Is impulsive car consumption during National Day holidays a money-losing proposition?

![]() 10/09 2024

10/09 2024

![]() 686

686

As the National Day holiday approaches, automakers traditionally enter a period of fierce competition for sales. Unlike previous years, 2024 may see a divergence in opinions between Li Bin and He Xiaopeng.

Li Bin stated at the Letao L60 communication meeting that it is an objective law that no global automaker has been able to achieve a high level of first-month production capacity while ensuring quality. In contrast, He Xiaopeng boasted that after expanding production, the Xiaopeng M03 set a new record for first-month deliveries among emerging automakers, reaching XXX units.

On the surface, it's undeniable that the Xiaopeng M03 has become a hit.

The so-called "on the surface" refers to the fact that the sales figures and stock price trends have undeniably shown a turnaround. However, when it comes to issues such as profit per vehicle, gross margin, production planning, delivery timelines, and substantial changes in stock prices, the deeper answer remains debatable.

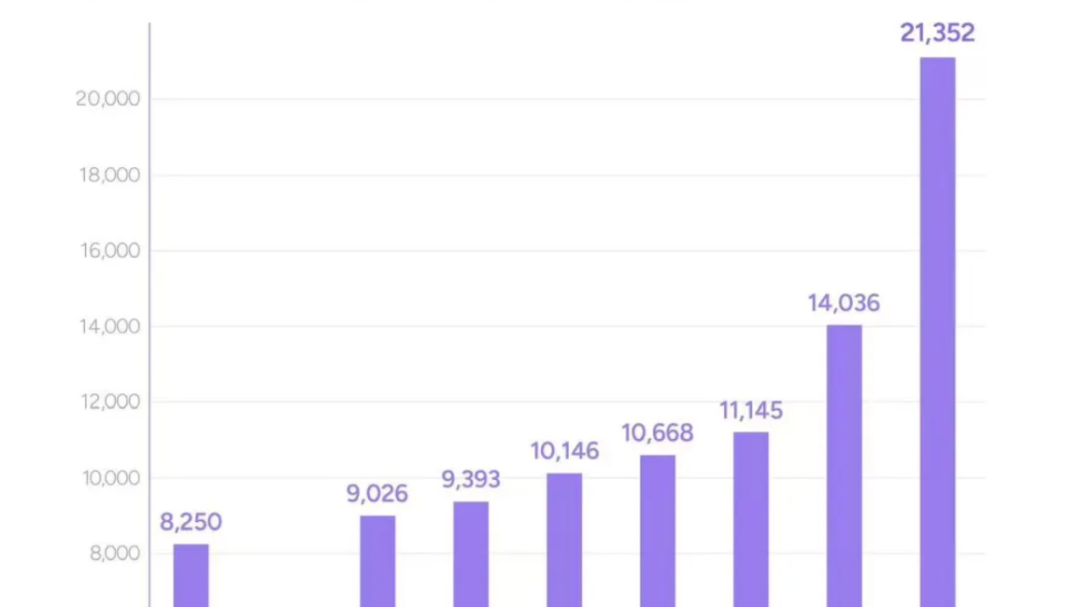

On October 1st, emerging automakers released their September sales figures. There were many highlights, such as Lixiang Auto delivering over 53,000 vehicles, on track to reach 1 million by October, NIO delivering over 20,000 vehicles for the fifth consecutive month, and Xiaopeng's MONA M03 boosting total sales to over 21,000, with MONA M03 alone exceeding 10,000 units.

He Xiaopeng's prediction held true as the Xiaopeng M03 did set a new record for first-month deliveries among emerging automakers' new models. However, despite leading the segment in this regard, the speed of deliveries has failed to appease many consumers who are still complaining. In car enthusiast groups and related forums, many people are asking when their vehicles will be delivered after placing orders on a specific date in a particular region.

The constant changes in delivery timelines have caused anxiety among consumers, and we will see the outcome by the end of October.

