Facing sluggish sales yet raising prices against the wind, is BMW digging its own grave by going back on its word?

![]() 07/23 2024

07/23 2024

![]() 686

686

Author | Xingxing

Source | Beiduo Finance

The traditional luxury car brand BMW has announced its voluntary withdrawal from the price war.

Recently, rumors about BMW price hikes have spread rapidly on social platforms, attracting the attention of many netizens. According to related reports, insiders disclosed on social platforms that due to heavy losses incurred by dealerships from the price war, BMW will stabilize prices by reducing sales volumes starting in July to alleviate operational pressures on dealerships.

Behind BMW's announcement to withdraw is a choice made based on the actual situation of brand sales and operational efficiency, amidst the loss of first-mover advantage among traditional high-end fuel brands and the pressure of the "price war." How to maintain brand value and consolidate its high-end positioning amidst the new energy wave will be a pressing issue for BMW after withdrawing from the price war.

I. Prices to be adjusted upwards, refusal to deliver causing dissatisfaction

According to Caijing News, after visiting a dealership in Beijing's Chaoyang District, it was learned that BMW's entire product line is undergoing price adjustments of varying degrees, with prices showing a significant upward trend. Moreover, several sales personnel indicated that BMW is highly likely to continue raising prices in the future, with adjustment cycles "ranging from a week to two or three days."

Taking the BMW i3 eDrive35L as an example, a salesperson at a BMW 4S store in Shenzhen told the Securities Times that as of July 16, the price of this model was over 200,000 yuan, while a week earlier, it was just over 190,000 yuan, already an increase of 20,000 yuan from the rumored "170,000 yuan to buy a BMW" a month ago.

However, other dealerships revealed that BMW's price hikes are not as widespread as online rumors suggest, with significant price increases concentrated in younger models, which have increased by around 30,000 yuan. There are also models with smaller price fluctuations and relatively stable prices. Overall, "gasoline-powered cars have slower price increases than electric cars."

Another BMW 4S store staff member explained to the Securities Times that BMW's move is not a price hike but a price adjustment, primarily due to "previous heavy losses, and offline dealerships can no longer withstand the large losses incurred by aggressive discounts on high-volume models."

Notably, shortly after "BMW announces withdrawal from the price war" hit the top trending list, Lanjing Finance reported that several consumers have reported that BMW cars they ordered before the price increase period are being refused delivery by local 4S dealerships, and they are being informed that they need to pay an additional fee in order to take delivery of their vehicles.This included models such as the BMW i3, ix3, and 3 Series, with dealerships citing various reasons for refusing delivery, such as model discontinuation or reduced production for those who have signed contracts and paid deposits, and "headquarters approval not passed" for those without contracts.

Regarding these incidents, BMW publicly responded to the media that it has initiated a preliminary internal investigation, with the involved cases being individual cases with varying circumstances. The company is actively communicating with relevant dealers to urge them to comply with the "Measures for the Administration of Automobile Sales" and relevant laws, regulations, and contractual agreements to safeguard consumer rights.

Currently, the follow-up developments of the incident have not been disclosed, but it is certain that BMW's unannounced price hikes and dealerships' forced price increases for already-purchased vehicles due to policy adjustments have severely damaged the brand's reputation, with many consumers criticizing BMW for its "unsightly behavior."

II. Impact of the price war, profits and sales both decline

BMW Group Chairman Oliver Zipse once emphasized in an interview that the Chinese market is essential to BMW in terms of raw material supply, manufacturing innovation capabilities, and market size. The company's continued investments in upgrading its R&D and production systems in China and enriching its product matrix demonstrate its commitment to the Chinese market.

However, amidst the "siege" of domestic automakers, BMW, once a symbol of luxury and high-end, has had to resort to price cuts to preserve market share. Previous data showed that BMW's discount rate for the entire year of 2023 was 17.66%, higher than the industry average of 15.7%.

Since entering 2024, BMW has even experienced "slashing" price cuts. The official guide price of the mid-sized electric sedan BMW i3 is 353,900 yuan, but with a five-year loan and early repayment after two years, the car can be purchased for just 170,000 yuan, with a daily bare-metal price of no more than 200,000 yuan.

To address the challenges posed by the market backdrop and domestic brands, BMW has also offered substantial subsidies and exemptions to all dealerships, including a 3% price discount (payable in advance) to help alleviate cash flow pressures, while reducing overdue payment penalties to an annual rate of 2.5% and port storage fees by 50%.

However, despite BMW's aggressive discount policies, sales have not picked up. In 2023, BMW (including the MINI brand) delivered approximately 825,000 new vehicles in China, an increase of 4.2% year-on-year but a retreat from the 846,000 vehicles delivered in 2021.

