BAIC ARCFOX, Have You Found Your "North"?

![]() 07/24 2024

07/24 2024

![]() 535

535

If we were to rank the new energy vehicle industry based on seniority, BAIC BJEV and its brand ARCFOX would undoubtedly be considered the "elders" of the industry. However, an early start does not necessarily equate to success, as evidenced by ARCFOX, the protagonist of this discussion.

On July 19, BAIC BJEV announced that it had recently received written resignation letters from Chairman Liu Yu and General Manager Dai Kangwei. Liu Yu will no longer hold any position in the company, while Dai Kangwei, after resigning as General Manager, is expected to succeed Liu Yu as Chairman, with Zhang Guofu taking over as General Manager and Liu Guanqiao as Deputy General Manager.

On the same day, BAIC BJEV's share price plummeted to its daily limit in the closing session, leaving market participants wondering if they had received advance notice of the personnel changes.

In recent years, BAIC BJEV's management has been in a state of constant flux since the launch of the ARCFOX brand.

In 2020, Wang Qiufeng, a senior media professional known as the "Iron Lady" of the automotive industry, joined ARCFOX as Vice President and General Manager of Marketing. In 2021, Yu Liguo resigned amidst a public controversy, and Liu Yu took over as Chairman, while the "post-80s" Dai Kangwei became General Manager of BAIC BJEV.

However, in November 2022, Wang Qiufeng chose to leave, and by January 2023, Zhang Guofu had taken over as legal representative of ARCFOX from Fan Jingtao, marking the third change in ARCFOX's legal representative since 2020.

Taking into account Liu Yu's resignation, it is not difficult to see that ARCFOX's lackluster sales can be partially attributed to its unstable management, but this is only the superficial reason behind its poor sales performance.

Less Than 20,000 Sold in Half a Year, ARCFOX "Can't Afford to Fail"

Some might argue that ARCFOX's sales have been doing well recently. However, the official data tells a different story. In June, ARCFOX sold 8,000 vehicles, which seems impressive at first glance. However, comparisons can be revealing. For instance, "upstart" Seres sold over 44,000 new energy vehicles in June alone.

Expanding the scope to the overall new energy vehicle sales rankings, ARCFOX struggled to even crack the top 10 in June.

Further analysis reveals that ARCFOX sold 18,000 vehicles in the first half of 2024, representing a year-on-year increase of 110.24%. However, this growth is largely due to the overall expansion of the new energy vehicle market. In comparison, ARCFOX's sales for the entire half-year may not even match the monthly sales of many independent brands. Not to mention industry leaders like NIO, Xpeng, and Li Auto, even third-tier players like Zeekr and Leapmotor sold around 20,000 vehicles in June alone.

In contrast, ARCFOX's sales of 18,000 vehicles in half a year are truly disappointing.

Data Source: China Passenger Car Association, Automakers

Those familiar with BAIC BJEV's past know that for a long time, BAIC BJEV's BJEV brand was at the forefront of the new energy vehicle industry, and it was among the first domestic enterprises to develop electric vehicles. In 2018 and 2019, BAIC BJEV sold over 150,000 vehicles each year.

At that time, BYD and Tesla were "junior players" compared to BAIC BJEV, while NIO, Xpeng, and Li Auto were still struggling to survive, and the name Seres had not even emerged.

Unfortunately, BAIC BJEV failed to capitalize on its first-mover advantage, missing out on the best opportunity period. Subsequently, with the reduction of subsidies and the intensification of market competition, BAIC BJEV's market share declined rapidly.

In 2020, sales plummeted to just 26,000 vehicles, a fraction of the previous year's figure. It was at this point that BAIC BJEV began to vigorously promote the development of its new brand, ARCFOX, in an attempt to turn things around. However, as the saying goes, "Waste an opportunity, and you will be punished." ARCFOX's development has not been smooth, and its sales figures reflect that its products have not made significant inroads into the market.

Despite this, BAIC seems to remain ambitious about developing new energy vehicles. At the recent delivery ceremony for the first batch of ARCFOX Alpha S5 users, BAIC Group Chairman Zhang Jianyong stated: "BAIC will continue to invest over 100 billion yuan..." In his remarks, ARCFOX has become the "top priority" of BAIC's independent business, with the entire group committed to building the ARCFOX brand.

While such a statement is certainly inspiring, upon reflection, one wonders if a 100 billion yuan investment is truly feasible. It's worth noting that BYD's R&D expenses over the past five years have amounted to less than 80 billion yuan.

Lost 22 Billion in 4 Years, R&D Investment Decreased Instead of Increased

The reason for such doubts lies in the lack of confidence inspired by BAIC BJEV's financial performance over the years.

