base and precise product control, forming a long-term stalemate with AITO.

In April this year, Lixiang launched its first extended-range SUV priced below 300,000 yuan, the Lixiang L6, which quickly took over the brand's sales burden, delivering over 20,000 units in June. In the second half of the year, if the momentum of the Lixiang L6 can be maintained, it's not impossible for Lixiang, which sold 47,800 units in June, to touch 50,000 units in subsequent monthly sales.

However, due to the unsuccessful launch of the Lixiang MEGA, Lixiang adjusted its original annual sales target of 800,000 units to 560,000-640,000 units. Although the target has been adjusted, considering that Lixiang delivered less than 190,000 units in the first half of the year, and the three pure electric models originally scheduled for release this year have been postponed to next year, this means that Lixiang will find it difficult to achieve its sales target for this year.

Meanwhile, AITO delivered 181,200 units in the first half of the year, lagging behind Lixiang by less than 8,000 units, and delivered 43,100 units in June, lagging behind Lixiang by around 5,000 units. Looking at the three models under AITO, all have impressive delivery volumes, with the AITO M9 delivering 17,200 units, the new AITO M7 delivering 18,500 units, and the new AITO M5 delivering 7,000 units.

In addition, Yu Chengdong, Chairman of Huawei's Intelligent Automotive Solution BU, previously announced that cumulative large-scale orders for the AITO M9 exceeded 100,000 units within six months of its launch (recently exceeding 110,000 units).

This means that the monthly delivery volume of the AITO M9 will also stabilize at 10,000 or even 20,000 units in the future. Additionally, the upcoming launch of the AITO M8 will undoubtedly intensify the competition between AITO and Lixiang.

Unlike the head-on competition between AITO and Lixiang, GAC Aion is on its own unique track.

In the first half of the year, Aion's global cumulative sales reached 177,400 units, with its main models, the Aion Y and Aion S, still popular in their respective segments. However, as various market segments become increasingly saturated, and more cost-effective models are launched, Aion's advantages are not as significant as before.

Apart from the aforementioned companies, NIO, ZEEKR, and Leapmotor also achieved sales of over 20,000 units in June, with monthly sales of 21,200 units, 20,100 units, and 20,100 units, respectively; and half-year sales of 87,400 units, 86,700 units, and 87,900 units, respectively. These three companies are at the same level in terms of both monthly and half-year sales.

Among them, after adjusting its BaaS battery leasing program in mid-March, NIO successfully joined the "20,000-unit club" twice in the first half of the year; ZEEKR, driven by the monthly sales of over 10,000 units of the ZEEKR 001, remains the sales champion among pure electric vehicles priced above 250,000 yuan; and Leapmotor quietly sells its extended-range vehicles in the 150,000-yuan price segment.

From monthly sales of 10,000 units to 20,000 units, these leading emerging automakers are undoubtedly the "darlings" of the current automotive market. While battling for 20,000 units, they are also leading the development of China's new energy market to a certain extent. However, as the old order breaks down and new business models emerge, the outcome is still uncertain, and anyone could be a dark horse. So, who will be the next "dream chaser" to battle for 20,000 units?

Who Will Be the Next "Dream Chaser"?

"An annual sales volume of 100,000 units is the 'life-and-death line' for many emerging automakers. Only by crossing this threshold can they survive."

Regarding the "life-and-death line" for annual sales of emerging automakers, both Li Bin, founder of NIO, and Shen Hui, founder of WM Motor, have publicly stated: "At least 100,000 units need to be sold."

In terms of June sales, five companies—Deep Blue, Denza, XPeng, Nezha, and Xiaomi—successfully exceeded 10,000 units. For the first half of the year, only Deep Blue, Denza, XPeng, and Nezha surpassed or approached this mark.

According to Li Bin's criteria, in the first half of this year, 10 automakers successfully crossed the "life-and-death line" with half-year sales exceeding 50,000 units. Of course, Xiaomi, which has only been listed for one quarter, has accumulated sales of 25,700 units, and its June sales also exceeded 10,000 units.

First, let's look at XPeng.

As a member of the "NIO-XPeng-Lixiang" trio, XPeng lagged behind NIO by 35,400 units and Lixiang by 137,000 units in sales in the first half of the year. It was also the only one among the trio whose monthly sales did not reach 20,000 units. During this period, the monthly delivery volumes of its main models, the XPeng P7 and XPeng G6, have declined to around 2,000 units, putting the company in a precarious situation.

It is evident that whether it's the entry of Xiaomi SU7 or NIO's launch of the Ledao, XPeng is the most affected.

To improve the current situation, XPeng will launch the MONA series in the second half of the year, with the first model named MONA M03, positioned as a pure electric compact sedan. The new car is expected to be delivered in August, and its performance will be a key factor in whether XPeng can return to the first tier.

Xiaomi Auto also successfully broke through in the first half of the year.

Since the launch of the Xiaomi SU7, Xiaomi has achieved cumulative sales of 25,700 units in just one quarter, despite initial capacity constraints. In June this year, Xiaomi fulfilled Lei Jun's promise of "achieving monthly deliveries exceeding 10,000 units." It is foreseeable that the momentum of the Xiaomi SU7 will not weaken in the second half of the year. During his annual speech on July 20, Lei Jun also stated the delivery plan for this year: delivering 100,000 units by early November and striving to deliver 120,000 units throughout the year.

A few days ago, a set of spy shots of the interior of Xiaomi Auto's first SUV circulated online, and the Xiaomi SUV undoubtedly carries many expectations and will continue to attract attention in the future automotive market. By then, the Xiaomi SUV and the sedan Xiaomi SU7 will work together in Xiaomi Auto's market offensive.

In addition, the Denza brand is thriving in multiple niche markets with its high positioning; Nezha launched the Nezha L extended-range version, with monthly cumulative orders exceeding 30,000 units; and Deep Blue, with its brand affordability and the support of the S7 extended-range version, continues to seize living space... They represent the top or mid-tier emerging automakers and have the best chance of achieving the leap from monthly sales of 10,000 units to 20,000 units.

Beneath them are emerging automakers with monthly sales of less than 10,000 units, including IM, Voyah, and AVATR. The cumulative sales of the latter three for the first half of the year were 23,300 units, 30,400 units, and 29,000 units, respectively. For them, it's "half heaven, half hell," with the "life-and-death line" of monthly sales exceeding 10,000 units ahead and the abyss of elimination behind.

Of course, the 100,000-unit "life-and-death line" was a requirement from previous years. As the domestic new energy vehicle market share approaches 50%, and sales of emerging automakers surge, companies like Lixiang and AITO have already surpassed 30,000 units in monthly sales and are touching the edge of 40,000 units.

Therefore, He Xiaopeng said, "The automotive industry's elimination race has just begun, and an annual sales volume of 3 million units in the next five years will merely be a ticket to the game for automakers." Li Bin also stated in a media briefing, "If NIO continues to sell only 10,000 units per month, Qin Lihong and I will have to look for jobs."

So, the "standard" for emerging automaker executives to greet people outside will continue to rise in the future.