Turning a profit is just the beginning, Thalys' growth continues

![]() 10/14 2024

10/14 2024

![]() 557

557

After Thalys released its third-quarter earnings report, many investors felt relieved in the comments section:

The heavy snow has weighed on me for two or three years, but I laugh at it as light as cotton.

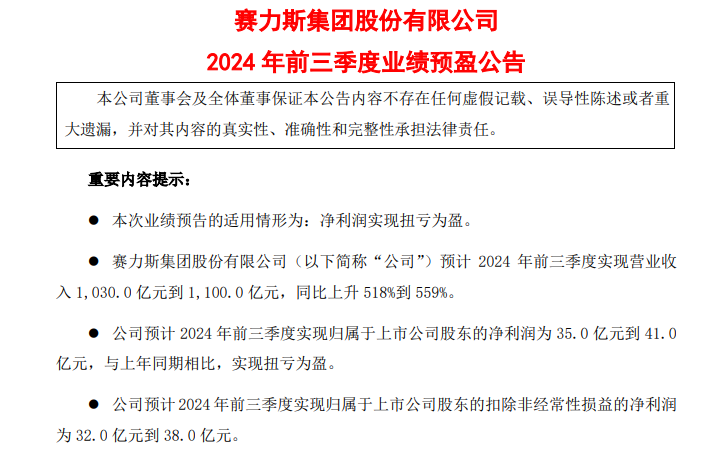

The earnings forecast shows that Thalys' revenue for the first three quarters of 2024 increased by 518% to 559% year-on-year, reaching RMB 103 billion to RMB 110 billion; at the same time, net profit turned positive for the third consecutive quarter, and the net profit margin for the three quarters grew steadily.

Through all doubts, Thalys' "comeback" has been impressive, and it can now be considered an absolute leader in the first tier. After the significant increase in revenue, it's time to set the tone for Thalys' future imagination space.

Only aiming for the high-end market, Thalys' growth expectations are stronger than expected

"Increasing revenue without increasing profit" has always been a common characteristic among new automotive companies, especially since price wars have put a heavy burden on businesses. However, differentiation is inevitable, and those who do not hesitate to enter the fray and face difficulties demonstrate the strength of their brand.

In 2023, Li Auto, as a representative of emerging automakers, was the first to turn a profit, signaling the beginning of differentiation. But in Thalys, we see even stronger momentum.

After the first quarter of 2024, Thalys became another new automaker to turn a profit. Subsequently, Thalys' profitability soared. According to financial reports, Thalys achieved net profit attributable to shareholders of the parent company of RMB 1.625 billion in the first half of the year, comparable to Li Auto during the same period.

The reason is clear to us all. Thalys achieved a record high quarterly sales volume in the first quarter, and more importantly, the dividends of the high-end market are accelerating.

In the past, domestic car brands had a relatively shallow connection with the high-end luxury car segment, and the premium market (priced above RMB 500,000) was long dominated by international brands such as BMW, Mercedes-Benz, and Audi, making it difficult for domestic brands to make a mark. Over time, consumer recognition has also been questionable, and it can be said that everything is difficult at the beginning.

Thalys has made a great start, and it's been very impressive. Partnering with Huawei to redefine cars with superior software, Thalys has broken the deadlock and successfully carved out a path in the domestic luxury car market.

In the first three quarters, AITO delivered over 310,000 new vehicles across its entire model range, with the AITO M9, which has been on the market for over nine months, having booked over 150,000 orders, maintaining its position as the sales champion in the Chinese luxury market for models priced above RMB 500,000 for six consecutive months.

Statistics show that starting from scratch, the AITO M9 surpassed BMW X5, the most representative model among BBA, in its fourth month on the market, and its lead has since widened further, truly representing the pinnacle of domestic automakers' quality and consumers' extremely high recognition.

Additionally, the AITO new M7 series, priced between RMB 200,000 and RMB 400,000, also performed exceptionally well, delivering 200,000 new vehicles in 12 months since its launch, setting a new record for China's new energy luxury brands.

Behind the continuous records in delivery speed lies Thalys' high-quality production assurance. As of the end of July this year, since the first vehicle rolled off the assembly line, AITO has successfully produced its 400,000th new vehicle in just 28 months, making it the fastest Chinese new energy automotive brand to reach this milestone.

With a continuously optimized product mix, Thalys has once again achieved both volume and price increases in an industry with increasingly strong market drivers, and its revenue scale has entered a period of rapid expansion. Starting in the first quarter, Thalys officially surpassed Li Auto in terms of total revenue, which reached RMB 26.561 billion, at the same level as Li Auto during the same period.

