Horizon Robotics to be listed: Alibaba and Baidu lead the investment, revenue relies on major customers

![]() 10/17 2024

10/17 2024

![]() 586

586

Bianniu Shi reported today

On October 16th, it was reported that Horizon Robotics, a smart driving technology company, officially launched its IPO in Hong Kong.

Horizon announced that it plans to issue 1.355 billion shares for its Hong Kong listing, with an expected issue price range of HK$3.73-3.99 per share. The maximum fundraising amount is approximately HK$5.41 billion (approximately RMB 5 billion). Pricing is expected on October 22nd, with trading commencing on the Hong Kong Stock Exchange on October 24th. Including pre-IPO shares, the current total market value is approximately RMB 60 billion.

Alibaba, Baidu, DHL Express, and a Ningbo municipal government fund are cornerstone investors, subscribing for a total amount of approximately US$220 million (approximately HK$1.7 billion).

According to publicly available information, Horizon Robotics was founded in 2015 and is a supplier of solutions for passenger vehicle advanced driver assistance systems (ADAS) and high-level autonomous driving. Since its inception, it has received multiple rounds of funding, totaling over US$2.363 billion. Following its final funding round in November 2022, its post-investment valuation reached a high of US$8.71 billion.

In March of this year, Horizon submitted its IPO prospectus to the Hong Kong Stock Exchange. In August, the China Securities Regulatory Commission issued a notice of record for Horizon's overseas listing, and Horizon plans to issue up to 1.154 billion overseas-listed ordinary shares for listing on the Hong Kong Stock Exchange.

Revenue soars year after year, highlighting the risk of "dependency" on major customers

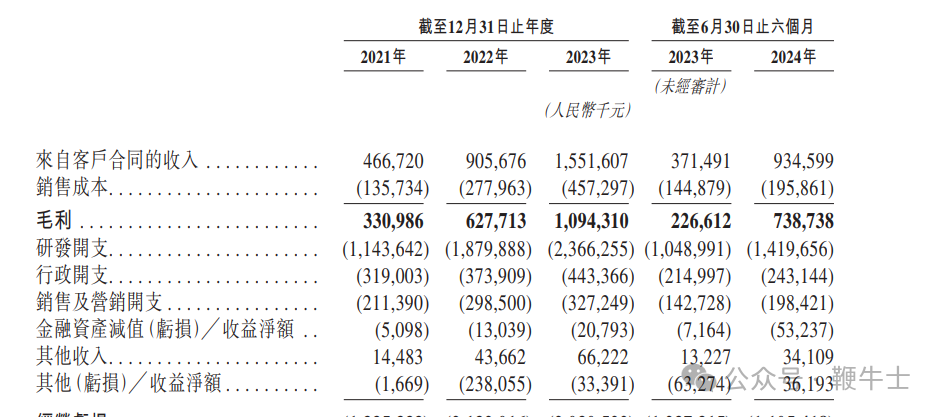

According to the prospectus, from 2021 to 2023, Horizon's revenue was approximately RMB 467 million, RMB 906 million, and RMB 1.552 billion, respectively, with a compound annual growth rate of 82.3%. Revenue for the first half of this year was approximately RMB 935 million, an increase of 151.6% year-on-year.

In terms of revenue structure, the vast majority of Horizon's revenue comes from selling advanced driver assistance systems (ADAS) and high-level autonomous driving solutions, as well as related licensing and services, to OEMs and Tier 1 automotive suppliers.

Due to the relatively low fulfillment costs associated with licensing and services, Horizon has consistently maintained a gross profit margin above the industry average. From 2021 to 2023 and the first half of 2024, gross profits were RMB 331 million, RMB 628 million, RMB 1.094 billion, and RMB 739 million, respectively, with gross profit margins of 70.9%, 69.3%, 70.5%, and 79.0%, respectively.

As of the last practicable date, Horizon's hardware-software integrated solutions have been adopted by 27 OEMs (42 OEM brands) and are equipped in over 285 vehicle models. Its partners include major automakers such as Audi, BYD, Beijing Automotive Group, Geely, Chery, and Guangzhou Automobile Group, as well as new energy vehicle brands like Li Auto, NIO, and Nezha.

It is worth emphasizing that Horizon's revenue is highly dependent on major customers. According to the prospectus for the first half of this year, from 2021 to 2023 and as of June 30, 2024, the total revenue generated by the top five customers was RMB 283 million, RMB 482 million, RMB 1.07 billion, and RMB 727 million, respectively, accounting for 60.7%, 53.2%, 68.8%, and 77.9% of total revenue, respectively.

Furthermore, the revenue contributed by the largest customer, CoreMile, is almost equal to or even exceeds the combined revenue of the other four major customers.

In November 2023, Horizon and CARIAD, Volkswagen Group's software company, established a joint venture, CoreMile (Beijing) Technology Co., Ltd., with respective stakes of 40% and 60%. By 2023, Horizon began licensing advanced driver assistance and autonomous driving solution-related algorithms and software to this company.

In 2023 and the first half of this year, the licensing revenue that Horizon received from this company amounted to RMB 627 million and RMB 351 million, respectively, accounting for 40.4% and 37.6% of total revenue during the corresponding periods.

The concentration of customers also exposes Horizon's vulnerability in terms of risk resistance. As competition intensifies and the market becomes more volatile, Horizon could suffer significant losses if its major customers encounter instability.

In fact, this trend is already emerging.

