This issue doomed Musk's failure even before the advent of Robotaxi

![]() 10/14 2024

10/14 2024

![]() 637

637

Introduction

The first year of the boomerang, and another one is seen coming back from the depths of time.

It's that time of the year again for Musk's annual "suffocate for your dreams" conference.

After an incident where someone at the venue suddenly fell ill and had to be rushed to the hospital, Elon Musk unveiled his "ecological counterreaction" – the Robotaxi product, which he first mentioned in the "Tesla Master Plan" back in 2016.

Image | "Hello everyone, I miss you all so much!"

Yesterday, Mr. Cui from the Commune gave a detailed account of this conference and also pointed out that European and American capital circles are not optimistic about the projects announced at this conference. The U.S. stock market responded to Musk's latest "pie in the sky" promises with a dive, wiping out RMB 470 billion in market value overnight.

This article does not intend to repeat the issues discussed by various media and analysts over the past few days regarding business logic, profit models, industrial impact, or even technical feasibility. Instead, it will focus on a critical "detail" to explain why Tesla's new project is fraught with uncertainty and far from being realized.

In fact, this issue is not limited to Tesla alone but also affects the entire American automotive manufacturing industry.

New Issues Arising from New Technologies

In early October last year, the refreshed Model 3 was first launched in the UK.

The outside world generally criticized Tesla's mid-cycle refresh of this model as "long overdue," with some even mocking its lack of sincerity. While these criticisms are valid, they fail to address the core issue. From a corporate perspective, the most significant upgrade in the refreshed Model 3 lies in the introduction of an integrated casting process similar to that used in the Model Y.

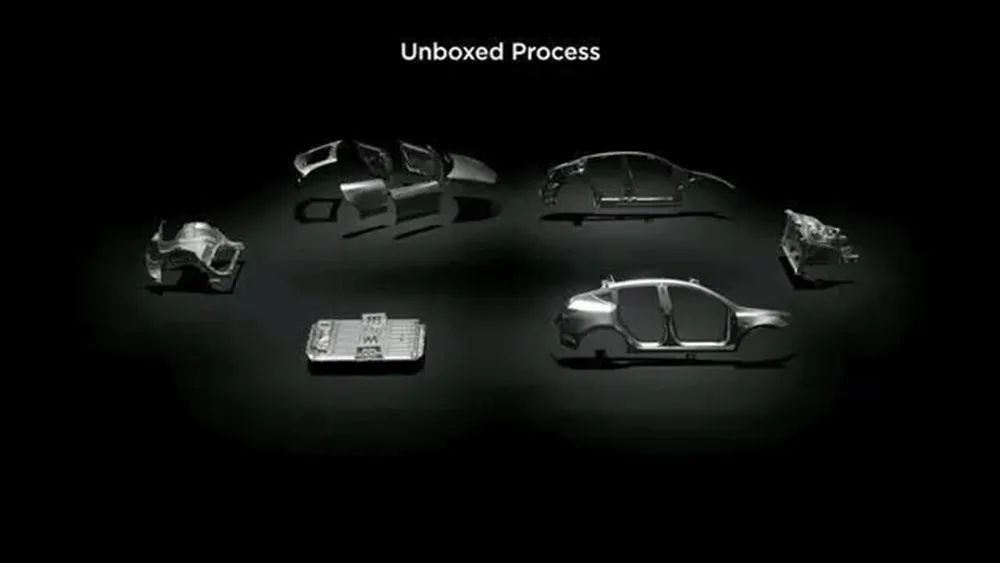

Image | In the past two years, apart from the repeatedly delayed "large-format" battery project, Tesla's truly implemented new technologies have been the continuous advancement of die-casting alternatives.

Marking this period, if we include the Cybertruck, which was scheduled to begin its first deliveries at the beginning of December, three out of Tesla's five mass-produced models have adopted the integrated casting process.

At that time, public opinion gradually shifted towards recognizing this integrated casting technology, which seemed poised to change the rules of the automotive manufacturing (and possibly repair and insurance) industry. In fact, by the first half of 2023, domestic OEMs had also gradually introduced die-casting technology into their automotive production processes.

