From the success of the Red Butt Tank 500, exploring the "deadly chess move" in Great Wall Motors' channel transformation

![]() 10/11 2024

10/11 2024

![]() 645

645

"A journey of a thousand miles begins with a single step."

Great Wall Motors has undoubtedly emerged as the most successful automaker in terms of marketing during this National Day holiday, with no competition.

At the Alashan Hero Rally, the red-butt Tank 500, with its white-to-red gradient paint job, emerged as the star of the show, nearly achieving a "grand slam" in the desert. The Tank 500's impressive maneuvers, including sliding, climbing side slopes, charging through sand dunes, and executing daring stunts, left spectators in awe.

More importantly, these high-difficulty "sand-playing" moves did not seem to originate from a standard Tank 500 model. Its existing 2.0T+P2 and 3.0T V6 powertrain systems may not possess such robust performance capabilities.

As a result, the mysterious powertrain of this Tank 500 has become a focal point of attention and discussion, with speculations ranging from the electrically decoupled Hi4-Z system to a large-displacement V8 or higher engine.

In this moment, Great Wall Motors' brand identity, characterized by product quality, technological prowess, and off-road capabilities, has achieved far greater reach and impact than any typical promotional campaign could ever hope to attain.

This underscores what Great Wall Motors, as a brand manufacturer, desperately needs to convey to the market (and its channel partners) once again: the core essence of its brand, akin to a personal narrative answering the questions, "Who am I? Where do I come from? Where am I going?"

Behind such bold marketing maneuvers lies the urgent need for Great Wall Motors to reassert its position as a leader in hardcore off-roading, as this status is increasingly threatened. Thus, "flexing its muscles" and issuing a response have become imperative.

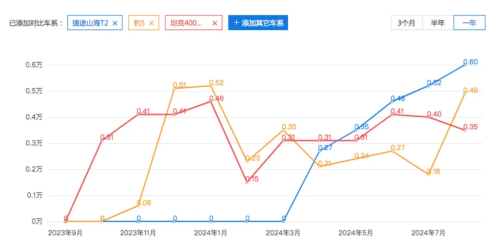

Currently, Chery JETOUR's Traveler and Shanhai T2 models have surpassed the Tank 300 and Tank 400 in popularity. Meanwhile, after a price reduction of RMB 50,000, the FANGCHENGBAO B5 achieved sales of 4,876 and 5,422 units in August and September, respectively, also outpacing the Tank 400. With the upcoming release of the B8, which is expected to compete with the Tank 500 and Tank 700 price segments, Tank brands face an imminent siege from competitors.

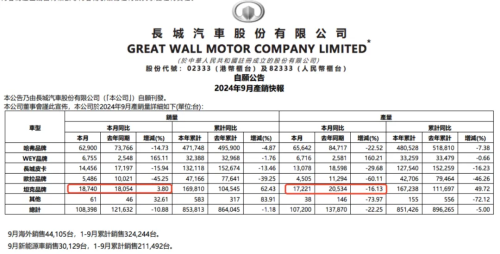

Under such circumstances, Tank's production and sales growth decelerated to -16.1% and 3.8% in September, dragging down the cumulative growth for the year. If Great Wall Motors fails to stem this trend promptly, its sole growth engine, the Tank brand, may soon falter, leaving the company in a precarious domestic position.

Looking back at Great Wall Motors' successful marketing campaign, the massive influx of traffic it generated ultimately needs to be channeled and converted through its distribution network. Whether Great Wall Motors' channel system can effectively collaborate with the brand to capture this wave of traffic is the focus of this article.

In fact, from 2016 to 2023 (and projected for 2024 as well), Great Wall Motors' sales have remained stable at between 1 million and 1.3 million units. During this period, various complex factors have hindered the company's expansion, including its long-standing product mix issues and the absence of a sedan business segment. Additionally, its pursuit of a "big and comprehensive" approach to technology development has pushed up vehicle pricing, leading to increased sunk costs (refer to the article "Being 'Big and Comprehensive' Backfires, Great Wall Motors Gets More Expensive with Each Sale").

Moreover, the company's stagnant sales volume over an extended period (or a mature market state) can easily destabilize its channel system, particularly during technological disruptions in the industry.

When a manufacturer's strategic issues impact its sales growth, channel instability can, in turn, become a significant obstacle to further growth.

In recent years, this channel instability has contributed to Great Wall Motors' struggle to expand its sales volume, triggering organizational restructuring and channel transformation efforts. This article delves into these dynamics.