From a straightforward financial perspective, BAIC BJEV has been in the red for four consecutive years from 2020 to 2023, with losses of 6.48 billion yuan, 5.24 billion yuan, 5.47 billion yuan, and 5.4 billion yuan, respectively, totaling over 22 billion yuan in losses over four years.

Recently, on July 9, BAIC BJEV released its 2024 first-half performance forecast, predicting a net loss attributable to shareholders of listed companies of 2.4 billion to 2.7 billion yuan, and a core net loss of 2.45 billion to 2.75 billion yuan, representing an expansion of losses year-on-year.

While it is true that the new energy vehicle industry is still in a "money-burning" phase at this stage, this phase cannot last forever. Many new players have already seen the light of profitability and are gradually emerging from losses, while BAIC BJEV's performance continues to deteriorate. Moreover, even in the "money-burning" new energy vehicle sector, many manufacturers have achieved the desired results through their investments, such as NIO, Xpeng, and Li Auto, whose sales and brand building are on track.

In contrast, ARCFOX has "burned" over 22 billion yuan and sold less than 20,000 vehicles in half a year. How embarrassing!

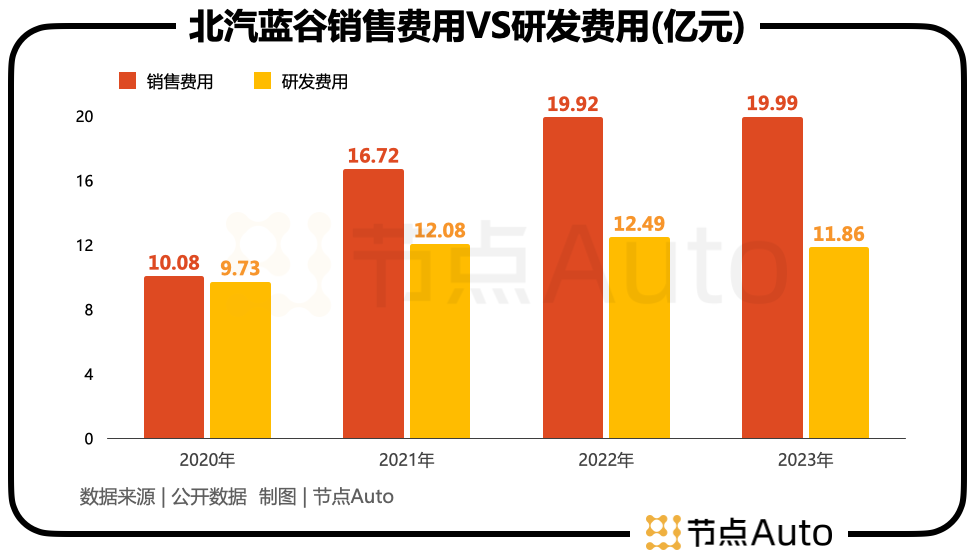

Moreover, Jie Dian Auto has found that among the years of heavy losses, ARCFOX's focus was not on R&D investment to build core competitiveness but on marketing and advertising. Annual reports show that BAIC BJEV's marketing expenses for 2020 to 2023 were 1.008 billion yuan, 1.672 billion yuan, 1.992 billion yuan, and 1.999 billion yuan, respectively, while its R&D expenses were 973 million yuan, 1.208 billion yuan, 1.249 billion yuan, and 1.186 billion yuan, respectively.

As competition in the new energy vehicle sector intensifies, all parties are "bloodthirsty" and eager to outpace their rivals technologically, leading to substantial investments in R&D. However, ARCFOX's R&D expenses are not only half that of its marketing expenses but have also decreased year-on-year. In contrast, BYD's R&D expenses are far higher than its marketing expenses, with growth rates exceeding 100% in the past two years.

What puzzles Jie Dian Auto even more is that despite the company's emphasis on marketing investment, with nearly 2 billion yuan spent annually, ARCFOX's sales and brand influence remain unimpressive. Given such an input-output ratio, even if BAIC Group Chairman Zhang Jianyong's pledge of a 100 billion yuan investment materializes, how much success can be expected?

It's worth reminding that BAIC is a state-owned enterprise with a solid foundation.

Yu Chengdong's Public Criticism: Can ARCFOX Still Rely on Huawei?

During Wang Qiufeng's tenure leading ARCFOX's marketing efforts, the brand's activities were once vibrant and colorful. For instance, ARCFOX served as the exclusive sponsor of Cui Jian's concert in April 2022, which attracted over 42 million viewers and over 100 million likes in the live streaming room, igniting ARCFOX's popularity. However, such popularity failed to translate into sales for ARCFOX.

