Is Huawei harvesting the National Day auto market again?

![]() 10/08 2024

10/08 2024

![]() 441

441

From the outside, Huawei seems to have the best luck among Chinese enterprises, so it turned the tables again against the wind.

"Haha, we now like to work overtime during holidays," Liu Xingang said. Whether his statement represents the state of most salespeople within Huawei's HarmonyOS Smart Mobility system is unknown. However, there is no doubt that as an enterprise that has rapidly gained popularity in China's auto market over the past three years, Huawei is the best at harvesting sales during statutory long holidays.

Some attribute this to good luck, while others attribute it to strong capabilities. Nevertheless, during the 2024 National Day holiday, Huawei once again replicated the rise and popularity of the AITO M7 in 2023, with the protagonist this time being the newly launched AITO R7 at the end of September.

During the National Day holiday from October 1st to October 3rd, HarmonyOS Smart Mobility received over 12,000 firm orders, with 4,200 for the AITO R7 and over 3,400 for the AITO M9.

The reason why it is said to have good luck is that the AITO M7 coincided with the release of the MATE60 phone, which broke through the chip blockade and attracted customers. Similarly, during the 2024 National Day holiday, the release of the AITO R7 coincided with multiple bonuses in the capital market, starting with the reduction of mortgage interest rates, releasing RMB 150 billion in repayment space, followed by a surge in the stock market, prompting many people to invest their profits in consumption, whether it be real estate or automobiles.

In the 2024 National Day auto market, Huawei once again completed its harvest.

Although the AITO M7 did not experience the same situation as during the 2023 National Day holiday, where test drives had to be booked two days in advance or customers had to queue up, there were always many people surrounding the AITO R7 in HarmonyOS Smart Mobility stores. Similarly, there were also many people around the AITO M9 five-seater version, which has been on the market for some time and exudes a sense of pursuing Rolls-Royce luxury.

Will the orders for the AITO R7 exceed those for the AITO M7 in 2023? The answer is that there is a chance.

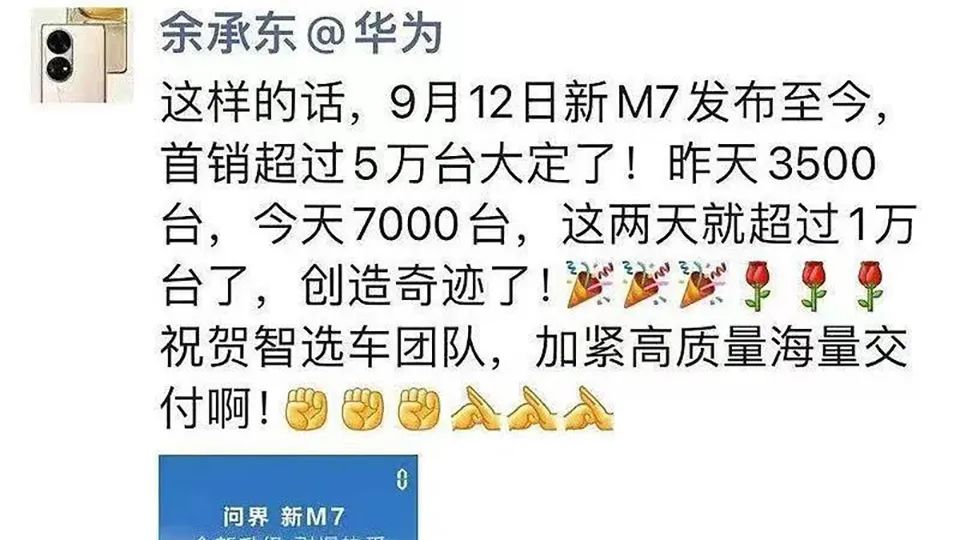

In 2023, the AITO M7, hailed by Yu Chengdong as a turnaround success, delivered a sales performance of over 50,000 firm orders from its release on September 12th to October 7th. Among them, 3,500 firm orders were placed on October 5th, and 7,000 on October 6th.

