After being forced to raise prices, is there still a need for a price war?

![]() 07/24 2024

07/24 2024

![]() 639

639

The Chinese automotive market is currently experiencing an unprecedented price war.

In terms of time span, it can be traced back to Tesla's price reduction at the beginning of 2023 and has now lasted for over 550 days;

From the perspective of scope, whether it's the mainstream consumer market dominated by domestic and joint ventures or luxury and even ultra-luxury brands represented by BBA and Porsche, they are all participants in this price war;

Finally, the intensity of price reductions, with terminal discounts equivalent to 20% off the guidance price, has become the norm in the industry, with even deeper discounts of 30%, 40%, and even 50% off being common.

As a result, under the pressure of intense market competition, automakers that once actively or passively participated in the price war have begun to show clear differences in their attitudes.

Is the price war still viable?

At the beginning of June, although voices emerged within the domestic camp, which has been the main force of the price war in the Chinese automotive industry, calling for a cooling-off of the "price war," the overall stance remains committed to the path of "continuing to compete fiercely."

In contrast, joint ventures and luxury brands are "collapsing" under the pressure of the price war.

On July 11, BMW China officially announced its withdrawal from the price war, citing a focus on business quality and supporting dealers in their steady progress. This was followed by Mercedes-Benz and Audi, and as of the time of writing, most of them, from luxury to joint venture brands, are planning to withdraw from this price war, which is dominated by Chinese automakers, using various "high-sounding" reasons.

Adjusting prices to participate in market competition has always been the most direct means for enterprises, applicable across the entire industry. After the baptism of the price war, enterprises can not only expand their product sales and gain more market share but also rely on their system strengths to force weak brands and inefficient production capacity to withdraw, ultimately achieving the survival of the fittest in the industry.

However, the price war is also a double-edged sword. Once the balance is not maintained, it can potentially backfire on the entire industry ecosystem, such as resorting to cost-cutting measures to reduce vehicle costs or pressuring upstream and downstream suppliers, thereby disrupting the entire automotive supply chain.

Fortunately, the price war in the Chinese automotive market has remained relatively rational rather than chaotic. As Li Yunfei, General Manager of BYD Brand and Public Relations, said, "Price wars should be undertaken according to one's capabilities. If you can follow, follow; if not, move on to the next product. We should compete in a healthy and positive manner, without getting angry or upsetting the table."

Looking at the leading players in the price war, such as BYD, they participate by upgrading technology and strengthening their system capabilities.

On the one hand, thanks to the healthy competition among Chinese new energy automakers and their supply chains, and as production volumes continue to expand, their hardware costs are continuously decreasing, while upfront investments in software can also be spread out;

On the other hand, due to the improved product capabilities of vehicles, users perceive the value of technological premiums more clearly and are more willing to support domestically produced new energy vehicles with continuously iterated technologies with their hard-earned money.

The most direct evidence of this is that against the backdrop of the price war, the prices of passenger cars in China are rising year by year. According to statistics from the China Passenger Car Association (CPCA) Secretary-General Cui Dongshu, the average price of passenger cars in China has increased annually over the past five years, from 142,000 yuan in 2019 to 186,000 yuan in June 2024.

