Tesla's automotive "pit" filled by energy storage, Full Self-Driving expected to enter China by year-end

![]() 07/24 2024

07/24 2024

![]() 470

470

Tesla has begun to fulfill its promise of being more than just an automotive company.

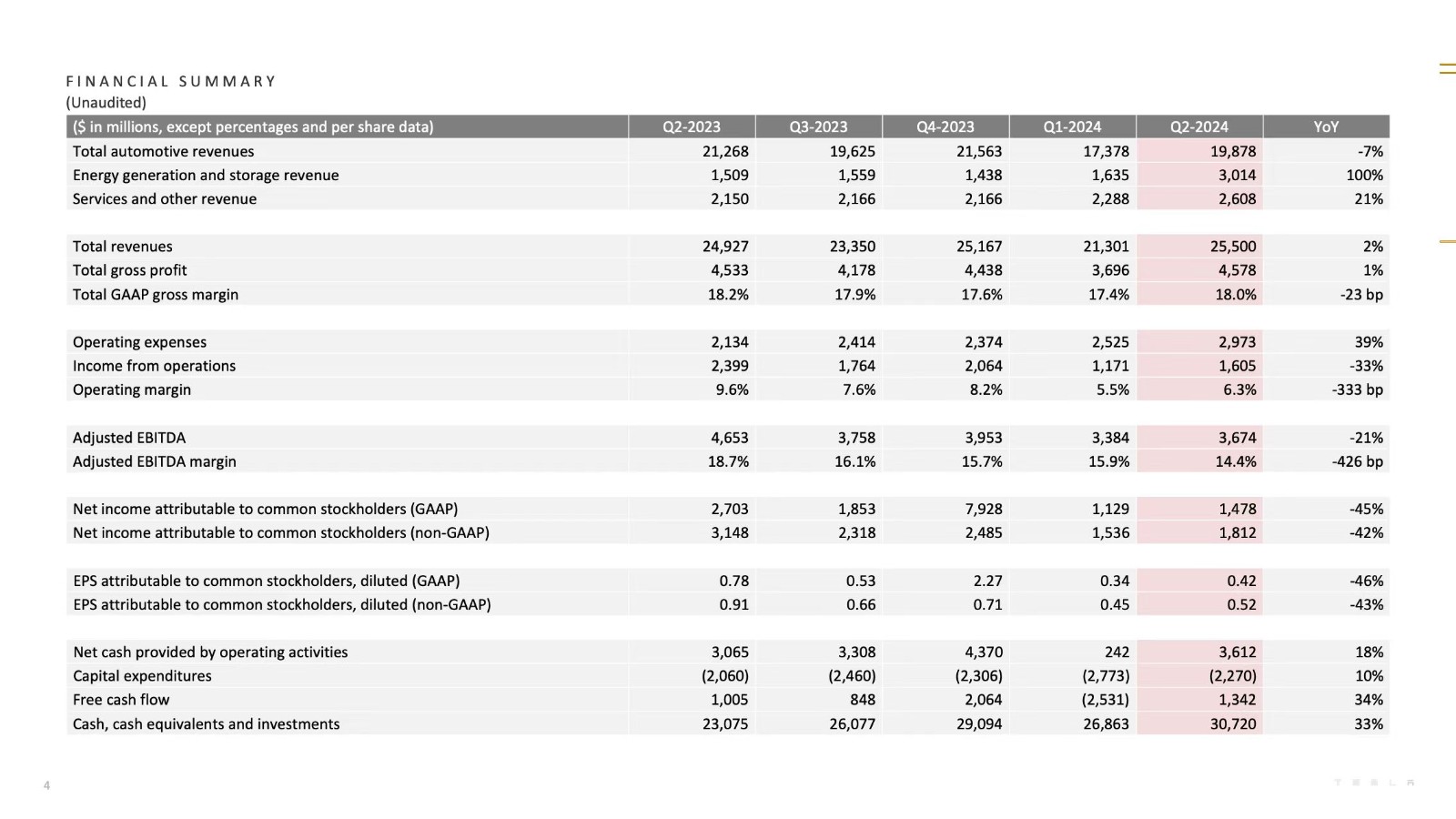

In the early hours of July 24, Beijing time, Tesla released its Q2 2024 financial results after the US market close. Thanks to significant revenue growth in its power generation and energy storage, service, and other businesses, Tesla's overall revenue for the quarter increased slightly by approximately 2.3% year-over-year to $25.5 billion, exceeding analysts' expectations of $24.63 billion.