The AITO R7 naturally has a chance to match this sales performance, as it secured 2,000 firm orders on September 28th, just before the official start of the National Day holiday.

It can be said that most automakers will benefit from the National Day auto market this year due to the upturn in the economy. However, there are several characteristics exhibited by Huawei's HarmonyOS Smart Mobility that deserve deeper consideration, as they may change the subsequent marketing strategies of automakers.

Firstly, behind the surge in orders, the AITO R7 was launched at a time when multiple SUV models were being released to compete with the Tesla Model Y, including the Letao L60, ZEEKR 7X, AVATR 07, and IM MOTORS LS6, all of which had similar dimensions, range, and configuration levels. Amidst the chaos in the automotive industry, the AITO R7's advantages were not particularly significant. In terms of price, it was the most expensive, with the entry-level model starting at RMB 249,800, and the most expensive top-spec model approaching RMB 350,000. In terms of benefits, it was not the most generous, for example, in terms of gifts, the last-released IM MOTORS LS6 offered optional equipment worth RMB 48,800, as well as a RMB 2,000 deposit bonus that could be used to offset RMB 25,000 of the final payment, effectively reducing the price by RMB 23,000.

As a result, the AITO R7 was not particularly prominent in the early order battle reports.

ZEEKR 7X secured 10,000 firm orders within 72 hours.

AVATR 07 received 11,600 firm orders within 20 hours.

IM MOTORS LS6 received 6,000 firm orders within 12 hours.

The AITO R7, on the other hand, received 6,000 firm orders within 24 hours.

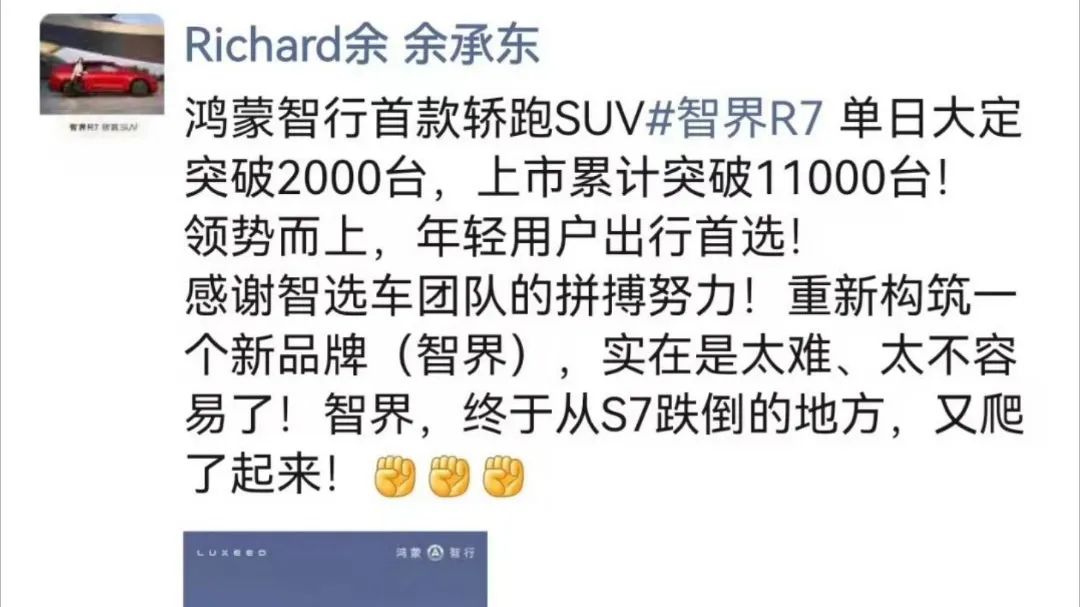

However, the subsequent growth of AITO R7 orders was quite astonishing, reaching 11,000 after just one Saturday.

