GAC AION faces growth bottleneck: leading decline in sales and revenue within GAC Group

![]() 10/12 2024

10/12 2024

![]() 490

490

Since the beginning of this year, GAC AION New Energy Automobile Co., Ltd. (hereinafter referred to as "GAC AION"), whose sales have been declining continuously, failed to achieve a turnaround during the "golden September" peak season, ending the month with a decrease of 21.78%.

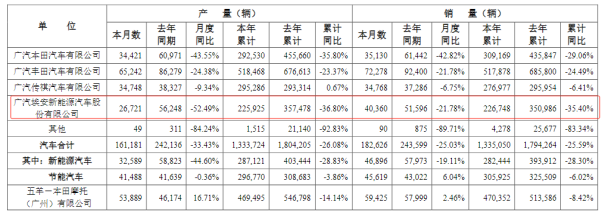

Stockstar notes that as the backbone of GAC Group (601238.SH) in the new energy vehicle sector, GAC AION has struggled to maintain the growth momentum of previous years. Sales have declined year-on-year for eight consecutive months since the beginning of the year, resulting in a revenue drop of over 40% in the first half of the year, the largest decline among the Group's major brands. The latest production and sales data shows that GAC AION's cumulative sales from January to September decreased by 35.4% year-on-year, also leading the decline among its sibling brands. Behind the setback in sales growth lies GAC AION's struggles with intensified market competition, a shrinking pure electric market, and saturation in the ride-hailing market.

GAC AION, once risen to prominence in the ride-hailing market, is now constrained by its "ride-hailing" image, limiting the development space of its brand. To shed the "ride-hailing" label, GAC AION has branded itself with intelligent driving, promoting two consecutive new models that feature advanced intelligent driving as their selling point. However, whether these intelligent driving-focused new models will ultimately boost GAC AION's sales and help the brand shake off the shackles of "ride-hailing" remains to be seen by the market.

01. Cumulative sales decline of over 30% this year

On the evening of October 9, GAC Group released its September production and sales bulletin, which showed that GAC AION's production and sales for the month were 26,700 and 40,400 units, respectively, down 52.49% and 21.78% year-on-year.

Rough estimates show that while GAC AION's sales volume ranks among the top compared to major new energy vehicle brands, it was one of the few to experience a decline in September amidst widespread sales growth across the industry. In contrast, Li Auto-W (02015.HK) regained its 50,000-unit sales mark in September, up 48.9% year-on-year; ZEEKR (ZK.N), NIO (09868.HK), XPeng (09863.HK), and Li Auto-SW (09866.HK) also recorded year-on-year growth of 77%, 113.7%, 39%, and 35%, respectively.

Founded on July 28, 2017, GAC AION is one of the core segments of GAC Group, shouldering the responsibility of the Group's new energy transformation. Focusing on the pure electric segment, GAC AION quickly captured market share after its product launch. From 2018 to 2023, its annual sales grew from 20,000 to 480,000 units, a more than 20-fold increase over six years.

However, GAC AION has reversed its growth momentum this year, achieving year-on-year growth of only 34.11% in January, followed by continuous year-on-year declines in sales starting from February. Specifically, from February to August, GAC AION's monthly sales figures were 10,000, 27,900, 21,400, 30,400, 25,700, 28,300, and 31,800 units, respectively, down 66.74%, 30.4%, 47.94%, 32.21%, 42.92%, 37.17%, and 29.44% year-on-year. Including September, GAC AION has now experienced eight consecutive months of year-on-year sales declines.

Stockstar notes that the pressure on sales has also severely impacted GAC AION's revenue, with its first-half revenue declining 44.61% year-on-year to 12.401 billion yuan, the largest drop among GAC Group's major brands. Affected by GAC AION's shrinking revenue and weak performance of joint venture brands, GAC Group's first-half revenue declined 25.62% year-on-year to 45.808 billion yuan, with corresponding net profit attributable to shareholders falling nearly 50% year-on-year to 1.516 billion yuan.

Due to its poor single-month performance, GAC AION's cumulative sales from January to September also declined 35.4% year-on-year to 226,700 units, the largest decline among GAC Group's major brands.

Stockstar notes that behind the steep sales decline, GAC AION faces numerous challenges. Since 2024, competition in the new energy vehicle market has intensified. With the sharp drop in battery-grade lithium carbonate prices, creating significant cost-reduction opportunities for vehicle manufacturing, domestic electric vehicle companies have joined the price war. Against this backdrop, some automakers with economies of scale have quickly capitalized on the lower penetration rate of A-segment models and the 100,000-200,000 yuan price range by offering competitive pricing, further intensifying competition in the economic electric vehicle market where GAC AION operates.

