Deep Blue Auto: Record Monthly Deliveries Can't Hide Its Dilemma

![]() 10/11 2024

10/11 2024

![]() 590

590

The power of the automotive industry's "golden September" is evident again, with many automakers achieving record monthly sales highs, and Deep Blue Auto is no exception. The company delivered 22,709 new vehicles in September, a year-on-year and month-on-month increase of 30.74% and 12.81%, respectively, setting a new record for monthly deliveries.

Stockstar notes that despite the uptick in sales, Deep Blue S07 and Deep Blue G318 have encountered difficulties in sales, resulting in sales falling short of expectations and casting uncertainty over the subsequent sales of two new models, Deep Blue L07 and Deep Blue S05.

Currently, sales and profitability are the two major challenges facing Deep Blue Auto. Last year, the company achieved only about 68% of its annual sales target, and this year, it struggled with a lack of momentum in the first half. To stimulate sales, Deep Blue Auto has accelerated the launch of new products in the second half of the year and adopted a strategy of trading price for market share to boost sales. However, cumulative sales are still only half of the annual target, and the company still faces severe challenges. Behind the pursuit of sales, Deep Blue Auto aims to achieve breakeven as soon as possible.

01. Two Consecutive Models Fail to Meet Sales Expectations

Less than two months after its launch, Deep Blue Auto encountered delivery issues with the Deep Blue S07.

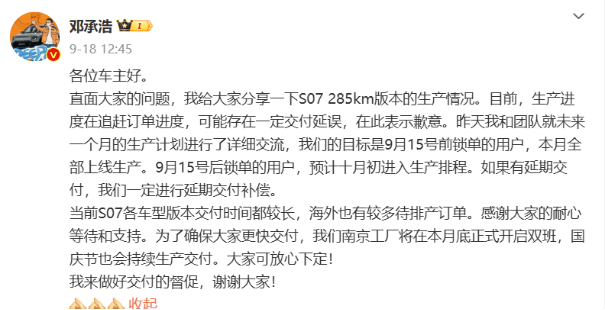

On September 18, Deng Chenghao, CEO of Deep Blue Auto, responded to delivery issues of the Deep Blue S07 285km version on Weibo. He stated that the current production progress is catching up with order progress, and there may be some delivery delays. Users who locked in their orders before September 15 will all go into production this month. Users who locked in their orders after September 15 are expected to enter the production schedule in early October. Currently, the delivery time for all versions of the Deep Blue S07 is relatively long, and there are also many pending production orders overseas.

Stockstar notes that this is not the first time Deng Chenghao has responded to delivery difficulties with the Deep Blue S07. On August 24, Deng Chenghao also responded on Weibo, stating that after the launch of the Deep Blue S07, the supply chain has been operating at full capacity, and the production of the 285km battery version has been significantly affected by capacity constraints. At the same time, Deng Chenghao expressed his commitment to closely monitor the delivery of the Deep Blue S07.

Judging from the latest response, it is clear that the delivery issues with the Deep Blue S07 285km version have not been completely resolved. According to media reports, according to Deng Chenghao's plan, the Deep Blue S07 is one of the core models that he claims will achieve monthly sales of 30,000 units in the fourth quarter of this year. In its model matrix, the Deep Blue S07 bears the task of achieving monthly sales of 10,000 units.

It is understood that the Deep Blue S07 is a modified version of the Deep Blue S7, which was first launched in June 2023 and is the second mass-produced model of Deep Blue Auto. Currently, Deep Blue Auto's lineup includes the Deep Blue G318, Deep Blue S07, Deep Blue SL03, and Deep Blue L07. The Deep Blue L07 was just launched on September 20, and another model, the Deep Blue S05, is expected to be launched in October.

Based on third-party sales data for August, the Deep Blue S07 sold 7,131 units, accounting for 54.2% of the brand's total monthly sales. The Deep Blue SL03 ranked second with a share of 36.08%, while the Deep Blue G318 accounted for only 9.73%.

In fact, Deep Blue Auto's third model, the mid-to-large SUV Deep Blue G318, which is positioned as a rugged off-road vehicle, previously suffered from insufficient demand forecasting, which constrained sales. According to media reports, the most popular versions of this car among users should be the two-wheel drive air suspension version and the four-wheel drive comfort version priced at 199,900 yuan. However, in actual orders, 80% of users placed orders for the four-wheel drive air suspension version priced at 229,900 yuan. In other words, there was a deviation between the actual production version and user orders.

