["In-depth Financial Report Analysis" Half-year R&D investment of 20.2 billion, who says BYD relies on "人海战术" (人海 tactics)?

![]() 10/10 2024

10/10 2024

![]() 686

686

Author | Meng XiaoFor more financial information | BT Finance Data HubThe main text contains a total of 4,081 words and is expected to take approximately 11 minutes to read

"The automotive market has always had the saying, 'Golden September, Silver October,' and this year's 'Golden September, Silver October' has become a stage for automakers to compete for sales."

Just past 'Golden September,' BYD achieved a record-high monthly sales volume of 419,400 vehicles. On September 25th, BYD marked a historic milestone with the rollout of its 9 millionth new energy vehicle, the high-performance electric supercar, Yangwang U9. Just 83 days prior, on July 4th, BYD celebrated the rollout of its 8 millionth vehicle. This rapid progression from 8 million to 9 million vehicles in such a short time frame contrasts sharply with the 13 years it took BYD to reach its first million vehicles. The comparison highlights BYD's exponential growth trajectory.

BYD's rollout ceremony for its 9 millionth new energy vehicle also addressed some doubts about the company's reliance on " Crowd tactics " ( A sea of people tactics) for success. On September 13th, Li Yunfei, General Manager of BYD Brand and Public Relations, shared a set of data on Weibo. He revealed that BYD's total workforce surpassed 900,000 employees on that day, making it the largest employer among over 5,300 A-share listed companies, with over 400,000 more employees than the second-largest. Among BYD's 900,000 employees, nearly 110,000 are involved in technology research and development, making BYD the automaker with the largest R&D team globally. While many netizens praised BYD for supporting over 900,000 families through its social responsibilities, some opined that BYD's rapid growth relied on so-called " Crowd tactics " ( A sea of people tactics).

In response, neither BYD nor Li Yunfei addressed these criticisms directly. However, the capital market reacted starkly differently. BYD's closing share price was 254.99 yuan on September 13th, and it peaked at 291.99 yuan during intraday trading on September 27th, representing a 15% increase. Extending the time frame to cover the National Day holiday in 2024, BYD's closing share price on the last trading day of 2023 was 194.90 yuan, while on October 8th, 2024, it closed at 327.38 yuan, marking a 68% increase year-to-date. Currently, BYD boasts a total market value of 952.4 billion yuan, making it the highest-valued automaker in China and the only one approaching the trillion-yuan mark.

BYD's popularity in the capital market stems from its outstanding performance. From the disclosure of its interim report on August 29th to the close on October 8th, BYD's share price increased by 38.2%, demonstrating that investors are most impressed by the company's financial performance.

1

Net Profit of 13.6 Billion in the First Half of the Year

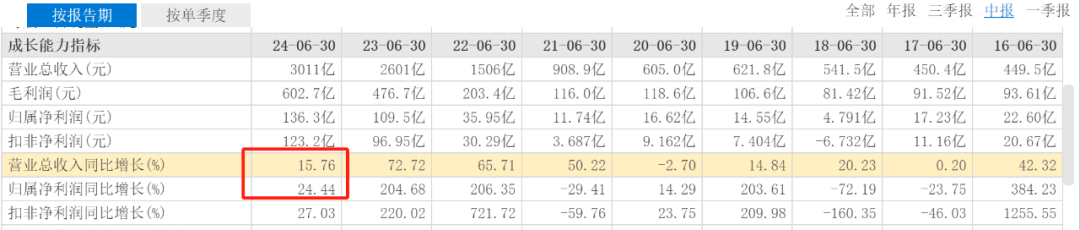

BYD released its interim report on August 29th. The report revealed that BYD's revenue for the first half of the year reached 301.1 billion yuan, a year-on-year increase of 15.76%. Although this growth rate was lower than the previous three years' increases of 50.22%, 65.71%, and 72.72%, it still represented double-digit growth and made BYD the only A-share listed automaker with revenue exceeding 300 billion yuan.

