Sales of the top seven domestic brands in September: BYD surpasses 400,000 units, and Geely overtakes Chery to rank second?

![]() 10/14 2024

10/14 2024

![]() 610

610

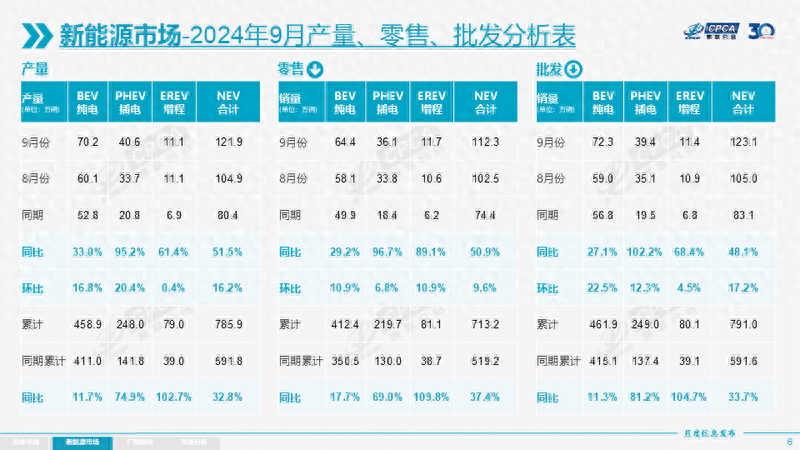

Recently, the China Passenger Car Association (CPCA) released the sales data for September. In September, nationwide narrow-sense passenger vehicle retail sales reached 2.109 million units, a year-on-year increase of 4.5% and a month-on-month increase of 10.6%; cumulative retail sales since the beginning of the year reached 15.574 million units, up 2.2% year-on-year.

Specifically, in September, conventional gasoline-powered vehicle retail sales reached 990,000 units, down 22% year-on-year but up 12% month-on-month; cumulative retail sales of conventional gasoline-powered vehicles from January to September reached 8.44 million units, down 16% year-on-year. In September, the domestic new energy vehicle retail penetration rate was 53.3%. So, how did the "big seven" domestic automakers, which are the leaders in the traditional automotive industry, perform in September? Let's take a look.

1. BYD (passenger cars)

September sales: 417,600 units

January-September sales: 2.749 million units

In September, BYD sold 419,400 vehicles, a year-on-year increase of 45.91%, marking the first time monthly sales exceeded 400,000 units. From January to September, BYD sold nearly 2.75 million passenger cars, and it is expected that cumulative sales will exceed 3 million units by October. If this target is achieved, it will surpass last year's annual sales.

Specifically, in terms of monthly sales by brand in September, BYD's Dynasty and Ocean networks sold 401,572 units, with Dynasty surpassing 200,000 units for the first time in a single month. The Qin, Song, and Yuan families contributed 75,785, 46,125, and 45,618 units, respectively; the Ocean network sold 194,099 units, with Seagull, Seal, and Song families contributing 43,425, 58,258, and 43,010 units, respectively; FANGCHENGBAO sold 5,422 units; Denza sold 10,299 units; and URUS sold 310 units.

In overseas markets, BYD exported a total of 33,012 vehicles in September, a year-on-year increase of 17.7%. Cumulative exports have exceeded 280,000 units this year, making a significant contribution to BYD's sales.

2. Geely

September sales: 308,000 units

January-September sales: 2.319 million units

In September, Geely Holding Group sold a total of 308,119 vehicles, setting a new record high and increasing by 17.8% year-on-year. Among them, new energy vehicle sales reached 152,515 units, up 59.6% year-on-year, with a new energy penetration rate of 49.5%; cumulative sales from January to September reached 2,319,664 units, up 21% year-on-year; and cumulative new energy vehicle sales reached 976,256 units, up 50.1% year-on-year.

By brand, Geely sold 154,813 units, Lynk & Co sold 25,803 units, and Zeekr delivered 21,333 units. Volvo Cars sold 62,458 units globally in September, focusing on the domestic and European markets; Proton sold 11,269 units in September, ranking second in Malaysian vehicle sales.

In terms of exports, Geely exported 39,183 vehicles in September, up 51% year-on-year; cumulative exports for the year reached 314,038 units, up 68% year-on-year.

3. Chery Group

September sales: 244,500 units

January-September sales: 1.752 million units

Chery Group sold 244,534 vehicles in September, up 28.6% year-on-year. Among them, exports reached 109,048 units, up 20.6% year-on-year; and new energy vehicles reached 58,941 units, up 183.4% year-on-year.

Performance of the four main passenger car brands: Chery sold 151,051 units in September, Starway sold 15,717 units, Jettour sold 60,226 units, and iCAR sold 5,180 units in September.