The initial order data for the Deep Blue G318 showed a strong trend, with orders exceeding 10,000 units within 70 hours of its launch and exceeding 14,100 units within five days. However, these orders failed to materialize during the actual sales phase. Data shows that sales of the Deep Blue G318 were 2,483 units in July and plunged to 1,280 units in August. This is far from the monthly sales target of 10,000 units previously disclosed by Deng Chenghao to the media.

The market is concerned about how the upcoming Deep Blue L07 and Deep Blue S05 will perform given the sales difficulties encountered by the Deep Blue S07 and Deep Blue G318. After all, these two models bear the responsibility of boosting sales for Deep Blue Auto. Deng Chenghao previously told the media that after the launch of these two products, he hopes to achieve monthly sales of 30,000 to 40,000 units this year and next. This means that these two models will be crucial for Deep Blue Auto to boost sales in the future.

02. Delivering a Combination Punch to Boost Sales

Deep Blue Auto was established in 2022 as the first independent electric vehicle brand under Changan Automobile (000625.SZ), playing a crucial role in Changan's competition in the new energy vehicle market.

In 2023, despite halving its original annual sales target to 200,000 units, Deep Blue Auto fell short of this target by about 60,000 units. At that time, the company relied solely on the Deep Blue SL03 and Deep Blue S7 to boost sales, and maintaining high growth undoubtedly posed a significant challenge.

In the first half of this year, Deep Blue Auto struggled with sluggish growth. Monthly deliveries plummeted to 9,994 units in February, with only January and June exceeding 17,000 and 16,700 units, respectively. The remaining months fluctuated between 12,000 and 15,000 units, all below the December 2022 figure of 18,300 units. Monthly deliveries from September to December last year were all above 15,000 units.

Stockstar notes that without a blockbuster model, Deep Blue Auto has struggled to achieve explosive sales growth. To effectively boost sales, the company has adopted a strategy of diversifying its product line. In the second half of this year, Deep Blue Auto has successively launched the Deep Blue G318, Deep Blue S07, and Deep Blue L07. The 2025 model of the Deep Blue SL03 was also launched in September, with the upcoming Deep Blue S05 still to come. While enriching its product line, Deep Blue Auto has also expanded its price range, covering multiple market segments from 119,900 yuan to 318,000 yuan. However, the Deep Blue G318 Carefree Traverse version, priced at 318,000 yuan, is expected to go on presale only in early 2025.

In addition, Deep Blue Auto has joined the price war, seeking sales by reducing profits. The Deep Blue S07 was launched on July 25 and announced a limited-time price reduction of 10,000 yuan for all models on August 25. The official guidance price of the 2025 model of the Deep Blue SL03 is 119,900 to 146,900 yuan, reducing the entry threshold by 20,000 yuan.

Stimulated by the above strategies, Deep Blue Auto's performance improved in the second half of the year. Following the first-ever monthly delivery record of over 20,000 units in August, monthly deliveries climbed to 22,700 units in September, surpassing NIO Inc. (09866.HK) and Xpeng Motors (09868.HK) among other new energy vehicle companies.

Stockstar notes that Deep Blue Auto bears the responsibility of boosting sales for Changan Automobile's new energy vehicles. Changan Automobile's new energy sales target for 2024 is 750,000 units, including 250,000 units for Changan Qiyuan and 90,000 units for Avita. According to the plan, Deep Blue Auto aims to complete an annual sales KPI of 280,000 units this year. Cumulative deliveries from January to September totaled 143,400 units, exceeding last year's annual figure but achieving only a 51.22% completion rate. In the remaining three months, Deep Blue Auto must deliver over 45,000 units per month to meet its target, which is no small feat.

Upon further investigation, the ultimate goal of this all-out sprint to boost sales is to achieve breakeven. Deng Chenghao has stated that by the fourth quarter of this year, Deep Blue Auto aims for monthly sales of 30,000 units, at which point the company can achieve profitability. He also noted at the mid-year communication meeting of Changan Automobile that Deep Blue Auto aims to achieve profit and loss breakeven by the end of this year and has the opportunity to become the first state-owned enterprise to achieve both scale and profit breakthroughs in the new energy vehicle industry.

Since its establishment, Deep Blue Auto has yet to achieve profitability. According to Changan Automobile's financial reports, in 2022 and 2023, Deep Blue Auto generated revenues of 15.678 billion yuan and 25.883 billion yuan, respectively, with net losses of 3.197 billion yuan and 2.999 billion yuan. In the first half of this year, Deep Blue Auto generated revenues of 13.981 billion yuan and a net loss of 739 million yuan, with the loss amount narrowing year-on-year mainly due to improved product mix, cost reduction, and efficiency enhancement. (This article was originally published by Stockstar, written by Lu Wenyan)