"Sales are too 'crazy cow', which car companies are 'open on National Day'?"

![]() 10/08 2024

10/08 2024

![]() 591

591

The stock market results for September 30 are out, setting multiple historical records.

In the first half-hour of trading, the trading volume of the two markets exceeded 1 trillion yuan, and in half a day, it exceeded 2 trillion yuan. At the close, it was 2.6 trillion yuan, far exceeding the peak record of historical bull markets and about five times the trading volume a week ago.

The broad market rose by 8%, stabilizing above 3300 points, and the ChiNext rose by 15%. There were thousands of stocks trading at the daily limit in the two markets. Today, under healthy exchange system conditions, it is impossible to buy stocks with money, and the daily limit situation continues to overflow, leading to all stocks trading at the daily limit in the end.

The Shanghai Composite Index rose by 10% in a single day, the Shenzhen Component Index rose by 10.67%, and the ChiNext Index rose by 15.36%. Almost all stocks traded at the daily limit.

Yes, this is a bull market, and it's a crazy bull market, but it's gone too far.

Anyone with even a basic understanding of the stock market knows how absurd this kind of gain is.

Even more absurdly, this bull market in stocks has also infected new energy vehicle sales released on October 1.

Indeed, judging from the specific sales data, the share of domestic new force sales has also increased alarmingly. The best-selling brands are naturally BYD, Lixiang, Leapmotor, Xpeng, and NIO.

In September, BYD exceeded 410,000 units in a single month; Lixiang Auto's monthly delivery volume returned to 50,000 units, reaching 53,709 units, an increase of 48.9% year-on-year and 11.6% month-on-month. Eight new forces exceeded 20,000 units, namely NIO, Xpeng, Lixiang, Aion, Leapmotor, Deep Blue, and ZEEKR.

From the perspective of new energy penetration, the head effect of brands is becoming more apparent. Notably, the luxury attributes of Lixiang, NIO, and Wenjie Wenjie are gradually winning over consumers. In September, their weekly delivery volumes surpassed those of the three traditional luxury brands of Mercedes-Benz, BMW, and Audi multiple times.

For a detailed sales analysis, please see below...

