Under heavy taxes, Chinese auto companies set fire to the EU's home base

![]() 10/16 2024

10/16 2024

![]() 679

679

Will this fire that has reached Europe's home base spread wildly?

It is evident that Chinese auto companies once again dominated the Paris Motor Show this year, adopting a guest-turned-host attitude.

Although unlike two years ago when independent Chinese brands accounted for half of the show, nine Chinese brands still made an appearance at the Paris Motor Show. These brands and manufacturers include WENJIE, BYD, Dongfeng Fengxing, GAC Group, FAW Hongqi, SAIC MAXUS, Leapmotor, XPeng Motors, and Skyworth Automobile.

Apart from the absence of Mercedes-Benz, major Japanese automotive brands such as Toyota, Honda, and Nissan also did not attend. The return of European brands on a larger scale and the emergence of Chinese electric vehicles as a highlight of this year's Paris Motor Show made it a rare spectacle.

Serge Gaschot, Director of the Paris Motor Show, stated that Chinese brands accounted for only one-fifth of the overall presence. Some foreign media have also begun to stir up trouble, claiming that this represents Europe's determination to defend its domestic market.

Heavy Tariff Pressure

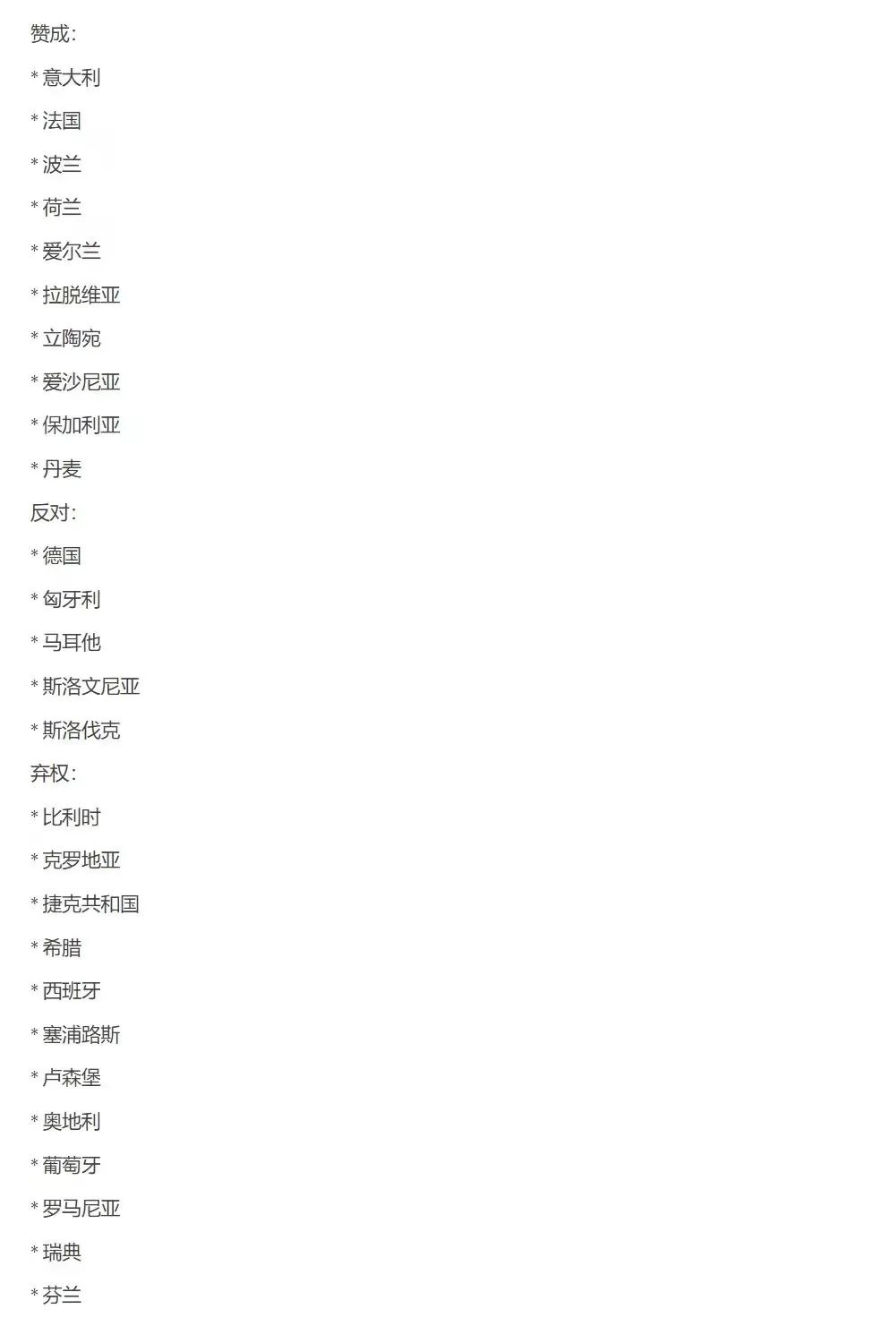

Just ten days before the official opening of the Paris Motor Show, on October 4th, the EU ignored China's opposition and insisted on pushing forward with its tariff proposal against China. In the final vote on whether to impose countervailing tariffs on imported electric vehicles from China, EU member states failed to block the European Commission's tariff proposal, with 10 votes in favor, 5 against, and 12 abstentions.

France led the charge on this proposal, and while the matter had been shelved from July until now, the formation of a new right-wing government in France has once again brought the issue of tariffs to the forefront.

Jean-Yves Le Drian, the newly appointed French Foreign Minister, directed his criticism at China's new energy vehicles, leading the charge at EU meetings to increase tariffs on Chinese electric vehicles.

To gain EU approval for its proposal, France actively courted and united several countries with similar views, including Italy, France, Poland, the Netherlands, Ireland, Latvia, Lithuania, Estonia, Bulgaria, and Denmark.

