In June, Germany's share of new energy vehicles declined, with multiple factors hindering the electric transition

![]() 07/24 2024

07/24 2024

![]() 609

609

The lingering effects of the abrupt halt to electric vehicle subsidy policies are still impacting the German new energy vehicle market.

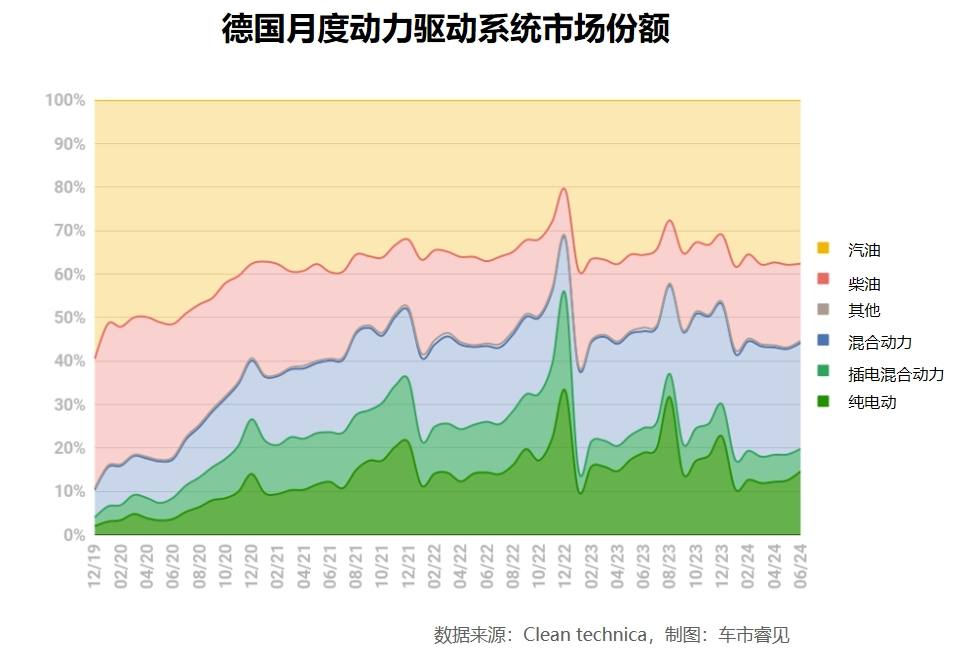

In June, the number of newly registered passenger cars in Germany reached 297,329, an increase of 6.1% year-on-year. The number of newly registered gasoline-powered vehicles increased by 12.1%, accounting for 37.6% of the market; diesel-powered vehicles saw a 12.4% increase in new registrations, accounting for 17.7% of the market; hybrid vehicles increased by 12.4% in new registrations, with a market share of 29.6%. The market share of new energy vehicles was 19.8%, a decline of 4.8 percentage points from 24.6% in the same period last year, indicating weak demand and a sluggish market for new energy vehicles.

Among them, the share of pure electric vehicles dropped to 14.6% (18.9% in the same period last year), while plug-in hybrid vehicles accounted for 5.2% (5.7% in the same period last year). As the largest automotive market in Europe, the reversal in Germany's pure electric vehicle market share is not good news.

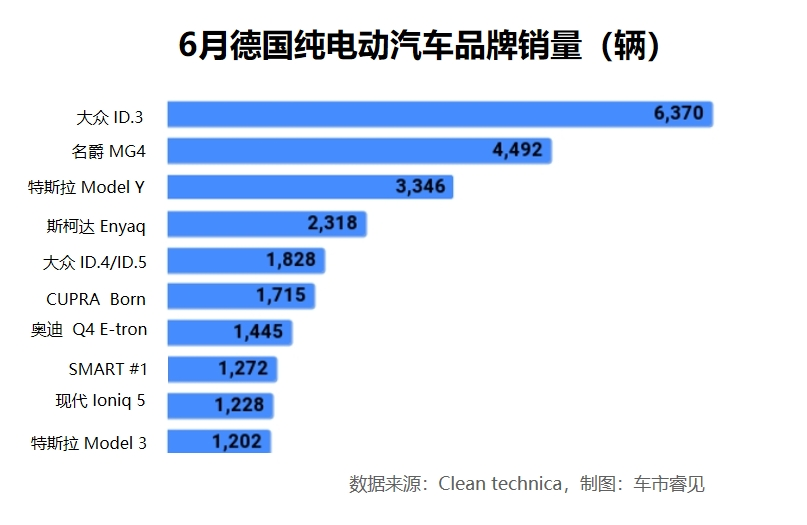

Specifically, in June's brand sales rankings, the Volkswagen ID.3 sold 6,370 units, making it the best-selling pure electric vehicle in Germany for the second consecutive month; followed by the MG4 with 4,492 sales; and the Tesla Model Y in third place with 3,346 sales. The increase in MG4 sales may be related to tariffs, and in addition, Volvo EX30 and Smart #1, which were also affected by tariffs, saw significant sales growth.