It is understood that many domestic new energy vehicle brands are beginning to lay out the smart driving field and increase investment in self-developed chips, including its customers NIO and Li Auto. In July, NIO announced the successful tape-out of its first automotive-grade 5nm smart driving chip, the Shenji NX9031, with both the chip and underlying software designed in-house. Separately, industry insiders have reported that Li Auto is accelerating the self-development of its smart driving SoC chip, aiming to complete tape-out by the end of this year. In August, He Xiaopeng, founder of XPeng Motors, announced the successful tape-out of XPeng's self-designed smart driving chip, Turing, on August 23rd. The Turing chip can be used for L4 autonomous driving.

In response, Horizon stated that while customer concentration is currently high, the number of customers is expanding, and the concentration is expected to decrease as the customer base grows. However, there is still a risk of customer concentration.

According to Tianyancha data, there are currently over 5,600 autonomous driving-related enterprises in China. Among them, from January to August 2024, over 350 new related enterprises were registered.

Horizon's Internal and External Challenges

According to data from the Gao Gong Intelligent Automobile Research Institute, based on total solution installations in 2023 and the first half of 2024, Horizon is the second-largest and largest provider of advanced driver assistance solutions to Chinese OEMs, with market shares of 21.3% and 35.9%, respectively. Its primary competitor is its long-standing rival Mobileye.

Mobileye is a company that provides autonomous driving and advanced driver assistance systems. Founded in 1999, it was acquired by Intel in 2017 and listed on the Nasdaq in 2022, earning the title of the first autonomous driving stock. It was once a loyal partner of Tesla for smart driving solutions.

As of the end of 2023, approximately 170 million vehicles worldwide were equipped with Mobileye technology.

It is understood that the Chinese market is Mobileye's largest single market, contributing 30% of its global revenue. It has deployed nearly 300 team members in various cities such as Shanghai, Beijing, Hangzhou, Changchun, Ningbo, and Wuhu.

It is worth emphasizing that although Mobileye currently holds the top position, competition in the smart driving chip field in China is fierce, and Mobileye faces the same challenge as Horizon in terms of loosening customer relationships.

In the past two months alone, Mobileye suffered a "betrayal" from its deep partner ZEEKR.

In early August, ZEEKR and Mobileye announced that they would accelerate the localization of technology in China and deeply integrate Mobileye technology into the next-generation ZEEKR vehicles, continuing to promote the implementation of driving safety and autonomous driving technology in domestic and international markets.

Intriguingly, just half a month after both parties officially announced the deepening of their "close" relationship, ZEEKR launched a new vehicle and switched the hardware supplier to NVIDIA, while the software was self-developed. Additionally, at Geely Holding Group's 2024 interim results conference, An Conghui, President of Geely Holding Group and CEO of ZEEKR, revealed that ZEEKR's first flagship SUV equipped with NVIDIA's Thor chip is expected to be released in the third quarter of 2025.

Public information shows that since the end of 2021, ZEEKR has delivered over 240,000 ZEEKR 001 and ZEEKR 009 models equipped with Mobileye's SuperVision solution to customers in China and globally.

From sweetheart to outcast.

In the same month, Mobileye lowered its annual revenue and profit forecasts due to fluctuations in demand for its smart driving chips in the Chinese market.

Currently, Mobileye's dominant position in China is not absolute, and Horizon has narrowed the market share gap with Mobileye to less than 6% in just eight years, indicating a high possibility of overtaking Mobileye. However, Horizon needs to build a solid moat through technological innovation to prevent a repeat of the "betrayal" experienced by Mobileye.

Deep in a quagmire of losses, commercialization urgently needs to be addressed

In fact, Horizon is at the forefront of the industry in terms of research and development expenses. However, the development and manufacturing of high-level autonomous driving chips are widely recognized as money pits. While significant investments bring technological advantages to Horizon, they also create a new challenge: the pressure of losses due to insufficient revenue.

According to the prospectus, research and development expenses for 2021 to 2023 were RMB 1.144 billion, RMB 1.88 billion, and RMB 2.366 billion, respectively, accounting for 245.0%, 207.6%, and 152.5% of revenue for the corresponding years.

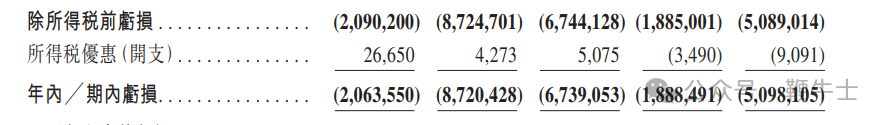

Correspondingly, net losses were RMB 2.064 billion, RMB 8.72 billion, and RMB 6.739 billion, respectively. Research and development investment reached RMB 1.42 billion in the first half of this year, exceeding the entire year's investment in 2021, with a corresponding net loss of RMB 5.098 billion.

As of June 30, 2024, the cumulative net loss exceeded RMB 22.6 billion.

Founder Yu Kai previously stated that a lot of money needs to be invested in the development of each generation of chips. He noted that the company is still some distance from breakeven but added, "We're not worried, as it's within our control."

It is understood that the funds raised through Horizon's IPO will be used to strengthen its research and development capabilities in the field of smart driving, including core technology development for advanced driver assistance systems and high-level autonomous driving solutions. Additionally, the funds will be used to expand sales and marketing efforts.

In terms of cash reserves, according to the prospectus, as of the end of June 2024, the company's cash and cash equivalents amounted to RMB 10.452 billion.

Horizon still has some financial cushion, but the high research and development expenses are unlikely to decrease in the short term. Rapidly commercializing and scaling automotive chips to achieve profitability is a pressing issue for Horizon. However, with strong competitors like NVIDIA, Mobileye, and Qualcomm, as well as automakers like Xiaomi, Huawei, and XPeng accelerating their layouts, the window of opportunity for Horizon is narrowing, making it challenging to achieve this goal.