While the Xiaopeng M03 has indeed become a hit, this is the fourth time Xiaopeng has faced issues with production capacity and delivery, and it has once again failed to satisfy most consumers. During the communication meeting on the evening of the MONA M03's launch, He Xiaopeng stated that the delivery cycle would be 4-6 weeks and would shorten further afterward. However, this prediction proved false as, just half a month after the launch, the delivery cycle for the best-selling version of the M03 had already extended to 7-9 weeks, with some customers waiting over two months. Another half a month later, around October 1st, it became clear that deliveries would not be completed within 2024, with the cycle further extended to 9-13 weeks.

In fact, Xiaopeng has been quite active in the past month since its launch at the end of August. First, it officially released videos and news about the offline production and nationwide shipment of its new vehicles. Then, on September 10th, it issued an open letter to suppliers, stating that orders had surpassed 30,000 within 48 hours and were growing by over 2,000 per day on average, urging suppliers to respond promptly. The subtext here was that suppliers had not been responsive enough. Subsequently, He Xiaopeng announced that Xiaopeng had completed two production expansions within ten days, all in an effort to instill confidence in consumers.

However, Xiaopeng still struggles to instill confidence in terms of production capacity.

In 2022, Xiaopeng set a sales target of 250,000 vehicles for the year. With the commissioning of its factories in Guangzhou and Wuhan, He Xiaopeng stated in an interview that the combined design capacity of Xiaopeng's Zhaoqing factory and the under-construction Guangzhou and Wuhan factories would reach 400,000 vehicles. Through "double-shift production," Xiaopeng aimed to support an annual production of 600,000 vehicles.

When considering the current delivery speed in light of these information points, the picture becomes quite disjointed.

Currently, despite leading among emerging automakers, experiencing production expansions, and seeing stock price increases, Xiaopeng still struggles to instill sufficient confidence in consumers.

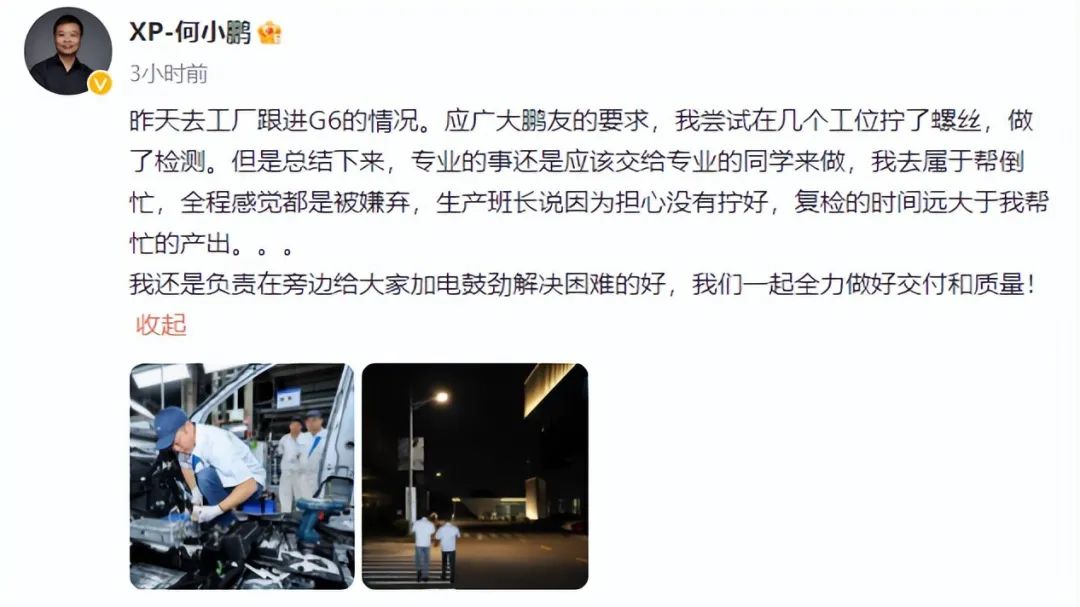

The reason for this is that this scenario has now played out for the third time. In 2023, He Xiaopeng stated in an interview that the Xiaopeng G6 would be considered a success if it delivered over 10,000 units per month. However, due to production capacity issues, the delivery cycle once extended to 16 weeks, leading to a loss of later orders and failing to reach the 10,000-unit delivery mark. During this time, He Xiaopeng also announced plans to increase production capacity and even got involved in manual labor on the assembly line.

