SAIC Changes Leadership! When Will Roewe Take the Lead?

![]() 07/23 2024

07/23 2024

![]() 577

577

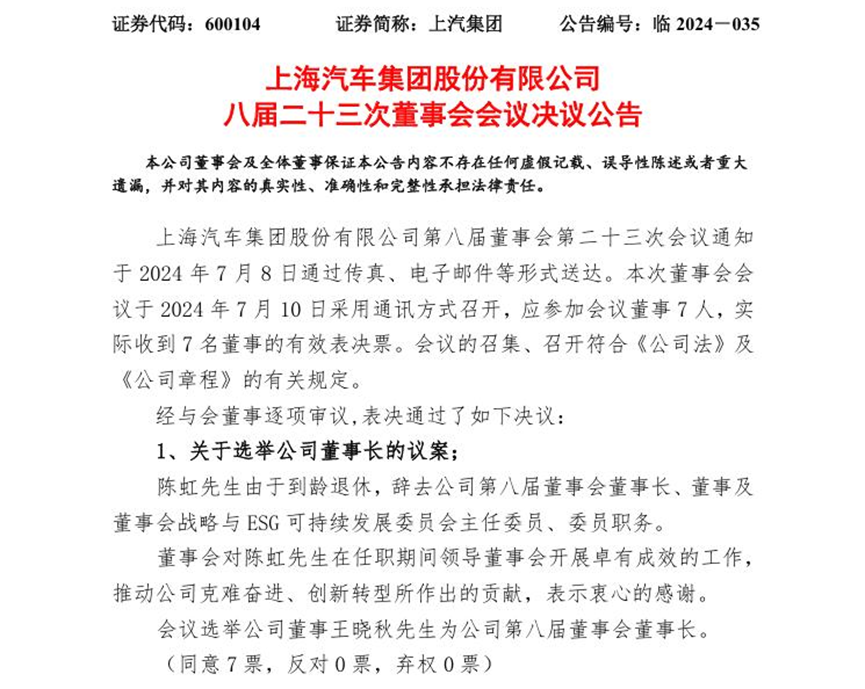

On July 10, SAIC Motor announced that Chen Hong, Chairman of SAIC Motor, had retired due to age and resigned from his position as Chairman and other duties. The Board of Directors meeting elected Wang Xiaoqiu, a company director, as the Chairman of the Eighth Board of Directors, and appointed Jia Jianxu as the company's President, with a term consistent with the current Board of Directors.

It is worth mentioning that Wang Xiaoqiu, the successor of SAIC Motor, has also reached retirement age. However, with previous examples of SAIC Motor's former chairmen Hu Maoyuan and Chen Hong both retiring at the age of 63, and following the same delayed retirement strategy, Wang Xiaoqiu may retire in 2027. Outside speculation suggests that an important reason why SAIC Motor did not directly appoint a younger candidate to take over is that the company is currently in a period of internal and external difficulties and needs a "veteran" to stabilize the group for three to four years as a transition, ensuring SAIC Motor's smooth sailing in the turbulent automotive market in the future.

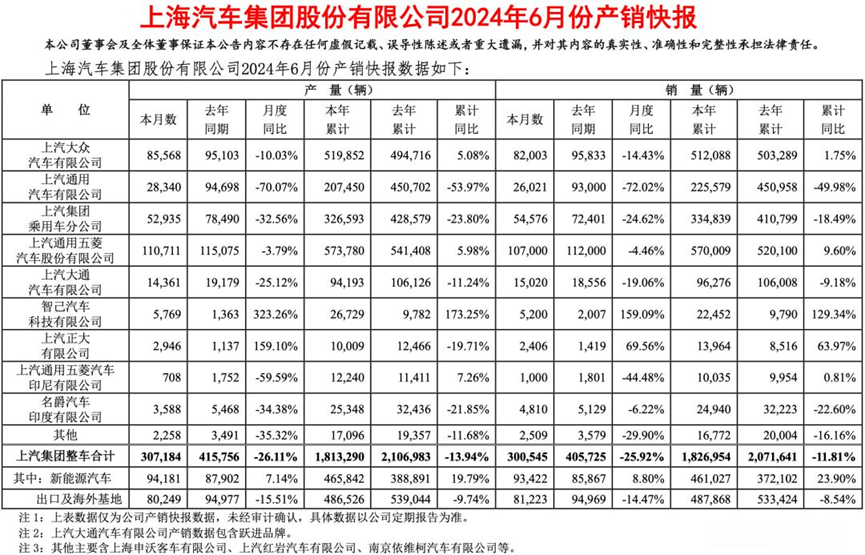

The speculation from the outside world is not unfounded. According to SAIC Motor's June production and sales report, seven out of nine companies under the SAIC Motor Group experienced varying degrees of sales declines. The joint venture sector is the focus of SAIC Motor's blood loss, and due to the current domestic automotive market's preference for new energy vehicles, the situation for joint venture brands that have developed slowly in electrification is not optimistic. In the independent sector, the biggest decline in sales is that of SAIC Passenger Vehicles, with sales of 54,576 units in June, a decline of 24.62% compared to last year. And since the beginning of this year, this is the sixth consecutive month of declining sales for SAIC Passenger Vehicles.

