The price war that BBA cannot fight, domestic brands will fight

![]() 07/23 2024

07/23 2024

![]() 563

563

BMW dealerships exploit customers due to their size; how can domestic manufacturers provide equivalent alternatives to overseas luxury models?

On July 21, 2024, the news of "BMW 4S stores in multiple locations refusing to deliver cars due to onerous terms" surged to the top of trending topics and remained there for a while.

Prior to BMW's price hikes, Lexus had already set a bad precedent with its own price increases. In March of this year, a Lexus 4S store in Haikou, Hainan, was in the news for raising prices by 100,000 yuan for car delivery, ultimately resulting in the manager being fired and Lexus apologizing. The insignificant punishment obviously did not serve as a lesson for BMW. Therefore, it is up to domestic automakers to teach domestic brands a lesson in the market.

Compared to automakers or 4S stores, consumers, who are clearly at a disadvantage, often consider the cost of safeguarding their rights too high and the process too long, ultimately choosing to accept their misfortunes. This time, BMW's temporary price hikes by 4S stores across the country, whether initiated by the dealerships or the automaker itself, have greatly harmed consumers and caused significant negative impact on the BMW brand.

In response to the 4S stores' refusal to deliver cars, BMW China stated that an initial internal investigation had been conducted, and all cases were individual incidents. Earlier this month, Brilliance BMW CEO Dai Hexuan publicly stated, "Prices are determined by dealers as independent business entities. BMW maintains intensive discussions with upstream and downstream partners to explore sustainable business models to ensure that all partners can earn enough money to survive into the future."

"Some competitors openly state that their pricing is below cost. We will not judge whether this is correct or not, but at least we should have sustainability in our business model."

Dai Hexuan believes that competition is a driving force for innovation and the ability to provide innovative products to customers, but all parties involved in competition need to follow certain rules and compete fairly for the competition to be sustainable.

As a result, the market believes that BMW has exited the price war, but many companies still choose to stand firm. On July 21, 2024, GAC Toyota publicly denied withdrawing from the price war. For being unexpectedly involved in BMW's incident, GAC Toyota models will still offer preferential prices.

In contrast to GAC Toyota's moderate price war strategy, domestic automakers like BYD have different views. Wang Chuanfu believes that actively embracing the price war is the key to surviving and thriving in the market. Chairman Zhu Ronghua of Changan Automobile believes that competition is a process of good money driving out bad money. Li Xueyong, Deputy General Manager of Chery, believes that the goal is to create optimal value in the price war, while Yu Chengdong, Chairman of Huawei Intelligent Automotive Solutions, believes that the focus should be on value rather than price, i.e., creating the highest "cost-effectiveness" within the same price range.

At the China Automotive Forum held in the middle of this month, Yang Xueliang, Senior Vice President of Geely, frequently mentioned "internal competition" in his speech. He believes that in addition to competing on price, the current market should also focus on technology, quality, service, brand, and ethics.

Yang Xueliang's statement actually reveals the bottleneck currently faced by Chinese automakers. There is too much focus on price competition and too little on brand competition. Only when automakers start to compete on brand can they truly achieve high premiums.

01

Domestic automakers are accustomed to price competition

Price wars are not just about lowering prices; they can also involve raising prices. After new forces in automaking launched pure electric/plug-in hybrid models priced above 300,000 yuan, BYD's Yangwang series targeted the million-yuan market and initially gained market recognition. BYD also used this to change its embarrassing situation of only competing on price.