However, just as discussions were underway about when Tesla would introduce this technology into its premium Model S/X models and when it would acquire super die-casting machines with a clamping force of 20,000 tons to cast mid-sized chassis assemblies in a single piece – as Musk had boasted about at Tesla's Investor Day on March 1st this year (for related content, see the article "Tesla's Promises on Integrated Casting Fall Flat") – U.S. media reported around Labor Day that Tesla had abandoned plans to further expand the production application of die-casting technology.

Image | The ultimate goal of the "unpacking process" is to integrate the entire vehicle body manufacturing into 11 large die-castings.

Reasons for Tesla's decision include the near-completion of backlogged orders for vehicles other than the Cybertruck and the weaker-than-expected market response to the main Model 3/Y models. The expected cheaper and more accessible Model 2/Q has yet to materialize, leading to speculation, though Tesla is unlikely to confirm this. However, there is another crucial yet often overlooked issue that outsiders find difficult to analyze and that Musk himself takes time to address specifically.

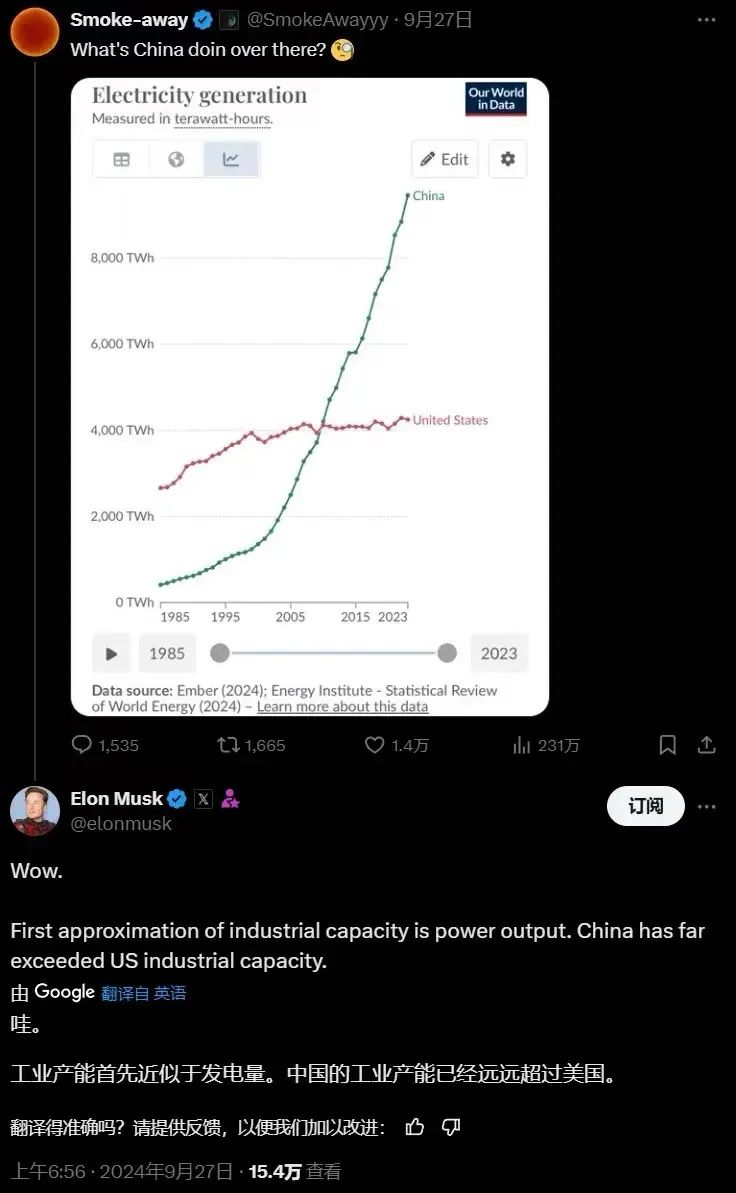

Just at the end of last month, Musk, widely recognized as the flagship of North American technology companies, casually discussed various high-minded and profound topics on his personal X platform page, as he often does. But this time, it was a comparison of industrial capabilities between China and the United States.

