The stock market is erratic and the auto market is booming. Should you buy a car or invest in stocks?

![]() 10/15 2024

10/15 2024

![]() 509

509

Author | Zhen Yao

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

After experiencing a downturn in July and August, the Chinese auto market has rebounded.

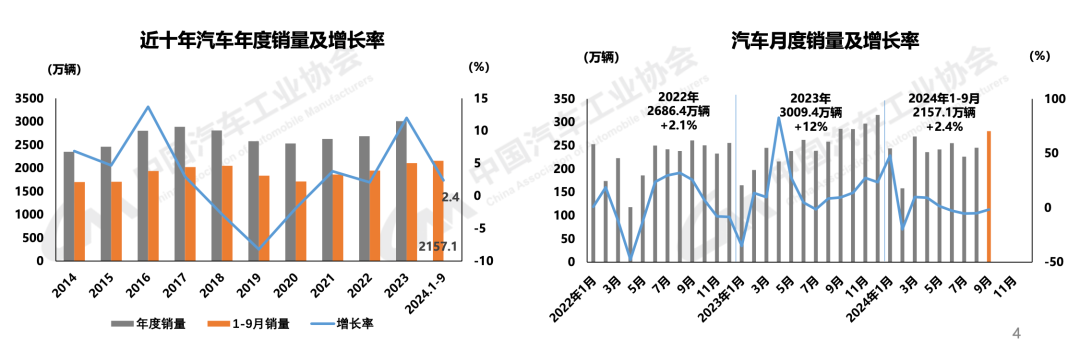

On October 12, the China Association of Automobile Manufacturers (CAAM) released data showing that 2.809 million vehicles were sold in September, representing a year-on-year decrease of 1.7% but a significant month-on-month increase of 14.5%, demonstrating the significant "Golden September" effect.

To date, China's auto sales in the first three quarters have exceeded 20 million units, reaching 21.571 million, a year-on-year increase of 2.4%.

New energy vehicles (NEVs) continue to be the primary driver of overall growth.

In September, 1.287 million NEVs were sold, representing a year-on-year increase of 42.3% and a new record high, accounting for 45.8% of total new vehicle sales for the month. In contrast, domestic sales of traditional fuel passenger vehicles were 940,000, a decrease of 402,000 units or 30% year-on-year but an increase of 18.3% month-on-month.

In the first three quarters, cumulative sales of NEVs reached 8.32 million, up 32.5% year-on-year, accounting for 38.6% of total new vehicle sales during the same period.

"It is estimated that cumulative sales of NEVs from January to October will reach 10 million units, with an annual total expected to reach 12 million, far exceeding initial projections for the year," said Chen Shihua, Deputy Secretary-General of CAAM.

Both the rebound in the September auto market and the rapid growth of NEVs are inseparable from robust policy support.

On the one hand, during the third quarter, with the strengthening of national-level vehicle scrapping and replacement incentives, the gradual implementation of local replacement and upgrade policies, and the introduction of new autumn models by automakers, the passenger vehicle market gradually recovered, particularly in the retail market.

On the other hand, the policy environment for NEVs is more favorable than that for traditional internal combustion engine vehicles. Taking trade-in incentives as an example, subsidies for NEVs are significantly higher than those for traditional vehicles. This disparity has become a crucial factor driving the continuous growth of NEV production and sales.

When the water temperature reaches 99 degrees Celsius, just one more degree will bring it to a boil. During the National Day holiday this year, the auto market's heat reached a boiling point.

Boiling Point of Heat

If one word were to describe the recent auto market, it would be "boiling".