According to its latest earnings forecast, Thalys' revenue volume reached a median of RMB 106.5 billion in the first three quarters of this year, more than five times the same period last year.

Referring to Li Auto's revenue growth rate of 20.8% in the first half of the year and sales growth rate of 45.4% in the third quarter, we can roughly estimate that Thalys' revenue volume in the third quarter has approached the revenue scale of Li Auto in 2023, and it is highly likely that Thalys will surpass Li Auto in terms of marketing growth and business volume by the end of the third quarter.

However, in terms of market capitalization, as of October 11, Thalys' (601127.SH) market value was RMB 139.202 billion, while Li Auto (02015.HK) reached HKD 227.1 billion. This already demonstrates Thalys' potential.

Deepening its layout, Thalys is still on the fast track

In fact, what strikes us most when observing Thalys' performance this year is its unwavering commitment to its goals. If Thalys successfully accomplishes its goals at this stage, can we have more optimistic expectations for its subsequent goal of selling one million vehicles in 2027?

Taking this year's performance as an entry point, looking at Thalys' revenue growth trend of RMB 26.6 billion, RMB 38.4 billion, and RMB 41.5 billion (forecast median), profit growth trend of RMB 220 million, RMB 1.4 billion, and RMB 2.2 billion (forecast median), and net profit margin growth trend of 0.8%, 3.65%, and 5.3% (estimated), Thalys' momentum may be stronger than initially expected by the market.

In the first three quarters, Thalys' deducted net profit is expected to increase by 2.53 to 2.79 times year-on-year, or approximately RMB 3.5 to RMB 4.1 billion. Combining this with its net profit attributable to shareholders of the parent company of RMB 1.625 billion in the first half, we can estimate that the median net profit for the third quarter increased by approximately 54.8% quarter-on-quarter.

Looking at products, on September 20, Thalys announced that the number of confirmed orders for the AITO M9 exceeded 140,000. Just 20 days later, the number surpassed 150,000, with the daily increase in confirmed orders averaging around 500 vehicles per day during this period.

Even if we conservatively estimate 400 vehicles per day, the M9 could sell between 32,800 and 41,000 units in the remaining 82 days of 2024, bringing its annual sales to between 182,000 and 190,000 units. Assuming an average sales price of RMB 550,000 per unit, Thalys' massive growth is already secured.

This is not taking into account the launch of other new AITO models next year, such as the AITO M7 Pro and the five-seat version of the AITO M9, as well as other potential new products.

Once sales volumes continue to grow, there is no reason to worry about the profit model not looking good. Based on the official financial data, we can roughly calculate that Thalys' net profit per vehicle in Q3 2024 was approximately RMB 16,300, compared to a loss of RMB 21,300 in the same period last year, with a slight quarter-on-quarter increase of RMB 900. The trend of marginal improvement in profitability per vehicle is evident, and the path to large-scale profitability is expected to accelerate.

Moreover, as Thalys' performance enters a stage of clear results, and after Thalys exceeds its performance doubling plan, it has greater confidence to expand production capacity and improve brand layout, thereby enhancing its asset quality and building stronger growth potential.

Since June, Thalys has announced several acquisition plans, including plans to acquire a 55% stake in Thalys Electric, related intellectual property rights such as AITO trademarks, a 19.355% stake in Thalys Automotive, and a 10% stake in Huawei's Shenzhen Intelligent Vision Technology Co., Ltd.

Acquiring a stake in Huawei's subsidiary can further upgrade Thalys' cooperation with Huawei from "business cooperation" to "business and equity cooperation." On the other hand, considering that Intelligent Vision has already opened a profitable channel, it will also bring additional investment income and continuous performance increments.

Recently, Thalys announced that it would spend RMB 8.16 billion to acquire a 100% stake in Longsheng New Energy through a share issuance, thereby owning its own "super factory," with obvious intentions of achieving large-scale industrial chain layout.

The shallow impact of this layout is Thalys' asset integrity and production scheduling capabilities. What is actually strengthened is Thalys' image as a "chain leader" and its ability to organize complex resources – in a sense, it can be compared to the value of Tesla's "Gigafactory."

In the current manufacturing environment, this may be a good example of new productivity. The private placement of state-owned assets in Chongqing is also a form of recognition and support.

Therefore, given Thalys' extremely high medium-term growth potential, its next round of earnings and valuation double-digit growth is highly anticipated. Because growth itself is valuable, and Thalys' growth quality is high, its future identity remains that of a growth stock.

Source: Pinecone Finance