It is evident that only France and Italy stand to gain direct benefits from this matter, with most other countries involved for political reasons, given that they do not have a domestic automotive industry.

"I do support the European Commission," French President Emmanuel Macron stated on the eve of the vote. "European manufacturers must compete with some advantaged Chinese automakers." In fact, France's actions have been predictable, as the government adjusted electric vehicle purchase subsidies last year to exclude Chinese-made electric vehicles.

Germany, which is intertwined with China's automotive industry, voted against the proposal.

Mercedes-Benz issued a statement saying, "We firmly believe that countervailing tariffs would weaken an industry's competitiveness in the long run. Free trade and fair competition bring prosperity, growth, and innovation to all parties. Therefore, we consider the European Commission's proposed imposition of countervailing tariffs to be a mistake that could lead to far-reaching negative consequences."

BMW Group also stated, "The EU's decision to impose additional tariffs on Chinese electric vehicles is completely unfeasible. Not only does it fail to enhance the competitiveness of European automakers, but it may also harm companies actively operating globally. Furthermore, the tariffs would limit the supply of electric vehicles to European consumers, thereby delaying the low-carbon development of Europe's transportation sector. Additionally, this approach severely undermines the EU's long-held principles of free trade."

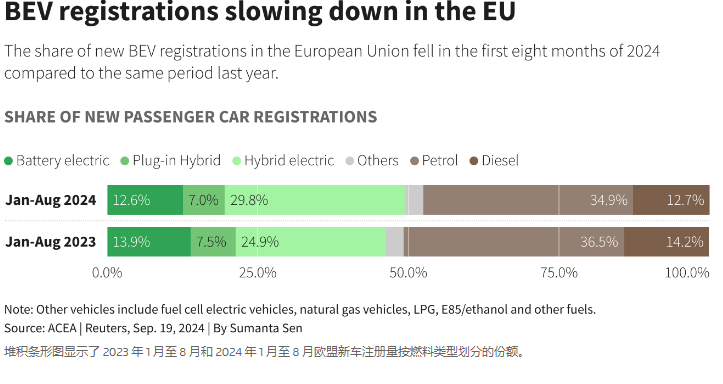

Data shows that China's electric vehicle exports to Europe more than doubled year-on-year in the first half of this year, with the share of Chinese brands in the European electric vehicle market continuing to expand. However, the rise of Chinese electric vehicles has also sparked concerns among some European countries, who fear that their low prices will undercut local automakers and compromise the competitiveness of the European automotive industry.

From the previous Paris Motor Show to this one, the Chinese voice has grown louder and more assertive, shaking the stronghold of traditional gasoline-powered vehicles. It is normal for some resistance to arise.