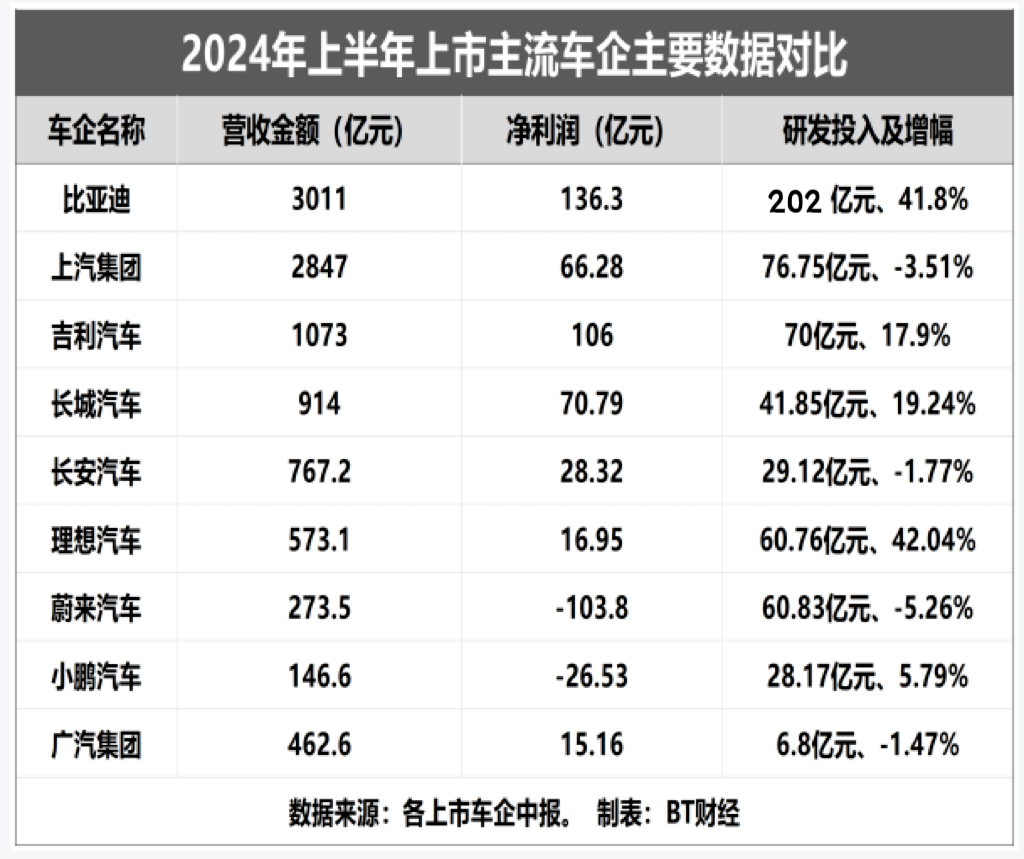

For comparison, BYD's primary competitor, Tesla, experienced a 3.02% year-on-year decline in revenue during the same period. Among domestic new energy vehicle startups like NIO, Xpeng, and Li Auto, revenue growth rates were 40.65%, 61.16%, and 20.81%, respectively. However, except for Li Auto, both NIO and Xpeng remain in the red, with NIO reporting a net loss of 10.38 billion yuan and Xpeng a net loss of 2.653 billion yuan.

BYD's net profit attributable to shareholders for the first half of the year was 13.63 billion yuan, a year-on-year increase of 24.44%. It is one of only two profitable new energy automakers in China, alongside Li Auto, which reported a net profit of only 1.695 billion yuan, less than one-eighth of BYD's profit.

Over the 182 days of the first half of the year, BYD's average daily net profit was 74.89 million yuan. This profitability ranks BYD among the top performers among the over 5,300 A-share listed companies, second only to state-owned enterprises like Sinopec and PetroChina, as well as the five major state-owned banks, firmly establishing it in the forefront of profitability.