Financial Report Operating Data

Specifically, Tesla's automotive revenue for Q2 totaled $19.878 billion, down approximately 6.5% from $21.268 billion in the same period last year. Revenue from power generation and energy storage was $3.014 billion, up approximately 99.7% from $1.509 billion in the same period last year. Service and other revenue was $2.608 billion, up approximately 21.3% from $2.15 billion in the same period last year.

In terms of profit, Tesla's operating profit for Q2 fell 33% year-over-year to $1.61 billion, below industry expectations, with an operating margin declining from 7.6% in the same period last year to 6.3%. Tesla attributed the decline in operating profit to factors such as a decrease in the average selling price of vehicles, restructuring, AI project expenses, and lower vehicle deliveries.

After the Q2 report was released, Tesla's share price continued to decline in after-hours trading, with a drop of over 7% at the time of writing.

01

"This is the best time to buy Tesla"

Focusing on Tesla's automotive business, the company is currently working to reduce inventory.

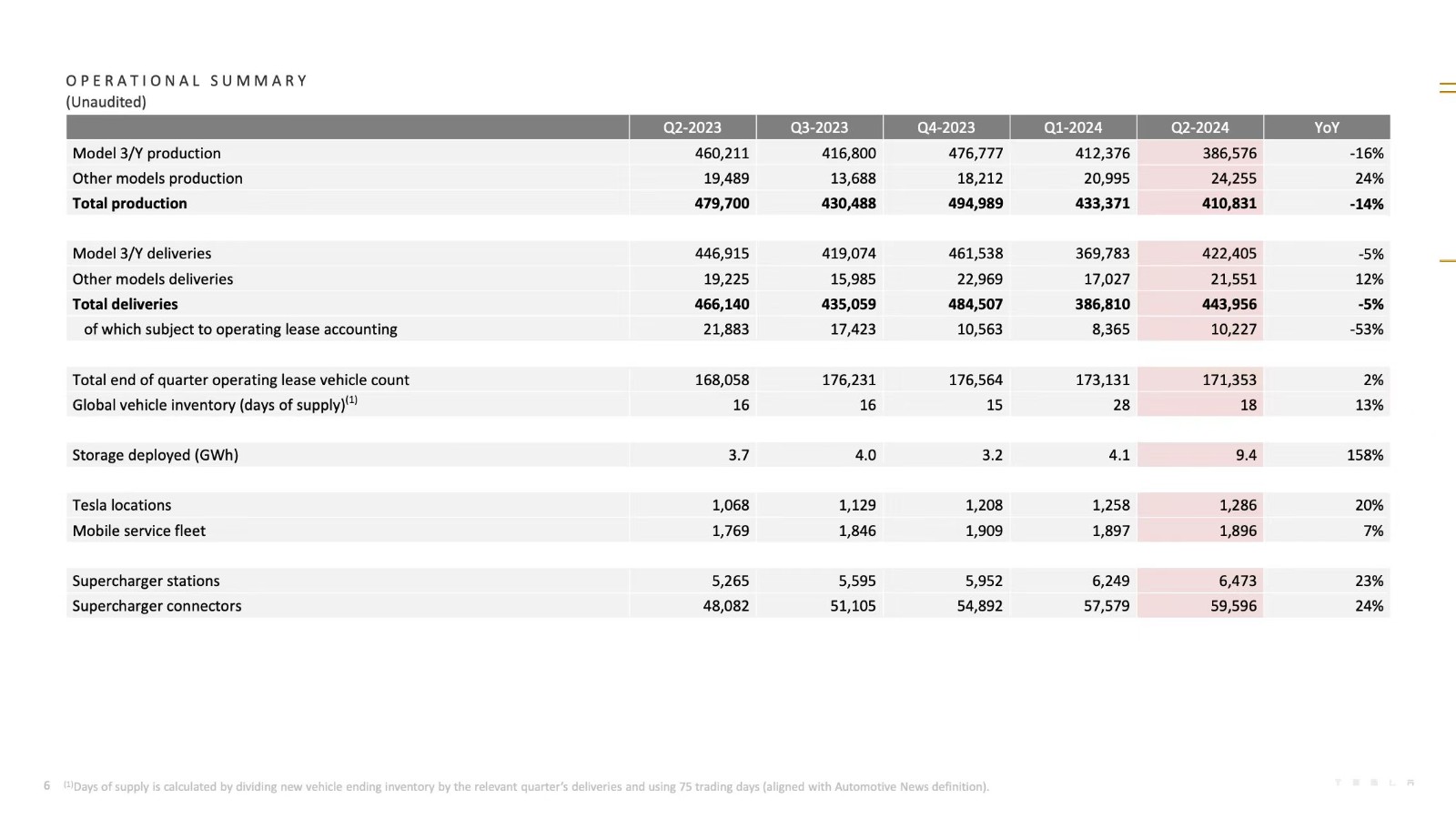

The report shows that Tesla produced a total of 410,831 vehicles in Q2, a decrease of over 10% year-on-year and quarter-on-quarter. During the same period, total vehicle deliveries were 443,956, down 5% year-on-year but up approximately 14.7% quarter-on-quarter. In other words, Tesla successfully consumed 33,125 inventory vehicles in Q2, but the previous production-sales gap has not been eliminated. In Q1, Tesla's total production was 46,561 vehicles higher than total sales.

It is worth noting that the vehicles experiencing weaker demand are primarily the Model 3 and Model Y, while the supply and demand of other Tesla models such as the Model S, Model X, and Cybertruck are relatively balanced, with significant year-on-year and quarter-on-quarter increases in deliveries.

Regarding Tesla's current state in the automotive market, CFO Dipak Ahuja stated during the earnings call that considering the various sales policies currently in place, such as low-interest loans, now is the most suitable time to purchase a Tesla. According to sources, Tesla China is currently offering a 5-year, zero-interest loan incentive for the Model Y and Model 3, valued at over RMB 20,000, which has significantly increased store traffic.

In fact, Tesla does not expect electric vehicle market demand to recover to its previous robust momentum within the year.

