Musk's Hard Talk Costs Tesla $400 Billion in Market Value

![]() 07/24 2024

07/24 2024

![]() 717

717

Net Profit Declines 45% Year-on-Year

A lackluster financial report is far less appealing than the flags set by Musk.

Today, Tesla released a bland financial report, with revenue hitting a record high but net profit plummeting 45%. Moreover, delivery results were not impressive.

After the financial report was released, the share price fell immediately, with an even larger decline in after-hours trading. As of press time, the decline exceeded 7%, erasing over RMB 400 billion in market value overnight, based on a closing market value of USD 785.7 billion.

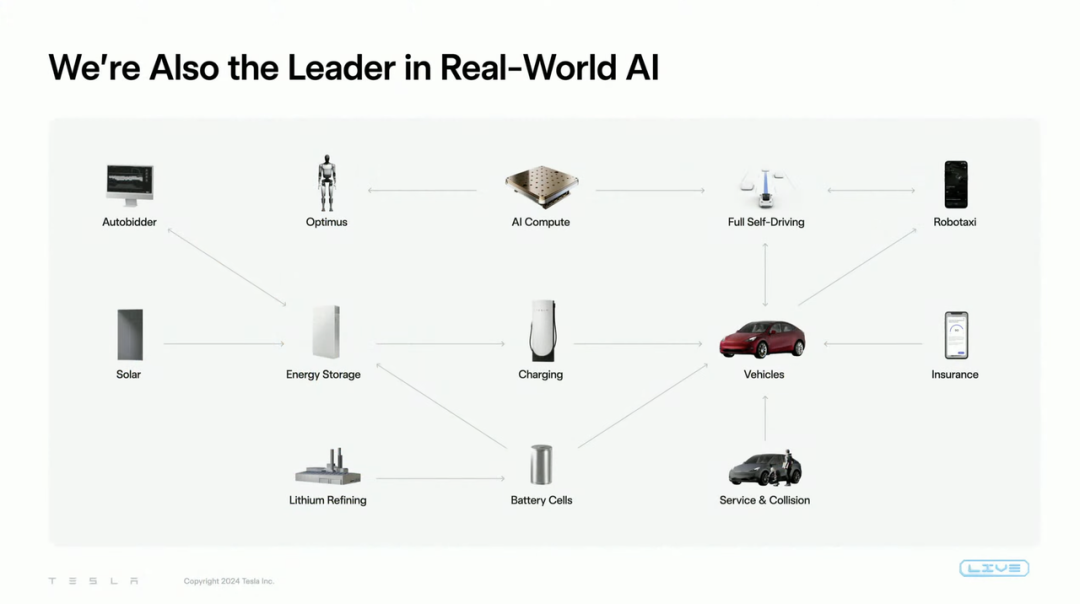

Compared to the financial report, the market paid more attention to Musk's comments during the conference call, such as when Robotaxi will hit the road, the status of FSD's landing in China, progress on Optimus humanoid robot mass production and delivery, among others. Musk released quite a few significant announcements.

He also dropped a smoke bomb, revealing that a new car would be launched in the first half of next year.

Overall, except for the two-year wait for robot mass production, autonomous driving results could be seen as early as the end of this year. It's time for Musk's global pie-in-the-sky promises to come true.

01 FSD Confirmed Entry into China, Humanoid Robots Will Sell Well

Autonomous driving remains Tesla's top priority, with Musk stating that "most of Tesla's value lies in autonomous driving."

Firstly, regarding the recently postponed Robotaxi, Musk confirmed that the Robotaxi conference scheduled for August 8 would be postponed to October 10, "with deployment as early as the end of this year or as late as next year."

As for the reason behind the delay, it was due to important design changes to the front of the robot taxi and the need for time to "show other things."

Although the latest timeline is next year, when the first batch of Robotaxis will hit the road depends on how far FSD has evolved.

Not long ago, Tesla began rolling out the new FSD V 12.5 version, improving vision-based driving focus monitoring, primarily relying on eye-tracking software to monitor the driver's attention, even with sunglasses on.

Musk also revealed during the conference call that Tesla would apply for regulatory approval for supervised FSD in Europe and China, expecting approval by the end of this year. Several mainstream OEMs now want to license Tesla's FSD.

Interestingly, Tesla is also considering licensing FSD to other Chinese automakers. Let's guess which one will be the first to use Tesla's FSD.

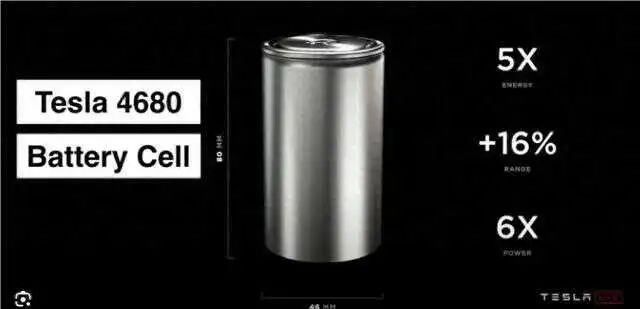

Cost Reduction of 4680 Batteries

There have also been new developments in the 4680 batteries, which were rumored to be discontinued previously.