In the game of Go, saving a solitary group ( Treating orphans ) involves strategies to transform isolated stones into viable positions. Failure to do so can lead to a complete loss, while success can revitalize the entire board.

Similarly, Tank's performance within Great Wall Motors' channel transformation is akin to saving a solitary group in Go. Only by revitalizing this critical piece can the company turn its passive situation around.

01

—

Deadly Chess Move: The Growing Tension between Great Wall Motors and Its Dealers over Pricing Difficulties

2020 and 2021 marked Great Wall Motors' ascendancy in the capital markets.

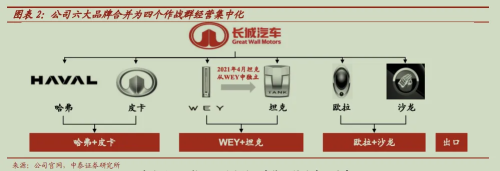

During this period, the company established a six-brand matrix comprising Haval, Great Wall Pickup, WEY, Tank, Ora, and Saloon, and implemented a "one vehicle, one brand, one company" management structure. The channel strategy adopted the "store-in-store" format.

At the time, the market was optimistic about the company's strategy of focusing on operations and expanding its scale. Consequently, both existing and new dealers were compelled to align with Great Wall Motors' expansion plans. If existing dealers could not meet the company's demands, new dealers had to be recruited.

Therefore, it can be inferred that both brand owners and dealers invested heavily in preparing for scale expansion during these two years.

However, due to a multitude of complex factors (including strategy, product, pricing, marketing, and channel management), only the Tank brand achieved significant growth in the mass off-road market. Brands such as Haval, WEY, Ora, and Saloon failed to gain market traction, leading to operational inefficiencies, management redundancies, resource wastage, and even internal friction within the group.

As a result, Great Wall Motors initiated a strategic consolidation, merging Haval and Great Wall Pickup, WEY and Tank, and Ora and Saloon. The corresponding channels were also integrated, with a temporary de-emphasis on pure electric vehicles (i.e., Ora and Saloon).

From the perspective of dealers, channel consolidation inevitably leads to a reduction in the number of outlets, potentially resulting in passive dealership closures. Dealers involved in Ora's business, both new and existing, also incurred losses, leading some to actively withdraw from the network.

With a decreasing dealer network, Great Wall Motors' overall sales volume became further constrained.

Meanwhile, the domestic automotive market underwent significant changes, with the penetration of new energy vehicles (NEVs) steadily rising. New-energy startups and traditional automakers launched new brands and aggressively expanded into new channels (e.g., dealerships, urban showrooms, and shopping mall stores) to reach mainstream consumers. Furthermore, the rapidly growing BYD continued to recruit and expand its traditional dealer network, putting further pressure on Great Wall Motors' struggling channel system.

Since the beginning of 2023, a price war has raged in the domestic automotive market. Both brand owners and dealers must adjust prices flexibly in response to regional market dynamics. Only through such cooperation can they withstand price competition.

However, due to sunk costs and a focus on financial structure, Great Wall Motors' price elasticity is relatively low compared to other manufacturers. This internal cost pressure is transmitted to the channel, weakening dealers' pricing power, reducing turnover and sales volume, and increasing cash flow and inventory pressures. Dealers have lost their previous business benefits, exacerbating tensions with Great Wall Motors.

Moreover, the departure of senior sales executive Wang Fengying from Great Wall Motors in late 2022 (or early 2023) is likely to further strain relations between the company and its dealers.

Currently, tensions in the Haval + Pickup channel are particularly pronounced within Great Wall Motors' system. Firstly, Haval + Pickup represents the company's core foundation, with many dealers being long-standing partners who have supported its growth. Secondly, domestic sales of both Haval and Pickup are declining, making it difficult for Great Wall Motors to sustain its existing dealer network.

As a result, most dealers are collaborating with third-party financial institutions to offer car loan schemes. By doing so, they can lower vehicle prices and generate profits from these financial institutions. Within the limited space allowed by Great Wall Motors' reluctance to officially reduce prices, dealers have sought to enhance market competitiveness and increase operating profits.

However, this approach has limited effectiveness in the face of ongoing price competition, as third-party financial institutions have their pricing models.

This indicates that tensions between Great Wall Motors and its dealers continue to escalate amidst the ongoing price war in the automotive market.

02

—

Critical Move: Steady Progress in Direct Sales Model Holds the Key to Breaking the Deadlock

With the above understanding, let's examine the changes Great Wall Motors has made in its channel strategy over the past two years.