There were two key factors behind this growth. Firstly, at the time of Huawei's autumn new product launch conference, the nationwide availability of the AITO R7 was still relatively low, and most of the initial buyers were die-hard Huawei fans who believed in the brand and placed orders even without seeing or touching the car. Secondly, after its launch, the AITO R7 received a large amount of consumer feedback and quickly adjusted its purchase benefits. Originally, the AITO R7 offered benefits worth RMB 30,000 to RMB 35,000 upon launch, including RMB 12,000 in optional equipment funds that could be used to purchase appearance, interior, and wheel upgrades, but not including relatively high-demand, high-popularity configurations such as batteries. Moreover, the zero-gravity seats were included as a gift, leaving only the Smart Technology Package as the only purchasable benefit.

The drawback was that if customers opted for the MAX or ULTRA models, especially the popular MAX version, and did not choose to upgrade the appearance or interior, the purchase benefits would be rendered useless. However, HarmonyOS Smart Mobility made timely adjustments, allowing customers to upgrade their optional equipment funds and increase battery capacity from 82 kWh to 100 kWh. In summary, to boost sales, the equivalent of an additional RMB 12,000 discount was offered. In terms of product strength, coupled with Huawei's full efforts, the AITO R7 boasts a fully loaded Huawei Intelligent Driving Solution ADS 3.0, a fully loaded HarmonyOS intelligent cockpit, and the ADS 3.0 Kunlun intelligent driving system, as well as the world's first downhill cruise control technology.

In fact, it was not unexpected that the AITO R7 sold well, given the recent surge in stock prices and the underlying economic stimulus policies.

In comparison, the details are worth learning from within the industry. Currently, among automakers that can adjust their strategies at the same pace as Huawei's HarmonyOS Smart Mobility, there are only a handful, including Tesla, BYD, NIO, and Geely.

Among them, NIO, which directly competes with HarmonyOS Smart Mobility, is now adjusting its sales strategies on a weekly basis. While maintaining a direct sales system, each sales region can formulate its own sales policies based on actual conditions. Meanwhile, NIO's intelligent driving technology has advanced to VLM+ end-to-end, enabling it to catch up with Huawei in terms of marketing perception.

Who else is harvesting the auto market during the holidays?

Upon further examination of the current automaker landscape, there are still many automakers that can capture holiday bonuses.

Foremost among them is the Tesla Model Y, which has effectively defused the competition posed by several similarly priced and more competitive models without much fanfare.

On September 26th, after announcing the pricing and benefits of its new locally produced SUV, Tesla extended its limited-time offer of 0% interest for five years on select models on September 27th. For those seeking the lowest possible entry threshold, the minimum down payment for the Model 3 and Model Y is just RMB 45,900. For more typical financing options, the minimum down payment is RMB 79,900, with monthly installments starting at around RMB 2,550.

