The Battery Swapping Market Stirs Up Again: NIO and CATL's "Love-Hate Relationship"

![]() 07/24 2024

07/24 2024

![]() 545

545

Recently, NIO Power and Huawei HarmonyOS Smart Mobility officially announced a partnership in charging services, allowing HarmonyOS Smart Mobility users to locate and use NIO Power's charging stations nationwide through relevant applications, significantly enhancing charging experience and efficiency. Following Chang'an Automobile, Geely Automobile, FAW, and other automakers, another "potential stock" has joined NIO's battery swapping camp. However, NIO cannot let its guard down as Contemporary Amperex Technology Co., Limited (CATL), the leading player in the power battery industry, is accelerating its layout in the battery swapping business. Who will emerge victorious in the end?

Although the dividends of the battery swapping business are enticing, this race is fraught with challenges and uncertainties. Tesla, for instance, attempted to venture into battery swapping but was forced to abandon the effort due to incompatibility among different models and low operational efficiency. Currently, domestic new energy vehicle (NEV) manufacturers are flocking to the battery swapping track. Among them, NIO, as one of the pioneers, has built a considerable scale after four years of development. However, its battery swapping stations are still struggling financially, and NIO's battery swapping solution is not compatible with most vehicle models. CATL, which entered the battery swapping scene with great ambition, is bound to have an impact on NIO.

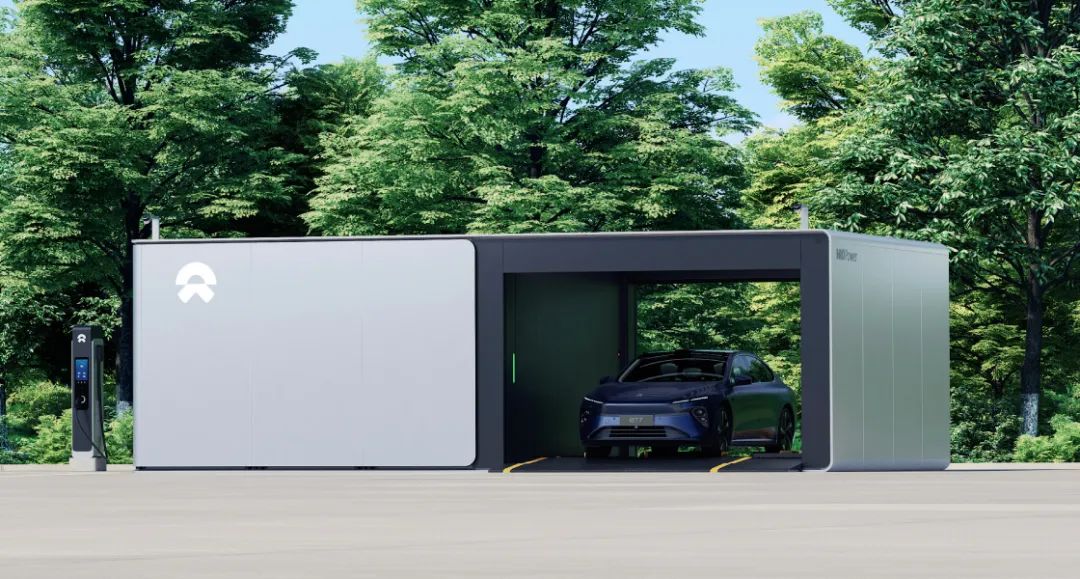

△ NIO has developed a considerable scale in the battery swapping sector

Each Has Its Strengths in Battery Swapping

NIO, which launched its battery swapping business in 2018, has achieved relative success in its layout. It has now covered 240 prefecture-level cities nationwide, with over 2,400 battery swapping stations, building the largest battery swapping network in China. Additionally, it has deployed 50 battery swapping stations in Norway, Germany, Denmark, Sweden, and the Netherlands. The influx of automakers into NIO's battery swapping alliance has accelerated NIO's development in this field, significantly reducing the cost of battery swapping infrastructure. For partner brands, joining NIO's mature battery swapping system is not overly complicated; they can achieve the latest battery swapping system by modifying their chassis based on NIO's provided dimensions, making it attractive for many automakers to collaborate with NIO.

CATL, on the other hand, officially entered the battery swapping market in 2022 with the launch of its EVOGO brand. Due to its late entry, CATL's battery swapping business scope is still limited, especially in terms of the number of charging stations, where it lags behind NIO. However, CATL's true strength does not lie in the quantity of battery swapping stations but in its superior battery performance as the leading player in the power battery industry.

At CATL's battery swapping brand launch event, its comprehensive battery swapping solution showcased the company's ambition. The "chocolate" battery, adopting CATL's latest CTP technology, boasts small size, high energy density, flexible combination, and minimalist design. A single "chocolate" battery can provide a driving range of approximately 200 kilometers. During the event, Chen Weifeng, General Manager of CATL's Energy Services, introduced CATL's new battery swapping station, which can store 48 chocolate battery blocks in an area the size of three parking spaces, with each battery block taking approximately one minute to swap, giving CATL a significant advantage in swapping speed.

△ CATL's battery swapping stations occupy a small area

Non-Conflicting Competitors

While NIO and CATL are both actively planning and deploying in the battery swapping sector, they are competitors. However, given their current overall development and the trends in the domestic battery swapping market, there is no direct conflict between them. CATL's late entry into the battery swapping race means it cannot compete with NIO in terms of charging station operations. A crucial factor driving CATL's entry into the battery swapping business is to boost power battery sales. If more automakers adopt battery swapping rather than simply purchasing and installing batteries, the demand for power batteries will naturally increase.

CATL's battery swapping business primarily adopts a rental model. It has previously established a joint venture with Didi to explore battery swapping models for the ride-hailing market, clearly targeting the ride-hailing and taxi businesses. NIO, on the other hand, focuses more on building a new energy vehicle ecosystem. On the one hand, it provides a dedicated charging network for NIO users to enhance product appeal and boost vehicle sales. On the other hand, it collaborates with other partners to create a multi-brand shared battery swapping network, primarily targeting household vehicles. For NIO, the primary reason for building battery swapping stations is to enhance its brand attractiveness. After all, it is fundamentally an automaker, and one of the reasons why its sub-brand Letao was well-received by consumers at its launch was its ability to share NIO's fourth-generation battery swapping stations. However, as NIO and CATL continue to expand their battery swapping businesses, they may eventually "clash head-on."

△ NIO's battery swapping business places greater emphasis on product appeal

Battery Swapping Market Heats Up

Both the expansion of NIO's "battery swapping alliance" and CATL's advancements in battery swapping blocks and stations will propel the battery swapping market forward. Currently, more and more domestic brands are beginning to layout battery swapping operations. Geely Automobile announced its battery swapping model in 2020, vowing to build over 5,000 battery swapping stations covering 100 core cities by 2025. BAIC BJEV and GAC Motor have also launched battery swapping services, though they lag behind NIO in scale and progress.

The battery swapping station model has effectively addressed the issue of slow charging speeds for NEVs. When consumers no longer need to wait in line, the advantages of NEVs will become apparent. On the one hand, the NEV market will experience further growth. On the other hand, standardized battery operations will elevate power battery companies like CATL to new heights.

△ NIO's "battery swapping alliance" continues to grow

Commentary

For NIO, entering the battery swapping business has been a difficult journey due to its costliness. Although the battery swapping alliance is growing, further reducing some of NIO's losses, the dividend period for the battery swapping business is far from arriving. It will take time for battery swapping standards to be unified and for automakers to join on a large scale, which may be too long for NIO.