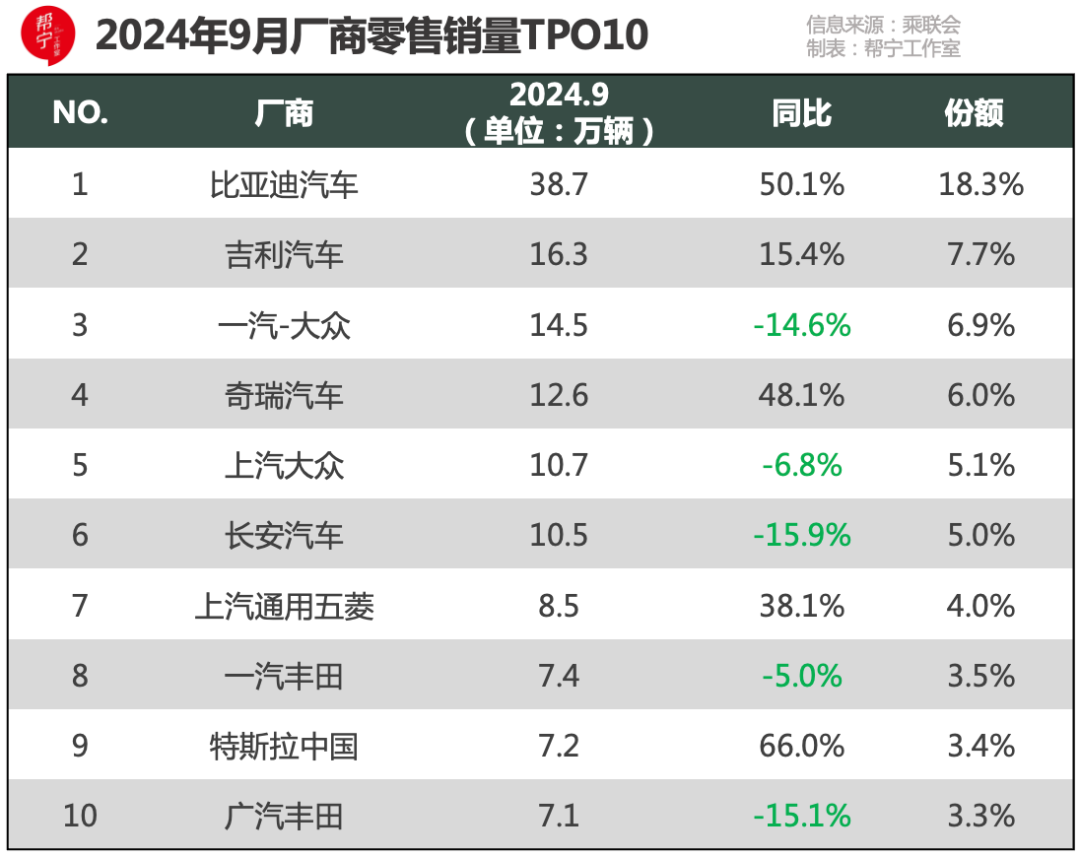

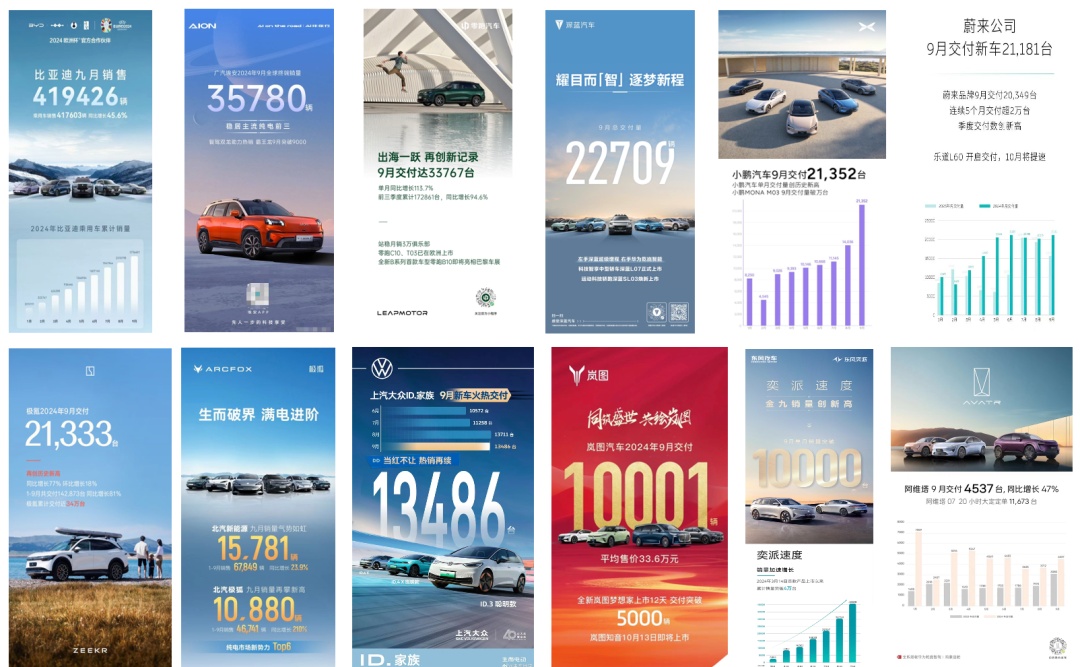

Firstly, on October 1, mainstream NEV brands unveiled their September sales figures. Brands like BYD, Seres, NIO, XPeng, Lixiang, Leapmotor, and Zeekr continued to show growth, with several automakers proudly announcing "record-high monthly deliveries."

Data from the China Passenger Car Association (CPCA) showed that in September, 21 automakers achieved monthly wholesale sales of over 10,000 NEVs (an increase of 3 year-on-year and 2 month-on-month), accounting for 92.7% of total NEV passenger vehicle sales (90.6% in the previous month and 88.5% in the same period last year).

"In terms of product launches, as independent automakers implement multi-pronged strategies in the NEV sector, the market base continues to expand," said Cui Dongshu, Secretary-General of the CPCA.

However, even during the peak September sales season, some brands performed poorly.

AITO delivered 35,800 vehicles globally in September, a year-on-year decrease of 30.65% despite a 1.2% month-on-month increase, indicating overall weak performance. Nezha Auto delivered 10,100 vehicles in September, a year-on-year decrease of 23.4% and a month-on-month decrease of 8.06%, also showing pressure.

Secondly, there has been a surge in new vehicle orders.

During the National Day Golden Week, multiple automakers reported a deluge of orders.

