Having achieved only 20% of its KPI in the first half, Xpeng aims to turn things around with its "big-small" collaboration

![]() 07/24 2024

07/24 2024

![]() 650

650

Once part of the "WEI-XIAO-LI" trio of new energy vehicle makers, Xpeng now finds itself struggling behind NIO and Li Auto, which have consistently led the pack in sales. While NIO frequently surpasses 20,000 monthly sales and solidifies its position as a top-tier player, Xpeng's journey has been fraught with challenges and uncertainties.

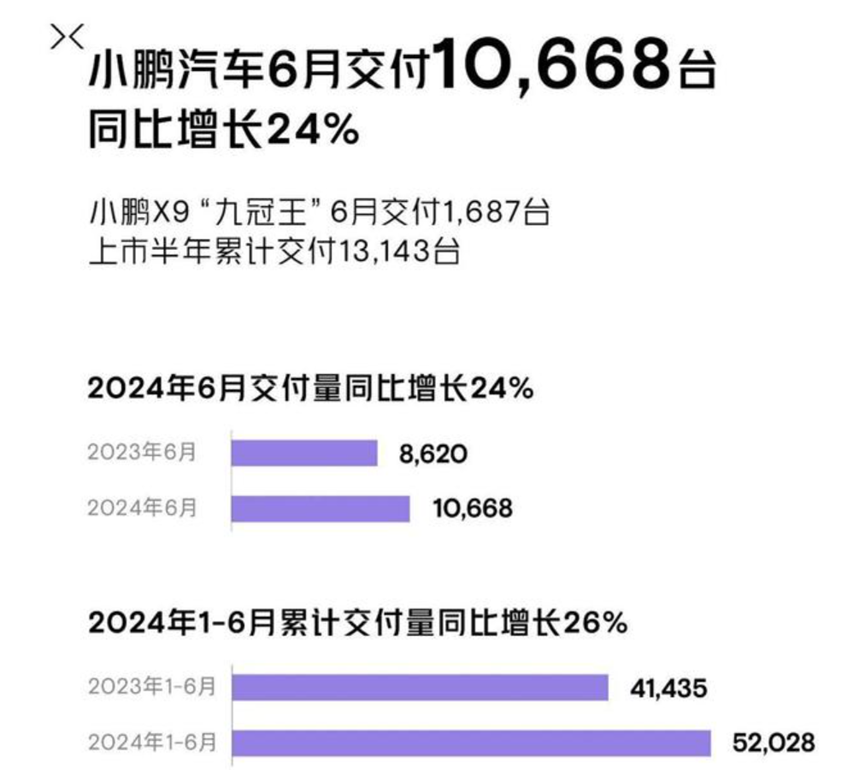

On July 1, Xpeng released its sales figures for June 2024. According to official data, Xpeng delivered 10,668 new vehicles in June, marking a year-on-year increase of 24%. Notably, Xpeng X9 deliveries reached 1,687 units, with cumulative deliveries of 13,143 since its launch six months ago. In the first half of the year, Xpeng delivered a total of 52,028 vehicles, up 26% from 41,435 in the same period last year. While this represents a year-on-year growth in monthly sales, Xpeng lags behind Li Auto, Wenjie, NIO, and even up-and-coming ZERORUN, with its highest monthly sales in 2024 barely exceeding 10,000 units, suggesting a tendency to fall behind.

Considering Xpeng's first-half sales of 52,028 vehicles, the average monthly sales fall short of 10,000. However, it's worth noting that Xpeng's annual sales target for 2024 is 280,000 vehicles, double the 140,000 target for 2023. With half the year gone, Xpeng has achieved just 18.6% of its target, far from the 20% mark. To meet its annual sales target, Xpeng needs to sell 228,000 vehicles in the remaining six months, averaging 38,000 vehicles per month, a formidable task for the company at present.

"Big-Small" Collaboration: Xpeng Keeps Busy

In the automotive industry, collaboration has become a pronounced trend, a necessity for both individual enterprises and the industry as a whole. The partnership between Volkswagen, a traditional automaker giant, and Xpeng, an emerging player, exemplifies this trend. This union not only leverages each other's strengths but also pioneers a new mode of cooperation between Chinese and foreign automakers.

Volkswagen and Xpeng's collaboration dates back to July 2023, when they announced a partnership. Volkswagen Group planned to invest approximately US$700 million to acquire a 4.99% stake in Xpeng, and both parties signed a long-term technical cooperation framework agreement. Initially, they aimed to jointly develop two electric vehicle models under the Volkswagen brand for the mid-size segment in China, scheduled for launch in 2026.

In February 2024, the two automakers deepened their cooperation by signing a joint development agreement, targeting shared components for jointly developed models and platforms to reduce costs and enhance efficiency. Volkswagen aims to integrate more deeply into China's industrial ecosystem through expanded cooperation with Xpeng, enabling a quicker response to Chinese consumers' needs.

Just a few days ago, the two parties announced another joint development agreement, building upon their previous strategic cooperation framework for electronic and electrical architecture technology. This collaboration focuses on developing electronic and electrical architectures for Volkswagen's CMP and MEB platforms in China. To this end, joint development teams have been established in Guangzhou and Hefei, where engineers will collaborate on this crucial task. The first model equipped with this jointly developed electronic and electrical architecture is expected to enter mass production within 24 months, marking a substantial new phase in their cooperation.

