Hong Kong stocks welcome another smart driving chip company, unicorn with a valuation of over RMB 60 billion passes the listing hearing

![]() 10/12 2024

10/12 2024

![]() 690

690

This article is based on public information and is intended for information exchange only, and does not constitute any investment advice.

Produced by | Company Research Office IPO Group

On October 8, the Hong Kong Stock Exchange website published Horizon Robotics' prospectus after the listing hearing, indicating that Horizon Robotics has officially passed the Hong Kong Stock Exchange listing hearing. Horizon Robotics will become another smart driving chip company to successfully list on the Hong Kong Stock Exchange after Black Sesame Technology.

In 2024, Horizon Robotics has two major events: one is the IPO on the Hong Kong Stock Exchange, and the other is the release of the Journey 6 series chip and Horizon SuperDrive full-scenario smart driving solution during the Beijing Auto Show in April.

Now, Horizon Robotics is just one step away from listing on the Hong Kong Stock Exchange, and the installation performance of Journey 6 will not be revealed until 2025.

A unicorn with a valuation of over RMB 60 billion is about to list on the Hong Kong Stock Exchange after a decade of establishment

Horizon Robotics was established in 2015 and is a domestic smart driving chip supplier that integrates algorithms, software, and processing hardware. It provides advanced driver assistance systems (ADAS) and advanced driving (AD) solutions for smart cars.

Since 2020, Horizon Robotics has been repeatedly reported to have intentions to go public, with the listing destination shifting from the STAR Market of the A-share market to the US stock market, and finally settling on the Hong Kong Stock Exchange.

In March 2024, Horizon Robotics submitted its IPO application to the Hong Kong Stock Exchange for the first time; on August 9, Horizon Robotics' IPO on the Hong Kong Stock Exchange was filed with the China Securities Regulatory Commission, and the company plans to issue no more than 1.15 billion overseas-listed ordinary shares and list them on the Stock Exchange of Hong Kong Limited; on September 30, Horizon Robotics updated its prospectus again; on October 8, it passed the Hong Kong Stock Exchange listing hearing.

It is worth mentioning that since the second half of 2024, several companies related to smart driving have successfully listed on the Hong Kong Stock Exchange, such as Ruqi Limousine & chauffeur, a subsidiary of GAC Group, which listed on the Hong Kong Stock Exchange in July, and Black Sesame Technology, a competitor of Horizon Robotics, listed on the Hong Kong Stock Exchange in August and successfully claimed the title of "the first smart driving chip company".

Now that Horizon Robotics has passed the Hong Kong Stock Exchange listing hearing, the smart driving sector on the Hong Kong Stock Exchange has been expanded.

As a company established for ten years, Horizon Robotics has raised 11 rounds of funding and is a unicorn with a valuation of over RMB 60 billion.

In July 2015, Horizon Robotics successfully obtained angel round funding from Innovation Works, Linear Venture, ZhenFund, Sequoia China, Hillhouse Capital, and Source Capital.

In 2021, Horizon Robotics conducted a total of seven rounds of Series C funding, with over 30 investors, including Capital Today, BYD, CATL, and BOE. Some investors remarked, "I've never heard of a Series C7 round before.""In 2022, Horizon Robotics completed its Series D funding from SAIC Motor and Volkswagen. In October of the same year, Horizon Robotics embarked on a new collaboration with CARIAD, Volkswagen's software company for intelligent mobility; in December 2023, Horizon Robotics and CARIAD announced the official establishment of their joint venture, CARIZON, and licensed advanced driver assistance systems (ADAS) and autonomous driving solutions-related algorithms and software to CARIZON.

Prior to the IPO, SAIC Motor held an 8.78% stake, Source Capital held a 5.55% stake, Hillhouse Capital held a 3.24% stake, Volkswagen's CARIAD held a 2.31% stake, and BYD held a 0.11% stake.

Deeper collaboration with Volkswagen leads to increased revenue and expanded losses

Compared to the previous prospectus, the latest prospectus clearly shows a deepened collaboration between Horizon Robotics and Volkswagen. This collaboration has significantly boosted Horizon Robotics' revenue.