While plans to revitalize U.S. domestic industrial capacity can be traced back to Obama's second term, Musk believes that the various stimulus measures currently being pursued by both former President Trump and current President Biden, as well as potential future presidents, are unfeasible. The reason for this, according to Musk, lies in the outdated U.S. infrastructure, particularly the power supply.

Currently, there is no comparable power supply capacity outside of China. "Even if we magically teleport all the industrial production facilities within China overseas, these facilities would shut down due to insufficient power supply. This is a hard physical constraint that cannot be changed, no matter how strong the political will of the United States may be," Musk said.

Image | A well-summarized point, but ultimately meaningless.

During this period, Musk quoted a chart comparing electricity generation between China and the United States, which was shared by an X user named Smoke-away, and summarized:

Industrial capacity is roughly equivalent to electricity generation, and China's industrial capacity has far surpassed that of the United States.

Linking this to another tweet by Musk discussing related topics on September 27th, while the topic initially centered on the Kardashev scale, a fictional metric used to measure the energy consumption of cosmic civilizations, it eventually led to a discussion on the value of photovoltaic power generation in Texas and New Mexico...

In early November last year, Tesla announced the completion and activation of the first phase of its photovoltaic roof project at its Texas Gigafactory, which was launched in July 2020 and has an installed capacity of approximately 10 megawatts.

The Texas Gigafactory's primary function is to produce the Model Y and Cybertruck for the U.S. domestic market. Such a photovoltaic roof power station is undoubtedly valuable in reducing the energy consumption costs associated with production, but its benefits are primarily long-term in nature.

Image | The roof is adorned with photovoltaic panels spelling out "TESLA." But is this any different from the joke about painting the moon red and writing "Coca-Cola" in black? Seriously, who would be able to see this from the ground, unless they were in an airplane or a drone?

After all, a modern OEM with an annual design capacity of over 250,000 vehicles, encompassing standard stamping, welding, painting, and assembly processes, consumes at least 500,000 kWh of electricity per day, even if its production capacity is maintained at around 60%.

So, how much will factory energy consumption increase after adopting the integrated casting process?

Trading Efficiency for Energy Consumption

Due to the lack of detailed data on many materials and equipment, the following figures are approximate estimates. Let's start by calculating the electrical energy required to melt each ton of aluminum –

Without considering the production process of aluminum ingots, we know that the specific heat capacity of aluminum is approximately 0.88 kJ/kg·℃, which means that each kilogram of pure aluminum absorbs 880 joules of heat for every 1℃ increase in temperature before melting.

With an aluminum melting point of 660℃, and considering that each kWh of electricity is equivalent to 3600 kJ of heat, the electrical energy required to melt 1 ton of aluminum at room temperature (25℃) is approximately 155.22 kWh.

However, the melting furnace itself has a thermal efficiency. Typically, for this type of medium-frequency melting furnace commonly used in die-casting processes, we calculate using the most advanced 80% conversion efficiency, which means that slightly more than 194 kWh of electrical energy is required to melt each ton of aluminum.

