To make money, go for extended-range EVs

![]() 07/23 2024

07/23 2024

![]() 682

682

Lead

Introduction

Low investment, high returns.

"The goal of Deep Blue Automobile is to achieve profit and loss balance by the end of this year, with the opportunity to become the first state-owned enterprise in China to achieve breakthroughs in both scale and profit in the new energy vehicle sector."

At the mid-year communication meeting of Changan Automobile in early July, Deep Blue Automobile General Manager Deng Chenghao made a bold statement. It's worth noting that currently, in the Chinese automotive market, aside from Tesla, BYD, and Lixiang Auto, almost all new energy vehicle manufacturers are still in a state of loss. So why does Deng Chenghao dare to make such a bold claim?

1 Profitable, 2 Turning Around Losses

Entering 2024, competition in the Chinese automotive market remains fierce, with price wars continuing, and the pressure faced by major automakers escalating. Against this backdrop, consumer preferences for car purchases have changed significantly, with new energy vehicles gradually becoming the market darling. This trend has forced traditional automakers, which are dominated by fuel vehicles, to adopt strategies of significant price cuts.

At the same time, Chinese electric vehicle brands are also actively adjusting their strategies, lowering the prices of new energy vehicles in an effort to seize opportunities in this expanding market. According to financial reports released in the first quarter of 2024, many automotive companies are facing huge losses or significant declines in profits.

As consumers' attention to the cost-effectiveness of vehicle models continues to increase, and following the huge success of Lixiang Auto in the extended-range electric vehicle (EREV) field last year, more and more domestic brands are turning their attention to the EREV technology route. This technology route, with its unique advantages, is gradually emerging in the market.

As of May this year, sales of extended-range plug-in hybrid vehicles increased by as much as 120% year-on-year. This significant growth is partly influenced by last year's low base, but more importantly, the continuous high sales of brands like Lixiang Auto and the strategy of brands like Wenjie to reduce costs through EREV technology and pass on the benefits to consumers have jointly driven the continuous increase in sales.

Lixiang Auto, as the brand currently focusing on EREVs, saw its sales increase by over 180% year-on-year in 2023, far outpacing the moderate growth of peers NIO and Xpeng. Notably, the three companies had roughly equivalent sales in 2022, but in 2023, Lixiang Auto left NIO and Xpeng, which focused on pure electric vehicles, behind.

From a technical perspective, EREVs, as a solution within the new energy technology route, have long been underestimated by mainstream automakers. They tend to invest directly in or develop pure electric vehicle models, neglecting consumers' pain point of range anxiety. Current battery technology or charging station layouts cannot completely dispel consumers' doubts, and at the same time, as battery capacity increases, the price of pure electric vehicles inevitably rises.