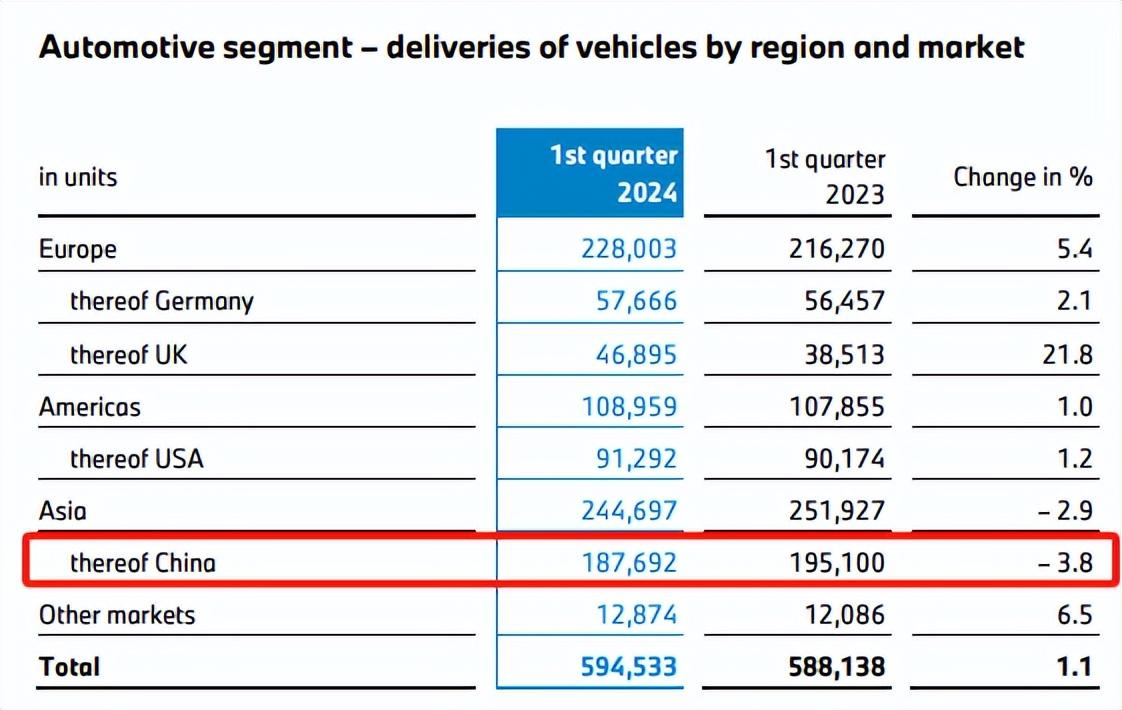

Regionally, among BMW Group's various markets worldwide, only China has experienced a decline in vehicle sales, falling from 195,100 units in the first quarter of 2023 to 187,700 units in the same period of 2024, a year-on-year decline of approximately 3.8%.

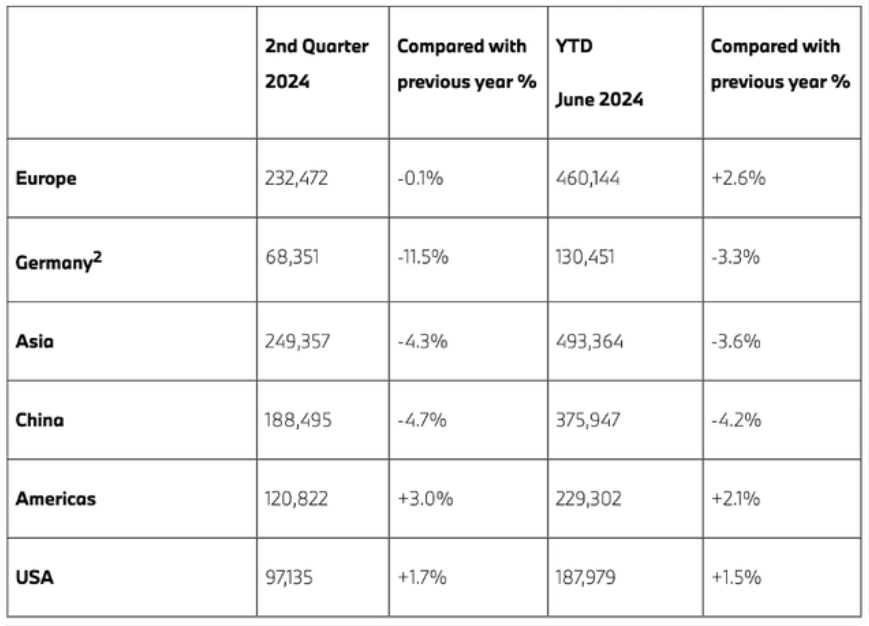

Furthermore, according to the 2024 interim report, BMW (including the MINI brand) sold a total of 1,096,500 vehicles globally in the first half of the year, an increase of 2.3% year-on-year; sales in the Chinese market were 375,900 vehicles, a decline of 4.2% year-on-year, with second-quarter sales showing a year-on-year decline of 4.7% despite a sequential increase.