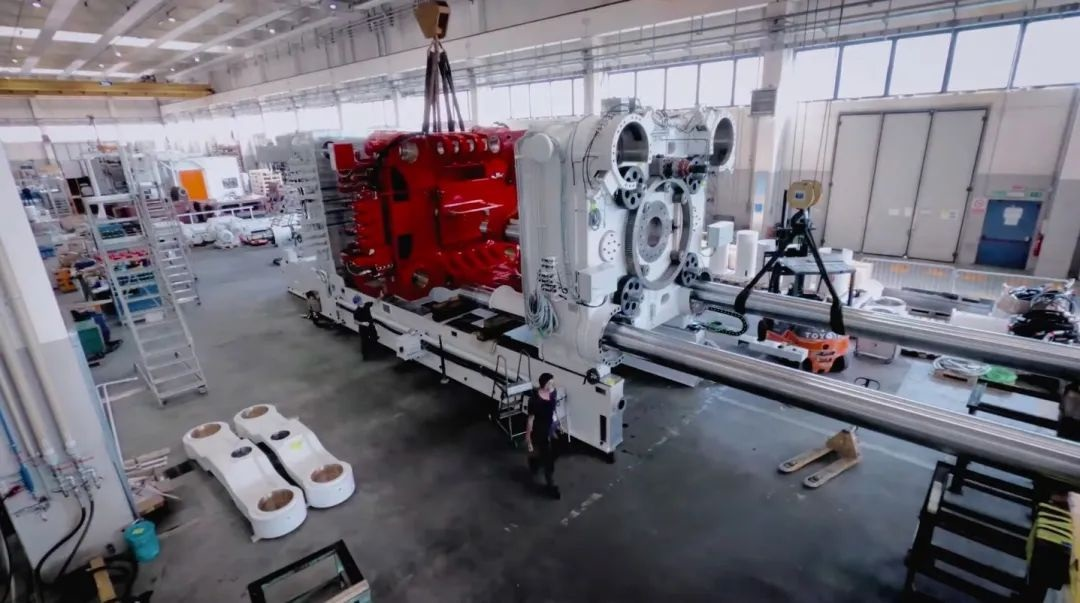

Image | Tesla's first Giga Press, supplied by Italian company IDRA.

Next, the startup of large die-casting machines, as well as the preheating of molds, temperature control processes, and mold closing and opening operations, all require electricity. Considering that die-casting is a continuous process, the mold only needs to be preheated during startup and can then be used continuously until shutdown for maintenance. Roughly estimating, we can assume that these operations, up until the completion of the chassis casting blank, consume a total of 46 kWh of electricity.

Based on the above calculations, the die-casting workshop of a U.S. OEM processing a chassis assembly blank weighing approximately 1 ton would roughly consume 240 kWh of electricity. If this OEM has a weekly production capacity of 5,000 units, such as Tesla's Texas Gigafactory mentioned above, and the die-casting workshop achieves a top-notch pass rate of 95%, then just the die-casting of chassis blanks alone would consume 1.2 million kWh of electricity per week, or over 170,000 kWh per day.

Image | The Cybertruck currently uses the highest proportion of die-casting technology, with its body constructed from three large die-castings welded together.

In reality, there are no chassis casting assembly blanks weighing as much as 1 ton. Even Tesla, which has been at the forefront of this technology, has struggled for many years to achieve front, middle, and rear chassis casting assemblies for the Cybertruck, and the yield rate for any given section barely approaches 90%, so the overall energy consumption is only higher than the calculated value above.

Furthermore, additional processing steps such as cutting and finishing are required after the blank is completed, so the actual production electricity consumption at the same scale could potentially double the calculated value. Therefore, our earlier description of Tesla's photovoltaic power station at its Texas Gigafactory as "a drop in the ocean" is quite apt.

While die-casting is indeed an innovative technology that can improve OEM productivity and save production time for automotive body components, as with any change throughout history, it is impossible for it to have only benefits and no drawbacks. In addition to the known issues that have already sparked controversy, its high energy consumption demand is a significant hidden constraint.

At this point, some of you who are familiar with the situation may be thinking: Electricity prices in the United States are lower than in China, especially for industrial use! This question is spot on and hits the nail on the head.

Image | The relatively low industrial electricity prices in the United States were a key incentive for a few Chinese companies to invest there in reverse.

Electricity prices in the United States have remained low, and while industrial electricity rates are complex to calculate, based on the average for January to May this year, the average industrial electricity price in the United States is 7.88 cents per kWh, which at current exchange rates is less than 0.56 RMB.

The relatively low industrial electricity prices in the United States were also a major motivator for energy-intensive companies like Fuyao Glass to establish factories there, in addition to being close to end markets. However, as mentioned earlier, with major U.S. internet companies racing to develop AI today, and given that the United States generated 4.4 trillion kWh of electricity last year and had an average per capita monthly electricity consumption of 371 kWh, there may not be enough excess generation capacity for automakers to undertake such significant energy-for-labor/efficiency transformations.