It is worth emphasizing that despite its tough stance on tariffs, the EU has not completely closed the door to cooperation with China and has even expressed strong interest in Chinese investment on multiple occasions.

For example, during a meeting with German Chancellor Olaf Scholz, European Commission President Ursula von der Leyen made it clear that negotiations with China would continue even if tariffs were imposed. She mentioned that the EU hopes to negotiate with China on price commitments or mechanisms for investment in Europe to seek solutions.

Carlos Tavares, CEO of Stellantis Group, stated at the 2024 Paris Motor Show that tariffs are a "good communication tool" but also have side effects. He added, "EU tariffs exacerbate overcapacity in the European manufacturing system. Chinese automakers are circumventing tariffs by building factories in Europe, which may accelerate the closure of European factories."

Industry experts have pointed out that Italy and France support the EU's imposition of countervailing tariffs in part to force Chinese brands to invest locally and support the transformation of their domestic automotive industries.

Behind this lies a cultural difference between East and West.

In the Chinese context, tariffs are the result, a hallmark event indicating strained bilateral relations. However, in the eyes of Europeans, tariffs are a process and a means, a bargaining chip to secure benefits before negotiations.

Despite the uncertainty, Chinese automakers have chosen to brave the challenges.

The European Market That Must Be Won

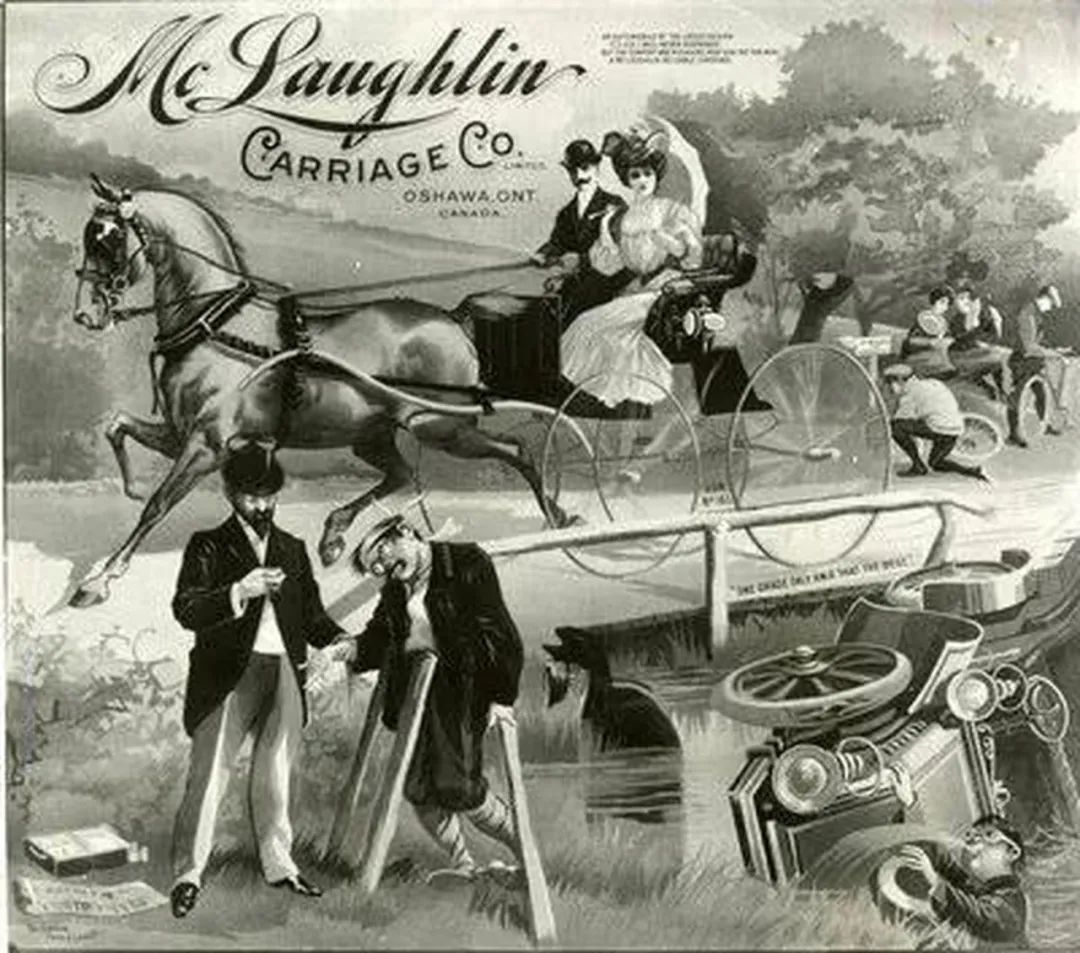

'When automobiles first appeared, horse-drawn carriages opposed them.' In the early days of the automobile, European countries even enacted laws requiring automobiles to yield to horse-drawn carriages. Today, the 'Horse-Drawn Carriage Protection Act' has become a historical joke, and using protectionism to avoid competition is akin to the 21st-century equivalent of such legislation.

The importance Chinese automakers attach to the Paris Motor Show reflects their focus on the European market. For Chinese companies aspiring to go global, the European market is unavoidable. Conversely, the value of the European market is also demonstrated by the attention Chinese companies pay to it.

As the leading player in China's electric vehicle market, BYD's presence at the Paris Motor Show was natural. BYD showcased the Dolphin 07, a rival to Tesla's Model Y, which has already been launched in China and is scheduled to enter the European market in 2025. Prior to this, BYD had already launched multiple models in Europe.

Leapmotor entered the European market in September this year with its C10 SUV and T03 city electric vehicle and unveiled its new Leapmotor B10 at the show. Based on Leapmotor's LEAP3.5 architecture B platform, the B10 is the first global model from the company. It is also Leapmotor's first product to enter overseas markets following its strategic partnership with Stellantis Group last year. Leapmotor revealed that the B platform is a vital component of its globalization strategy, with plans to launch multiple models by 2025.