01

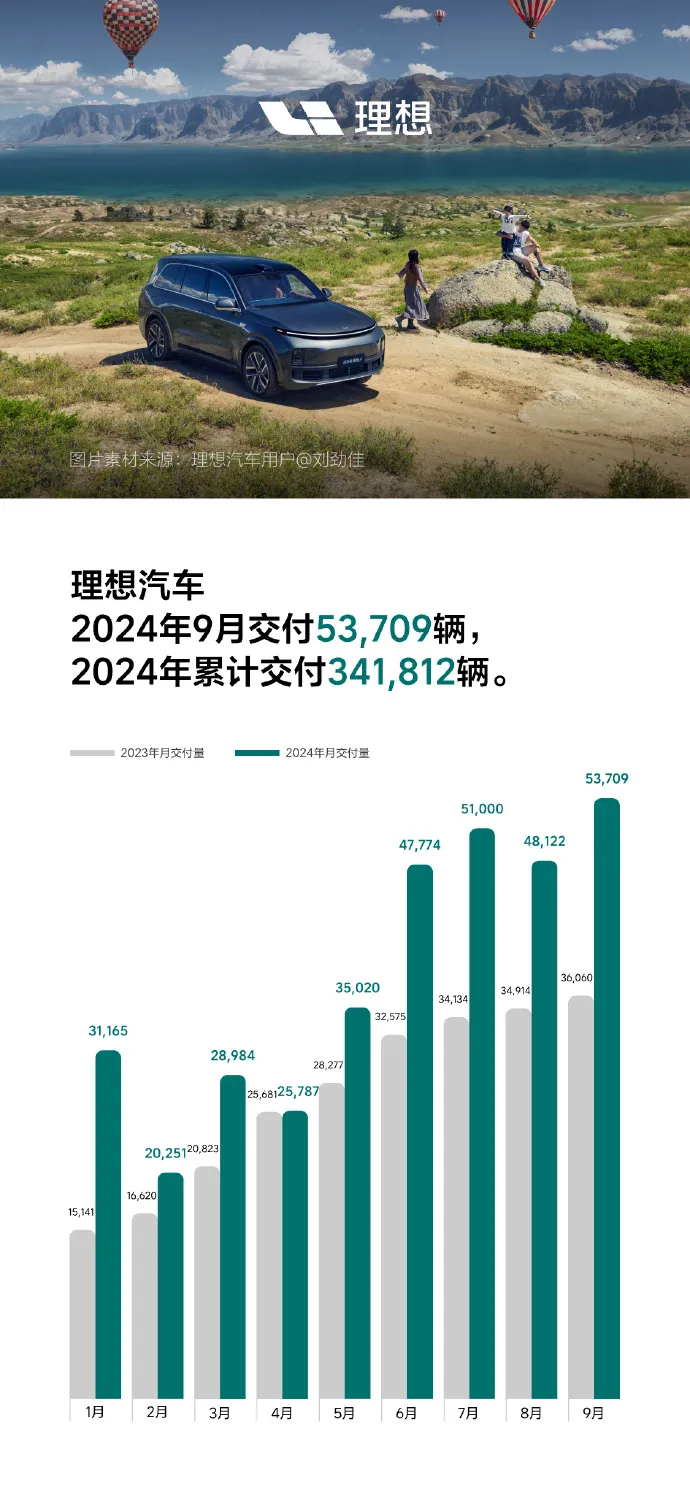

Lixiang: 53,709 vehicles delivered in September

Early this morning, Lixiang Auto announced its monthly sales. In September, sales exceeded 50,000 units, setting a new record for monthly deliveries, totaling 53,700 units, or about 5,600 more than the previous month.

And officially, in the third quarter of 2024, Lixiang Auto delivered 153,000 vehicles, a year-on-year increase of 45.4%. In the new energy vehicle market above 200,000 yuan, Lixiang's market share has exceeded 17%, ranking first among Chinese automobile brands in sales.