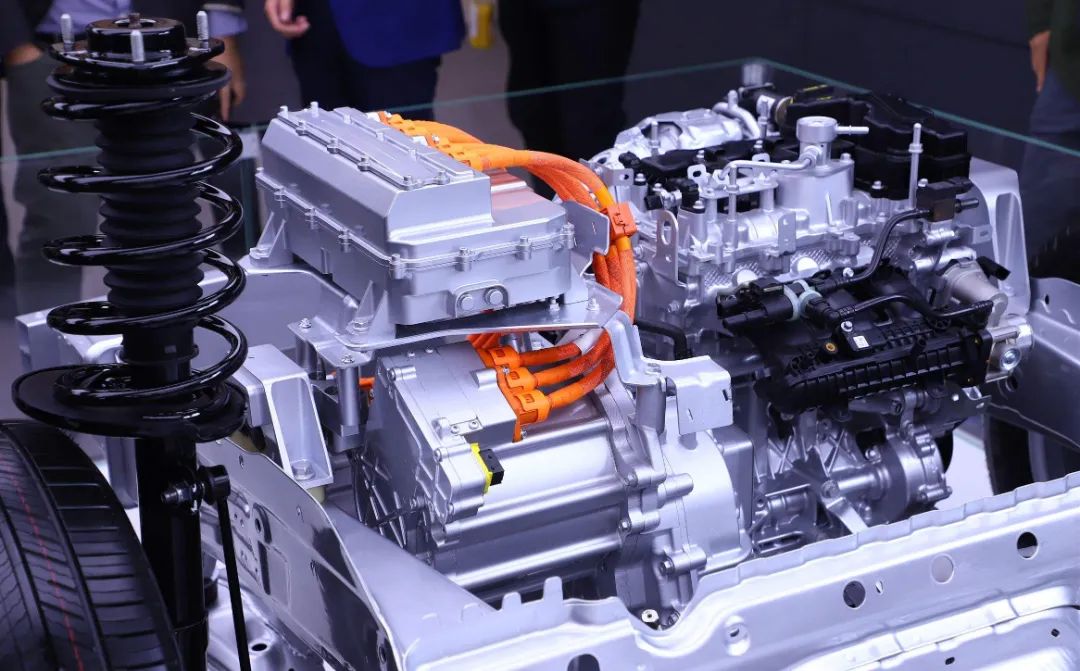

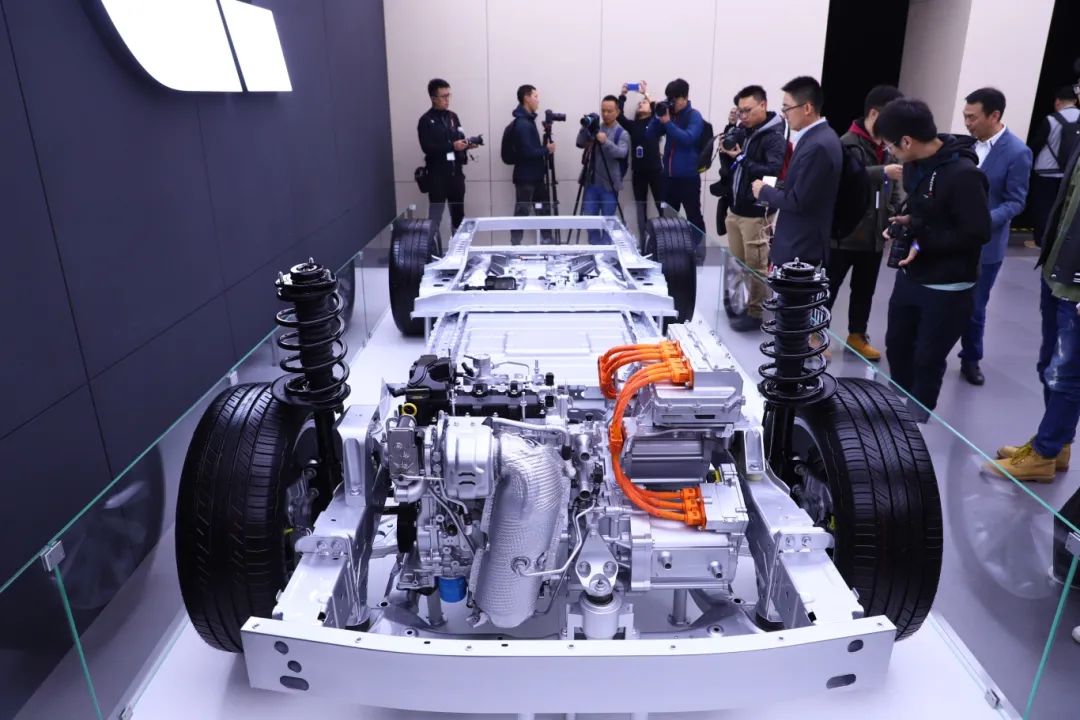

In contrast, EREVs generally have a combined driving range of over 1000km, with mature technology and low costs. The additional cost of the current EREV system is only around 3000 yuan, and the price consumers pay is only about 50% of that of pure electric vehicles or fuel vehicles of the same level. Therefore, high cost-effectiveness has become the core reason for the significant increase in sales of EREV models.