Data on October 8 showed that automakers including HarmonyOS Intelligent Driving, Dongfeng Nissan, IM Motors, Leapmotor, ARCFOX, XPeng, Lixiang, and others, all recorded cumulative orders exceeding 10,000 during the seven-day National Day holiday, with some automakers seeing almost the same number of orders as in the previous month.

Prior to this, automakers keenly captured policy opportunities and market trends, accelerating the launch of facelifted models and new vehicles to capture market share.

Since September, over 40 new or facelifted models have been introduced to the market, including NIO's first model, the L60, Wenjie M9 five-seater version, Zeekr 7X, ARCFOX L07, IM Motors LS6, and AVATR 07, injecting new vitality into the market.

At the retail level, many automakers and dealers competed to offer promotional discounts, adding fuel to the auto market's fire.

"During the National Day holiday, in-store traffic doubled compared to usual, and order conversions far exceeded expectations, with many customers opting for 'trade-ins' or 'replacements,'" said a salesperson at an XPeng showroom in Beijing.

In Qingdao, stores of brands like HarmonyOS Intelligent Driving, Great Wall Motors, and BYD were bustling with customers eager to view and purchase vehicles.

"I've been wanting to switch to an electric vehicle but hesitated over the price. Now, with the trade-in subsidy policy, I can get up to 15,000 yuan," said Mr. Li, a Qingdao resident, to Bangning Studio. "Taking advantage of the National Day holiday, I specifically came to the store to place an order and got the car quickly."