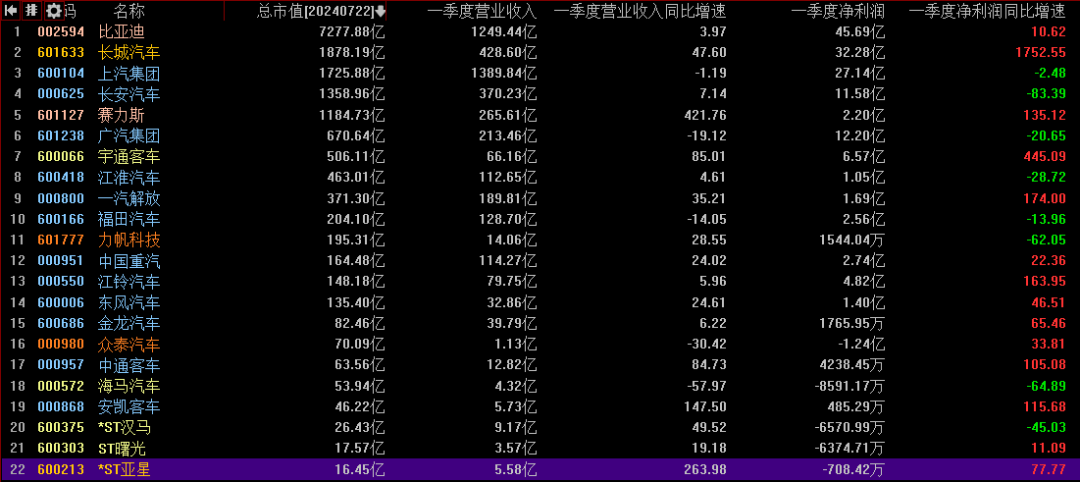

According to the first-quarter reports of A-share listed automakers, under the background of price competition, SAIC's sales declined by 6.4% year-on-year, revenue declined by 1.19%, and net profit declined by 2.48%. Other companies with declining revenue included Haima Automobile, Foton Automobile, and GAC Group. Under Yu Chengdong's "value competition" guidance, Seres achieved a 421.76% year-on-year increase in revenue in the first quarter, leading A-share listed automakers.

In such a price competition market, such results are inevitable and unavoidable. In March of this year, Ouyang Minggao, academician of the Chinese Academy of Sciences and vice chairman of the China Electric Vehicle Hundred People Forum, publicly stated that China's automobile industry has entered a painful period of new energy vehicle revolution and in-depth transformation of the automotive industry. Cui Dongshu has a similar view: in the major transformation from fuel-driven to electric-driven, price competition is the core manifestation.

Previously, Zeng Qinghong, Chairman of GAC Group, expressed his views on price competition, believing that the goal of enterprises is to make a profit, and price competition must be rational. He noted that GAC has laid off many employees due to price wars, and this is not a sustainable solution.

However, Zeng Qinghong overlooked the fact that not all competitors lowering prices have experienced a year-on-year decline in profits. Automaker profitability is a complex subject, and lowering prices primarily requires cost control, which requires automakers to integrate their supply chains to the utmost extent and even achieve self-production and self-sale of major components.

According to first-quarter report statistics, out of 22 listed automakers, 8 saw a year-on-year decline in net profit, including one company, "*st Hanma," which incurred a loss in the first quarter. Five companies, including three st companies and two others (Zotye Auto and Haima Automobile), were among the automakers with the weakest performance in recent market competition.

Among the companies with a year-on-year decline in net profit in the first quarter, Chang'an Automobile had the highest decline, but its revenue increased by 7.14% year-on-year, mainly due to the company's investment income of 177 million yuan in the first quarter, down 96.43% year-on-year. In the same period last year, Chang'an Automobile's acquisition of Deep Blue Automobile led to a significant increase in investment income.

Foton, GAC, and SAIC all saw year-on-year declines in both revenue and net profit growth, while BYD, which reduced the price of the Qin model to five digits, achieved a resonance increase in both revenue and net profit. An important factor is that BYD has integrated its supply chain to the utmost extent and is the first automaker globally to achieve independent production of the "three-electric system." As of July 22, 2024, BYD also has the highest total market value among automakers, reaching 727.788 billion yuan, far ahead of the second-placed Great Wall Motor and third-placed SAIC Motor.

However, BYD is also aware that blindly lowering prices is not a long-term solution, so it has launched a million-yuan high-end series, BYD Yangwang, hoping to break into the luxury car market, which domestic automakers have previously not ventured into deeply.

02

When will domestic substitutes for overseas luxury cars appear?