02

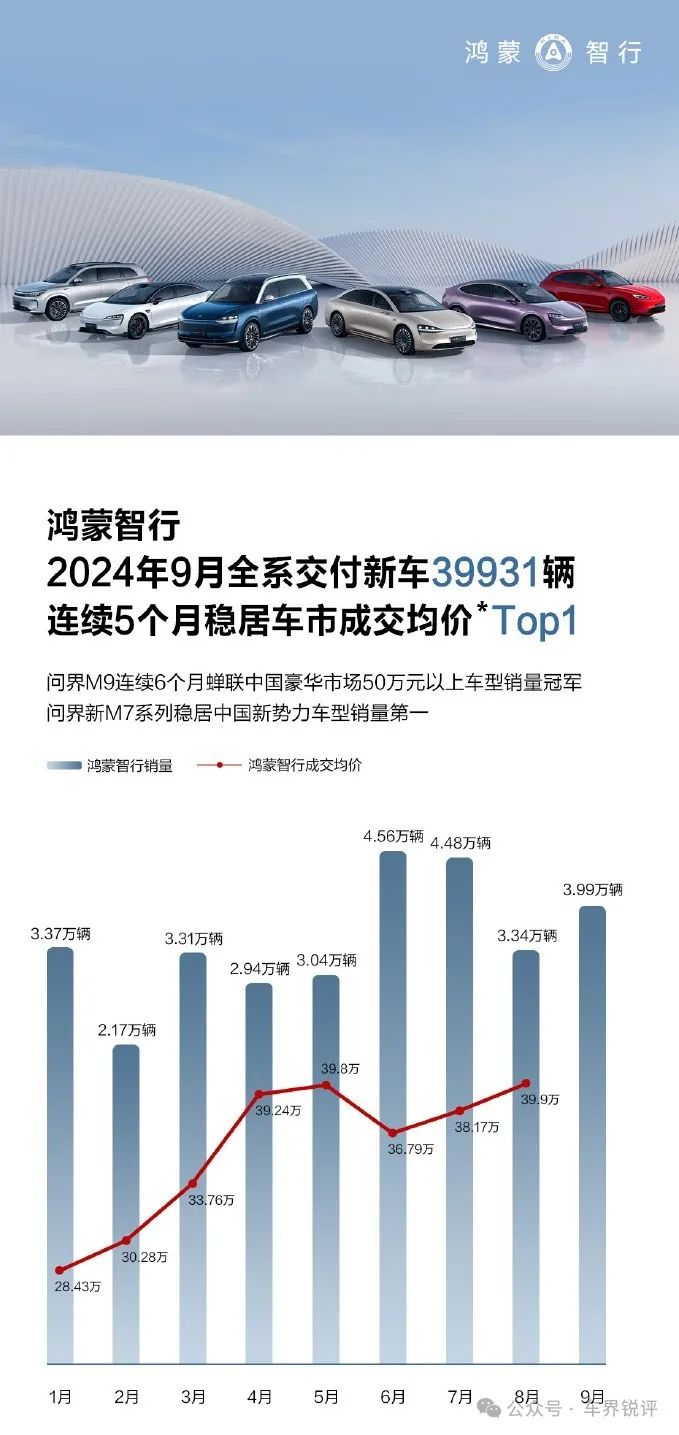

HarmonyOS Intelligent Mobility: 39,931 new vehicles delivered in September, topping the high-end market's average transaction price for five consecutive months

In September 2024, HarmonyOS Intelligent Mobility delivered 39,931 new vehicles across its entire lineup. The AITO Wenjie series delivered 35,560 new vehicles in September. Among them, the Wenjie M9 series delivered 15,496 units, the new Wenjie M7 series delivered 16,805 units in September, and the panoramic smart flagship sedan Xiangjie S9 delivered over 2,169 units.