"Vehicle sales growth in 2024 is likely to be significantly lower than in 2023." In its Q2 report, Tesla did not provide a new full-year sales target but stated that the company is currently between two peaks of vehicle sales growth: the first peak being the Model 3 and Model Y, and the second peak being new products derived from the next-generation vehicle platform.

Tesla also noted that the gap in vehicle sales growth this year will be filled by its power generation and energy storage business, which was already evident in the Q2 report.

02

Full Self-Driving expected to enter China by year-end

Although the automotive sales business is facing headwinds, Tesla's outlook for the second half of the year and beyond remains promising.

During the earnings call, CEO Elon Musk revealed that Tesla's FSD (Full Self-Driving) will apply for regulatory approval in Europe and China, with an expected entry into these markets by the end of the year.

For a long time, due to legal and regulatory issues, Tesla's smart assisted driving capabilities in China have been limited to relatively basic functions such as Navigate on Autopilot and Autosteer. The optional price of Tesla's FSD, at RMB 64,000, has been viewed as a joke within the industry. Without FSD, Tesla models lag far behind domestic smart assisted driving leaders such as Huawei HarmonyOS and XPeng Motors (NYSE: XPEV, 09868.HK), which are already capable of point-to-point smart assisted driving in urban areas.

The introduction of Tesla's FSD in China is expected to elevate the competitiveness of the Model 3 and Model Y to a new level. Previously, XPeng Motors CEO He Xiaopeng experienced this feature in the US and described it as "as smooth as an experienced human driver." It is rumored that Tesla's FSD is currently being tested on roads in Lingang New Area, Shanghai.

Musk has high expectations for Tesla's FSD. "I would be very surprised if Tesla doesn't achieve unsupervised full self-driving next year," he said.

In addition to the news about Tesla's FSD entering China, updates on Robotaxi, affordable new vehicles, and the highly anticipated Roadster 2 were also shared.

New Vehicle Production and Sales Data

Musk stated during the earnings call that due to regulatory approvals and adjustments to the front design of the Robotaxi, the originally scheduled Robotaxi launch event in August will be postponed to October. The affordable new vehicle based on the new platform is scheduled for delivery in the first half of next year. The long-awaited Roadster 2 is also progressing smoothly and is expected to begin production next year.