The second largest "electric chicken" company worth 27.6 billion yuan suddenly has its boss placed under investigation!

![]() 10/12 2024

10/12 2024

![]() 709

709

■ After net profit plummeted by 80%, Arrow Home's CFO wants to "run away"! The boss's wife leads the way in praying to Buddha for blessings

Source | Shenlan Finance

Written by | Wu Ruixin

The second largest "electric chicken" company worth 27.6 billion yuan suddenly has its boss placed under investigation!

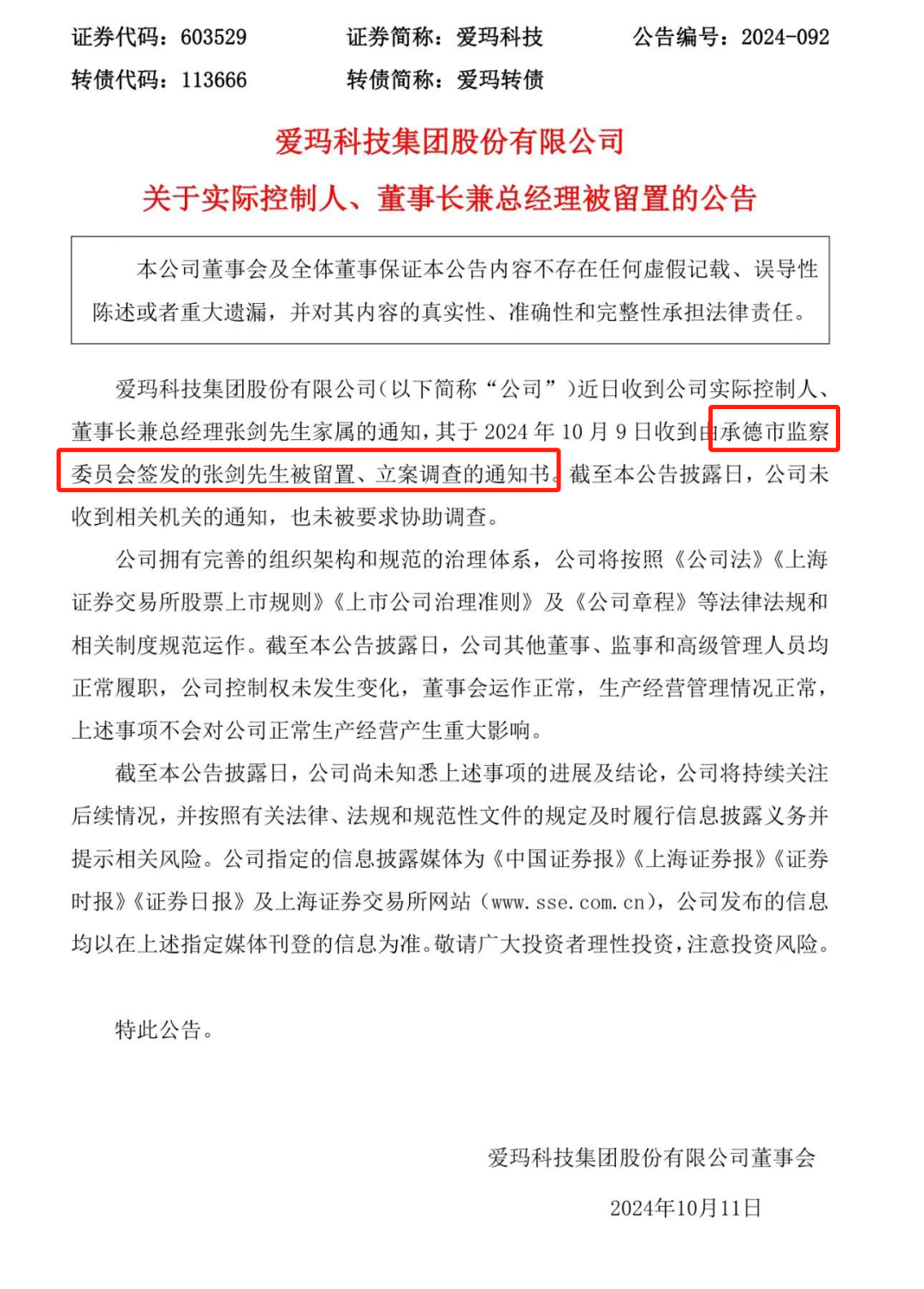

On the evening of October 10, Aima Technology suddenly announced that it had recently received a notice from the family members of the company's actual controller, chairman, and general manager Zhang Jian, informing them that on October 9, 2024, he received a notice from the Chengde Municipal Supervisory Committee that Zhang Jian had been detained and placed under investigation.

What's going on here? Outsiders are confused.

Impacted by this news, Aima Technology opened the trading day with a limit down and fell by 6.91% by the afternoon break.

As the second-largest electric bike brand in China, Aima Technology gained fame after inviting Jay Chou as its spokesperson. However, in recent years, Aima Technology's growth rate has plummeted, and its net profit growth rate has also fallen to single digits. It raises questions: Are electric bikes no longer selling?

1

The actual controller Zhang Jian was suddenly detained and once involved in the "largest extortion case in history"