03

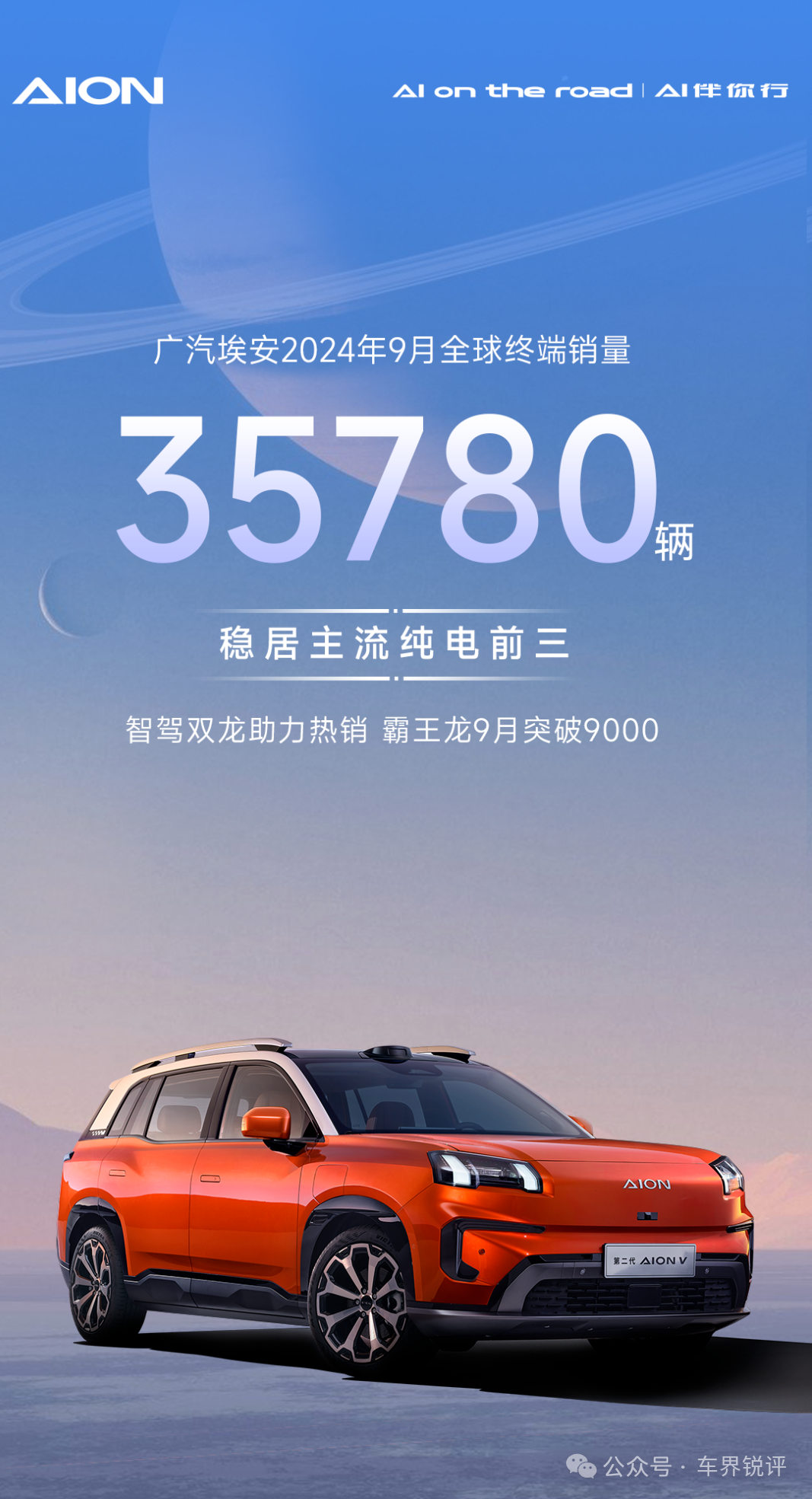

Aion: 35,780 terminal sales in September

GAC Aion sold 35,780 global terminal vehicles in September, firmly ranking among the top three mainstream pure electric vehicles.

I wonder if Aion's second global model, the AION RT, which was launched at a low price on September 26, will affect GAC Aion's October sales.

04 Leapmotor: 33,800 vehicles delivered in September

Leapmotor once again broke its historical sales record in September, delivering 33,800 vehicles, a year-on-year increase of over 113% and a month-on-month increase of 12%. Sales remained among the top five new force automakers.

Meanwhile, according to a car blogger on Weibo, Leapmotor C10/C16/C11 orders accounted for 80% of total orders in September, indicating that the combination of affordable pricing and extended-range technology has enabled Leapmotor to successfully capture the low-cost market niche left by Lixiang Auto.

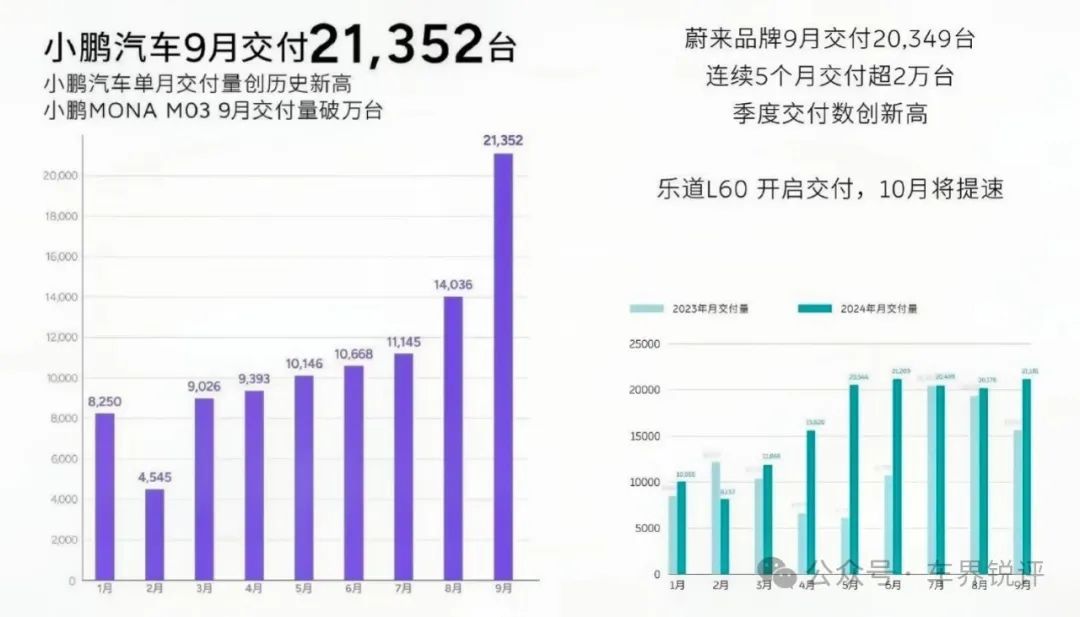

05 NIO: 20,349 new vehicles delivered in September; Xpeng sales exceeded 21,352 units

The biggest highlight of the September sales rankings was Xpeng and NIO's turnaround with the MONA M03 and LeDao L60.