In 2024, Xiaopeng's X9 encountered similar issues. In February, Xiaopeng's monthly sales plummeted to 4,545 vehicles, primarily attributed to insufficient production capacity for the X9. As of now, customers who have placed orders for the X9 are facing a delivery timeline that has once again been extended to December 2024. In other words, with 75% of 2024 already elapsed, the production speed of the X9 has not improved in any meaningful way.

It is worth noting that, despite facing similar production capacity pressures, other popular models have not encountered such frequent and persistent doubts about their production capabilities. This topic is also related to several recently launched new vehicles, including the Letao L60 and the Shenlan S07.

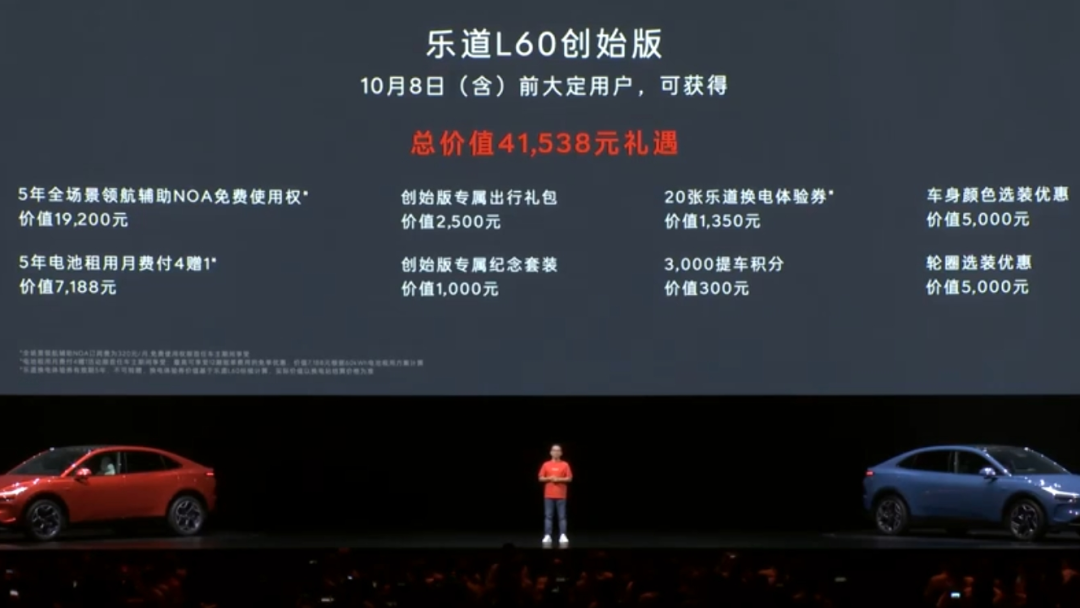

During the lead-up to and aftermath of the Letao L60's launch, Li Bin was relatively restrained. The entire launch event was dominated by Ai Tiecheng, and the communication meeting mainly focused on the overwhelming number of orders. As for production plans, Letao has set clear targets of delivering 5,000 units in October, 10,000 units in November, 16,000 units in January 2025, and 20,000 units in March 2025. If this plan holds, Letao will have fulfilled over 65,000 confirmed orders by the end of March 2025. According to channel agency statistics, over 30,000 confirmed orders were received within 72 hours of the launch, and other sources indicate that the figure had surpassed 65,000 within six days.

Regarding Letao's production ramp-up speed, reaching a monthly production of 20,000 units within a certain timeframe is in line with its planning over the past few years. Additionally, considering the disruptive potential of the BAAS model, Letao has very few direct competitors capable of stealing market share.