In 2023, BYD's revenue reached 602.3 billion yuan, a year-on-year increase of 42.04%, with a net profit attributable to shareholders of 30.04 billion yuan, up 80.72% year-on-year. In comparison, both BYD's revenue and net profit growth rates declined in the first half of 2024 compared to the previous year, and even its average daily net profit decreased. In 2023, BYD's average daily net profit was 82.3 million yuan, representing a daily decrease of 7.41 million yuan. Nevertheless, among A-share automakers in the first half of 2024, BYD's net profit remained unparalleled, surpassing Great Wall Motor by 6.55 billion yuan and SAIC Motor by over 7 billion yuan.

Automotive journalist Zhang Zhiyong believes that BYD's declining revenue growth rate is related to its decision to pass on benefits to consumers. "Recently, the cost of raw materials for new energy vehicles has dropped significantly, but BYD has chosen not to capitalize on this by increasing its own profits. Instead, it has passed on these savings to consumers, not only benefiting BYD's customers but also driving down prices across the industry, including for traditional luxury brands like BMW, Audi, and Mercedes-Benz. This year, all car buyers have indirectly benefited from BYD's pricing strategy," Zhang commented, expressing admiration for BYD's responsible approach and its positive impact on the industry's development.

BYD owner Wang Dongxing also welcomed the company's pricing strategy, noting, "BYD's price reductions differ from those of other automakers that cut costs by reducing configurations. Instead, BYD increases configurations while lowering prices, effectively passing on cost advantages to consumers. This allows us to purchase flagship-level technology at the lowest possible prices. Take the second-generation Song Pro as an example; equipped with the latest fifth-generation DM-i technology, it consumes less fuel than a motorcycle and starts at just 112,800 yuan. A few years ago, even a price tag of 300,000 yuan would have been highly sought-after."

2

Net Profit per Vehicle of 8,500 Yuan

BYD's dual first-place rankings in revenue and net profit are underpinned by its substantial sales volumes. Including sales figures, BYD emerged as the 'triple crown' winner in the first half of the year. During this period, BYD sold 1.613 million vehicles, a year-on-year increase of 28.46%, including 726,200 pure electric vehicles (up 17.73% year-on-year) and 881,000 plug-in hybrid vehicles (up 39.54% year-on-year). Achieving nearly 30% growth on such a large base underscores BYD's popularity in the market.

According to data from the China Association of Automobile Manufacturers, China's passenger vehicle wholesale sales (including exports) reached 11.979 million units in the first half of the year, a year-on-year increase of 6.3%. Among them, new energy vehicle wholesale sales (including exports) totaled 4.7 million units, up 31.5% year-on-year. With sales of 1.613 million units, BYD further increased its market share to 32.6%.

While BYD ranks first among automakers in terms of net profit, its net profit per vehicle stands at 8,500 yuan, placing it fourth among many automakers. BT Finance's analysis of multiple listed automakers' financial reports revealed that Great Wall Motor had the highest net profit per vehicle in the first half of the year, at 12,800 yuan, surpassing BYD by 4,300 yuan. This means that for every vehicle sold, BYD earned half as much as Great Wall Motor. Geely Auto ranked second with a net profit per vehicle of 11,100 yuan, making it one of only two automakers with a net profit per vehicle exceeding 10,000 yuan. Li Auto came in third with a net profit per vehicle of 9,000 yuan, narrowly trailing BYD.

In fact, since last year, BYD has been reducing the starting prices of its various models while enhancing their configurations. This approach, seen as technology democratization in the industry, allows consumers to enjoy the benefits of BYD's new energy technology advancements at lower prices. It is also a direct manifestation of the social responsibility of China's leading new energy vehicle manufacturer.

Relying on its robust supply chain and production capacity, BYD has gradually reduced the production cost per vehicle, creating significant economies of scale. As production capacity continues to expand, BYD has achieved low-cost competitiveness, driving down prices and boosting sales. This positive cycle is fueled by its thin-margin, high-volume sales strategy.