In Jie Dian Auto's view, if ARCFOX were a fast-moving consumer good like mineral water, milk, or beverages, its brand popularity would likely drive sales. However, in the new energy vehicle market, consumers have longer decision-making cycles and are more rational. Even with high brand exposure, if the product's capabilities fall short, it will be difficult to truly motivate consumers to open their wallets.

Therefore, the root cause of ARCFOX's sluggish sales likely lies in its products.

This is not a baseless accusation by Jie Dian Auto. Last April, Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, and Chairman of the Intelligent Automotive Solutions BU, bluntly stated during the China Electric Vehicle 100 Forum: "The HI model is now limited to Changan Avatar, while GAC has abandoned it. ARCFOX (BAIC) has issues with product definition and competitiveness."

For a long time, ARCFOX and BAIC BJEV were favored by the capital market primarily due to their collaboration with Huawei. Therefore, Yu Chengdong's public criticism speaks volumes.

Yu Chengdong was not unjust in his criticism of ARCFOX. In late 2021, ARCFOX's flagship model, the Alpha S Hi version, experienced widespread delays in delivery, stretching from November that year to July 2022. Such delivery capabilities make it understandable why consumers might turn to other brands.

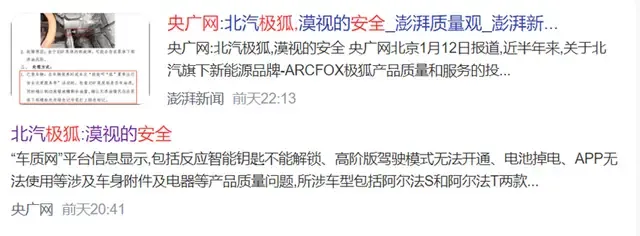

Furthermore, ARCFOX has also encountered product safety issues. In June 2022, media reports indicated that BAIC ARCFOX's after-sales service department issued a notice to service providers, warning of potential oil leakage risks in the ESP pump bodies of ARCFOX models due to internal faults in the ESP pump bodies.

Currently, the ARCFOX brand has launched three models covering sedans, SUVs, and MPVs, providing a comprehensive product lineup. However, in Jie Dian Auto's view, this product layout may also pose problems. The core issue lies in the overly broad scope, with unclear product positioning, making it difficult to concentrate resources and break through. In contrast, NIO precisely targets middle-class fathers, and its products revolve around this positioning, which has helped it gain traction.

In summary, behind ARCFOX's sluggish sales, marketing is not the primary reason; product quality is the key, as Yu Chengdong pointed out regarding "product definition and competitiveness." From an external perspective, if anyone can help ARCFOX out of its predicament, it would likely be Huawei.

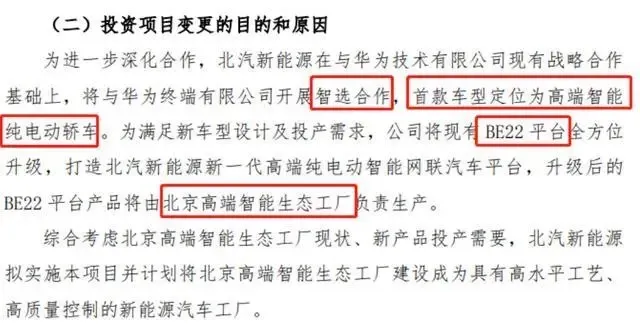

On August 14, 2023, BAIC BJEV officially announced its collaboration with Huawei on the Smart Selection model, previously adopting the HI model. Compared to the HI model, the Smart Selection model involves deeper involvement from Huawei, not only in product R&D and design but also in leveraging Huawei's sales channels.

Image Source: BAIC BJEV Announcement

Recently, the Enjoy S9, jointly launched by BAIC BJEV and Huawei, is about to be delivered, targeting the BBA segment and attracting high expectations from the outside world. It remains to be seen whether this 500,000 yuan price range product can make inroads into the market.

Currently, investors are even more concerned about rumors that Huawei will terminate its cooperation with BAIC BJEV starting next year, not only withdrawing from product R&D and design but also preventing the use of Huawei's sales channels. In response, BAIC BJEV stated: "The current cooperation is proceeding normally. If there are any changes, the company will disclose the information in accordance with laws and regulations. Please refer to the company's official announcements for accurate information."

In fact, the future of Enjoy remains uncertain, and ARCFOX, a brand that has been established for many years, seems to be drifting further away from Huawei. It remains to be seen how much resources and attention it will receive in the future.