Crazy new cars: 54 models in September, with an oil-electric ratio of 2:3, Model Y as the target

![]() 09/30 2024

09/30 2024

![]() 613

613

Gasoline cars are also going smart

Author|Liu Yajie

Editor|Qin Zhangyong

Perhaps every automaker has dreamed of an exciting National Day holiday filled with expectations.

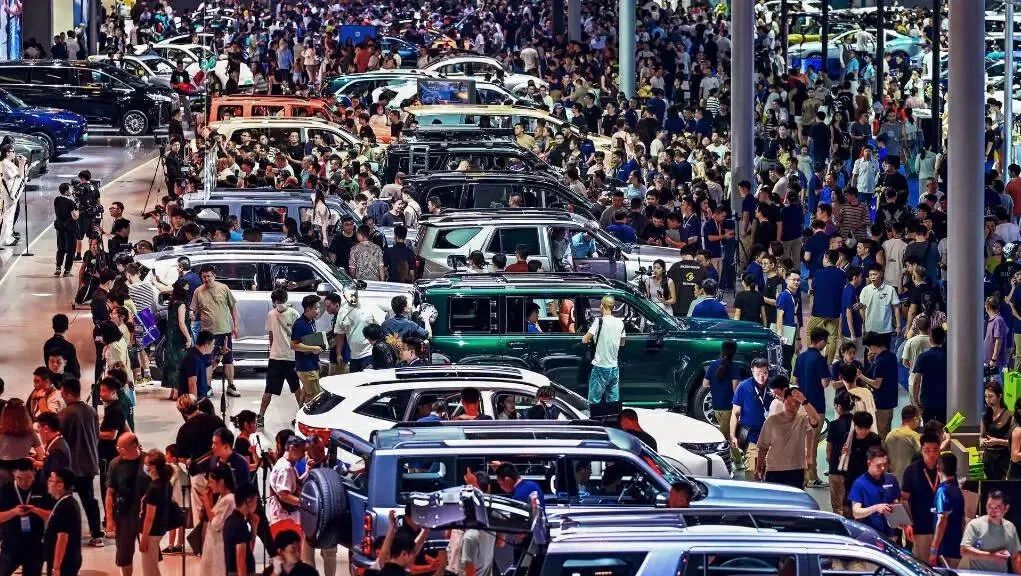

According to incomplete statistics from Chaodian Lab, as many as 54 new car models were launched or went on presale in September, catching up with the "auspicious day" with seven or eight new models being released within a single day.

Amidst the cacophony of various launch events, automakers not only vigorously promoted their technological advantages but also exhausted every means to garner attention, including inviting celebrity endorsements and staging lively performances. Of course, there were also new models quietly introduced without much fanfare.

Judging from the new cars launched in September, the ratio of new energy vehicles to gasoline cars was approximately 3:2, with new energy vehicles clearly experiencing a spurt of growth.

Data from the China Passenger Car Association (CPCA) shows that the domestic retail penetration rate of new energy vehicles has exceeded 50% for two consecutive months, aligning with the broader market trend at such a rapid pace of renewal.

However, beneath this seemingly booming market lies a harsh reality: the automotive industry has long surpassed the era of easy profits. Instead, under the relentless pressure of price wars, suppliers, dealers, and automakers alike are treading on thin ice.

The gasoline car market is becoming increasingly saturated, while the new energy vehicle sector is fiercely competitive. This forces all players to remain vigilant and proactive; otherwise, they risk being engulfed in the relentless competition.

01 Hybrid and pure electric vehicles coexist

While the new energy market is booming, hybrid vehicles are also experiencing significant growth. To ensure stability, over one-third of new models have opted to launch both pure electric and extended-range or plug-in hybrid versions.

Pure electric SUVs currently represent the most segmented market, and these products have unanimously targeted the same rival: Tesla's Model Y. However, judging from the attributes of these pure electric vehicles, their advantages are quite evident.

Take the NIO's second brand's first model, Letao L60, as an example. Its biggest advantage is its battery swap capability, which allows customers to lower the purchase threshold through the BaaS battery leasing program.

The base price of the entire vehicle is originally set at 206,900 yuan, with the long-range version priced at 235,900 yuan. However, if customers opt for the BaaS battery leasing service, the starting price drops to just 149,900 yuan.

Similarly, the ZEEKR 007X, which also targets the Tesla Model Y and the mid-size pure electric SUV market, boasts distinct features. With its "non-sloping" design, the ZEEKR 007X achieves a "cabin utilization rate" of over 83%, offering a spacious interior comparable to that of a Porsche Cayenne.