Horizon Robotics' revenue primarily comes from its automotive solutions business, which has accounted for over 87% of total revenue during the reporting period. This business segment is further divided into product solutions and licensing and services.

From 2021 to 2023, Horizon Robotics' revenue was RMB 470 million, RMB 910 million, and RMB 1.55 billion, respectively, representing a compound annual growth rate of 82.3%.

In the first half of 2024, Horizon Robotics' revenue was RMB 940 million, a year-on-year increase of 151.6%. Among this, licensing and services revenue amounted to RMB 690 million, a year-on-year increase of 351.6%, and the proportion of licensing and services revenue rose from 41.1% to 73.9%.

Due to the substantial increase in licensing and services revenue, Horizon Robotics' gross margin also improved significantly in the first half of 2024.

From 2021 to 2023, Horizon Robotics' gross margins were 70.9%, 69.3%, and 70.5%, respectively, remaining stable at around 70%.

In the first half of 2024, Horizon Robotics' gross margin increased significantly to 79%, with the gross margin for licensing and services reaching as high as 93%.

Horizon Robotics attributed the rise in gross margin primarily to the relatively low fulfillment costs associated with providing services to customers through its licensing and services business.

However, while the gross margin of the licensing business increased, the gross margin of the product solutions business continued to decline. From 2021 to 2023, the gross margin of the product solutions business dropped from 68.5% to 44.7%, and further declined to 41.7% in the first half of 2024.

From a financial performance perspective, Horizon Robotics' losses have also increased.

From 2021 to 2023, Horizon Robotics' net losses were RMB 2.06 billion, RMB 8.72 billion, and RMB 6.74 billion, respectively, totaling RMB 17.5 billion in cumulative losses. In the first half of 2024, Horizon Robotics' net loss was RMB 5.10 billion, a year-on-year increase of 170%.

Horizon Robotics anticipates a substantial increase in losses for the full year, partly due to factors such as valuation changes and the CARIZON joint venture plan with Volkswagen, and partly due to continued investments in research and development.

During the reporting period, Horizon Robotics' research and development expenditures continued to grow. From 2021 to 2023, Horizon Robotics' R&D expenses were RMB 1.14 billion, RMB 1.88 billion, and RMB 2.37 billion, respectively. In the first half of 2024, Horizon Robotics invested RMB 1.42 billion in research and development, a year-on-year increase of 35.3%.

As of the end of June 2024, Horizon Robotics' R&D team consisted of 1,696 members, accounting for 73.1% of the total workforce, an increase of 218 people from the end of 2023.

While the collaboration with Volkswagen has boosted revenue and gross margin, it has also increased Horizon Robotics' dependence on major customers.

Before collaborating with Volkswagen, in 2021 and 2022, the revenue contribution from Horizon Robotics' top five customers accounted for 60.7% and 53.2% of total revenue, respectively.

After collaborating with Volkswagen, in 2023 and the first half of 2024, the revenue contribution from the top five customers accounted for 68.8% and 77.9% of total revenue, respectively. Among them, the share of the largest customer also increased from 24.7% in 2021 to 37.6%.

Can Journey 6P, with a computing power of 560 TOPS, raise the ceiling for Horizon Robotics?

In 2024, Horizon Robotics has two major events: one is the IPO on the Hong Kong Stock Exchange, and the other is the release of the Journey 6 series chip and Horizon SuperDrive full-scenario smart driving solution during the Beijing Auto Show in April.