Xpeng sold over 21,000 units in September, setting a new monthly delivery record, with a year-on-year increase of 39% and a month-on-month increase of 52%. In the first nine months of 2024, Xpeng delivered a cumulative total of 98,600 new vehicles, a year-on-year increase of 21%.

Furthermore, Xpeng Chairman and CEO He Xiaopeng announced on Weibo that Xpeng MONA M03 deliveries exceeded 10,000 units, describing it as the "fastest delivery speed for a new model from a new force automaker."

NIO also performed impressively in September, delivering a total of 21,18 units. Among them, NIO's main brand delivered 20,349 units, a year-on-year increase of 30.1%, marking the fifth consecutive month of delivering over 20,000 units per month.

Additionally, LeDao L60's first performance report, calculated from September 28th, showed deliveries of 832 units in three days, with an average daily delivery rate of nearly 280 units, matching Li Bin's mention of delivering 20,000 units in three months.

06 Xiaomi and Nezha sales also exceeded 10,000 units in September, with Xiaomi thriving overall and Nezha facing an uncertain outlook

Nezha Auto delivered 10,118 vehicles across its entire lineup in September. Meanwhile, the first Nezha X rolled off the production line at its Indonesian factory, and the first batch of 500 owners received their vehicles.

In addition, Xiaomi Auto continued to deliver over 10,000 vehicles in September. More importantly, the official poster set October production and delivery targets at 20,000 units, indicating that Xiaomi Auto's factory is continuing to ramp up production and rush to meet delivery commitments.

Lei Jun also revealed in a CCTV news studio broadcast this afternoon that Xiaomi will deliver 20,000 vehicles in October.

07

JiYue: 2,605 vehicles delivered in September

Xia Yiping, who shed tears at the Chengdu Auto Show, finally managed to sell over 2,000 JiYue vehicles in September.

I wonder how much the 300 million yuan spent on the "moving the A-pillar back 6.5 cm" project contributed to JiYue's sales?

Sometimes I wonder who buys the rebadged Zeekr 007 with Baidu's system. Are they all harvesting Baidu fans and Li Yanhong fans?

08

Second-generation automakers: Collective stability, with Hovan breaking through 10,000 units under Huawei's support

Second-generation automakers, including Lanwei, Zeekr, Hovan, AVATR, and IM Motor, have relatively stable sales collectively, but they are also under significant pressure from the second brands of new forces.

However, compared to August sales, Hovan achieved a breakthrough of 10,000 units under the support of the all-new Dreamer, which is commendable. It is worth mentioning that Hovan's new pure electric SUV model, the Hovan Zhiyin, will be officially launched on the 13th of this month, with a current pre-sale price ranging from 209,900 to 266,900 yuan.

In terms of traditional automakers and joint ventures, among those that have released sales data so far, BYD leads with 419,400 units; Chery Auto sold 244,500 new vehicles in September, and Geely Auto sold 170,400 units. However, as of the time of writing, Great Wall Motor has not released specific sales figures, and it is highly likely that they did not exceed 100,000 units, essentially falling behind compared to BYD, Geely, and Chery.

09 Summary: The wealth gap among domestic brands is gradually widening

Looking at the recent surge in the stock market, it feels like good news keeps coming, but has it risen too much to be healthy? The same question applies to the new energy vehicle market, especially as anxiety among automakers is increasing daily.

For example, September 26th may have been an ordinary workday for many people, but for those in the automotive industry, it was certainly an unusual day. According to incomplete statistics, in addition to the more significant launches of AVATR 07 and IM Motor's all-new LS6, at least a dozen new models were launched on this day, including the new Lynk & Co 06, Aion's AION RT, Dongfeng Fengxing Xinghai S7, Changan Qiyuan A07, and even Xpeng G9 added a new 650 AWD High-Performance Pro version.

In fact, it wasn't just September 26th; the entire month of September was permeated with a strong wave of new product launches in the automotive industry. Major brands such as HarmonyOS Intelligent Mobility, Geely, NIO, and BYD launched significant new products one after another, with roughly over 50 new models released throughout the month.

So many new models coming out in clusters shows how brutal and fiercely competitive the entire market is, and one slip-up could easily result in losing sight of niche markets.