While primarily marketed as a family car, it is equally capable of tackling rugged terrain and even climbing desert dunes.

The ZEEKR 007X's intelligent driving capabilities are also noteworthy, featuring standard lidar and dual Orin-X chips, along with 31 perception hardware components. All models come equipped with the latest Haohan Intelligent Driving 2.0 system.

With over 58,000 orders received within just 20 days of its presale, the ZEEKR 007X's performance speaks for itself.

Meanwhile, Dongfeng Fengshen's L7 model, which launched its plug-in hybrid version in May, followed up with a pure electric variant in September. The pure electric version features the i-Talk voice control system, capable of executing eight commands within ten seconds, and is equipped with Qualcomm's Snapdragon 8155 chip.

Power-wise, it incorporates the industry's first "land, sea, and air" tri-mode tested Mahle battery and the Dongfeng Mahle E iD3-160 electric drive system, which shares technology with Lantu and Maxus.

This system utilizes an ultra-integrated flat wire motor with a maximum power of 160kW, peak torque of 310N·m, and a 0-100km/h acceleration time of around six seconds. Paired with a 62.3kW·h battery pack, it offers a CLTC pure electric range of 518km.

Now, let's shift our attention to plug-in hybrid models.

The official price range for the Denza Z9 GT is 334,800 to 414,800 yuan. Despite this pricing, the initial batch of Denza Z9 GT sold out almost immediately.

As the first product from the Yi Sanfang platform, the new car boasts three independent electric motor drives and rear-wheel dual-motor independent steering technology, enabling extreme turning, compass-style U-turns, easy three-way parking, stability enhancement on low-friction surfaces, and crab-like movement. These features have attracted many BMW, Benz, and Audi owners.

Domestic automakers are not alone in this race; joint ventures are also striving to keep up.

The Mazda EZ-6, a product imbued with high hopes by Changan and Mazda, utilizes Changan's tri-electric technology and architecture comprehensively, making it the only B-segment model in the joint venture market to offer both pure electric and extended-range platforms.

Unlike some joint ventures that take a half-hearted approach to electric and intelligent vehicle development by simply converting gasoline models to electric ones, the EZ-6 boasts features like zero-gravity seats, an electric spoiler, and electric sunshades, all of which are unprecedented in Mazda's manufacturing process.

02 Gasoline cars are also going smart

The gasoline car market has also undergone significant changes. While many of the newly launched models still belong to joint ventures, they are indeed embracing intelligence.

Take the all-new Passat Pro from SAIC Volkswagen as an example. This new model not only integrates the IQ. Pilot intelligent driving assistance system, developed in collaboration with Zhide Technology (formerly DJI Auto), supporting L2++ level driving assistance functions, but also features the IQ. Drive parking assistant. In addition to supporting parallel and perpendicular parking, it also offers memory parking capabilities.

In terms of functionality alone, it may not quite match the city navigation capabilities of leading new energy vehicle brands. Features like lane change assistance and memory parking, while not the latest technologies, are still capable of covering most urban driving scenarios.

Furthermore, the Passat Pro incorporates Baidu's Wenxin ERNIE Bot AI model, introducing the "vehicle-mounted large language model" to its cockpit for the first time. The infotainment system is powered by Qualcomm's 8155 automotive-grade chip.

While newer new energy vehicle brands often opt for the higher-end 8295 chip, this represents a significant step forward for joint venture gasoline cars.

Similarly, the new Toyota HARRIER from FAW Toyota is equipped with the L2-level Toyota Safety Sense driver assistance system, encompassing functions such as lane departure warning, forward collision warning, automatic emergency braking, lane keeping assist, and full-speed adaptive cruise control.

As a veteran Chinese automaker, Great Wall Motors has been developing new energy vehicles while also embracing intelligence in its gasoline car lineup. The Haval H9 has lowered its price threshold to below 200,000 yuan for the first time.

Building upon the success of the first-generation Haval H9, the second-generation model now features an L2-level driver assistance system, encompassing 13 functions including ACC full-speed adaptive cruise control, ICA intelligent cruise assist, forward collision warning, blind spot monitoring with lane change assist, and more. It also comes with features like one-touch remote start, smartphone app remote monitoring, 540-degree panoramic view, panoramic fusion parking, and FOTA upgrades.

Chery Automobile is even more aggressive, launching both a gasoline and a plug-in hybrid version of the Tiggo 8 PLUS in September. The plug-in hybrid model specifically targets the Song L DM-i and Leapmotor C10.