To some extent, these overseas automakers' dealerships repeatedly raise prices because they are confident that consumers have a "non-X-don't-buy" mentality or believe that adding tens of thousands or even hundreds of thousands of yuan to the price of a car costing hundreds of thousands or millions of yuan is insignificant to consumers. However, if consumers have more domestic models to choose from, these overseas automakers might think twice before breaching contracts.

About a month ago, the founder of 360 auctioned off his Maybach for 9.9 million yuan and subsequently tested multiple domestic cars, ultimately choosing between Seres AITO M9 and Zeekr 009. These two vehicles are large urban SUVs and MPVs, respectively. For corporate management, Zeekr 009's more extreme interior design better suits Zhou Hongyi's needs, and it is rumored that Zhou Hongyi does not have a driver's license and only rides in cars, so AITO's biggest selling point of intelligent driving is not within his consideration.

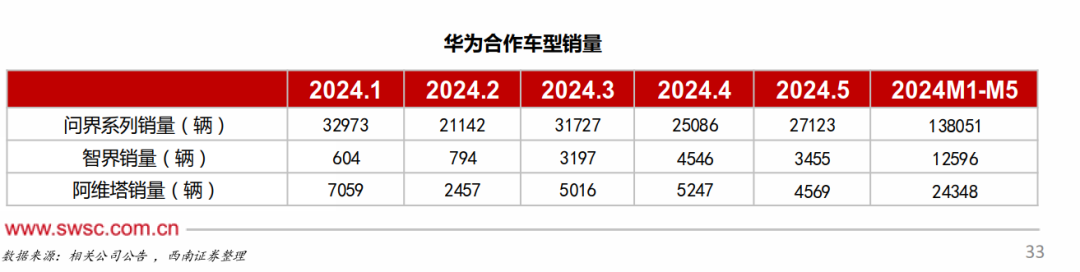

In fact, regardless of whether Zhou Hongyi chooses M9 or 009, it is a major victory for domestic automakers. In recent years, domestic automakers have developed rapidly. Taking Seres, which cooperates with Huawei, as an example, it took just four years from transformation to sales exceeding 10,000 units and turning a profit. The newly released AITO M7 Ultra, announced on May 31, received over 12,000 orders on its first day of launch and delivered over 4,349 units in its first week.

In addition to the positive sales of the AITO M7 series priced between 200,000 and 300,000 yuan, Seres' AITO M9, priced between 400,000 and 600,000 yuan, has received over 110,000 orders and recently received a five-star safety rating from C-NCAP.

In addition to Seres, automakers such as Changan, SAIC, GAC, Beijing Automotive Group, Chery, Dongfeng, and FAW have all cooperated with Huawei to launch models for the mass market. Recently, there were also reports that JAC and Huawei's jointly developed Zunjie model may be priced at the million-yuan luxury level. On July 12 of this year, Xiang Xing, Chairman and General Manager of Anhui JAC Motor Group Holding Co., Ltd., stated at the "2024 China Automotive Forum" that they will fully promote cooperation with Huawei, and the first product has entered the vehicle testing and verification stage, with plans to roll off the production line this year and be launched in the first half of next year. Furthermore, the development of subsequent products is progressing steadily.

Xiang Xing also emphasized, "To ensure the high-quality mass production of JAC and Huawei's jointly developed models, we have built a world-class smart factory integrating digital R&D, green and low-carbon manufacturing, and brand experience services. The construction of the factory is basically complete, with a planned annual production capacity of 200,000 units, which will support the production of more JAC and Huawei jointly developed models in the future."

If JAC's million-yuan luxury Zunjie model is still in development, the already launched domestic luxury models BYD Yangwang U8 and U9 have broken through the barrier and achieved success for domestic luxury cars.

About three or four months ago, vehicle review videos of the Yangwang series were ubiquitous on the internet, including those from well-known overseas vehicle reviewers or industry insiders. These videos covered various aspects such as interior design and in-place turning. According to public information, the Yangwang series is priced at around 1.1 million yuan, with an overseas sales premium of approximately 400,000 yuan per unit.