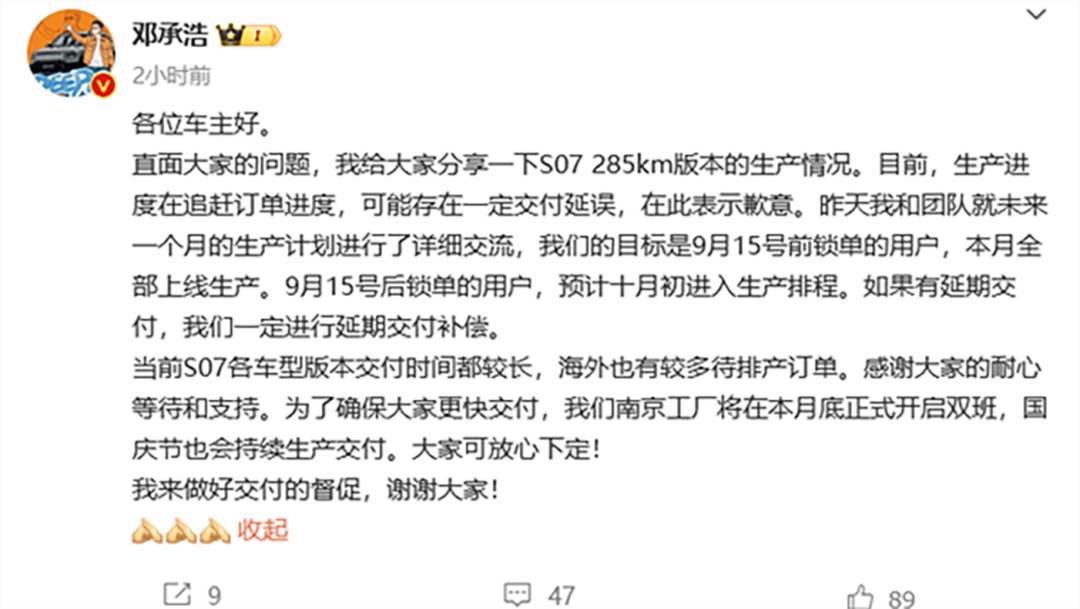

Facing similar production capacity challenges is the Shenlan S07, which received 14,231 orders within its first month on the market. Deng Chenghao responded to delivery concerns in mid-to-late September, assuring customers who locked in their orders before September 15th that production would commence within the month. For those who locked in their orders after September 15th, production was expected to be scheduled in early October, with overtime production and delivery during the holiday period.

In summary, while everyone is striving for hit products, the automotive industry's competitiveness does not solely depend on a single vehicle's quality or price. It also hinges on delivery speed, sales attitude, and support systems.

It is not intended to undermine Xiaopeng, but it is evident that placing an order with Xiaopeng currently does not offer the same positive expectations and certainty regarding delivery speed as other hit products released around the same time. Moreover, Xiaopeng's competitive advantages in terms of pricing, technology, interior space, and intelligent driving capabilities have been gradually eroded by new models like the Shenlan L07, Dongfeng Honda Lingxi L, Aion RT, and upcoming BYD pure electric vehicles in the same price range. As a result, Xiaopeng's models are far less substitutable than the Shenlan S07 and Letao L60.

Is there truly no production crisis for this new round of hit products?

Many consumers may believe that the speed at which automakers produce vehicles is simply a matter of waiting a little longer or a bit shorter. However, a closer examination reveals that this is not the case. Established automakers are more trusted and have a better brand reputation because their systems are healthy and can minimize losses for consumers.

To facilitate understanding, let's use the changes in Huawei's HarmonyOS Intelligent Driving over the past two years as an illustrative example. In 2023, following the launch of the upgraded and price-reduced Wenjie M7, over 60,000 confirmed orders were received in the first month. Subsequently, a subsidy of 200 yuan per day, up to a maximum of 10,000 yuan, was offered for delayed deliveries. Production capacity increased rapidly, from 5,000 units in September to over 10,000 in October and 20,000 to 30,000 in November.

The expansion speed was impressive, and it sensibly adhered to industrial operational principles by limiting production capacity expansions. Blindly expanding production capacity would significantly increase subsequent order demand pressure. While this may yield notable short-term profit gains, it could lead to greater losses in the long run due to idle capacity.