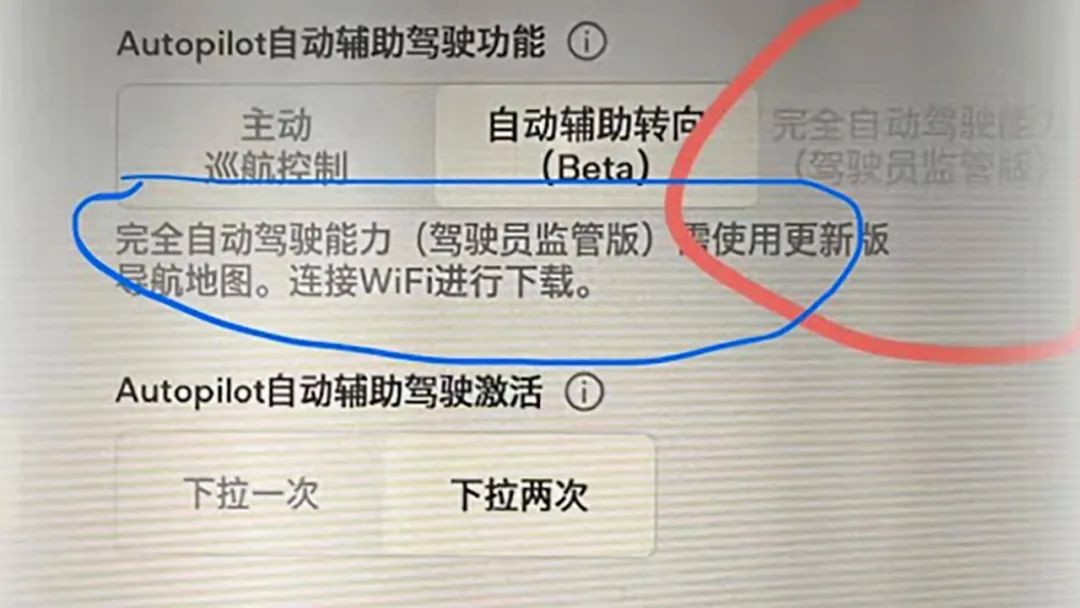

Whether or not the siege of the Model Y will be successful remains to be seen. After all, Tesla's Full Self-Driving (FSD) capability is awaiting approval and is expected to be rolled out in the first quarter of 2025, potentially at a price comparable to that of domestically produced vehicles, which could breathe new life into the Model Y. Following that, the introduction of new generations of the Model Y and lower-priced models can be anticipated.

BYD is also among the beneficiaries, with a strategy that differs from that of new-energy vehicle startups. BYD opts for price reductions, increased configurations, and financial incentives.

Throughout September, BYD introduced a large number of new vehicles to the market, such as the 2025 Han, which features a standard five-link rear suspension, the fifth-generation DM system, and optional LiDAR. After the upgrades, the price was reduced by RMB 4,000. Similar logic was applied to the Song Pro DM-i and Sea Lion 05 DM-i, which were priced RMB 3,000 lower than their 2024 counterparts and featured increased configurations and the fifth-generation DM system.

Moreover, BYD is further tapping into popular trends. Rumors about the pricing of its upcoming MPV have emerged in 4S stores, suggesting a possible price range of RMB 289,800 to RMB 350,000 with a RMB 2,000 deposit. This figure is likely higher than the official price and is accompanied by six major selling points, including the fifth-generation DM technology, a new-generation plug-in hybrid platform, a C-NCAP five-star crash rating, the Dragon Face design, the DiPilot intelligent driving system, and versatile interior space.