Don't assume that U.S. companies can squeeze out a significant amount of wasted energy from residential consumption based on China's lower per capita residential electricity consumption (69 kWh per month). In the aftermath of a two-year inflation cycle that has just ended in the United States, where the living pressures on lower-income groups have intensified, implementing such energy-saving plans would be political suicide for any party under the U.S. system.

Moreover, the U.S. system leads to a fully market-driven energy supply system. Power suppliers will not arbitrarily expand their generation capacity based on manufacturing companies' development expectations unless they can demonstrate tangible benefits to the companies' financial statements.

Image | The Ivanpah Solar Power Facility in the Mojave Desert, California, uses mirrors to focus sunlight and heat boilers rather than photovoltaic panels. The facility has a capacity of 392 megawatts but cost $2.2 billion to build.

Furthermore, under current U.S. regulations, it is quite difficult to initiate new power generation facilities, whether fossil fuel-based or nuclear, apart from distributed renewable energy sources.

Of course, there are quick fixes, such as restarting old facilities...

On the morning of September 20th local time, Constellation Energy, the largest nuclear reactor operator in the United States, announced that it had signed an "unprecedented" long-term power purchase agreement with Microsoft. Over the next 20 years, Constellation Energy will supply Microsoft's PJM (Pennsylvania-New Jersey-Maryland Interconnection) servers with long-term zero-carbon green electricity.

"Image | PJM platform's main control hall, which is currently responsible for the operation and management of the power systems in 13 states of the United States and the District of Columbia. It requires powerful servers and considerable power support, so Microsoft, which is responsible for its operation and maintenance, has always wanted to decarbonize its energy supply."

"Stimulated by this positive news, Consolidated Edison's stock opened high at $235.16 on the same day (closing at $205.11 on the 19th) and continued to rise to close at $254.98. Not only did it record a 22.29% surge on September 20th, but this upward trend also continued until October 9th, the date of this writing."

"Actually, after years of frequent news about major power outages across states in the United States, such news has probably become mundane, akin to 'a dog biting a man' and lacking much intrigue. Furthermore, with the well-known fact that American tech companies are rushing into the AI race, eagerly building their A.I. computing platforms for large-scale model training, power consumption is soaring, making Consolidated Edison's skyrocketing stock price unsurprising."