After launching its pure electric model MEGA, Lixiang Auto's cheaper L6 model has become a sales leader. Similarly, Leapmotor, while offering pure electric vehicles, has also introduced an EREV option, a new strategy that has kept its sales strong. Since introducing the EREV option, Leapmotor's sales have grown significantly, with quarterly sales exceeding 18,000 units, more than doubling compared to the same period in 2022.

Leapmotor claims that its total vehicle sales have exceeded 400,000 units. However, with the implementation of its EREV strategy, the company sold its third 100,000 vehicles in less than six months, while it took a year to sell the second 100,000 and three years to sell the first 100,000.

Nearly 10 Automakers to Join

Although the EREV technology solution exhibits unique advantages in certain aspects, we must also acknowledge its limitations.

As this solution requires the integration of engines, range extenders, and battery systems, it often results in an increased wheelbase, affecting its application in smaller models. Therefore, it is not difficult to observe that the EREV system is more commonly seen in medium and larger models, and as the wheelbase increases, the number of models adopting this system also shows an increasing trend.

However, precisely because the technical threshold of EREV technology is relatively low, this makes it possible to invest in high-end configurations such as autonomous driving and smart cockpits for models equipped with this system. By enhancing these high-end configurations, automakers allow consumers to experience not only the inherent value of the brand but also the high-end quality of the vehicle.

Judging from the latest financial report data, Lixiang Auto has achieved a gross margin of over 20% through EREV technology, a remarkable performance that undoubtedly demonstrates the market potential of this technology. At the same time, brands like Wenjie have also achieved financial turnarounds, further validating the market value of EREV technology.

Against this backdrop, several well-known manufacturers such as Geely, Dongfeng, Changan, and Seres, as well as new forces like AVATR, Xiaomi, IM Motors, and even Xpeng, have announced plans to launch EREV models in an effort to secure a foothold in the market.

Among them, the news of Xiaomi Automobile launching an EREV version is particularly noteworthy. Although rumors suggest that this may be its third model in the pipeline or under development in the second phase, Xiaomi Automobile is already actively recruiting talent with EREV experience and may offer an EREV option on its first SU7 model in the near future.

Meanwhile, Chery Automobile also plans to target overseas markets with its Starway Star Era ET EREV version. This is because Lixiang Auto has stated that it does not consider exports before 2028, leaving a gap in the market for other domestic brands and demonstrating the interest and confidence of Chinese brands in EREV technology in the international market.

Chinese brands can leverage international interest in this technology to provide attractive solutions for consumers who have abandoned pure electric vehicles due to range anxiety. Notably, not all Chinese manufacturers are waiting for opportunities; Leapmotor has already expressed its international ambitions. Through its partnership with Stellantis, it aims to further expand its market share beyond China.

This move undoubtedly serves as a wake-up call to European automakers, reminding them to pay attention not only to the competitive crisis in the pure electric field but also to the new front opened up by EREV technology. More dangerously, EREVs may challenge their footholds in hybrid and plug-in hybrid vehicles earlier and more severely than they anticipated.

In fact, some automakers have begun to recognize the potential threat of EREV technology. For example, Mazda has introduced the EREV model MX-30 R-EV into its product line, clearly stating that it is a distinct plug-in hybrid. The Jeep brand under Stellantis also plans to launch an EREV version of its Ram 1500 electric pickup truck, although these models may not be available until 2025.

Ironically, Europe and the United States have had experience with EREVs before but largely abandoned the technology, such as the Chevrolet Volt, Cadillac ELR, and BMW i3. For well-known automakers that have abandoned EREV technology or never seriously considered it, will they regret their initial decisions?

However, the danger of ignoring the electrification trend emerging in China has been fully demonstrated. Therefore, for both domestic and international automakers, paying attention to and investing in EREV technology has become an important choice that cannot be ignored.