Musk stated that Tesla's 4680 battery production capacity achieved strong growth in the second quarter, with deliveries increasing by 51% compared to the first quarter, while also achieving a significant cost reduction.

Currently, the weekly production capacity of Cybertruck equipped with 4680 batteries exceeds 1,400 units, and 4680 batteries will gradually achieve the cost parity target set for the end of the year.

Additionally, Tesla has successfully manufactured the first Cybertruck utilizing dry electrode technology on mass production equipment and plans to use this technology for production in the fourth quarter of this year. If successful, this will significantly reduce battery costs.

Optimus May Outnumber Humans in the Future

As a tech company, the humanoid robot Optimus has become a new revenue growth point for Tesla's future.

At the 2024 Annual Shareholder Meeting, Musk predicted that the future ratio of humanoid robots to humans will exceed 1:1 and may even reach 2:1, with annual production potentially reaching 1 billion units. If Tesla can capture 10% of the market, with an estimated cost of around USD 10,000 per robot and a selling price of USD 20,000, Tesla could potentially generate USD 1 trillion in annual profits.

During this conference call, Musk reiterated that the contribution of the second-generation humanoid robot Optimus to the company's revenue could exceed the combined total of all other business units. "I believe we are the only company with all the elements in humanoid robots."

Currently, Optimus is already handling battery-related tasks in the factory, and it is expected that thousands of Optimus units will be deployed in Tesla factories by the end of 2025, with mass production and delivery to external customers in 2026.

In the AI field, Musk believes that the AI 5 chip, which will go into production by the end of next year, will enable distributed computing power. Physically, future vehicles will be equipped with AI 5 and later versions of the chip, and there may be billions of humanoid robots. When vehicles and robots are idle, these chips can provide astonishing computational power for inference.

Ark Invest predicts that based on the autonomous driving business alone, Tesla's valuation has the potential to increase tenfold, exceeding USD 5 trillion. If we add the humanoid robot business, Tesla's market value could reach USD 20 trillion under optimistic scenarios, ten times that of most current tech giants.

Affordable Model to Be Produced in the First Half of 2025

Tesla's existing electric vehicle business is also moving forward, with expected third-quarter production exceeding that of the second quarter.

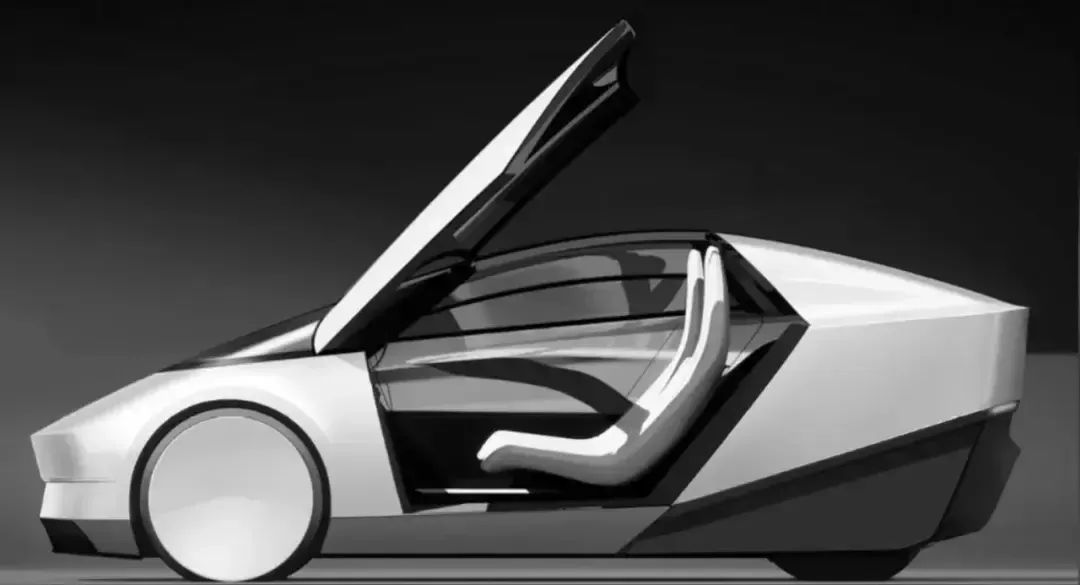

Moreover, Cybertruck is expected to become profitable by the end of this year. The affordable model, which fell into production rumors in April, is expected to start production in the first half of 2025, utilizing existing production lines to maximize the use of nearly 3 million units of existing capacity.

Most of the vehicle engineering design for the Roadster (Tesla's electric sports car) has been completed, with some upgrades to follow, and it is expected to enter production next year.