This month, new Chinese brand entries included the BYD Tang, which made its debut in the German market with the 2024 model, achieving sales of 41 units; NIO ES8 completed its first deliveries in Germany, while AICHI U5 SUV and Xpeng G9 SUV also saw small-scale deliveries.

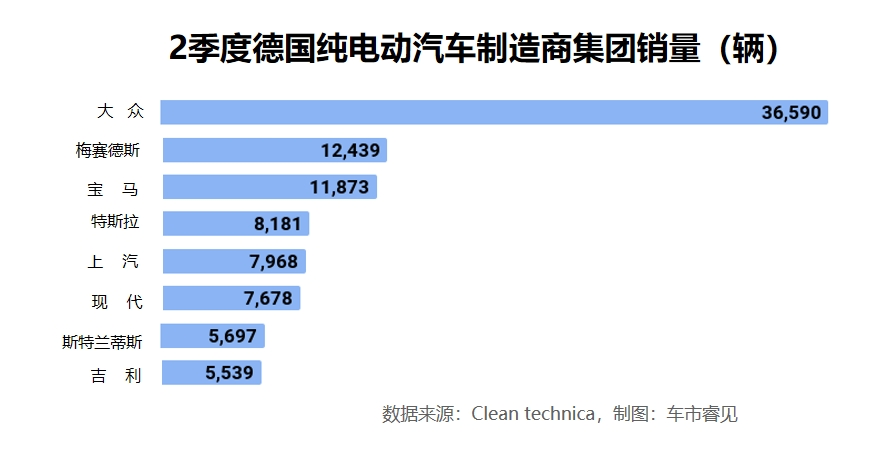

In terms of automakers, in the just-concluded second quarter, the Volkswagen Group continued to maintain its leading position in the pure electric vehicle market, with its market share increasing to 35.9%. Tesla fell from second to fourth place, with its market share dropping from 16.2% to 8.0%. Notably, Tesla's sales fell by a staggering 41.6% in the first half of 2024. Both the Mercedes-Benz Group and BMW Group rose one place, with their shares remaining largely unchanged. SAIC Motor climbed from ninth to fifth place, with its market share increasing to 7.8%.

Additionally, the Toyota Group delivered 324 pure electric vehicles in the second quarter. In the first half of the year, Toyota sold 49,225 vehicles in Germany, of which 1,099 were pure electric vehicles, accounting for 2.2% of total sales.

Analysts attribute the decline in Germany's new energy vehicle market share to the macroeconomic downturn and a setback in consumer confidence. Germany's economy officially entered a recession in the fourth quarter of 2023 and the first quarter of 2024 (with GDP declining 0.2% year-on-year), leading to uncertain economic growth prospects and reduced consumer spending power. This makes it difficult for consumers to afford the higher prices of new energy vehicles. Furthermore, the abrupt halt to electric vehicle subsidy policies at the end of 2023 severely eroded consumer trust in government policies promoting electric vehicle purchases, having a significant negative impact on electric vehicle sales.

Secondly, compared to fuel-powered vehicles, electric vehicles are still expensive, and there is a lack of affordable electric vehicles in the market. High prices are one of the main factors hindering sales. It is reported that the price of electric vehicles in Germany is generally more than double that of their gasoline counterparts. For example, the price of the Fiat 500e, a 42 kWh electric vehicle, is 34,990 euros (approximately 276,837 yuan), while the gasoline version costs only 17,490 euros (approximately 138,379 yuan). Similarly, the Volkswagen Up gasoline version sells for 14,555 euros (approximately 115,158 yuan), while the electric version costs 29,995 euros (approximately 237,317 yuan). With tight budgets for car purchases, consumers are unlikely to pay more than 15,000 euros for an electric version of the same brand.

Moreover, the EU's imposition of higher tariffs on imported electric vehicles from China will also negatively impact German consumers, the progress of Germany's electric vehicle transformation, and even the long-term healthy development of the European automotive industry. While high tariffs may protect automakers from competition in the short term, they will also make European vehicles lose their competitiveness in terms of both price and value in the larger global automotive market beyond Europe.

These "threats" hindering the development of electric vehicles are expected to persist in the second half of 2024, so the sales outlook for pure electric vehicles in Germany remains weak.