Before delving into these changes, it's essential to have a general understanding of Great Wall Motors' domestic channel structure. According to the company's 2021 financial report (no further details have been disclosed since), Haval operated over 1,000 4S stores and more than 1,500 exclusive stores. WEY had over 300 4S stores and an additional 80 secondary stores, while Great Wall Pickup boasted over 2,000 sales and service outlets. Ora and Tank had relatively small store networks and were not disclosed separately.

In March 2023, Haval officially launched its new sales channel, "Longwang" (Haval New Energy Stores). Great Wall Motors pinned its hopes on this dedicated new energy channel to replace the existing "store-in-store" format for several reasons:

Firstly, the newly designed new energy stores, through their ambiance and tone, could rebrand and reposition the company's image and philosophy in the market.

Secondly, they could effectively reduce operational pressures on existing dealers related to inventory management, cash flow, and turnover.

Thirdly, by aligning with market changes in new channels, the store network could be extended to more populous and widely accessible urban centers, attracting higher-quality and more targeted traffic.

Therefore, the "Longwang" channel was initially planned to reach 800+ stores nationwide by the end of 2023.

However, based on current developments, the rollout of "Longwang" stores has fallen short of expectations, with some outlets already closing or withdrawing. Potential reasons include:

1. Product-related issues, primarily high pricing, have led to sluggish sales of Haval Longwang's Xiaolong and Xiaolong MAX models, significantly impacting overall sales performance. The monthly sales of Menglong PHEV range between 3,000 and 6,000 units, insufficient to support the planned 800+ store network.

2. Brand positioning is another challenge. Haval's primary user base comprises families in third- and fourth-tier cities and below, primarily in northern China. In contrast, new channel formats like urban center stores, mall showrooms, and pop-up stores are concentrated in cities above the third tier. As a result, Haval's new energy stores have struggled to convert traffic effectively in these channels, particularly when competing with other new-energy startups in the same spaces.

3. The overall contraction of Haval's sales volume has inevitably impacted the scale of its dealer network. Rapid expansion of the "Longwang" channel could exacerbate tensions with existing Haval dealers, limiting the scope for network expansion.

Despite underwhelming results, Haval's "Longwang" channel remains open for recruitment, albeit at a significantly slower pace. Currently, the penetration rate of new energy vehicles in Great Wall Motors' monthly sales stands at around 30%, with roughly 20% coming from Haval New Energy (primarily the Menglong PHEV model).

It is foreseeable that Great Wall Motors will continue to boost its new energy penetration rate, which necessitates growth in Haval New Energy. If the company can successfully transition existing Haval dealers to the "Longwang" channel, there is still potential for growth. However, this transition poses significant challenges, particularly in the context of overall sales contractions.

As a result, the progress of the "Longwang" channel has stalled. Breaking this deadlock requires Great Wall Motors to offer more competitively priced new energy vehicles, which the company, focused on financial profitability, finds difficult to achieve at present.

Fast forward to the end of April 2024, when Great Wall Motors announced plans to trial a dual-channel sales model combining dealerships and direct sales, starting in May. The company branded its direct sales brand and stores as "Great Wall Smart Choice" and initially included WEY and Tank models in this channel.

Building on the experience of Haval's "Longwang" channel, we can gain further insights into the evolution and considerations behind Great Wall Motors' Smart Choice model.

1. The optimal entry point (or path of least resistance) for Great Wall Motors' channel reform lies in focusing on the incremental new energy vehicle market. The Tank 300, with its cult following, also possesses the prerequisites for entering the direct sales channel.

2. Compared to Haval, WEY and Tank have smaller dealer networks, implying less resistance to channel changes. Furthermore, Tank's high growth rate can mitigate the impact of direct sales on existing dealers.

3. WEY and Tank's brand positioning, model categories, and target audiences align better with the marketing needs of the new channel model, a quality lacking in Haval's new energy offerings.

4. Leveraging Tank's high growth, Great Wall Smart Choice could have adopted a dealership model for new channels (e.g., urban center stores, mall showrooms, pop-up stores). Well-performing existing dealers could have expanded into these display channels. However, Great Wall Motors ultimately chose the direct sales route, possibly to prepare for a broader strategic play involving its entire portfolio under the "GWM" umbrella.

5. Most directly, Tank's high margins and growth support Great Wall Motors' gradual establishment of a direct sales network, offering financial viability.