On the other hand, the market share of pure electric vehicles has shrunk significantly compared to the past. Affected by issues such as range anxiety and safety concerns, the market share of pure electric vehicles has been significantly eroded by plug-in hybrids and extended-range electric vehicles. Currently, the market penetration rate of new energy vehicles has reached 50%, with plug-in hybrids and extended-range electric vehicles accounting for more than half of this figure. Notably, pure electric vehicles accounted for over 60% of the new energy vehicle market in the previous two years. It is worth mentioning that GAC AION plans to enter the plug-in hybrid and extended-range markets in 2025.

Furthermore, GAC AION's over-reliance on the ride-hailing market, which is now nearing saturation in various regions, has led to sluggish sales growth.

Judging from current performance, GAC AION has only achieved 32.39% of its 700,000-unit sales target for 2024. To meet its goal, the company must sell over 470,000 vehicles in the final quarter, almost matching last year's annual target.

02. Difficulty in shedding the "ride-hailing" label

Currently, GAC AION's product lineup includes the AIONS, AIONY, AIONV, AIONLX, and the AIONRT, which began pre-sales on September 26. The main sales drivers for GAC AION are the AIONY and AIONS, compact SUVs and A-segment sedans with starting prices of 99,800 yuan and 129,900 yuan, respectively.

GAC AION's rapid rise is closely tied to its precise targeting of the ride-hailing market. The AIONY and AIONS are GAC AION's flagship models in this market. According to the China Passenger Car Association's analysis report, approximately 850,000 new ride-hailing vehicles were added nationwide in 2023, of which 220,000 were from GAC AION, accounting for approximately 45% of the company's total sales last year.

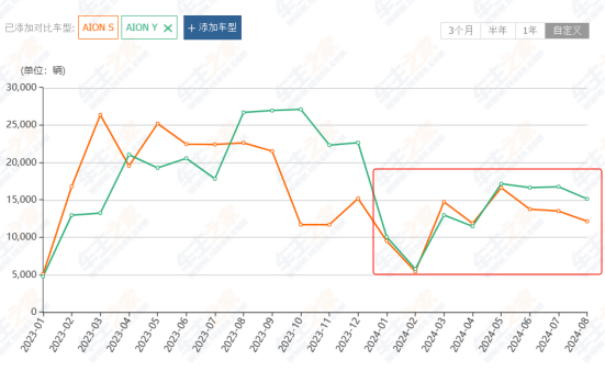

This year, these two models continue to dominate sales. According to sales data for August disclosed by Chezhuzhijia, the monthly sales of the AIONY and AIONS were 15,166 and 12,169 units, respectively, accounting for 48.69% and 39.07% of GAC AION's total sales. In contrast, the AIONV and AIONLX contributed only 12.13% and 0.11% of total sales, with 3,779 and 33 units sold, respectively.

However, as the ride-hailing market gradually becomes saturated, both the AIONY and AIONS have experienced varying degrees of decline this year. According to Chezhuzhijia data, the cumulative sales of the AIONY and AIONS from January to August decreased by 22.25% and 39.14% year-on-year, respectively.

Stockstar notes that the "shortcut" of the ride-hailing market is not a long-term solution. With limited development space for its current sales drivers, GAC AION must ultimately return to direct market competition. However, it seems that GAC AION faces significant challenges in doing so, as its models lack strong competitiveness in the consumer market. Previous attempts to appeal to consumers, such as the AION S Plus and AION S Max, failed to gain traction. The company has also attempted to enter the luxury pure electric vehicle market with its Hyperion brand, but with limited success.

To shed the "ride-hailing" label, GAC AION has placed its bets on intelligent driving. This year, following the second-generation AIONV Aionbaolong, GAC AION introduced its second global model, the AIONRT Aionmenglong, with a pre-sale price range of 119,800 to 169,800 yuan. Alongside the Aionbaolong, it is dubbed the "Intelligent Driving Twin Dragons."

GAC AION has consistently emphasized the intelligent driving capabilities of its products. The second-generation AIONV was the first in the industry to offer a lidar-based, mapless autonomous driving solution in the 160,000 yuan price range. Similarly, the AIONRT is equipped with high-level autonomous driving lidar. During the AIONRT launch event, Xiao Yong, Deputy General Manager of GAC AION, noted that high-level autonomous driving penetration is currently only 1% in the 100,000-180,000 yuan A+ segment market. Therefore, GAC AION hopes that the AIONRT can become a pioneer in popularizing high-level autonomous driving and join the first tier of such technology.

However, it remains uncertain whether intelligent driving can reverse GAC AION's fortunes. Sales of the Aionbaolong have been climbing since its July launch, with deliveries exceeding 6,000 and 9,000 units in August and September, respectively, but the final outcome remains to be seen. In the same market segment as the AIONRT, XPeng's MONA M03, launched on August 27, delivered over 10,000 units in September. (Originally published by Stockstar, written by Lu Wenyan)

- End -