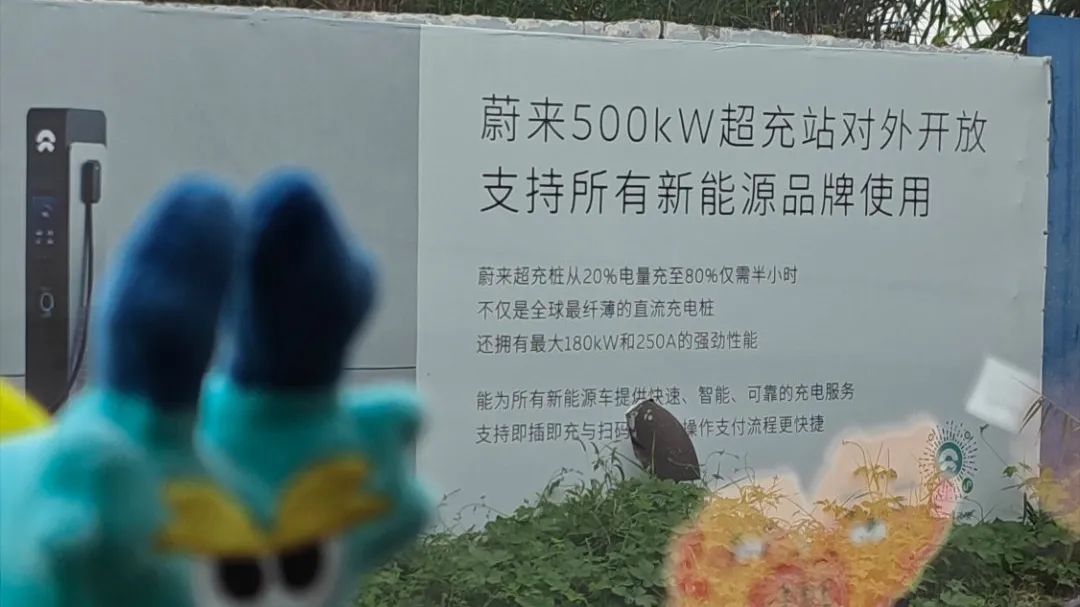

NIO's approach during the National Day holiday was similar to that of HarmonyOS Smart Mobility during previous holidays. The company fully promoted its end-to-end high-level intelligent driving capabilities and actively invited consumers for test drives, aiming to instill in them a perception similar to that of Huawei's ADS 3.0. Additionally, NIO shifted its charging network strategy, abandoning the previous 2C+5C charging pile layout in favor of an all-4C+5C combination going forward. In short, after setting competitive prices, NIO avoided stimulating existing customers with price cuts and instead focused on attracting customers through intelligent driving and charging capabilities.

Geely increased the trade-in subsidies offered during the National Day holiday. The current national subsidy policy offers RMB 15,000 for fuel-powered vehicles and RMB 20,000 for new energy vehicles. Geely topped up its own funds, offering trade-in subsidies starting at RMB 30,000 for its mainstream models and up to RMB 47,000 for new energy vehicles.

Apart from these typical automakers that made swift adjustments, there were not many others that made significant moves.

For example, NIO expanded its charging network along the Beijing-Tibet Expressway's Beijing-Mongolia section and in the Central Yunnan urban agglomeration ahead of the National Day holiday. Chery launched the new Tiggo 8 PLUS before the holiday, providing a certain stimulus. Changan adopted a similar strategy, opening reservations for the all-new, highly anticipated Qiyuan A07, which comes with a gift package worth RMB 45,000. Great Wall Motor launched the second-generation Haval H9 and was busy with the delivery of the new WEY Blue Mountain models.

However, besides these, most automakers rarely have clear official actions.

Zero Run has no actions; Xiaopeng offers a blind box with the highest prize of an iPhone. The same is true for joint venture brands. The stores can offer slightly larger discounts, but not the companies as a whole. Traditional luxury brands are slightly better. For example, BMW has released the price of the second revision of the 3 Series and also revised the BMW i3. The price of the 330Li has dropped directly to the pricing range of the old 325Li, while the i3 has added many smart configurations. The final prices are that the new BMW 3 Series has dropped to 319,900-399,900 yuan, and the new BMW i3 continues to be priced at 353,900-413,900 yuan.

Cadillac is the same. Before the National Day holiday, it completed the launch of the new Cadillac XT5, with a one-time price reduction to 265,900-335,900 yuan for a limited time, which is more than 120,000 yuan lower than the pre-sale price. However, facing the continuous decline of BBA, although Cadillac offers a one-time price, many people still expect further price reductions before making a purchase.

In fact, it can be seen from all the above changes that in the rapidly transforming Chinese automotive market, only a few people have quickly figured out the new way to play, rather than sticking to the original way. Speaking of this, we have to mention the topic that joint venture brands need to negotiate with both shareholders, as well as the topic that many non-founder enterprises have a large system and slow transformation.

Last Words

In short, more new perceptions are gradually forming for Chinese automotive consumers.

Changes include the fact that the end of the year may not necessarily be a critical moment for price reductions of many mainstream cars, but rather shifted to major and minor holidays. It also includes the fact that more and more leading automakers have responded so quickly that they have kept up with the pace of the mobile internet, but most automakers still need to learn from Huawei.