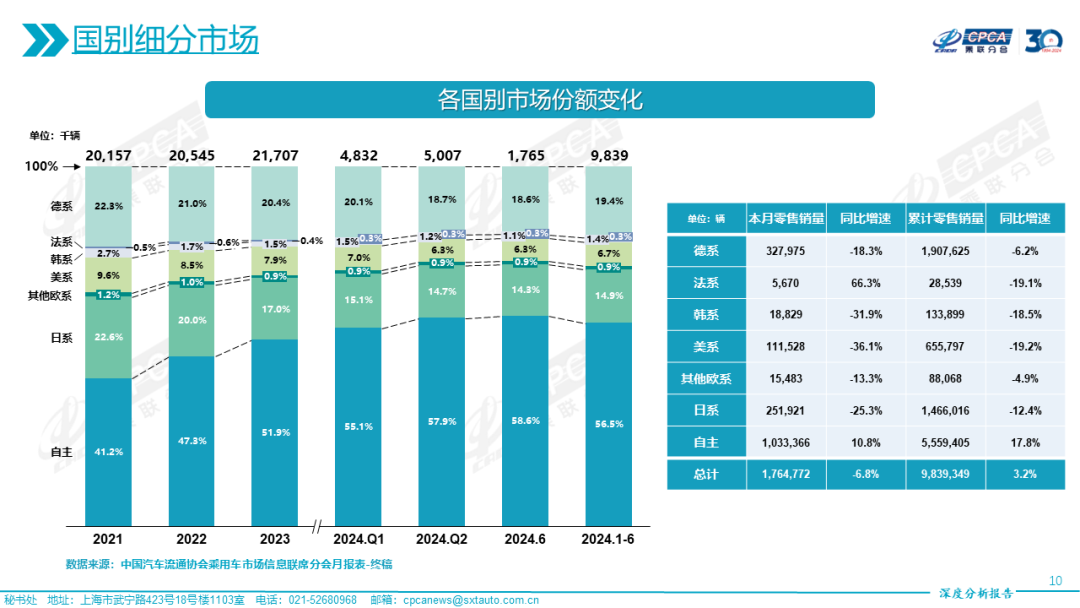

At the same time, in terms of market share changes, domestic brands, which are better at using new technologies to compete in the market, are continuously eroding the shares of traditional joint ventures and luxury brands. CPCA data shows that from January to June this year, the share of domestic brands increased to 56.5%, an increase of nearly 5 percentage points compared to 51.9% in 2023; while Japanese, German, and American brands, despite participating in the price war, still showed different degrees of decline.

After driving joint ventures and luxury brands out of the price war, is there still a need for Chinese automakers to continue competing fiercely?

The price war is a must!

Admittedly, as domestic brands move upmarket, there will be some profit compression, and some automakers may be competing fiercely even to the point of selling cars at a loss.

But as a firm supporter of the price war, Wang Chuanfu, Chairman and President of BYD, said: "Competition is a natural law. Don't be anxious. Only by actively embracing it can we come out on top. Only with overcapacity can there be competition, and only with competition can there be fierce competition, which leads to technological breakthroughs, industrial upgrades, and the birth of excellent products."

Therefore, in the current era of new energy, it can be seen that BYD, with its technological trump cards such as DM-i 5.0, e-platform 3.0, and iTAC technology, holds the discourse power in the price war, ultimately bringing more affordable and high-quality vehicles to users by leveraging its scale advantages.

The feedback from the market and users to BYD is also unattainable for other automakers. From January to June this year, BYD sold a cumulative total of 1.613 million vehicles, not only becoming the undisputed sales champion in the Chinese automotive market but also truly achieving its brand slogan of "Global New Energy Vehicle Leader."

It is worth mentioning that in the eyes of consumers, media, and competitors, BYD has become a "public enemy" due to its role as a "price slayer," but more often than not, the initiator of the price war is actually Tesla. The reason why the latter is easily overlooked is that competitors can bypass Tesla but not BYD.

On the one hand, the anxiety of Chinese new energy vehicle users regarding energy replenishment is objectively present, so BYD insists on a parallel new energy route of plug-in hybrids and pure electric vehicles, which can cover a wider range of user groups; on the other hand, BYD responds to the diverse needs of Chinese consumers across different price points and segments, from micro-mobility vehicles priced just over 10,000 yuan to million-yuan ultra-luxury SUVs and supercars.

Whether it's Tesla's initial price reduction or BYD's subsequent competitive pressure on its peers, the reason their price adjustments can provoke the sensitive nerves of competitors and users is that they hold the core weapon of the price war – pricing power.

Looking back at the history of global automotive development, it can be seen that every automotive revolution essentially brings consumers better and cheaper automobiles, and its direct carrier is the price war.

In 1913, Henry Ford, the founder of Ford Motor Company, invented the assembly line, a groundbreaking production method that, with lower production costs and higher efficiency and quality, directly crushed the expensive cars produced by European automakers at the time using non-standardized handmade methods.

In the 1950s, Toyota introduced the "lean manufacturing" model, whose core idea is to eliminate waste, improve efficiency, and reduce costs to maximize customer satisfaction and ultimately achieve sustainable development and competitiveness. The Corolla, born from this concept in the 1960s, was priced at just over 400,000 yen, while the average price of cars in the Japanese market at the time was as high as 1 million yen.

Ultimately, while the price war may seem to be just about prices, it affects every aspect of the automotive industry chain, from design and research and development to manufacturing. Therefore, Chinese automakers, at the forefront of the new energy revolution, are destined to bear the growing pains brought about by change.

Therefore, in the current era of new energy, only by continuing to compete fiercely can Chinese automotive brands one day truly stand on the global automotive stage, and it is believed that everyone would not mind seeing more "villains" like BYD emerge.