’

Notably, this collaboration has already shown financial results. Financial reports indicate that Xpeng's service and other revenues reached RMB 1 billion in the first quarter of 2024, a 93.1% increase from RMB 520 million in the same period last year and a 22.1% increase from RMB 820 million in the fourth quarter of 2023. This growth, fueled by technology research and development services stemming from the technical collaboration with Volkswagen Group, not only boosted Xpeng's revenue but also improved its service and other profit margins, demonstrating the immense potential and market value of technology exports.

He Xiaopeng remarked that through strategic cooperation with Volkswagen, Xpeng has successfully exported and empowered its self-developed intelligent technologies, earning wider market recognition and better financial returns for the company's technologies. This not only affirms Xpeng's technological prowess but also opens up broader horizons for the company's future development.

Multiple New Models Coming in the Second Half: P7+ and M03

To achieve its 2024 sales target, Xpeng is not only intensifying its collaboration with Volkswagen but also remains unwavering in new model development and sales.

On July 3, 2024, Xpeng grandly unveiled the M03, the first model in its MONA series. This pure electric intelligent hatchback coupe boasts an affordable price tag below RMB 200,000. With its low wind resistance, high aesthetics, spacious interior, and youthful design philosophy, the M03 has attracted significant attention since its debut. Scheduled for official launch in August, the M03's affordable price combined with its sleek appearance is expected to appeal to young consumers.

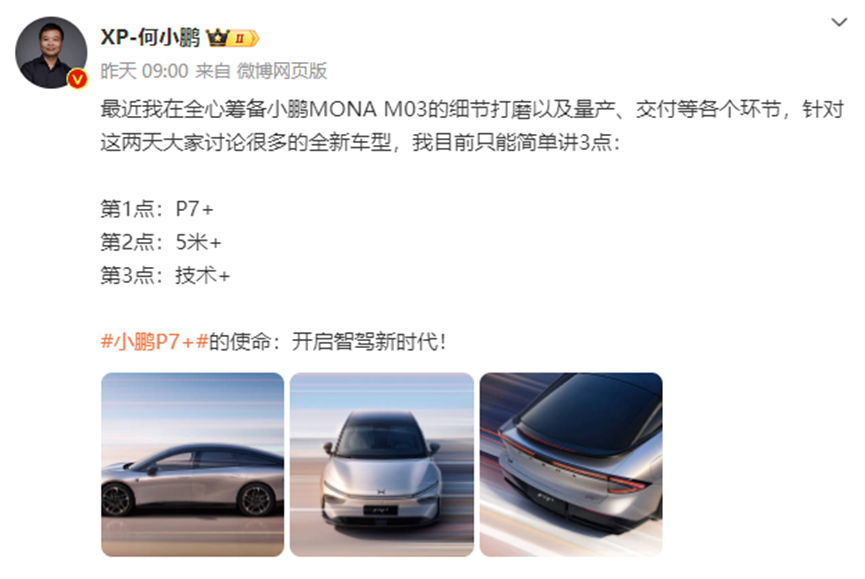

Apart from the MONA M03, Xpeng's upcoming P7+ also garners considerable attention. This new sedan, expected to launch in the second half of the year, positions itself above the current Xpeng P7 and is hailed as the "technology plus" model. On July 10, Xpeng released official images of the P7+, showcasing its classic family design language and modern front fascia. Compared to the P7, the P7+ features more sculptural lines and a clearer hierarchy.

Based on the 800V platform, the new model is expected to offer both single-motor rear-wheel-drive and dual-motor all-wheel-drive options, equipped with an all-aluminum intelligent chassis, intelligent dual-chamber air suspension, and other advanced technologies. Notably, the Xpeng P7+ is expected to adopt a lidar-free autonomous driving solution, incorporating a higher-level intelligent driving system, fostering high expectations for its future performance. Whether it will share the autonomous driving system with the recently unveiled Xpeng MONA M03 remains to be seen.

To smoothly achieve its 2024 sales target, Xpeng has devised multiple strategies. Beyond forging a "double-edged sword" collaboration with Volkswagen and introducing new models, Xpeng has also been expanding into overseas markets and strengthening cost control. According to Xpeng's financial report, the company's total revenue in the first quarter of 2024 was RMB 6.55 billion, up 62.3% from RMB 4.03 billion in the same period last year. Sales costs for the quarter stood at RMB 5.7 billion (US$790 million), up 43.8% from RMB 3.97 billion in the same period last year and down 53.4% from RMB 12.24 billion in the fourth quarter of 2023. Notably, the company's gross margin reached 12.9% in the first quarter of 2024, a significant improvement over the 1.7% and 6.2% recorded in the same period and fourth quarter of 2023, respectively. Specifically for automotive products, the gross margin was 5.5% in the first quarter of 2024.

Amid revenue growth and cost control efforts, Xpeng's operating loss in the first quarter of 2024 was RMB 1.65 billion, down from RMB 2.59 billion in the same period last year and RMB 2.05 billion in the fourth quarter of 2023. Xpeng's loss has significantly decreased due to its dual efforts in expanding technical service business and controlling costs, indicating some improvement in its operating performance. While reaching the annual sales target of 280,000 vehicles remains a long shot based on current sales figures, Xpeng's operating condition and financial pressure have indeed improved.