Crazy Auto Stocks

"How much did you make on your stocks?" "Which stock are you going all in on?" "Although I'm sightseeing at the scenic spot, my heart is already back in the stock market..."

Before the National Day holiday, both the A-share and Hong Kong stock markets soared.

This bull market began on September 24. Within a week of the announcement of the "September 24 Financial New Deal," the A-share market rallied for five consecutive trading days, delivering tangible holiday bonuses to over 200 million investors.

October 8 was the first trading day after the holiday, and A-share trading volume set a new record.

The stock market is on fire, and auto stocks are even crazier.

▲Left: October 8, Right: October 9

On September 30, shares of Seres, Great Wall Motors, and JAC Motor closed at their daily limits on the A-share market. BYD and CATL hit all-time highs.

On October 7, even though the A-share market was closed, the heat in the auto consumer market remained undiminished, driving a continued rally in auto stocks on the Hong Kong stock market. By the close, Guangzhou Automobile Group surged 19.06%, Beijing Automotive Group rose 11.76%, Geely Automobile gained 6.92%, and Dongfeng Motor Group advanced 6.79%. In addition, Xiaomi Corporation, Leapmotor, BYD, and XPeng also recorded varying degrees of gains.

Looking back at this rally, while it appears to be a flurry of activity on the surface, the underlying logic is clear and can be attributed to two main camps.

Firstly, amidst the turbulent stock market, Huawei concept stocks have stood out as a bright spot.

Seres, JAC Motor, and Beijing Electric Vehicle are standouts among Huawei concept stocks and are highly favored by investors.

For example, on October 8, Seres shares opened higher and gained over 8%.

In terms of sales, on October 10, Seres announced on its Weibo platform that its Wenjie M9 had surpassed 150,000 cumulative orders since its launch over nine months ago, making it the sales champion among vehicles priced above 500,000 yuan.

Earlier, on October 7, Seres released its September production and sales report: NEV sales reached 37,407 units, a year-on-year increase of 265.09%; from January to September, cumulative sales reached 316,713 units, up 364.23% year-on-year, continuing to lead the premium market.

Seres is the first automaker empowered by Huawei and has benefited the most.

On August 6, at the HarmonyOS Intelligent Driving Enjoy S9 and Huawei Full Scenario New Product Launch Event, Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, and Chairman of the Intelligent Automobile Solution BU, announced that the "Fourth Realm" of HarmonyOS Intelligent Driving would be jointly created with JAC Motor and named "MAEXTRO Zunjie."

Thus, the "Four Realms" lineup of HarmonyOS Intelligent Driving was finalized, comprising Wenjie, Zhijie, Enjoy, and Zunjie, with the latter three being jointly developed by Chery, Beijing Electric Vehicle, and JAC Motor with Huawei.

For example, according to HarmonyOS Intelligent Driving's strategic plan, Zunjie will compete with top luxury brands like Maybach and Rolls-Royce, positioning itself in the ultra-high-end automotive market with an expected price range exceeding one million yuan.

This layout has greatly benefited JAC Motor. Data shows that its share price has risen strongly for six consecutive trading days, climbing from 19.07 yuan to 29.07 yuan in the past three months, representing an increase of over 50%.