In the first three quarters, Chery Group sold a cumulative total of 1,752,793 vehicles, a year-on-year growth rate of 39.9%, which is 93% of its 2023 annual sales. Among them, new energy vehicle sales reached 331,788 units, up 186.4% year-on-year; gasoline-powered vehicle sales reached 1,421,005 units, up 24.9% year-on-year; exports reached 829,353 units, up 24.5% year-on-year; and domestic sales reached 923,440 units, up 57.2% year-on-year. Among domestic automakers, Chery Automobile is one of the few that has not abandoned the gasoline-powered vehicle market while focusing on the new energy vehicle market.

4. Changan Automobile

September sales: 129,000 units (independent passenger cars)

January-September sales: 1.16 million units

From January to September 2024, Changan Automobile sold a cumulative total of 1,904,979 units, a slight year-on-year increase of 1.89%. Among them, Changan's independent brands sold a cumulative total of 1,584,526 units, its independent passenger car brands sold 1,160,876 units, and its independent brands exported a cumulative total of 287,722 units. From January to September this year, independent brand new energy vehicle sales totaled 447,618 units.

Currently, Changan has released specific sales figures for each sub-brand from January to September. Data shows that Changan Qiyuan delivered 109,851 units from January to September, Deep Blue delivered 143,419 units, AITO delivered 40,904 units, and the Changan brand sold 895,453 units from January to September. In terms of exports, Changan's independent brands exported 287,722 units overseas from January to September, up 65.5% year-on-year.

5. Great Wall Motor

September sales: 108,000 units (including commercial vehicles)

January-September sales: 853,000 units

In September, Great Wall Motor sold 108,398 vehicles, down 10.88% year-on-year. In the first three quarters of 2024, Great Wall Motor sold a cumulative total of 853,813 vehicles, a slight year-on-year decrease of 1.18%. In the new energy vehicle segment, Great Wall Motor sold 30,129 units in September, with cumulative sales reaching 211,492 units for the year.

Specifically, by brand, Haval sold 62,900 units in September, down 14.73% year-on-year; WEY sold 6,755 units in September, up 165.11% year-on-year; Great Wall Pickup sold 14,456 units in September, down 15.94% year-on-year; Ora sold 5,486 units in September, down 45.25% year-on-year; and Tank sold 18,740 units in September, up 3.8% year-on-year.

Although domestic sales were not impressive, Great Wall Motor performed well overseas. In terms of exports, Great Wall Motor sold 44,105 units overseas in September, with cumulative overseas sales reaching 324,244 units in 2024.

6. GAC Group

September sales: 75,000 units

January-September sales: 503,700 units

In September, GAC Motor and GAC Aion sold 34,700 and 40,300 new vehicles, respectively, down 6.75% and 21.78% year-on-year. Cumulative sales for the first nine months were 277,000 and 226,700 units, respectively, down 6.41% and 35.4% year-on-year.

Affected by the "price war," GAC Group's sales have declined, and the pressure is immense going forward, especially in the once-proud new energy vehicle segment, which has become a drag. At present, it seems challenging for GAC Group to rely on new energy vehicles for a breakthrough.

7. SAIC Passenger Vehicles

September sales: 65,500 units

January-September sales: 557,700 units

Recently, SAIC Motor released its September production and sales bulletin, reporting total sales of 313,260 units, a significant year-on-year decrease of 35.03%. Among them, SAIC Passenger Vehicles sold 54,366 units, down 41.12% year-on-year; IM sold 6,263 units, up 246.98% year-on-year; and MG Motor India sold 5,021 units.

Currently, SAIC Passenger Vehicles encompasses the Roewe, MG, and Feifan brands. Among them, Roewe has launched the D-series, which can run on both gasoline and electricity; MG focuses on overseas markets; and the outlook for Feifan Automobile is relatively uncertain. IM, which pursues a high-end strategy, currently has four models on sale: IM L7, IM LS7, IM LS6, and IM L6.

MG4 EV

IM L6

In the sales bulletin, the only brand that did not experience a decline in sales was IM, which was closely related to the strong sales of the IM L6 model. Other brands experienced varying degrees of sales declines.

Closing Remarks

In 2024, the domestic automotive market will undergo further "reshuffling." Judging from the current situation, the rankings of the top seven domestic brands are relatively stable: BYD remains firmly in first place, while Geely and Chery compete for second and third places.

Clearly, competition in the domestic automotive market will become increasingly fierce. Currently, overseas exports and new energy vehicles remain growth points, and many domestic brands are seeking transformation and renewed momentum. 2024 may be a watershed year, and we eagerly await the unfolding picture of the domestic automotive market this year. Welcome to follow "Cheyuwuwujiang" and share your thoughts in the comments section.