Unlike previous announcements of other listed company executives being detained and placed under investigation, Zhang Jian's notice came from the Chengde Municipal Supervisory Committee.

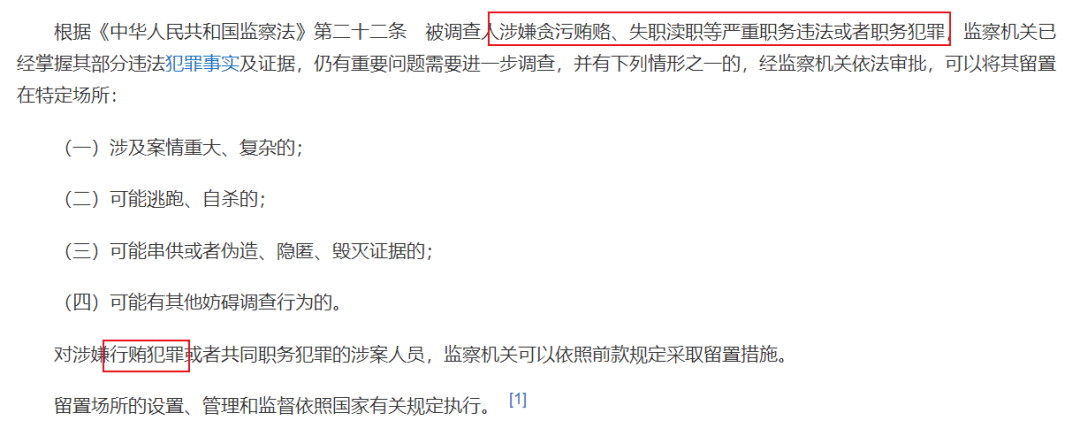

"Detention" is a severe measure adopted by discipline inspection and supervision organs and procuratorial organs to restrict the personal freedom of the person under investigation. For non-public officials suspected of bribery, supervisory organs can also take detention measures in accordance with regulations.

In other words, Aima Technology's boss is likely suspected of bribery and has been detained by relevant authorities.

According to reports, Zhang Jian was born in 1969 in Shangqiu, Henan Province. After graduating from college, he joined a state-owned enterprise in Shangqiu and soon ventured into bicycle sales. In 1999, Zhang Jian and his wife Duan Hua established Tianjin Taimei Vehicle Industry Co., Ltd. in Tianjin, the predecessor of Aima. In 2004, they officially entered the electric bike industry. In 2006, they began researching and producing the "Aima" brand electric bikes. In 2009, the company was officially renamed "Tianjin Aima Technology Co., Ltd."

Not only Zhang Jian and his wife but also Zhang Jian's sisters are involved in the electric bike industry. His older sister Zhang Hong is the boss of Xiaoniao Electric Bikes, and his younger sister Zhang Ru founded Bubuxian Electric Tricycles. The Zhang family is therefore known as the "First Family of Electric Bikes in China."