The Cyberquad ATV, which may become the best-selling model in the US segment in the second quarter, saw a more than threefold increase in production quarter-on-quarter and is expected to become profitable by the end of 2024.

However, to develop other products, Tesla's vehicle delivery growth rate in 2024 may be significantly lower than that in 2023.

02 Carbon Credits Become a Revenue Booster

Next, let's look at Tesla's second-quarter financial report.

Overall, Tesla "did a lot but didn't make much money from cars" in the second quarter, similar to trying to look fat by puffing out one's cheeks.

In the second quarter, Tesla produced 410,800 new vehicles, a 14% year-on-year decrease. However, in terms of deliveries, the second-quarter result of 444,000 units, though down 5% year-on-year, still exceeded market expectations. In the first half of this year, Tesla delivered over 830,000 new vehicles globally.

Total revenue was USD 25.5 billion (approximately RMB 185.51 billion), setting a new quarterly revenue record. This figure was higher than market expectations of USD 24.8 billion and last year's same period of USD 24.927 billion, with year-on-year growth exceeding 2%.

Looking at this data alone, Tesla's performance seems decent, breaking new highs and exceeding market expectations, especially since fewer cars were sold in the second quarter, which should logically result in declining performance.

However, upon breaking down the detailed data, it's not hard to see that the record-breaking total revenue was also significantly contributed by the sale of carbon credits (USD 890 million), with Tesla's "carbon credit revenue" more than doubling year-on-year.

Next, let's look at the core indicators in this financial report. Automotive revenue was USD 19.878 billion (approximately RMB 144.61 billion), a 7% year-on-year decrease from USD 21.268 billion in the same period last year.

In addition, the nearly USD 19.9 billion in automotive revenue seems USD 200 million higher than market expectations, but this is primarily due to double the market-expected regulatory credit income, which is pure profit.

The decline in sales is the direct cause of the decline in car sales revenue.

The delivery result of 444,000 units was down 5% year-on-year but up from 387,000 units in the previous quarter. To ensure sales, Tesla has made significant efforts in pricing, such as offering discounts, leasing subsidies, and interest-free financing to intensify promotions in the US and Chinese markets.

However, behind Tesla's second-quarter sales performance is a bleeding profit margin.

In the second quarter, Tesla's operating profit was USD 1.61 billion, a decrease of USD 790 million or 33% year-on-year, with net profit attributable to shareholders at only USD 1.478 billion, a decrease of USD 1.23 billion or 45%.

The sharply declining profit margin has also brought Tesla's profit per vehicle to an all-time low. Specifically, the gross margin of the automotive segment's three sub-segments—vehicle sales, vehicle leasing, and regulatory credits—has fallen to 14.6% after excluding "carbon credit" income, far below market expectations of 16.2% and 1.7 percentage points lower quarter-on-quarter.

However, Tesla's overall gross profit in the second quarter was USD 4.578 billion, up 1% year-on-year, with a gross margin of 18%, lower than the same period last year's 18.2% but higher than analysts' expectations of 17.4%.

Calculations show that Tesla's average revenue per vehicle is now around USD 42,000, with gross profit per vehicle also at an all-time low of around USD 5,800.

Clearly, Tesla used interest-subsidized sales in June to stem the decline in sales in April and May. Although quarterly sales exceeded market expectations, the cost behind it was not low.

Tesla also explained the reasons for the decline in second-quarter earnings, including reduced vehicle deliveries and average selling prices, increased operating expenses from AI projects, and related costs from restructuring.

However, in the second quarter, Tesla still had some bright spots, namely its energy storage business, which was the main force supporting Tesla's record-high quarterly revenue.

Revenue from its energy generation and storage business was USD 3.014 billion, a 100% increase from USD 1.509 billion in the same period last year and a significant increase from USD 1.635 billion in the previous quarter.

In the second quarter, a total of 9.4 GWh of Megapack and Powerwall energy storage products were deployed, setting a new single-quarter record. Based on this, both revenue and gross margin for the energy generation and storage business also set new single-quarter highs.

Regarding the energy business, Tesla also mentioned that the Lathrop energy storage factory in California achieved its highest single-quarter production in the second quarter, and the Shanghai Gigafactory will also be on track for production in the first quarter of next year.

The AI boom has driven an increase in demand for energy, which has become the main reason for Tesla's energy business to set new highs.

In addition, in terms of cash flow, Tesla's cash flow from operating activities in the second quarter was USD 3.6 billion (approximately RMB 26.19 billion), with free cash flow of USD 1.3 billion (approximately RMB 9.457 billion), including USD 600 million (approximately RMB 4.365 billion) in AI infrastructure capital expenditures.

Over the same period, Tesla's total cash and investments increased by USD 3.9 billion (approximately RMB 28.372 billion) to USD 30.7 billion (approximately RMB 223.339 billion).

It has become a consensus that electric vehicle performance is weak, and now it remains to be seen how Musk will tell the AI story.