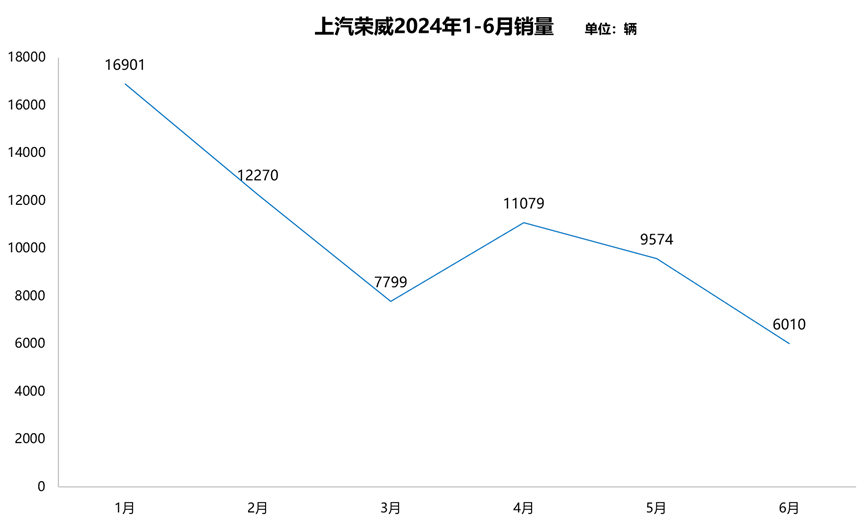

SAIC Passenger Vehicles mainly consists of the MG and Roewe brands. MG has a higher sales share within SAIC Passenger Vehicles, but compared to the domestic market, MG focuses more on overseas markets. Recently, the European Union announced tariffs on electric vehicles from China, with MG, which has outstanding overseas performance, facing tariffs of up to 37.6% (total tariff reaching 47.6%). In response to this situation, SAIC Motor plans to build a factory in Europe. Currently, SAIC Motor is in discussions with the Spanish Ministry of Industry to consider establishing an electric vehicle factory in the country to produce MG vehicles. In addition to Spain, SAIC is also considering building factories in Hungary or the Czech Republic due to lower labor costs. Compared to MG, Roewe's monthly sales figures are even less impressive. In fact, SAIC Roewe has always been vague about announcing its monthly sales figures, often resorting to wordplay. For example, when announcing May sales, SAIC Roewe stated, "In terms of new energy, sales of hybrid models continued to rise, surging 882% year-on-year, and overall new energy vehicle sales increased by 21.5% year-on-year; in terms of fuel vehicles, sales of multiple popular models increased, with sales of the all-new Roewe RX5 growing 14% month-on-month, and stable performance keeping the overall market share of Roewe brand fuel vehicles stable." Therefore, we can only glimpse at Roewe's sales through third-party data. As can be seen from the table below, Roewe's overall sales trend in the first half of the year showed a decline, with monthly sales in some months falling below 10,000, facing a relatively precarious situation.

The Roewe i5 is the brand's top-selling model in the first half of the year, with cumulative sales of 20,854 units from January to June. The Roewe D7 ranks second, with cumulative sales of 17,413 units in the first half. The Roewe i6 MAX New Energy follows closely behind, with cumulative sales of 10,419 units in the first half. The combined sales of these three models in the first half have reached 48,686 units, accounting for approximately 76.51% of Roewe's overall sales. From the sales share and sales data of these three models, we can also see the problems faced by Roewe in its development. For example, the Roewe i5 is positioned as a compact car with an official price range of 68,900 to 90,900 yuan. In this price range, there are not only traditional joint venture fuel vehicles but also new energy vehicles priced below 100,000 yuan. Compared to them, the Roewe i5 not only has slow product upgrades, with the latest model being the 2023 version launched last year, but also lacks product competitiveness, making it easy to get lost in the market.

Although both the Roewe D7 and the Roewe i6 MAX New Energy are new energy vehicles, barely keeping up with the trend of the times, they do not exhibit enough product highlights in the current dazzling automotive market. Taking the Roewe D7, which has been on the market for more than half a year, as an example, Roewe claims to use the core strategy of "B-class car space, B-class car experience, A-class car price" to compete with main competitors including the BYD Qin, BYD Han DM-i Champion Edition, Changan Qiyuan A05, and Geely Galaxy L6. However, if we compare the plug-in hybrid model of the Roewe D7 with mainstream competitors, we can see that the Roewe D7 only has some advantages in terms of wheelbase, range, and total motor power, and overall, it does not have any significant advantages. Moreover, the Roewe D7 offered a discount of 16,000 yuan across the entire lineup upon its launch, giving consumers the impression of an unstable pricing system.

As the two main drivers of SAIC Passenger Vehicles sales, both Roewe and MG face significant challenges ahead. Therefore, from any perspective, SAIC Motor will prioritize selecting a "veteran" to control the situation during the current critical period of transformation, ensuring that its various brands stay on track to achieve broader ambitions in the future.

(Images sourced from the internet, removed upon infringement)