Although Aima has been deeply involved in electric bikes for many years, it truly gained national recognition thanks to Jay Chou.

In 2009, to build brand awareness, Aima invested 30 million yuan to invite Jay Chou, the peak Asian Mandopop king, as its spokesperson, setting a record for the highest endorsement fee in the electric bike industry at the time. However, this investment was well worth it. After the advertisement aired, Jay Chou riding an Aima electric bike became an instant hit across the country, and Aima's market share quickly rose to the top.

In March 2024, Hurun Research released the "Hurun Global Rich List 2024," with Zhang Jian and his daughter Zhang Gege ranking 1577th on the list with a wealth of 16.5 billion yuan.

However, despite Jay Chou's endorsement and soaring market share, Aima Technology's path to going public was not smooth.

According to media reports, Aima Technology had planned to go public as early as 2012 but did not officially list on the Shanghai Stock Exchange until June 15, 2021. By that time, Aima's biggest competitors, such as Yadea Holdings (01585.HK), Xinri Co., Ltd. (603787.SH), as well as new players like Ninebot (689009.SH) and Niu Technologies (NIU.O), had already gone public.

Aima Technology's bumpy road to going public is closely related to Chairman Zhang Jian's involvement in a "sky-high extortion case."

From 2008 to April 2009, Zhang Jian entrusted Jiangsu Tianjue Motorcycle Technology Co., Ltd., controlled by Gu Jianxin, to manufacture electric bike parts on a subcontract basis. The two subsequently established a new joint venture, "Wuxi Aima," with Zhang Jian holding 70% of the shares and Gu Jianxin holding 30%.

In May 2010, Zhang Jian, Gu Jianxin, Wuxi Aima, Tianjin Aima, and Jiangsu Tianjue signed an agreement stipulating that Zhang Jian and Wuxi Aima would repay a debt of 125 million yuan to Gu Jianxin and Jiangsu Tianjue. Jiangsu Tianjue would compensate Wuxi Aima with real estate valued at over 62.05 million yuan, and Gu Jianxin would transfer his 30% equity in Wuxi Aima to all shareholders of Tianjin Aima at zero consideration. Subsequently, Wuxi Aima became a subsidiary of Tianjin Aima.

Gu Jianxin believed that he did not receive the due consideration for transferring his equity and demanded 235 million yuan from Zhang Jian on the pretext of tax issues at Aima, which was described by the then Legal Evening News as the highest-value extortion case in China.

However, according to China Business News, Gu Jianxin emphasized that his financial transactions with Zhang Jian were mostly evidenced by IOUs and other documents indicating a civil relationship. He also mentioned spending tens of millions of yuan on "public relations" to smooth things over on one occasion. A former Wuxi Aima employee also revealed that "the public relations expenses required for market expansion are considerable and often involve flexible financial arrangements, such as public relations personnel borrowing funds for expenses or simply using personal accounts for fund transfers.""

In 2014, Zhang Jian sued Gu Jianxin. Ultimately, Gu Jianxin was sentenced to 15 years in prison for extortion of 235 million yuan and 30 million yuan in job-related embezzlement, with the sentences to be served concurrently for a total of 20 years. Six months after Gu Jianxin's arrest, Wuxi Aima was also pursued by the Wuxi Municipal State Taxation Bureau for unpaid VAT of over 18.25 million yuan for 2009 and 2010 due to tax evasion issues.

At the time of the incident, Aima Technology was in an expansion and growth phase. However, due to the dispute between the two parties, Aima, which entered the electric bike industry early, not only lost its top position but also faced a bumpy path to going public, finally listing on the capital market in 2021.

2

The industry's "number two" is mired in growth difficulties

In the third year after going public, Aima Technology, whose performance had maintained steady growth for many years, suddenly stagnated.

In 2022, Aima Technology achieved revenue of 20.8 billion yuan and net profit of 1.873 billion yuan, representing year-on-year growth rates of 35.09% and 182.14%, respectively, marking its best performance since going public. However, the following year, Aima Technology's growth rate suddenly plunged.