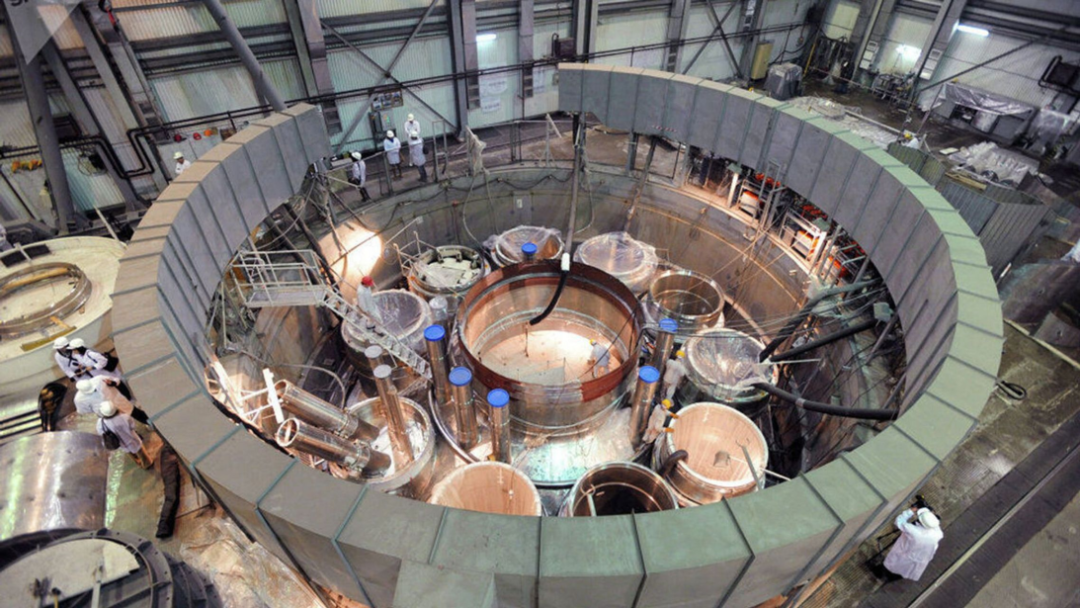

"However, the real significance of this news lies not in the positives or future prospects but in how Consolidated Edison plans to fulfill its contract to provide PJM with 'zero-emission green electricity.' According to the current plan, Consolidated Edison intends to restart the Three Mile Island Nuclear Power Plant's TMI-1 unit by 2028."

"Image | An overview of the Three Mile Island Nuclear Power Plant's core area, with the concrete dome and condenser tower on the left representing the TMI-2 unit, which was shut down after the 1979 accident."

"For Chinese people, unless you're a fan of Marvel comics and movies and have seen 'Wolverine,' 'Three Mile Island' is probably a very unfamiliar name compared to Fukushima or even Chernobyl. However, in the global history of atomic energy, it's a name that cannot be overlooked in any related textbooks or industry safety courses."

"In the history of human atomic energy power generation, there have been three accidents that have reached the level of core meltdown. In chronological order from recent to past, they are the Fukushima nuclear accident on March 11, 2011, the Chernobyl disaster on April 26, 1986, and the Three Mile Island accident on March 28, 1979."

"Unlike the two 'juniors' that reached the highest nuclear accident level of 7, the Three Mile Island accident did not cause a hydrogen explosion that led to the widespread release of radioactive material, hence it was classified as only a Level 5 accident. However, non-dispersal does not equal non-leakage; the core of the plant's TMI-2 reactor melted down and was exposed for a time."

"This accident marked a devastating blow to the once-booming US nuclear power industry, with all planned projects abandoned. It wasn't until 33 years later, in 2012, that the US Nuclear Regulatory Commission approved a new nuclear power plant project."

"The most direct reason why Consolidated Edison chose to restart the Three Mile Island Nuclear Power Plant is that the site has existing cooling towers, and the TMI-1 unit was still operational before 2019. Even if they invest in procuring Westinghouse's latest AP1000 reactor, as is done in newly built nuclear power plants in recent years, they can at least utilize existing facilities."

"Image | Inside the original concrete shell of the TMI-1 reactor, a new Westinghouse AP1000 reactor may be installed. However, if there's only one, its maximum installed capacity would be no more than 1,250 megawatts."

"Yet this nuclear power plant, commissioned in 1974, is located on a small island in the middle of a river with limited space. Even though the accident occurred 45 years ago and the accident area has been thoroughly cleaned up, the radioactive contaminated workshops will remain unusable for many years to come. This makes the so-called restart of Three Mile Island a one-time deal for one reactor and one unit."

"Nevertheless, this is one of the few options available within the current system. After all, the global leading suppliers of various renewable energy equipment are China, which the current American ruling elite are eager to contain and suppress."

"Just a month ago, on September 13th, the Office of the United States Trade Representative announced final measures regarding Section 301 tariffs on China, imposing an additional 50% 301 tariff on photovoltaic cells and modules originating in China, effective from September 27th."

"For all manufacturing enterprises, adopting new processes and technologies to produce better-quality products at lower costs to maximize market competitiveness is their most fundamental path. However, even though industry pioneers have blazed this new process path, the energy conditions for large-scale implementation are no longer available... This is indeed ironic and thought-provoking."

"Image | 'Make America Great Again!'"

"Although the legendary low-end Tesla model failed to materialize at the previous day's event, the Tesla Robotaxi, touted to cost less than $30,000, bears some resemblance to the rumored Model 2/Q. But even setting aside the still-in-development L5 autonomous driving system, which is more advanced than Full Self-Driving, can Tesla's US factories maintain confidence in ensuring mass production, both now and in the future?"

"Fortunately, that's not something we need to worry about."

| Lindenman |