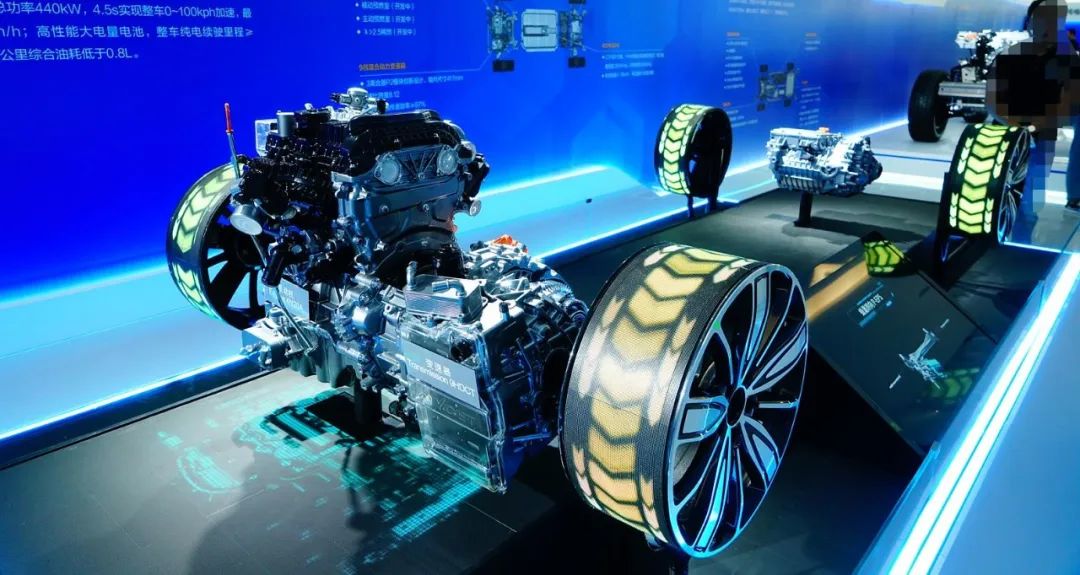

Secondly, automakers with prominent technological attributes, such as BYD, Great Wall Motors, and Geely Automobile, have seen their share prices surge.

Taking BYD as an example, its closing price on the last trading day of 2023 was fixed at 194.9 yuan, while on October 8, 2024, its share price jumped to 327.38 yuan, representing a year-to-date increase of 68%.

On that day, BYD's total market value climbed to 952.4 billion yuan, not only firmly occupying the top spot among domestic automakers but also the only one approaching the trillion-yuan market value threshold.

Similarly, Great Wall Motors, which also focuses on technological innovation as its core competitiveness, has also performed impressively in the market recently. Its share price has risen by over 30% in the past month.

In the past 90 days, a total of 31 institutions have provided professional ratings for Great Wall Motors' stock, with 23 of them giving a "buy" rating and 8 recommending an "overweight" position.

However, the stock market can also be unforgiving, and situations can turn around in an instant. On October 9, after four consecutive trading days of gains, the three major A-share indices reversed their trend and fell. By the close, the Shanghai Composite Index dropped 6.62%, the Shenzhen Component Index plunged 8.15%, and the ChiNext Index tumbled 10.59%. In line with the overall market trend, the A-share passenger vehicle sector performed poorly, with only JAC Motor recording gains.

At the close on October 14, the three major A-share indices rebounded from their lows, with the Shanghai Composite Index rising 2.07%, the Shenzhen Component Index gaining 2.65%, and the ChiNext Index advancing 2.6%. However, compared to the highs reached on October 8, the current indices are still relatively low, leaving uncertainty about whether they will surge again in the future. "A sudden surge in the stock market is unlikely to quickly boost the auto market," said Cui Dongshu. "When more money flows into the stock market, it is difficult for the auto market to rise synchronously. However, if the stock market remains stable and upward in the long term, the auto market will inevitably strengthen."

Faced with the frenzy in the A-share market, some consumers are torn between solidifying their car-buying plans or seizing the opportunity presented by stock market corrections to invest in stocks for higher returns.

For the auto market, this year's "Golden September" has come to a perfect close, and the "Silver October" is worth looking forward to. Looking further ahead, for the final quarter, the China Automobile Dealers Association predicts that automakers and dealers will sprint to the finish line, with auto market demand continuing to soar.

Additionally, the auto market may have another pleasant surprise – considering the positive role that trade-in incentives have played in driving auto consumption, CAAM recommends continuing these policies next year and releasing implementation details as soon as possible to stabilize market expectations.