With the continuous development of domestic automakers, in the future, whether it's luxury cars priced below 200,000 yuan or above 1 million yuan, or within the 200,000 to 1 million yuan range, best-selling models will be produced by Chinese automakers. Overseas automakers will also fully consider whether consumers really have no choice but these overseas brands before raising prices. Ultimately, overseas automakers will return to the market and attract consumers with "cost-effectiveness."

03

The end of the auto market's price war

Today, most BBA automakers dare to abandon the price war mainly because dealers are currently losing money to gain publicity. In the words of Brilliance BMW CEO Dai Hexuan, "the business model must be sustainable." However, when domestic automakers continue to seize market share from BBA with low-priced, high-quality products, they have no other choice but to face the competition head-on. This can be seen from the mobile phone price wars of years past and aligns with BYD Chairman Wang Chuanfu's view that "actively embracing the price war is the only way to truly emerge victorious in competition."

Actively embracing the price war does not conflict with corporate profitability, provided a balance is found to provide consumers with the best consumer experience at the same price point. In the current auto market, the label of "cost-effectiveness" has obviously been distorted. So-called cost-effectiveness is not about absolute low prices but rather providing consumers with the best consumer experience, including pre-sales and after-sales services, and most importantly, the best user experience, within the same price range. The previously underappreciated Seres AITO M9, priced at 400,000 to 600,000 yuan, also received over 100,000 orders.

This may directly overturn the market's inherent perception of recent auto market competition and the popularity of low-priced models. Among BBA's models currently on sale, the BMW i5, with a starting price of 439,900 yuan, once offered discounts of around 100,000 yuan, while the final prices of Mercedes-Benz EQ series and Audi etron series electric vehicles also plummeted significantly.

The key point is that these brand cars did not see an increase in sales after price reductions. According to the China Automobile Dealers Association's inventory warning index survey, in June, the inventory warning index for Chinese auto dealers was 62.3%, above the threshold line, indicating that dealers still face significant inventory pressure. By brand type, the market pressure on luxury and imported brands is prominent, with an inventory warning index of 66.4%, mainstream joint ventures at 60.8%, and domestic brands at 61.5%.

In contrast, under similar pricing, AITO M9 is clearly popular, while BBA models at the same price point fail to increase sales, demonstrating that domestic cars offer significantly higher cost-effectiveness than BBA models.

According to sales data from the China Automotive Data Research Center, the top-selling luxury model (priced above 300,000 yuan) in the first quarter of this year was Tesla Model Y with sales of 101,000 units; second was AITO M7 with sales of 74,000 units; followed by Audi A6L (48,000 units), Mercedes-Benz C-Class (47,000 units), and BMW 3 Series (36,000 units).

Although Mercedes-Benz and BMW have models on the list, according to sales statistics, BMW's sales in the Chinese market declined by 4.2% year-on-year to 375,900 units in the first half of the year; Mercedes-Benz's sales in the Chinese market declined by nearly 6% to 352,600 units. However, data from the China Association of Automobile Manufacturers shows that the luxury car market in 2024 has grown significantly compared to 2023, with a market share of 13.8% in the first quarter, up 0.7 percentage points from the whole of 2023.In the second quarter, it increased by an additional 1.5 percentage points.

Based on the sales data from the second quarter, the Seres M9 has become a new entrant in the rankings. Among other domestic car manufacturers, only Li Auto made a significant contribution. In the overall sales rankings, the BYD Dynasty series, Changan CS75, and Geely Xingyue were among the top 10. In the top 10 rankings for sedan sales, only three series from two manufacturers made the list: BYD Qin, Seagull, and Wuling Hongguang Mini.

From the sales rankings, it's evident that while domestic car manufacturers have been frequently competing on price, the road to breaking into the high-end market remains challenging. In the market for vehicles priced below 300,000 RMB, domestic manufacturers have entered by offering low prices and have maintained market share through continued low pricing. They have also started to enter the market for vehicles priced above 300,000 RMB with competitive pricing. As domestic cars continue to develop, with ongoing advancements in electrification and intelligence, they are expected to widen the gap from traditional car manufacturers, who are slower to transition to electrification, thereby further seizing market share from them.