6. Additionally, Great Wall Motors' product roadmap includes new brand models for 2025, such as repositioned Ora, sedans, and pure electric vehicles. The direct sales model is better suited for the "cold start" of these brands and models. By integrating them into Smart Choice stores, the company can streamline early planning, recruitment, and regulatory hurdles, avoiding potential constraints from dealers in the future.

,"In line with Wei Jianjun's remarks, Great Wall Smart Choice may not primarily aim to carve out a slice of the pie for dealers (though it inevitably will to some extent). Rather, it seeks to overhaul Great Wall Motors' currently passive and fragmented channel system.

Unfortunately, only by taking matters into its own hands can Great Wall Motors effectively invigorate its channel network and respond swiftly to market dynamics. This approach is essential to maximizing synergy with its product and marketing strategies, ultimately addressing the long-standing sales bottlenecks that have plagued the company.

03

–

Live chess: Only by fully maintaining the comparative advantage of the Tank brand can we revitalize the situation

At present, the success of the direct sales model largely depends on four aspects: first, it is a new brand without historical burdens; second, the brand pricing is at least in the mid-to-high end and above; third, it can maintain high growth continuously; fourth, the scale must be controllable.

Of course, Tesla's scale of nearly 2 million vehicles still belongs to the direct sales model. This is mainly because there are no competitors globally (except for markets outside of China), and a relatively relaxed competitive environment supports its high gross margin and high brand tone, although this advantage is being challenged by Chinese competitors.

Currently, Lixiang still adopts the direct sales model, mainly because its current production and sales scale of approximately 600,000 vehicles is still controllable. However, as domestic competition intensifies and average vehicle prices gradually decline, the direct sales model may put some pressure on Lixiang in the future, at which point the advantages of the dealership system will become prominent.

As for NIO, the reason why it is still making many moves in the dealership model is mainly because it needs to maintain its high-end brand tone, so price control is particularly crucial. The involvement of dealers is bound to disrupt NIO's current pricing system.

Brands like XPeng and AVATR have already switched to the dealership model to expand their channels and scale.

Therefore, for traditional automakers like Great Wall, the dealership model will remain the absolute core channel, with direct sales only serving to address the current market difficulties faced by OEMs.

Looking back at Great Wall's channel changes over the years, I can roughly understand how Great Wall adjusts its channels to cope with its different stages of development.

From 2005 to 2013, Great Wall divided its SUV models into two sales networks: the H-series and M-series. Due to the high growth and large market share of its H-series SUVs during this period, Great Wall eventually spun off the H-series into an independent brand called "HAVAL" in 2013, while the M-series was transformed into a sedan network.

From 2015 to 2018, as domestic SUVs entered a period of high growth, Haval needed to expand its dealership system to take advantage of this trend and achieve rapid scale expansion. This inevitably impacted existing dealers. Therefore, Haval officially launched a red-blue network distribution strategy in 2015, dividing the same model into two visually differentiated versions through different design languages and styles of red and blue badges, and entering them into two separate sales networks. This minimized direct competition between old and new Haval dealers in the same region.

From 2018 to 2022, as the domestic auto market entered a relatively stable phase against the backdrop of the new four modernizations and the rise of young consumers, Haval attempted to further bet on growth by renaming the red-blue network as the H-series and F-series. The F-series targeted young users by highlighting intelligent, youthful, and sporty product attributes.

In 2020 and 2021, to cater to the preferences of young users, the F-series further evolved into a series of internet buzzwords, such as Big Dog, First Love, Chitu, and Divine Beast, for model names. However, these did not achieve success, putting immense pressure on the F-series network. The confusing marketing and product homogeneity also strained the H-series network, ultimately leading to the integration of Haval's channels into their current state.

It is evident that the success of a separate network requires a brand's incremental growth. Attempting to separate channels in a stable market environment can easily lead to internal conflicts and obstructions.

In fact, the reason why BYD was able to double its scale rapidly in a short period is inseparable from the support of its separate network strategy. In the second half of 2021, BYD launched its new "Ocean Network," forming a dual sales network of "Dynasty" and "Ocean," which smoothly accommodated BYD's subsequent expansion.

Therefore, for Great Wall to make changes to its channels, it can only start with the high growth rate of Tank and utilize a highly self-controlled direct sales model to coordinate with its marketing strategies and product layout, thereby gradually reversing its current passive domestic situation.

Great Wall's marketing breakthrough during this National Day holiday is to uphold the core labels (or comparative advantages) of the Tank brand. Only by preserving the incremental growth of the Tank brand can Great Wall smoothly advance its overall channel transformation.