In 2023, Aima Technology achieved revenue of 21.04 billion yuan, a slight increase of 1.12% year-on-year; net profit was 1.881 billion yuan, a slight increase of 0.41% year-on-year. Compared to previous double-digit or even triple-digit growth rates, Aima Technology's 2023 performance can be described as stagnant.

A closer look at quarterly data reveals an even more pronounced decline in Aima Technology's performance.

Starting in the second quarter of 2023, Aima Technology's revenue suddenly showed negative growth. In the first quarter of 2024, revenue fell 8.97% year-on-year to 4.954 billion yuan.

In terms of net profit, Aima Technology experienced negative growth in both the third and fourth quarters of 2023. Specifically, net profit in the fourth quarter of 2023 fell 34.89% year-on-year to 323.6 million yuan.

In 2024, Aima Technology's performance continued to decline. In the first quarter of this year, Aima Technology achieved revenue of 4.954 billion yuan, a year-on-year decrease of 8.97%; net profit attributable to shareholders was 483 million yuan, a slight year-on-year increase of 1.16%, while net profit after deducting non-recurring gains and losses was 450 million yuan, a year-on-year decrease of 3.9%.

The direct reason for the decline in performance is that Aima electric bikes are no longer selling well.

Financial reports show that in 2023, Aima sold a total of 10.7415 million electric bikes, a decrease of over 30,000 units compared to 10.7727 million units sold in 2022. Among them, sales of core product electric bicycles reached 7.603 million units, a slight year-on-year increase of 5.06% compared to 7.2369 million units in 2022, when sales grew by 44.2%.

Meanwhile, industry leader Yadea sold 16.5 million electric two-wheelers in 2023, including 4.9 million electric scooters and 11.6 million electric bicycles, an increase of 17.9% over 2022.

The gap between Aima and Yadea has widened further. According to data, as of the end of 2023, Aima held a 15.6% market share in the global electric two-wheel market, ranking second. Yadea ranked first with a market share of 28.8%.

Faced with declining sales, Aima Technology's response has been to aggressively spend on marketing. Financial reports show that in the first half of this year, Aima Technology's selling expenses amounted to 412 million yuan, a year-on-year increase of 39.08%, with advertising and business promotion expenses reaching 102 million yuan, a year-on-year increase of 59.38%.

The effect of spending money is direct and obvious. The interim report shows that in the first half of this year, Aima Technology achieved revenue of 10.591 billion yuan, a year-on-year increase of 3.66%; net profit was 951 million yuan, a year-on-year increase of 6.24%. Compared to the declines in previous quarters, Aima Technology's performance has shown some improvement. However, the growth rate is still lower than that of the same period last year.

On the other hand, the "new forces" that focus on "intelligence" are also growing at a rapid pace. For example, Ninebot has seen its revenue from two-wheeled electric bikes grow nearly tenfold since going public in 2020. In 2023, its two-wheeled electric bike revenue even surpassed that of its electric skateboards and electric scooters, becoming the largest source of total revenue.

According to the "2023 China Two-Wheeled Electric Bike Industry White Paper," in the "high-end" two-wheeled electric bike market priced above 7,000 yuan, Ninebot and Niu have market shares of 51.7% and 43.8%, respectively, while Aima Technology has only 0.1%.

Unable to compete with Yadea in the traditional electric two-wheeled bike segment and the "new forces" in the high-end electric two-wheeled bike segment, Aima has also been plagued by frequent quality issues.

Since 2023, Aima electric bikes have repeatedly been found to have quality issues in spot checks conducted by market supervision departments in various regions. Recently, the State Administration for Market Regulation released the "Announcement on the Results of the National Supervision and Special Spot Checks on the Quality of Electric Bicycle Products in the First Half of 2024," in which Aima electric bikes were listed five times.

Now, with the founder suspected of being detained by the supervisory committee for bribery, Aima Technology is in even more trouble.