In terms of delivery speed, Wenjie delivered 10,547 units in October, 17,039 in November, 20,611 in December, and reached a peak of 31,253 units in January 2024.

Wenjie's current production capacity planning involves three smart auto factories: the Liangjiang factory for the Wenjie M5, the Fenghuang factory for the M7, and the new Liangjiang factory for the M9. The Wenjie M5 factory has a production capacity of 30 vehicles per hour, which translates to 300 vehicles per 10-hour shift and 600 vehicles per double shift. The Wenjie M7 aims for a production capacity of 20,000 to 30,000 units, while the Wenjie M9 factory is designed with an annual production capacity of 150,000 units, with a maximum daily capacity of 750 units.

For those concerned about Huawei HarmonyOS Intelligent Driving's current sales performance, Wenjie's rapid turnaround from losses to profits can be attributed to its effective management of production capacity. Without such effective management, the result would have been a price war to secure orders, leading to a collapse in new car prices, existing profits, and used car residual values.

Let's summarize the delivery speeds of various new vehicles that consumers are most concerned about in the current market:

The Zeekr 7X, AVIDA 07, and IM Motor LS6, all backed by major automakers, chose to commence deliveries immediately upon launch.

IM Motor R7 is scheduled to commence mass deliveries on October 15th. Given IM Motor's previous missteps with the S7, this time around, it is likely that production capacity has been ramped up in advance, and subsequent delivery speeds are expected to be swift. In the business world, latecomers often learn from the mistakes of early entrants and strive to improve. As automakers increasingly grasp the business logic of leveraging their strengths to create advantages, a clear trend is emerging: while the primary focus remains on order volume and sales figures, more and more automakers are choosing to deviate from this traditional model.

It is worth mentioning that Xiaomi SU7 is not a representative typical case, but an individual case. Its appearance that brings freshness, Xiaomi's ecological capabilities, Lei Jun's personal charm, and good price performance make it have few alternatives in the market. Therefore, even with a current order waiting period of 22-25 weeks, Xiaomi still gained many orders during the flat sales period.

The current Leadway L60 shares some similarities with Xiaomi SU7. Unless Model Y forcibly reduces its price again, it can continue its order growth well with its BAAS model and battery swap feature.

Many large manufacturers adopt a catch-up strategy due to their abundant production capacity and production and transformation capabilities. As the market has become increasingly volatile in recent years, direct sales and order-based sales have gradually exposed their drawbacks, leading manufacturers to abandon the logic of blindly chasing orders.

A typical case is BYD, which rarely discloses order numbers after new car launches but focuses on ramping up production and fast delivery. Taking Qin L as an example, its first natural month sales exceeded 20,000 units after launch, while its sister model Seal 06 DM-i sold 14,000 units in June, 25,200 units in July, and surpassed 40,000 units in August. The so-called production ramp-up was already planned internally in advance.

Similarly, Great Wall Motors is following the same logic. Launched at a price of 299,800 yuan on August 21, it officially announced 8,571 orders on August 23 and rolled off 10,000 new vehicles on September 12. According to multi-channel weekly sales statistics from September 16 to September 22, Lanshan has surpassed Lixiang L7 in the segmented market, with over 1,700 units sold in a single week.

As consumer attitudes change again, the market is also adjusting. Overly pursuing orders can easily lead to production capacity issues, so more and more automakers are pursuing health rather than just numbers.

Final Thoughts

Whether to wait three months for a car delivery or to consider similar models and enjoy the car sooner is a topic that will undoubtedly be discussed for a long time without a definitive answer. For models with strong product capabilities that are irreplaceable in their niche markets, there is room for customers to wait. Judging from the latest moves of leading automakers such as BYD, Lixiang, Hongmeng Zhixing, and Tesla, they are gradually adjusting and ensuring sales-boosting strategies on a weekly basis.

The topic of production capacity is not just about the development of the automotive industry; it is also an inevitable path for Chinese car consumers to evolve from simply pursuing popular models and following trends to adopting a more mature consumption outlook.