Zhu Jiangming, founder of Leapmotor, stated, 'Localization is the optimal choice. Leapmotor does not intend to fight on two fronts but instead focuses rapidly, innovates continuously, and is not afraid of competition. When Japanese and Korean companies entered the European market, they engaged in homogeneous competition. Today, Leapmotor is pursuing a new path. This year, Leapmotor will also launch new vehicles for sale in the UK.'

'Europe will become an important market for XPeng Motors,' XPeng Chairman He Xiaopeng reiterated the core position of Europe in the company's global strategy at the Paris Motor Show.

He Xiaopeng revealed that XPeng aims to enter over 60 countries and regions globally by 2025 and become China's leading mid-to-high-end new energy brand overseas. Over the next decade, XPeng will accelerate the expansion of its global 'Pengyou Circle,' targeting overseas sales to account for half of its total sales. The XPeng P7+ was unveiled at the same event, with a pre-sale price starting at 209,800 yuan. Immediately after the launch, He Xiaopeng shared the pre-sale results, revealing that over 30,000 orders had been placed within 1 hour and 48 minutes.

Notably, on the same day, Gu Hongdi, XPeng's Vice Chairman and Co-President, stated at the show, 'We are just a ten-year-old company. We will not overthrow automakers that have been around for over a hundred years.'

He later added that XPeng and Volkswagen had reached an agreement earlier this year to jointly develop two electric vehicles. The company remains open to further cooperation with Volkswagen in the future. This can be seen as an indirect response by a Chinese company to EU tariffs.

Traditional automakers also made a strong showing at this year's Paris Motor Show. GAC Group officially announced its GAC Europe plan at the show, laying out a comprehensive strategy for market expansion, service network development, green transportation, and cultural integration. Its Trumchi ES9 and E9, Aion's second-generation AION and AION Y PLUS, and Hyper GT and Hyper SSR under the Aion LX brand were also on display.

Feng Xingya, General Manager of GAC Group, said, 'We are entering the European market with a cooperative attitude. We are willing to work with partners in the industry chain to meet the needs of European consumers.'

Compared to the 'muscle-flexing' two years ago, Chinese brands at this year's Paris Motor Show showcased more tangible offerings for the European market, not only launching models tailored for the region but also outlining long-term goals for establishing a foothold there. It is foreseeable that the competition between Chinese brands and European traditional giants has just begun. Will this fire that has reached Europe's home base spread widely?

We'll have to wait and see.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.