Just 15 days later, the Tiggo 9 gasoline and electric dual-model lineup was also unveiled. The 2025 Tiggo 9 gasoline version is powered by a 2.0T engine paired with an 8AT/7DCT transmission, delivering a maximum torque of 400N·m and featuring an L2.5-level intelligent driving assistance system with 21 functions. Coupled with IPB intelligent brake-by-wire technology, it achieves a rapid braking response of 0.15 seconds, reducing the braking distance by one meter.

It also boasts a zero-gravity co-pilot seat, an 8155 chip, and adopts hardware seen in new energy vehicles, such as a 24.6-inch ultra-smooth curved screen and a 50-inch AR-HUD.

With its dual focus on gasoline and plug-in hybrid models and a steady stream of new launches, Chery's Tiggo lineup appears poised to win with a "sea of cars" strategy. However, with minimal price differences between the Tiggo 8 PLUS and Tiggo 9, there's a risk of internal competition.

03 Pronounced polarization

Generally speaking, September and October are peak sales months for the automotive industry. Apart from diverse promotional activities by automakers, national and local governments also introduce policies to stimulate automobile consumption and facilitate industrial transformation and upgrading during these months.

For instance, since the end of August 2024, multiple regions have announced updated vehicle trade-in policies, offering subsidies of up to 20,000 yuan per vehicle. On August 30, Chengdu announced an investment of 100 million yuan to launch its third round of automobile consumption incentives, coinciding with the 27th Chengdu International Automobile Exhibition.

According to the latest data from the CPCA, the narrow passenger vehicle retail market is expected to reach approximately 2.1 million units in September, representing a year-on-year increase of 4% and a month-on-month increase of 10.1%. Among them, new energy vehicle retail sales are projected to reach around 1.1 million units, up 47.3% year-on-year and 7.3% month-on-month, with a penetration rate of approximately 52.4%.

Despite the overall positive market outlook, the price war continues, and the intensely competitive market environment is unlikely to change in the short term. While many new models are being launched, only a select few are likely to generate significant profits.

This polarization is particularly evident in the new energy vehicle sector.

Leading automakers, with their large scale and ample funding, can devote more resources to research and development of key technologies and parallel development of multiple product lines. In contrast, smaller automakers may struggle to withstand risks and could easily collapse with a single misstep.

For example, BYD launched four new models this month, while some other companies may have to put all their eggs in one basket.

Moreover, judging from the selling points of these new cars, the threshold for intelligence in China's new energy vehicle market is decreasing, and the concept of technology equality is becoming increasingly tangible. Prices in various market segments are also plummeting.

The Baojun Yunhai, priced at just 100,000 yuan, comes standard with advanced intelligent driving features. Its Lingmou Intelligent Driving 2.0 Max system, co-developed by Baojun and Zhide, is the first end-to-end model to be mass-produced within the 150,000 yuan price range.

Another trend in the new energy vehicle market is the introduction of intelligent and electric entry-level models.

The Wuling Bingguo SUV five-seater variant is equipped with the Ling OS intelligent infotainment system. Its electric motor boasts a maximum power of 75kW and peak torque of 180N·m. According to official data, it consumes just 10.1kWh of electricity per 100 kilometers. Its DC fast charging can replenish its battery from 30% to 80% in just 30 minutes and is compatible with household 220V/10A sockets. As a pure electric SUV, its high-end variant offers a range exceeding 500km.

Similarly, the Geely Xingyuan is poised to become a formidable competitor to models like the BYD Yuan UP and Dolphin.

Furthermore, many pure electric SUVs have explicitly targeted the Tesla Model Y, suggesting that this segment is poised for intense competition in the near future.

There are also numerous new gasoline car models, particularly from joint ventures like Toyota and Honda. Amidst setbacks in their electric vehicle strategies, these brands are attempting to salvage their losses in the Chinese market with their gasoline cars, which still dominate the domestic market.

Well-established gasoline car brands continue to enjoy significant advantages.

Japanese brands like Toyota RAV4, Toyota HARRIER, Honda Vezel, and Nissan Teana, as well as European and American brands like Ford and MG, and even luxury brands like BBA and Cadillac, are all vying for attention, hoping to reignite consumers' desire for traditional brands through their premium offerings.

However, the reality is harsh: the trend towards electric and intelligent vehicles is irreversible. Regardless of whether it's gasoline or electric, only a handful of leading brands are currently recognized, and the Matthew Effect is becoming increasingly pronounced. Overthrowing the sales leaders is no easy feat.