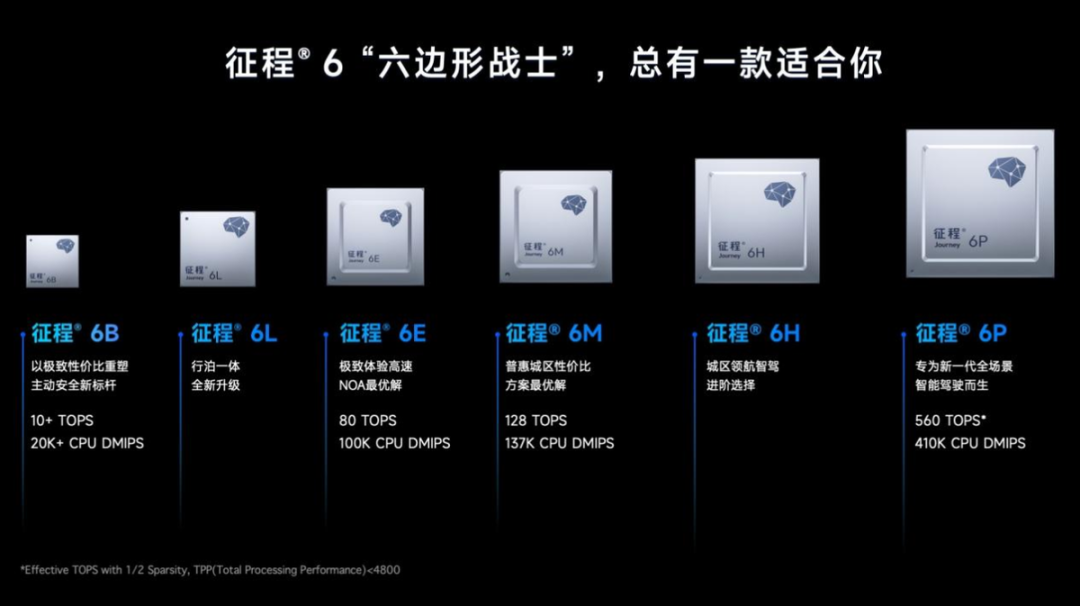

The Journey 6 series is a family of chips with six versions targeting different smart driving scenarios, including Journey 6B, Journey 6L, Journey 6E, Journey 6M, Journey 6H, and Journey 6P.

For the low-end smart driving market, Horizon Robotics introduced Journey 6B with a computing power of over 10 TOPS. For the mid-range smart driving market, Horizon Robotics introduced Journey 6E and Journey 6M with computing powers of 80 TOPS and 128 TOPS, respectively.

The most significant product in the Journey 6 series is Journey 6P, a chip with a computing power of up to 560 TOPS. It is understood that Journey 6P is currently the most powerful domestic smart driving chip in terms of computing power.

Based on Journey 6P, Horizon Robotics also released the Horizon SuperDrive algorithm solution. According to the prospectus, Horizon SuperDrive can achieve high-level autonomous driving functions in all urban, highway, and parking scenarios.

At the April press conference, Yu Kai, founder and CEO of Horizon Robotics, revealed that the Journey 6 series has reached mass production cooperation with ten initial partner automakers and brands, including SAIC Motor, Volkswagen Group, BYD, LIXIANG Auto, GAC Group, DEEPAL Blue, Beijing Automotive Group, Chery Automobile, EXEED, and VOYAH.

Yu Kai further stated that the Journey 6 series will commence deliveries of its first mass-produced pre-installed vehicle models within 2024 and is expected to achieve mass production deliveries of over 10 models by 2025. Meanwhile, SuperDrive will launch its standard mass production solution in the fourth quarter of 2024 and is expected to deliver its first mass-produced partner vehicle model in the third quarter of 2025.

In addition, Yu Kai also mentioned that Horizon Robotics has invested over RMB 3 billion in research and development for the Horizon SuperDrive smart driving system, with a research and development team of over 1,000 people. He believes that "if Horizon Robotics cannot support a very high ceiling for smart driving, its entire business ecosystem will not be sustainable.""According to the latest prospectus, as of the latest practicable date, Horizon Robotics' hardware and software integrated solutions have been adopted by 27 OEMs and installed in 290 vehicle models.

According to Gaogong Auto data, in the domestic high-level autonomous driving NOA solution market in 2023, NVIDIA led with a 48.9% market share, followed by Horizon Robotics with a 35.5% market share.

From a market share perspective, Horizon Robotics appears to be on par with NVIDIA. However, in terms of chip computing power, NVIDIA remains Horizon Robotics' target for catch-up.

Leveraging the financing platform of the Hong Kong Stock Exchange, Horizon Robotics may have more ample funds for research and development, further elevating the level of domestic smart driving chips.