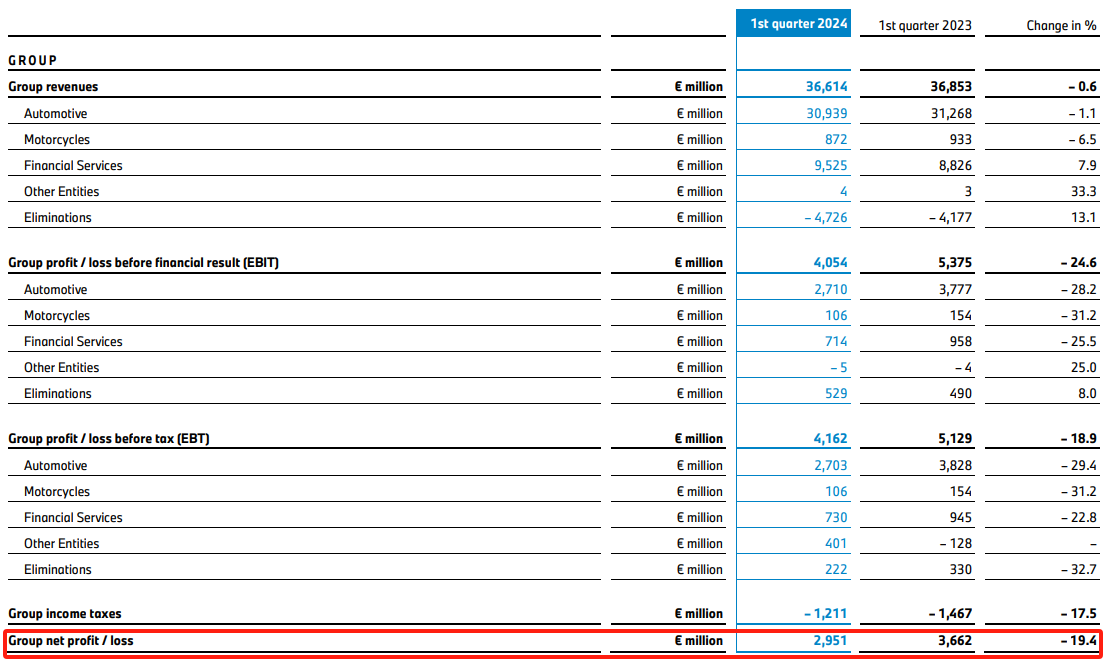

Meanwhile, the price-for-volume approach has eroded BMW Group's overall profitability, with the company's pre-tax profit in 2023 declining by 27.3% to 17.096 billion euros; the core automotive business's EBIT margin was 9.8%, below market forecasts of 9.9%; and net profit in the first quarter also declined by 19.4%.

III. The rise of new forces, how to break the declining halo

In reality, the "reshuffling of market positions" has become the main theme of the domestic automotive industry in recent years. Under digital competition, the brand value behind "high-end" has been overturned and reshaped, with technological achievements and intelligent experiences represented by smart cockpits, autonomous driving, and vehicle-to-machine connectivity becoming new themes in automotive consumption.

On the one hand, local independent brands represented by new carmakers have closely followed the trend of intelligent driving, leveraging technology to connect the ecological chain and achieving rapid development. By the end of June 2024, Wenjie's sales had increased by 573.80% year-on-year, while Lixiang, NIO, and Leapmotor's sales growth rates were 35.8%, 60.2%, and 46.9%, respectively, all achieving double-digit growth.

On the other hand, traditional fuel brands such as BBA have been slow in their electric transformation and do not possess technological advantages amidst market changes. At the same time, frequent participation in price competition can easily blur their "luxury" positioning and tarnish brand value.

According to the 21st Century Business Herald, in addition to BMW, Mercedes-Benz's sales in China also declined by 6.52% in the first half of 2024; while Volkswagen Group did not provide specific sales figures for Audi, it did point out that the group's deliveries in China declined by 7.4%; Porsche experienced the most significant sales decline, at 33%.

Whether in terms of performance or brand value, BMW's announcement to withdraw from the price war seems more like a timely stop-loss after "losing both the battle and the war." It is reported that BMW will focus on business quality in the Chinese market in the second half of 2024, supporting dealers to steadily progress.

At the recently held Fourth BMW Group China Sustainability Summit, Gao Xiang, President and CEO of BMW Group Region China, clearly stated that "there can be no luxury without sustainability" and that sustainability is an integral part of BMW's role as a premium brand.

In 2024, BMW will launch over 20 new BMW and MINI brand models in China. According to BMW's plan, by the end of the year, the number of BMW M brand models sold in China will expand to 23, covering compact, mid-sized to large luxury vehicles, as well as gasoline, electric, and plug-in hybrid energy forms.

To promote the launch of its "NEUE KLASSE" models in 2025, BMW Group also announced an additional investment of 20 billion yuan in China for large-scale upgrades and technological innovations at its Shenyang production base. Earlier, BMW's "NEUE KLASSE" sixth-generation battery project, with a total investment of 10 billion yuan, was completed and equipment installation started in March 2024.

BMW revealed that it will showcase several mid-cycle refreshed and new-generation models at the upcoming Chengdu Auto Show next month. However, under the pressure of public opinion, it may not be easy for BMW to repair the damage to its brand reputation caused by price fluctuations and regain ground with product quality and price ratios amidst the "inward-turning" price environment.