BYD's positive cycle is evident in the sustained growth of its gross and net profit margins. From the first half of 2021 to the first half of 2024, BYD's gross margin increased from 12.76% to 20.01%, and its net profit margin rose from 1.29% to 4.53%. Notably, BYD's automotive business gross margin reached 23.94%, up 3.27 percentage points year-on-year, contributing 76% of the company's total revenue.

'BYD's strategic sacrifice of some profits during its development has driven sales growth and market share gains,' Zhang Zhiyong observed. While many automakers struggle to meet their sales targets, BYD consistently achieves its predetermined goals each year. Currently, BYD leads the global new energy vehicle sales rankings. From January to August 2024, it sold 2.3284 million vehicles, a year-on-year increase of 125%. This means that in July and August alone, BYD sold 715,400 vehicles. As of August, the company had already achieved 64% of its annual sales target. With most automakers ramping up efforts in the second half of the year, BYD is just 1.272 million vehicles shy of its 3.6 million-vehicle target for the year. At an average monthly sales rate of nearly 360,000 vehicles based on July and August figures, reaching this target seems achievable.

3

King of R&D Investment

BYD's willingness to offer substantial price concessions stems not only from passing on cost savings to consumers but also from the technological returns generated by its substantial R&D investments. BT Finance's analysis of mainstream listed automakers' R&D expenses in the first half of 2024 revealed that BYD led the pack with R&D investments of 20.2 billion yuan, a year-on-year increase of 41.8%. This puts BYD far ahead of its nearest competitor, SAIC Motor, which invested 8.96 billion yuan in R&D, less than half of BYD's investment.

As the table above shows, both BYD and Li Auto exceeded 40% year-on-year growth in R&D investments, making them the only two automakers to do so. In the first half of the year, BYD spent an average of 108 million yuan per day on R&D. Other automakers' R&D growth rates were below 40%, with several even experiencing declines. NIO experienced the most significant decline, at 5.26%. SAIC Motor, Changan Automobile, and Guangzhou Automobile Group also saw some decreases in their R&D investments.

BT Finance's preliminary review of A-share listed companies that have released financial reports, including but not limited to automakers, revealed that BYD's R&D investment of 20.2 billion yuan ranked first among over 5,300 A-share listed companies. This follows BYD's substantial R&D investments last year, totaling 39.57 billion yuan, underscoring the company's commitment to research and development.

BYD's R&D expenses rank among the top globally. In the first half of 2024, Tesla invested 22.25 billion USD in R&D, equivalent to approximately 15.6 billion yuan at the latest USD exchange rate. Despite Tesla's reputation for heavy R&D investment, BYD's R&D spending exceeded Tesla's by over 4 billion yuan. BMW invested 4.169 billion euros (approximately 32.6 billion yuan) in R&D in the first half of the year, while Mercedes-Benz invested 22.44 billion yuan. Among global automakers, BYD's R&D investment ranks third, behind only BMW and Mercedes-Benz, and ahead of Honda's 19.56 billion yuan.

Compared to all domestic automakers, BYD's R&D investments are significantly ahead. Its massive investments have resulted in over 48,000 global patents for BYD in the new energy vehicle field, with over 30,000 of these being authorized. These patents cover various areas, including new energy vehicles, battery technology, and motor control. As mentioned earlier, among BYD's over 900,000 employees, over 100,000 are dedicated to R&D, making it the automaker with the largest R&D team globally. These substantial R&D investments have significantly enhanced BYD's technological innovation capabilities and global competitiveness in the automotive market, laying a solid foundation for its leading sales and net profit performance.

In conclusion, BYD's success is not significantly attributed to " Crowd tactics " ( A sea of people tactics). Its 900,000 employees represent the company's social responsibility to support the livelihoods of millions. However, it is BYD's annual investments of billions of yuan in R&D that give it the confidence to continuously reduce prices, which is why consumers are grateful to BYD. Today, BYD has emerged as a global leader in new energy vehicles, inspiring many companies to follow its example and invest heavily in R&D, significantly driving the development of the entire new energy vehicle industry.